A crisis of overproduction in bandwidth means that telecoms capex will inevitably fall

The world is entering an era of ubiquitous, plentiful, affordable and reliable bandwidth. The telecoms industry can afford to keep up with changes in demand (and at much lower capital cost than in the past 30 years). This is because:

- telecoms networks are close to delivering enough infrastructure for foreseeable future use

- productive forces deliver exponential growth in capacity, but demand for bandwidth does not grow exponentially

- new devices and applications that could drive surges in bandwidth demand will be developed to exploit already-abundant network resources

- the capital cost of optimising the utilisation of already-built assets is a fraction of the cost of building them.

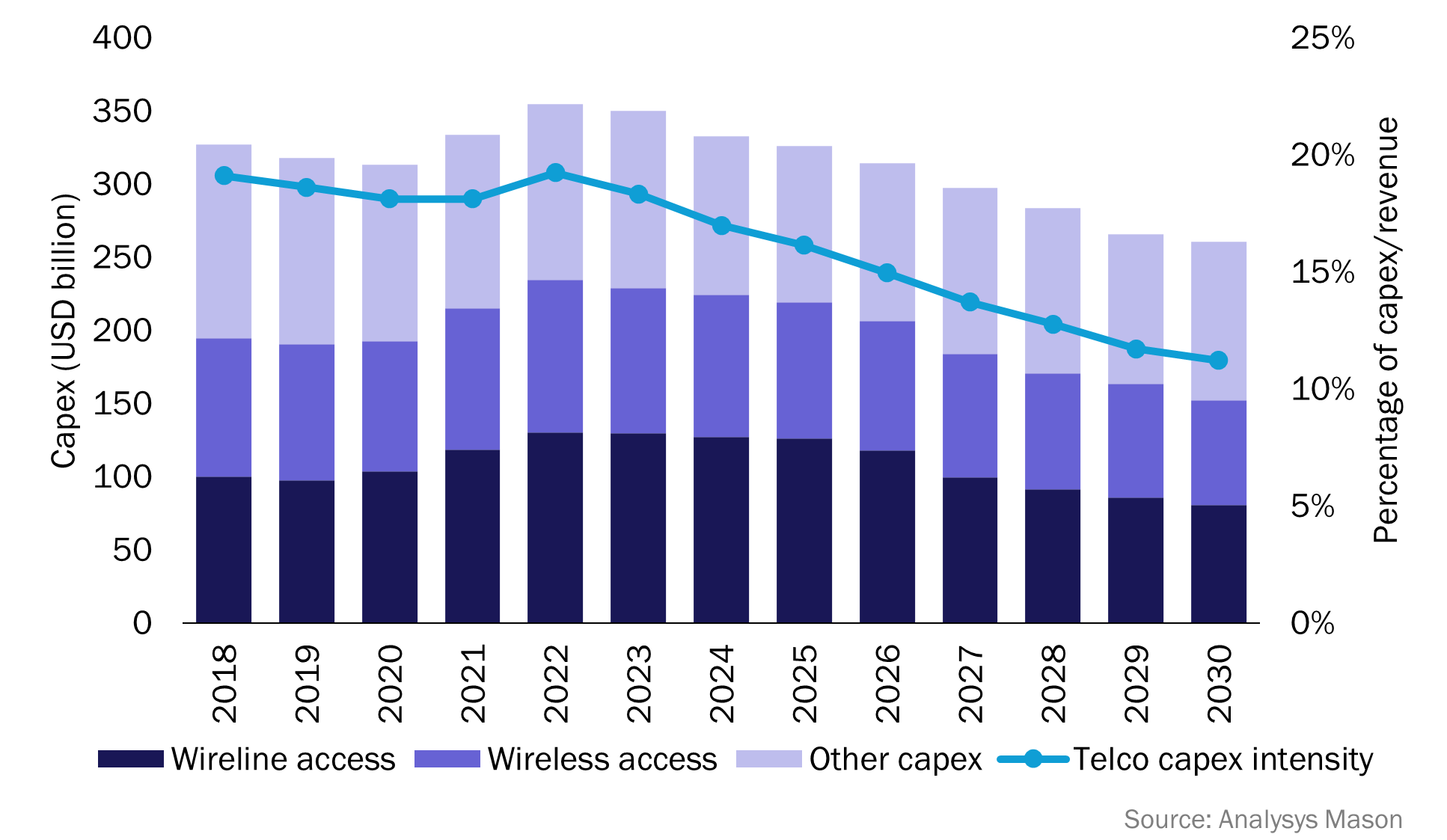

We therefore expect network capital intensity to decline sharply from current levels of around 20% to around 12% by the start of the 2030s. We do not expect another cyclical rebound. This article provides a high-level summary of Analysys Mason’s The end of big capex: new strategic options for the telecoms industry, outlining the current inflection point for telecoms, as well as the challenges and opportunities that a permanent reduction in capex brings for operators and vendors.

Operator investment has delivered bandwidth capacity far ahead of demand

Global telecoms capex has reached a peak at a moment when demand is stalling.

