The application-to-person messaging market continues to grow steadily, but the position of operators is weakening

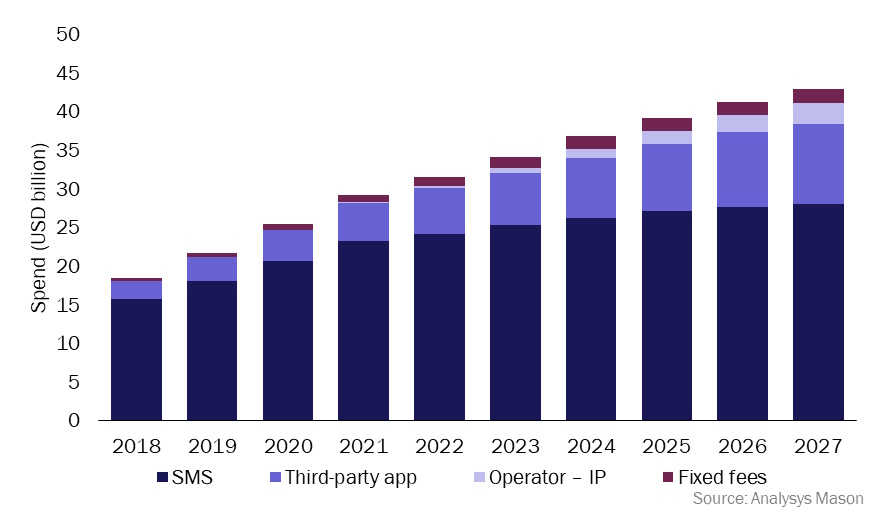

Business spending on application-to-person (A2P) messaging worldwide will grow from USD32 billion in 2022 to USD43 billion in 2027 as the demand for A2P messages continues to increase in all regions. The A2P messaging market will grow in all regions in terms of traffic and enterprise spending across all channels, though third-party apps, like WhatsApp, will outpace SMS.

SMS messaging has been the dominant A2P channel, in both volume and value. It will remain the largest spend category but will be overtaken in terms of volume by third party apps. In 2027, businesses will send 1.7 trillion message on third-party apps (for example, WhatsApp), compared to 1.6 trillion SMS and 0.35 trillion Operator IP (for example, RCS) messages.

The opportunity for operators will vary by country. Where alternatives have not yet gained traction, such as in the USA, prospects for SMS remain good. However, alternatives like WhatsApp have already seen penetration exceed 90% in major countries such as Italy and Spain; operators should be cautious about implementing aggressive price rises in these countries.

The data in this article comes from our newly released report Application-to-person messaging: worldwide trends and forecasts 2022-2027.

Businesses will spend USD43 billion on A2P messaging in 2027

SMS, third-party apps, brand apps, websites and emails all provide cheap, effective and efficient avenues to communicate with customers. Communicating with customers through third-party apps is less expensive than SMS and (often) offers security benefits from end-to-end (E2E) encryption preventing unauthorised access to the message content. For example, one-time passwords used in two-factor authorisations cannot be intercepted if sent using E2E encryption but they can be when sent via SMS. Third-party apps also facilitate a more engaging customer service experience than SMS for example, customers can send images or videos over WhatsApp to demonstrate a product is faulty, and similarly businesses can send pictures and videos in order to show customers how to use a product.

However, SMS has a greater reach than third-party apps or Operator IP. SMS messages are more likely to be received and read. SMS also offers spam protection filters. Despite this, customers prefer communicating with brands via apps or social media to SMS in all regions.1

A2P revenue can be generated by four categories of service.

- SMS. This includes circuit-switched SMS/MMS messages that are generated and terminated on operators’ networks.

- Operator IP. This is the use of operator-provided IP-based services, mainly rich communication services (RCS) business messaging but also includes Apple Business Messaging.

- Third-party apps.2 This includes IP-based messages sent using communication apps such as Facebook Messenger, WeChat and WhatsApp.

- Fixed fees. This includes all of the services that are related to A2P messaging and billed outside the traditional pay-per-transaction model.

SMS’s unique ubiquity, reliability and reach will limit the desire of businesses to seek alternative channels with these benefits, justifying its premium price. SMS messages are delivered without an internet connection, which gives SMS A2P messages an advantage over third-party apps, especially for reminder notifications. SMS A2P messaging will continue to generate the highest share of A2P global revenue throughout the forecast period. SMS A2P traffic will increase at a CAGR of 2.6% between 2022 and 2027, while third-party app A2P traffic will increase at a CAGR of 14% over the same period.

Figure 1: Enterprise spend on A2P messaging services, by channel, worldwide, 2018–2027

Most growth in the A2P messaging industry will result from increased third-party app usage. Demand for third-party app A2P messaging will grow, with 36% of all A2P traffic in 2022 being generated over third-party apps which will rise to 47% by 2027. However, third-party app A2P revenue will remain a relatively small part of the total spend (24% of total A2P messaging spend in 2027, up from 19% in 2022) since price per message is cheaper than for A2P SMS messaging. Globally, on average, third-party app A2P messaging is 40–50% cheaper than SMS A2P messaging.

WhatsApp has the largest reach of any third-party communication platform, with over 2 billion monthly active users worldwide. Some localised communication platforms dominate their country’s third-party communication apps market, such as WeChat in China, Kakao Talk in South Korea and LINE in Taiwan, each with over 90% penetration for person-to-person (P2P) messaging. Businesses can quickly and cheaply acquire A2P messaging services for these platforms. Alongside increased security offered by E2E encryption, third-party apps offer an enhanced experience compared with SMS including being able to send images which may improve customer service.

A significant degree of uncertainty continues to surround RCS; it will likely remain largely irrelevant in most countries and to most businesses. The technology significantly improves messaging experiences compared to SMS, but adoption is low. Apple has stated it will not adopt RCS technology, limiting its reach.

Chinese operators China Mobile, China Telecom and China Unicorn committed to a common Chinese RCS strategy in 2020. So far, this strategy has failed to compete with that of giant third-party app competitor WeChat. There are only six countries (Belgium, Germany, Japan, South Korea, Spain and the USA) in which all major operators support RCS as of 4Q 2022. The prospect of significant RCS take-up would be highest in a country with low third-party app and low Apple iPhone penetration. France (32% iPhone penetration, 58% WhatsApp penetration) is a strong contender for significant RCS adoption.

SMS messaging remains a powerful tool in many countries, but operators should be cautious about price rises

The strength of SMS’s position varies greatly by country. SMS is, and will remain, in a strong position in Australia, Canada, France, New Zealand, Sweden and the USA. In these countries, no competing service has more than 60% penetration of users.

However, SMS is in a much weaker position where competing platforms have much greater penetration. For example, based on our survey, the following apps have over 90% penetration:

- WhatsApp in Indonesia, Italy, South Africa, Spain and Turkey

- Facebook Messenger in the Philippines

- WeChat in China.

In all countries, operators will need to be careful about raising prices for SMS, but especially so in countries where the alternatives (for example, WhatsApp, WeChat) already have a high user penetration.

1 According to the Analysys Mason Consumer Survey 2022.

2 Analysys Mason formerly referred to this category as OTT or non-operator IP messaging.

Article (PDF)

Download