AI buzz at DTW2024-Ignite: operators turn their attention to data-related issues on their AI journeys

TM Forum’s global industry event, DTW-2024 Ignite, was not short of AI-related industry developments. New AI-based products and services were launched, TM Forum’s Catalyst project teams1 demonstrated AI innovations and operators partnered to address key issues affecting the pace of AI-related innovation in the telecoms industry.

Operators’ acknowledgement of the need to focus on transforming existing data environments to enable AI projects to progress from the proof-of-concept (PoC) stage to full-scale deployments was a highlight of the event. This development will bring opportunities for data platform solution providers, but these vendors must be prepared to help operators to justify investments in data modernisation projects by providing solutions that greatly reduce the cost and time to deploy, while delivering returns on investment (ROIs).

AI-related activities dominated DTW2024-Ignite

Generative AI (GenAI) was a hot topic at the event; telecoms industry players are developing GenAI use cases that go well beyond enhancing chatbots. Interesting use cases at the event included:

- T-Mobile USA’s implementation of a GenAI-based process optimisation tool to improve RAN optimisation productivity levels

- Amdocs’s Cloud Consulting Service’s use of large language models (LLMs) to refactor legacy systems before migrating them to the cloud

- Google Cloud’s use of its multi-modal Gemini LLM to address the constraints that network engineering/provisioning, network and field operations teams face when using a multi-modal GenAI assistant.

Telecoms application providers such as Cerillion, CSG, Huawei, Netcracker and Nokia also showcased their GenAI solutions. For example, Cerillion demonstrated the use of a bring-your-own-LLM approach to enable operators to simplify product and offer development using Cerillion’s GenAI-based catalogue.

Participants of TM Forum’s Catalyst projects demonstrated how AI can be used to transform telecoms operations and explore new business models. For example, five TM Forum members collaborated on a project titled ‘AI agent empowering higher autonomous level’ to investigate how an LLM-based AI agent can transform network operations.2 This project used an LLM to deduce a user’s intent from a natural language prompt, deconstruct it into specific tasks to fulfil the intent and signal the relevant AI agents (that use GenAI and non-GenAI technology) to execute them. We expect that use cases of this kind will become more popular because they enable operators to combine prior investments in non-GenAI developments with the generative capabilities of LLMs to address more-complex tasks.

Operators used DTW2024-Ignite to deepen their partnerships and accelerate AI innovation within the telecoms industry. For example, the founding members of the Global Telco AI Alliance (GTAA) launched a joint venture (JV) at Mobile World Congress 2024 to co-develop a multi-lingual telecoms LLM. Members of the JV agreed, at DTW2024-Ignite, to make an equal investment into the JV. These investments will then be used as working capital. This development is likely to enable members of the GTAA to achieve their GenAI ambitions at a reduced total cost of ownership (TCO).

Operators recognise the need to modernise data environments for AI use cases, but expect vendors to help to justify the TCO/ROI benefits

The telecoms industry’s buzz around AI will be short-lived if operators cannot progress from the current PoC stage to the production or full deployment of use cases in business and network environments. Operators’ existing data environments are unfit to support the full deployment of most AI use cases. Even the popular retrieval augmented generation (RAG)-based deployments for GenAI use cases will be affected by the level of access to, and the recency of, the data being retrieved to support RAG workflows. Data that is easy to access and recent is essential to avoid inaccurate responses and hallucinations of the LLMs used to support RAG-based use cases.

It was therefore gratifying to learn, from interactions with industry players at the event, that operators realise that they must prioritise investing in creating the right data environment in order to make meaningful progress with their AI deployments. This development presents opportunities for data platform solutions providers to grow their operator engagements. Analysys Mason’s research and insights provide details on these opportunities and how vendors can position their solutions to address operators’ data challenges.

However, resolving operators’ data challenges will not be easy, quick or cheap. Vendors will need to provide solutions that greatly reduce the associated time and cost, thereby improving the business case for operators. In addition, vendors will need to give operators a clear understanding of the potential benefits of data modernisation projects (for example, a faster time to market for AI use cases) and the timelines to realise them.

For example, Campbell McLean, BT Digital’s Chief Architect, shared with TelecomTV that BT plans to develop a single data ‘fabric’ that encompasses all forms of data related to BT’s customers and services. He acknowledged that establishing an effective data environment will not be easy for any operator and that operators have struggled to understand their datasets because they are large, dispersed and very diverse. Operators like BT with data in multiple locations (on premises, and in private and public clouds) and with growing data volumes, sources and variety, will find the creation of this single data fabric to be complex, time-consuming and expensive. However, this data modernisation investment will deliver simplified data access and accelerate BT’s AI developments.

