How will 5G networks be deployed?

5G is the next generation of mobile networking. It promises to provide better mobile network performance for consumers, and – more significantly – flexible, high-performance mobile services for a wide range of enterprise uses.

5G is defined by the 3GPP, an international telecoms standards body.

Analysys Mason has published over 100 5G-related reports in the past year, which provide deep insights into the impact of 5G so far, and the commercial and architectural decisions that lay ahead in the 2020s. Our 40-page summary of this research is freely downloadable here: Strategies to maximise the returns on first-phase 5G deployment.

What spectrum is used for 5G?

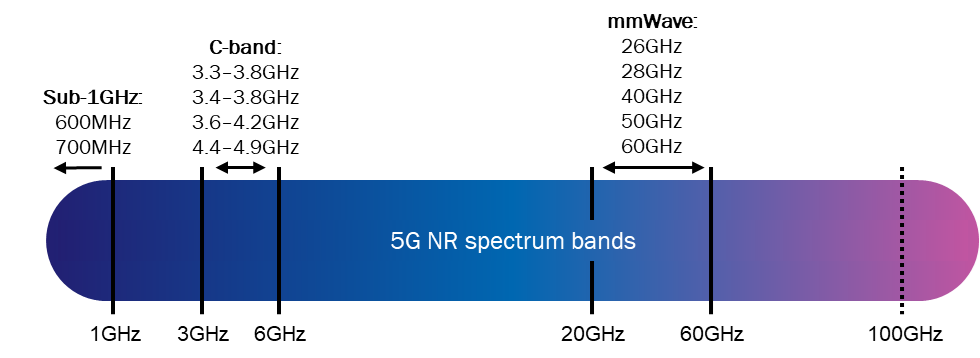

A fundamental aspect of 5G is New Radio (NR). This new radio access technology uses in the following three broad spectrum frequency bands.

- Millimetre wave or mmWave (26GHz and above). This band provides the best performance but is limited by short distances that require many cell sites to provide coverage. mmWave was seen as the focus for 5G initially, but deployment costs and the inability of mmWave signals to penetrate walls have limited the use of this band to a few urban market deployments.

- C-band (2–6GHz). This is sometimes called mid-band, and is now the ‘sweet spot’ for 5G deployments. Recent auctions in the USA produced bids of over USD80 billion. C-band spectrum covers about 1km from a tower and offers good in-building penetration but with less capacity than mmWave. Most countries have focused on C-band spectrum for 5G. Strictly speaking, C-band is 3.4–4.2GHz, but some operators are using nearby spectrum that was allocated previously – for example, T-Mobile USA is using spectrum in the 2.5GHz band.

- Sub-1GHz. 5G NR can operate in the 600MHz or 700MHz bands. Operators use sub-1GHz to get wide coverage – over 100km – but this offers no better throughput than LTE.

Figure 1: 5G spectrum frequency bands

Source: Analysys Mason

5G NR requires massive multi-input multi-output (MIMO) antennas, particularly for C-band deployments. This technology increases the data capacity of the cell sites where it is deployed. MIMO technology allows transmission of more than one data signal over the same channel. It is widely used in 4G and Wi-Fi, and typically involves two or four antennas. Massive MIMO usually involves more than 100 radios but it can be fewer.

Massive MIMO inherently includes beamforming to improve signal quality, extending the effective reach of coverage from a cell site.

What are the 5G use cases?

Enhanced mobile broadband (eMBB). This is an extension of 4G and the capabilities are similar; the first wave of commercial 5G deployments were carried out in a conservative way that was closer to 4G with slightly better download performance. The only difference from LTE is the use of 5G NR.

Fixed-wireless access (FWA) is an important new 5G use case because it will enable network operators to deliver ultra-high-speed broadband to suburban and rural areas, where fibre is expensive to lay and maintain. mmWave 5G can provide the same user performance as fibre to the home (FTTH), but the distance and building penetration limitations of mmWave will require operators to deploy fibre to the curb (FTTC) and some in-building routing via Wi-Fi or internal coax. C-band is much easier to use for FWA and many operators are taking this approach despite the fact it is not a full fibre replacement.

