Business A2P messaging will continue to migrate away from SMS, but operators can help to stem the flow

Operators face competition from third-party applications (such as WhatsApp) for business messaging customers. As the penetration of these apps increases, many businesses will opt for platforms such as WhatsApp instead of SMS. This has already happened in China, where WeChat is the primary channel for B2C messaging (rather than SMS).

To compete with third-party apps in the B2C messaging space, operators need to understand the different business models these apps use, their strengths and weaknesses, and how they can prevent revenue migration. Operators should reconsider their application-to-person (A2P) SMS pricing models, invest in two-way A2P SMS messaging and encourage long-term RCS adoption to prevent revenue migration.

Analysys Mason explores the B2C messaging business models of third-party app providers and recommends the steps that operators can take to limit revenue loss in this report: Third-party communication platform business messaging models: case studies and analysis.

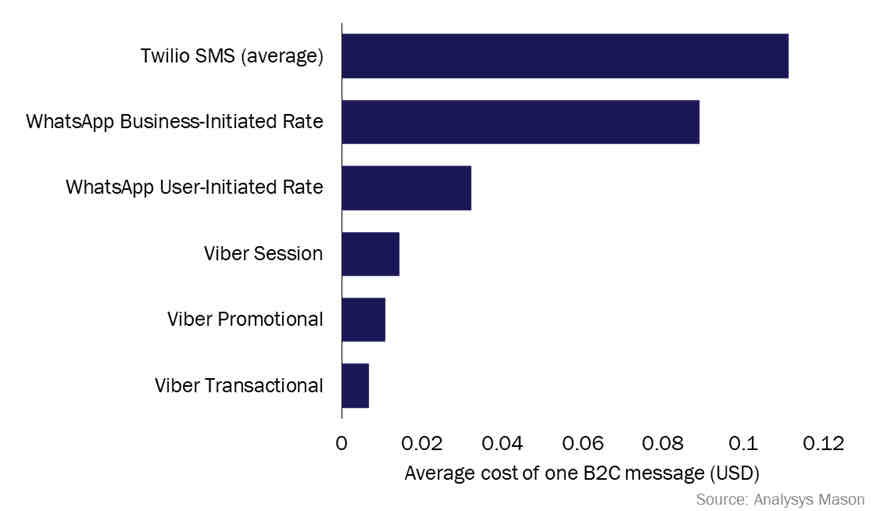

A2P SMS messaging is more expensive than alternative third-party messaging options

Third-party apps offer cheaper business messaging than SMS, with more functionality, including the capability for multimedia messaging (for example, image sharing). Additionally, many third-party apps charge a one-time fee for 24 hours of conversational business messaging, enabling businesses to offer cheap customer service, which is convenient for consumers. Some competitors, like Facebook, do not charge for messages, but do have some limitations on their services. RCS uses a one-time fixed fee per 24-hour period for conversational customer service but the service has drawbacks such as lack of reach and incompatibility with iOS.

Figure 1: The cost variation of one message across 214 locations on Twilio, WhatsApp and Viber, 20231

Third-party apps vary significantly in their B2C messaging strategies but outperform SMS on price and functionality

No app can outperform SMS on reach. However, every app outperforms SMS on functionality (such as image and video sharing, conversational commerce, read-receipts), making these platforms preferable for many consumers to interact with customer support. Additionally, the most advanced apps (such as WeChat) enable e-commerce within the app or conversational commerce (for example, Facebook Messenger offers services such as Uber).

As third-party apps are cheaper for businesses to communicate with customers, many will do so once it is established that a customer can be contacted on an app. However, each app has unique selling points and weaknesses. In general, the most common weakness is a limited reach (compared to SMS, which is ubiquitous). However, specific apps in some countries have reached near-ubiquity (for example, KakaoTalk in South Korea, WeChat in China and WhatsApp in Spain).

Figure 2: Third-party apps and their business messaging strategies, by price and functionality

| Third-party app | Overview of business messaging pricing strategy | Price (1 = expensive, 5 = cheap) |

Functionality (1 = limited, 5 = comprehensive) |

| Facebook Messenger | Facebook Messenger offers free business accounts and free B2C messaging. However, businesses cannot make initial contact (they can only respond when a customer contacts them), encouraging businesses to pay for advertisements. | 5 | 5 |

| KakaoTalk | KakaoTalk offers three tiers of business messaging based on the users’ relationship with the business. | 2 | 5 |

| LINE | LINE offers free one-to-one customer messaging. For bulk messaging, LINE allows 1000 free messages per month, but charges for more than 1000. | 3 | 5 |

| WeChat offers free business accounts, but verification is charged annually. It has two business accounts that facilitate bulk messaging. Its offer is customisable to various business needs; customer service messaging is free. | 4 | 5 | |

| WhatsApp offers two tiers of business messaging. For both, the business pays a flat fee to message a user within a 24-hour period. The fee depends on whether the business or user initiates the conversation. | 2 | 3 | |

| SMS A2P | SMS A2P messaging is priced per message. | 1 | 2 |

| RCS A2P | RCS A2P messaging can be priced per 24-hour chat window, facilitate inter-app functionality and offers end-to-end encryption. | 2 | 4 |

Many third-party app features are available through RCS. In all countries covered in Analysys Mason’s consumer survey, at least one app has higher penetration than RCS. Additionally, where RCS is limited to Android users (in most countries), third-party apps can be used on all devices.2

Operators should act to prevent future revenue migration and consumer preference for third-party apps over SMS

Operators can limit customer migration to third-party apps. In the report, we recommend that operators should manage their business messaging strategies to remain competitive by:

- working with A2P vendors to reconsider their SMS A2P pricing models

- investing in facilitating two-way A2P SMS messaging channels

- encouraging RCS adoption and usage by targeting Android users and businesses.

Using A2P SMS is more expensive for businesses than using third-party apps. In some cases, the ubiquity of SMS makes it the clear choice for business. However, this is not universally the case with many businesses turning to third-party apps for their messaging needs. To help combat this threat to revenue, operators with wholesale SMS businesses or those that work with A2P vendors could offer a lower price for subsequent A2P SMS messages (that is, after the first message is delivered within a 24-hour period). This could increase the popularity of SMS messaging for some businesses, such as delivery companies, and could limit the migration to third-party apps.

Operators cannot stop the flow of business to third-party apps, but they can do more to support their SMS business, maintain competitivity and maximise revenue. For example, with investment in network-as-a-service (NaaS) APIs and reselling third-party app APIs, operators can generate new revenue to mitigate the decline in wholesale SMS revenue.

1 Viber’s pricing data is taken from Tyntec, WhatsApp’s pricing data is from WhatsApp’s website and Twilio’s SMS data is from Twilio’s website. It is accurate in February 2023.

2 WIT Software has developed a commercial RCS app for iPhone, which is available in Japan and India.

Article (PDF)

Download