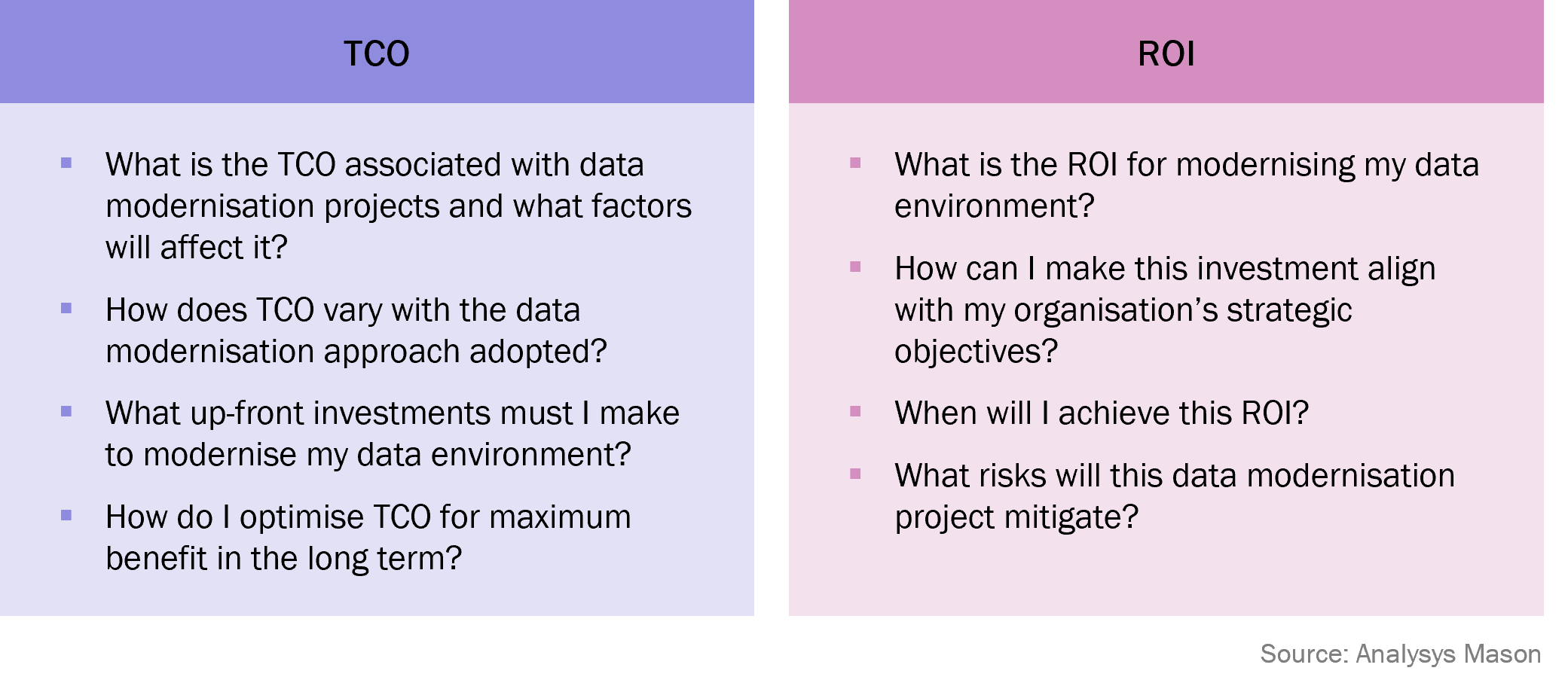

Data solution vendors must be prepared to address the questions that operators will raise as they embark on their data modernisation journeys (Figure 1).

Figure 1: Questions that data and AI solutions providers should prepare to address when engaging with operators to modernise their data environments

The pressure that operators face to improve margins means that data platform solution providers must approach operator customers with data modernisation solutions that are cost-effective in the medium-to-long term, and that deliver rapid ROI in the short term, to facilitate sign-off.

1 TM Forum’s Catalyst projects bring together TM Forum members (operators and vendors) to develop solutions that advance telecoms industry innovation using TM Forum’s assets, AI and automation.

2 LLM-based AI agents are designed to operate alongside other AI agents that address specific tasks (using GenAI- or non-GenAI-related technologies). They also integrate with operators’ OSSs and BSSs to execute tasks.

Article (PDF)

DownloadAuthor