Operators should build 5G into existing enterprise propositions rather than develop new 5G solutions

Operators have already invested heavily in 5G networks, but the promise of increased revenue from new enterprise services has yet to materialise. 5G private networks are slowly gaining traction, but the capabilities of 5G public networks remain largely untapped.

Developing holistic enterprise solutions that integrate 5G capabilities with other technologies is complex and time-consuming. Nevertheless, it is likely to be the best way for operators to capitalise on their 5G investments. Operators should also prioritise the commercial deployment of at least a few basic 5G-enabled solutions to stimulate engagement with developers, partners and potential customers.

End-to-end managed services and enterprise solutions are likely to deliver the greatest returns on operators’ 5G investments

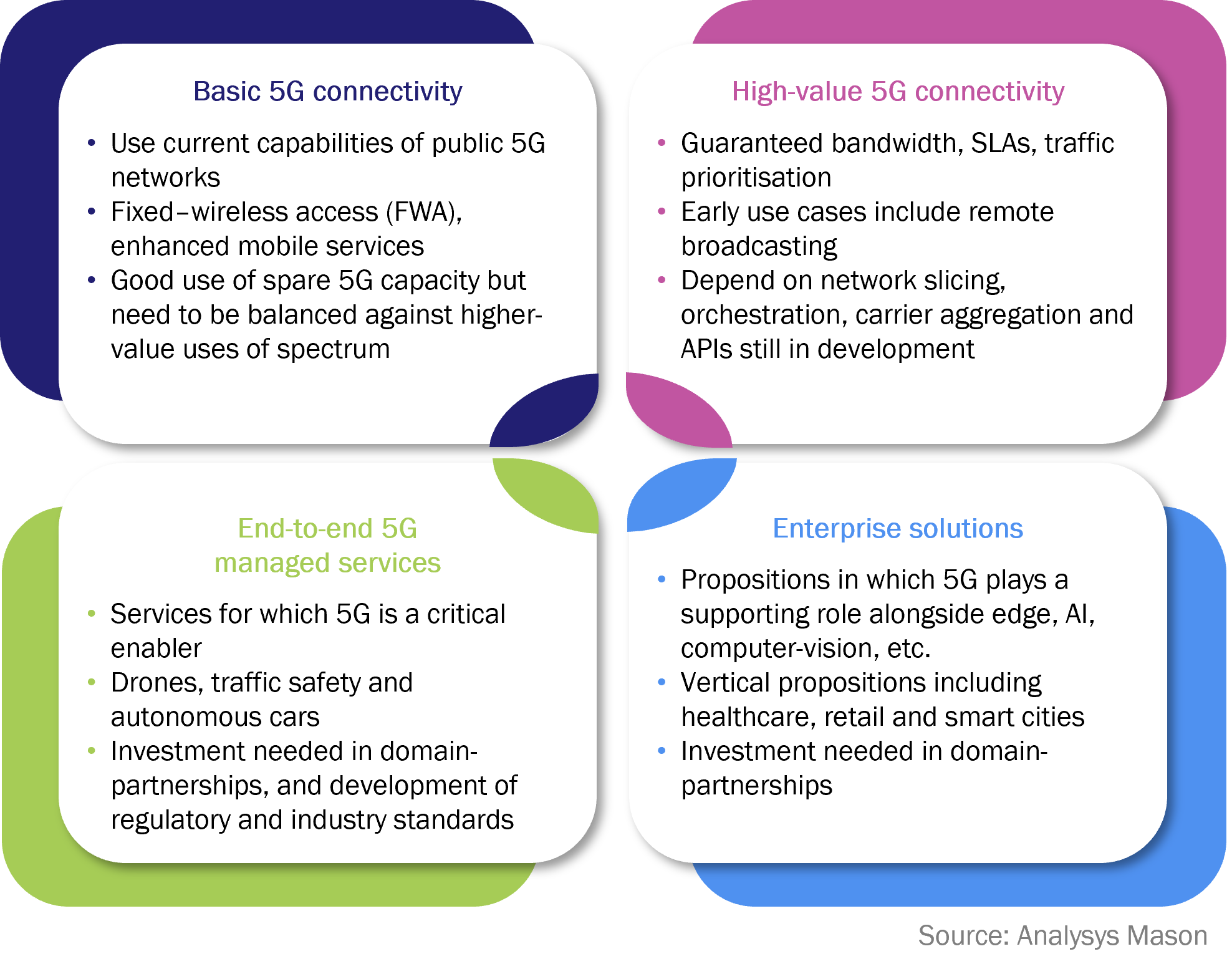

We have identified four main options for operator delivery of public 5G enterprise services (Figure 1). Basic 5G connectivity is widely available today, but is unlikely to provide the level of returns that operators expected from their 5G investments. Almost all operators aim to improve returns by developing commercial offers based on high-value connectivity with traffic prioritisation and security-backed by service-level agreements (SLAs).

