MNOs in MEA should enrich their A2P propositions to capitalise on the long-term growth in the market

Business messaging is a revenue growth opportunity for telecoms operators in the Middle East and Africa (MEA) because most application-to-person (A2P) messaging currently relies on SMS. However, consumers are increasingly using IP-based messaging to communicate with brands. Indeed, 26% of the respondents to our consumer survey in MEA use social media or OTT apps as a customer service channel, compared to 12% for SMS.

This migration to digital channels will start to erode the value of the A2P market as more OTT players, such as Meta, look to monetise their messaging platforms and ecosystems. Operators should update their messaging propositions to remain relevant and should consider extending their mobile messaging and wallet platforms to support digital business-to-consumer (B2C) communications.

Operators will continue to dominate the A2P messaging market, but they will increasingly be challenged by OTT players

Businesses worldwide rely on messaging solutions to communicate directly with their customer bases. Sending messages via SMS, apps, websites, OTT communications and social media services is an efficient means of confirming transactions, communicating promotions and resolving customer service enquiries. The A2P messaging market will continue to grow strongly in terms of traffic and business spending in all regions worldwide between now and 2025.1

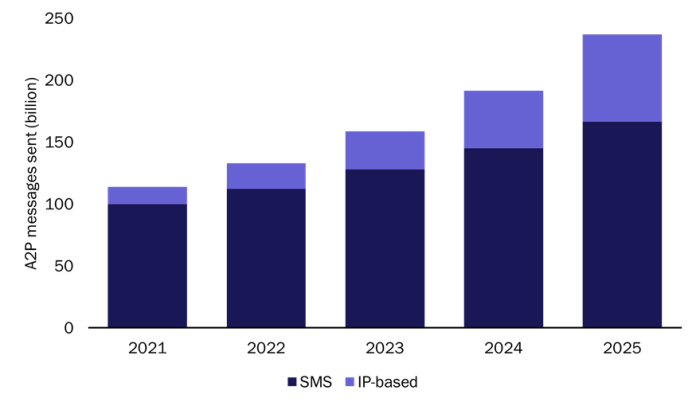

SMS is the main channel for A2P messaging in MEA thanks to its universal handset support and the widespread adoption of mobile money services that use SMS for notifications, authentication and authorisation. SMS will remain a key channel in terms of traffic and businesses’ A2P spending until at least 2025. However, SMS’s share of A2P traffic will fall from 88% in 2021 to 70% in 2025 as the use of OTT IP-based messaging (including operator IP messaging using technologies such as rich communication services (RCS)) grows (Figure 1).

Figure 1: A2P messages sent per year, by channel, MEA, 2021–2025

Source: Analysys Mason, 2022

Consumers’ rapid adoption of digital channels will increase OTT players’ share of both business A2P spending and consumer spending on OTT services (through the cross-selling other services such as e-commerce). The migration towards high-volume, low-cost, IP-based services will also contribute to the erosion of the value of A2P SMS messaging. Operators therefore need to evolve their core offerings if they want to protect their share of the increasingly competitive business messaging market.

OTT apps and social media are the preferred channels for consumers to interact with brands in MEA

The rich features of social and chat apps, such as the ability to send images and videos, are used by an increasing number of businesses to communicate with their customers. Major social and chat players (such as Meta, Snapchat and TikTok) are also using their large user bases to find new ways in which to monetise their services. For example, they have been providing tools that enable businesses to establish direct relationships with their clients and are offering APIs to integrate businesses’ back-end IT systems.

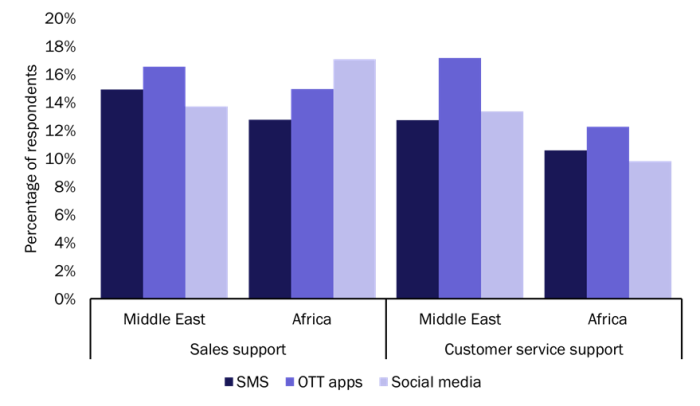

Consumers are also increasingly using digital channels to communicate with brands and government services. This has been driven by the increased penetration of smartphones and businesses’ adoption of multi-channel messaging solutions. Almost all of the respondents to our survey of smartphone users in MEA (conducted between September and October 2021) use OTT apps, and on average, they use more than 2.5 such apps each.2 The percentage of respondents that used OTT apps and social media to learn about products and promotions and to access customer service in 2021 was also higher than the proportion that used SMS (Figure 2). Conversely, SMS was the main channel for support with both sales and customer service in the 2020 edition of our survey.

Figure 2: Preferred channel for sales and customer service support, by region, MEA, 2021

Source: Analysys Mason, 2022

Operators in MEA should be proactive about improving their A2P platforms in order to benefit from the long-term growth of the market

Operators will benefit from the growth in A2P SMS traffic in the next 5 years. However, they need to be proactive in order to avoid missing out on the growth in the adoption of digital channels for B2C communications. There are two main approaches that they can take to enrich their A2P propositions.

- Enhance the messaging experience. Operators can enhance the messaging experience (compared to that when using SMS) by developing a native mobile messaging application using technologies such as RCS.3 A few operators in MEA, including 9Mobile, MTN (Nigeria), Orange and Vodacom, have been deploying RCS since 2019. However, OTT alternatives currently have the lead in terms of penetration, and it is unclear how long it will take for RCS to be accessible via a sufficiently large base of smartphones to be competitive.

- Build on the success of existing applications. Operators that have developed their own self-care or messaging apps or have deployed an app-based mobile financial service should consider adding A2P messaging features. Operators can differentiate from global OTT platform providers by supporting local languages and dialects, and by working more closely with local content developers and businesses. For example, MTN deployed the Ayoba messaging app in 20 countries in MEA and had 10 million active users by the end of 2021. The app supports gaming, music, entertainment, news, payments and money transfers (through MTN’s MoMo mobile wallet). MTN has also provided open APIs and two developer portals (one for Ayoba and one for MoMo) to enable merchants to create their own sales channels.

SMS will continue to dominate the B2C messaging market in MEA for the next 5 years, but operators that wish to capitalise on the long-term revenue growth opportunity from A2P messaging should look beyond SMS. They should consider developing digital alternatives to compete with the major OTT players and should create opportunities for new partnerships with local brands and marketing agencies.

1 For more information, see Analysys Mason’s Application-to-person messaging: worldwide trends and forecasts 2020–2025.

2 For more information, see Analysys Mason’s OTT communication services in the Middle East and Sub-Saharan Africa.

3 For more information, see Analysys Mason’s RCS Business Messaging opportunities for operators.

Article (PDF)

DownloadRelated items

Article

Nigeria will experience strong growth in telecoms service revenue in 2025, after price increases were approved

Forecast report

Sub-Saharan Africa: telecoms market forecasts 2024–2029

Article

Challenger telecoms operators in the Middle East and Africa are promoting services that offer value for money