Cloud gaming. Gaming is a big market that could shift toward mobile with 5G performance. Network operators will work with cloud-based gaming partners to enhance the value of 5G connectivity plans. The cloud-gaming market will be worth USD14.5 billion worldwide by 2024, or just over 6% of the total USD230 billion digital gaming market.

Industrial use cases: 5G is likely to have its most significant impact on manufacturing and other businesses.

- Private 5G networks. These new networks are built specifically for the private use of a government or an enterprise. Such networks are most commonly deployed on a single site (for example, in a factory or a mine). They can also be deployed to address wide-area network requirements, such as a utility’s need to monitor a transmission network. Currently, most private cellular networks deploy LTE technology, but 5G adoption is growing as enterprises prioritise support for key capabilities such as low latency, high bandwidth and device density.

- 5G and IoT. Adoption of 5G in IoT will be slower than in the mass-market smartphone business. IoT devices are not yet widely available and are costly but more importantly few IoT applications require the high-bandwidth, low-latency attributes of 5G. The 5G IoT market will develop slowly in three phases:

- enhancing existing deployments such as public surveillance

- enabling connected vehicles – there are 1 billion cars worldwide

- establishing private 5G networks for IoT applications.

When will 5G be available?

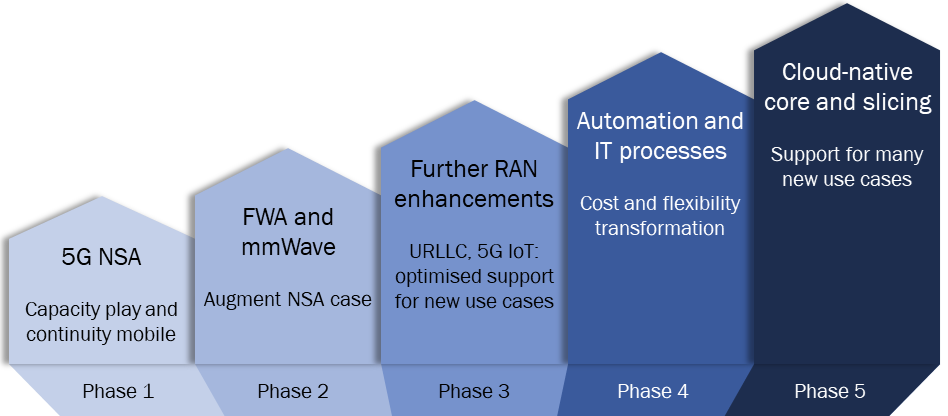

5G will be deployed in phases (see Figure 2). The pace of deploying each phase will depend upon the availability of technology from vendors, national decisions about spectrum availability and the business plans of individual operators.

Figure 2: The phases of 5G availability

Source: Analysys Mason

What is the size of the 5G market?

Network operator revenue from 5G was USD29 billion worldwide in 2020 and we predict that this will increase to USD456 billion in 2025.

Network operator spend (capex) on 5G was around USD26 billion worldwide in 2020, approximately 15% of total network capex. We forecast that operators will invest about USD115 billion in 5G in 2026, approximately 75% of total network capex.

What is the difference between 5G non-standalone and standalone architecture?

5G non-standalone (5G NSA) architecture uses a 4G network as an anchor to deliver eMBB or FWA services and enables operators to deploy a 5G network relatively quickly. Operators will be able to continue to use the technology and spectrum investments needed to support NSA when future use cases are rolled out using SA architecture.

5G standalone (5G SA) architecture is the full implementation of 5G capabilities and includes a new core cloud-based network that is not required for NSA architecture. Use cases that require ultra-reliable, low-latency communications (URLLC) and massive machine-type communications (mMTC) will create more demand on the network, which will only be met with SA architecture.

What are other important 5G technologies?