However, the greatest returns are likely to come from end-to-end managed services and use of 5G capabilities to support broader enterprise solutions. 5G is primarily an enabler, and as such its value lies in how it is used and what it contributes to other services.

Figure 1: Options for operator delivery of public 5G enterprise services

For many enterprises, demand is shifting from a requirement for point solutions to a requirement for managed end-to-end solutions across multiple connectivity and IT services. This is an opportunity that many enterprise-focused operators are already embracing. Most already offer solutions that integrate security, cloud compute and applications alongside connectivity; some also offer edge, professional services and more.

5G enables operators to further extend the range of services included in these enterprise solutions, enhancing capabilities in areas such as computer-vision, AR/VR and data analytics. By building 5G into an existing proposition, operators can extend their market reach, sell more services to their existing customer base and deliver a higher degree of differentiation. This may not deliver obvious new 5G revenue streams, but it can nevertheless add significant value to their overall enterprise propositions.

Some solutions being enhanced by 5G in this way include:

- T-Mobile USA’s Advanced Industry Solutions for retail: 5G is being used to enhance services such as in-store monitoring and customer heat-mapping.

- TIM’s Smart Cities proposition: 5G’s ability to support large-scale dynamic data-exchange could support applications such as traffic safety and management and environmental monitoring.

- Vodafone’s STEP road safety platform: 5G’s low-latency characteristics will enhance the range of features and service levels that can be offered in future.

- Healthcare propositions from multiple operators: 5G can support better remote monitoring and provide more advanced resources to front-line response teams.

All operators should launch at least a few 5G-enabled solutions – even just fairly basic ones

For mobile-only operators, or those without an existing enterprise practice, developing end-to-end 5G-enabled services is especially challenging. However, even for those operators that aim to be little more than connectivity providers in the long-run, there is a need to lead the way in pushing through some initial 5G propositions.

We believe there is a significant benefit in moving beyond pilots and test cases to bring at least a few 5G-enabled propositions to market. These can help establish confidence in the commercial viability of 5G-enabled services and strengthen efforts to engage with developers, tech startups and domain specialists to develop future 5G services. It is clear that there is no one ‘killer app’ for enterprise 5G and its long-term success will depend on encouraging a proliferation of partner-led solutions alongside operators’ own solutions.

Few operators yet have nationwide 5G standalone (SA) networks available; orchestration for dynamic network slicing needs further development, and network APIs are still in the process of being standardised. However, this should not hold operators back from experimenting with some commercial offers. It is better to bring solutions to market and refine them over time, than to develop a fully mature proposition offline only to discover that the market has moved on or that demand does not materialise as expected.

Examples of how 5G is being used in current market propositions include:

- enhancing Ooredoo Qatar’s surveillance solutions by enabling real-time facial recognition

- supporting video live-streaming from the cloud as part of BT’s Immersive Spaces proposition

- enabling network capacity to be booked in advance at a given location for Deutsche Telekom’s 5G Live Video Production proposition.

More details on these solutions, and other 5G enterprise services either at, or close to commercial launch are available in our report, Public 5G enterprise services: operator case studies and analysis.

Operators need to promote cross-team cooperation and communication

The internal structure of operators sometimes makes it challenging to create holistic enterprise propositions. Historically, the opportunity in the enterprise market for mobile operators has centred on handset services and many have dealt with opportunities in IoT, edge, private networks and data analytics by developing separate business units. Similarly, converged operators often have separate divisions for fixed connectivity, security and cloud services. This approach helps facilitate a more agile approach to developing individual new services but can be a hindrance to developing more complete solutions.

Some operators have sought to bring together linked technologies in a single division. For example, 5G+IoT (Vodafone) or 5G+Edge (Verizon). Others have tried to create a more agile environment for internal development by creating a separate unit tasked with innovation (for example, BT’s Division X). It is not clear which approach will work best, and each operator will need to build on its existing capabilities, but in all cases, we think that facilitating and incentivising better communication and cooperation across different teams will be vital to the success of enterprise 5G services.

The ideas highlighted in this article are explored further in our report: Operator strategies for monetising public 5G enterprise services.

Article (PDF)

DownloadAuthor

Catherine Hammond

Research DirectorRelated items

Strategy report

Strategies for telecoms operators to evolve their network-as-a-service (NaaS) propositions

Tracker

Cloud service providers' revenue tracker 2024

Forecast report

USA: telecoms operator business and IT services forecast 2024–2029