Centralised RAN. Radio heads and antennas are separated from digital baseband functions. The baseband functions are deployed in software, in units that can be shared by multiple radio sites. However, these baseband units remain as proprietary appliances with integrated hardware and software.

Virtualised RAN (vRAN). The new generation of RAN virtualisation is largely emerging in tandem with 5G. This further disaggregates the RAN by breaking the shared baseband unit into two layers – a centralised unit (CU), typically located in a data centre, for non-real time functions; and a distributed unit (DU), located at or near the cell site, for real-time functions. In a true vRAN, the CU and DU are based on standard cloud infrastructure, the DU on an edge cloud unit. Commercial vRANs currently implement the software as virtual machines but containerised, cloud-native platforms are starting to emerge.

Cloud RAN. The first generation of network virtualisation, which was adopted for 4G networks by a small number of operators. This deploys the centralised baseband functions as virtual machines on cloud infrastructure but does not disaggregate the network any more than in centralised RAN.

Open RAN (O-RAN) is a specific implementation of vRAN in which the interfaces between the different disaggregated elements are fully standard, and therefore hardware and software from different suppliers can be easily combined and re-combined. The most developed interface is for open fronthaul between the radio unit and the DU, and a prominent example has been defined by the O-RAN Alliance. Several organisations, including the O-RAN Alliance, the Open Networking Foundation, the Small Cell Forum and the Telecom Infra Project, are defining different interfaces and architecture elements from the semiconductor layer to RAN control and orchestration. An O-RAN architecture could enable an open supply chain.

Converged packet core architecture. The 3GPP has designed the 5G core using a service-based architecture (SBA) and control/user plane separation (CUPS) so that it can be developed in a modular way and operators can procure best-of-breed core modules from different vendors. The 5G converged core supports multiple access networks, including Wi-Fi and wireline, as well as cellular. Some fixed/mobile operators plan to migrate to a single core network that supports services across all their networks in a unified way, focused mainly on cost efficiencies.

Edge computing is distributed cloud computing that takes place in locations closer to users and sources of data than traditional cloud computing. Locations where edge computing takes place are significantly more resource-constrained and numerous than those that support cloud computing at hyperscale. Edge computing may take place on private or public premises: in the latter case, it can be delivered to customers as a (multi-tenant) service by public edge cloud providers.

In a 5G context, operators need to deploy edge clouds in metro/central offices and potentially cell sites to host distributed virtualised/cloud-native network functions such as the 5G SA core and vRAN. These edge clouds can also act as public edge computing locations for other applications, such as industrial use cases that have low-latency and security requirements that are similar to those of operator network functions. Operators often refer to edge computing that supports both 5G network functions and third-party applications such as multi-access edge computing (MEC).

Network slicing. The segmentation of the 5G network into virtual, bespoke networks that can provide distinct properties and characteristics to specific customers and use cases without the need to build separate, physical networks. These properties and characteristics may include differentiated security and quality-of-service features, performance capabilities and functionality, and they can be selected and instantiated through a network slice selection function (NSSF) defined in the 5G standards.

Ultra-reliable low-latency communications (URLLC). A key 5G SA capability that will deliver highly reliable and less than 2ms low-latency communication that is necessary for time-sensitive applications. Mobile network operators will use this capability to off new revenue-generating B2C and B2B services, such as AR/VR for gaming applications and smart factories.

Dynamic spectrum sharing (DSS). A way of using LTE spectrum for both LTE and 5G services. MNOs can use DSS to deploy 5G on existing 4G spectrum and gain first-mover advantage in countries where the national regulatory authorities (NRAs) have not yet made 5G spectrum available.

Self optimising networks (SON). An automation technology that adjusts radio parameters and other mobile network features that are otherwise manually controlled. SON enables rapid network tuning that can improve the customer experience and reduce costs.

Larry Goldman is the chief analyst at Analysys Mason. He has led Analysys Mason’s networks and software research since 2008. Larry co-founded the research firm OSS Observer, which was acquired by Analysys Mason. Before that, he led telecoms software development efforts at HP, Infinera and Verizon.

Article (PDF)

Download