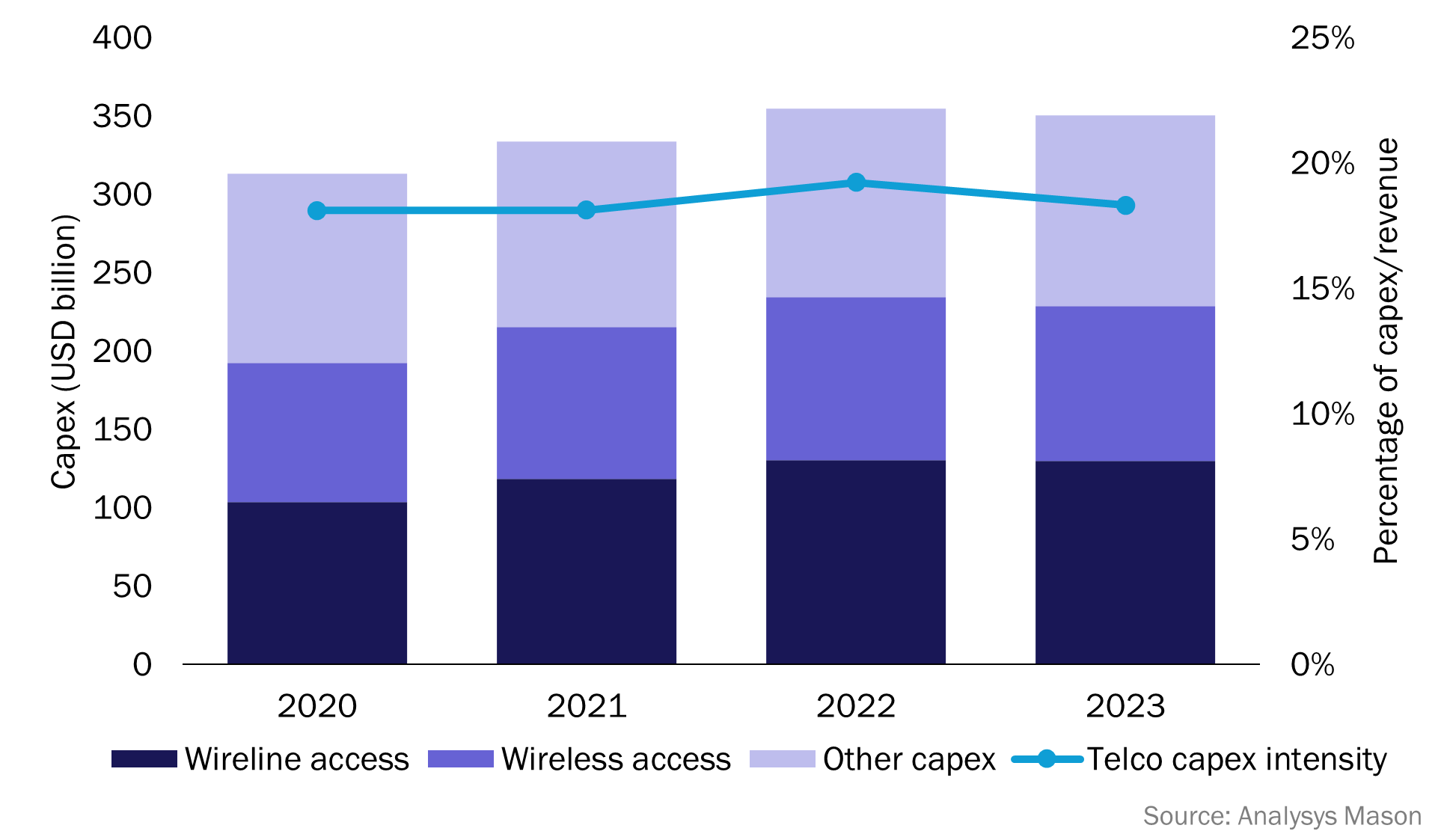

Figure 1: Telecoms capex, worldwide, 2020–2023

The last 3 years have represented a confluence of two peaks in capex:

- a cyclical high in mobile spending because of initial 5G coverage roll-out. This has now passed its peak in high and middle-income countries, and capex on advanced 5G and 5G standalone (SA) is not growing as fast as the decline in 5G non-standalone (NSA) and 4G.

- a one-off high in fixed access spending. The timetable of FTTP roll-out varies greatly between countries and operators, but capex has plateaued at a global level.

The 2023 accounts of the 50 largest operating group accounts worldwide show a sharp reversal of capex trends, and their outlooks indicate further decline to come.

Ownership of towers and fibre has shifted significantly in the past few years from vertically integrated operators to infracos. However, this does not mean that capex continues at a high level of intensity, but rather through different types of company. Infraco capex intensity is also facing decline.

- Towerco pipelines of build-to-suit are generally contracting.

- Fibrecos that are building FTTP are ultimately subject to the same demand constraints (limits of overbuild) as vertically integrated operators.

In addition, the capex-based IT investment model has shifted to an opex model in which spend goes to cloud providers. IT capex is rarely as much as 10% of operator capex, and this gradual shift does not greatly change overall capex intensity.

Data traffic growth is lower than ever before

For both consumer mobile and consumer fixed broadband connections, average usage exhibits clear signs of saturation in the most advanced markets.

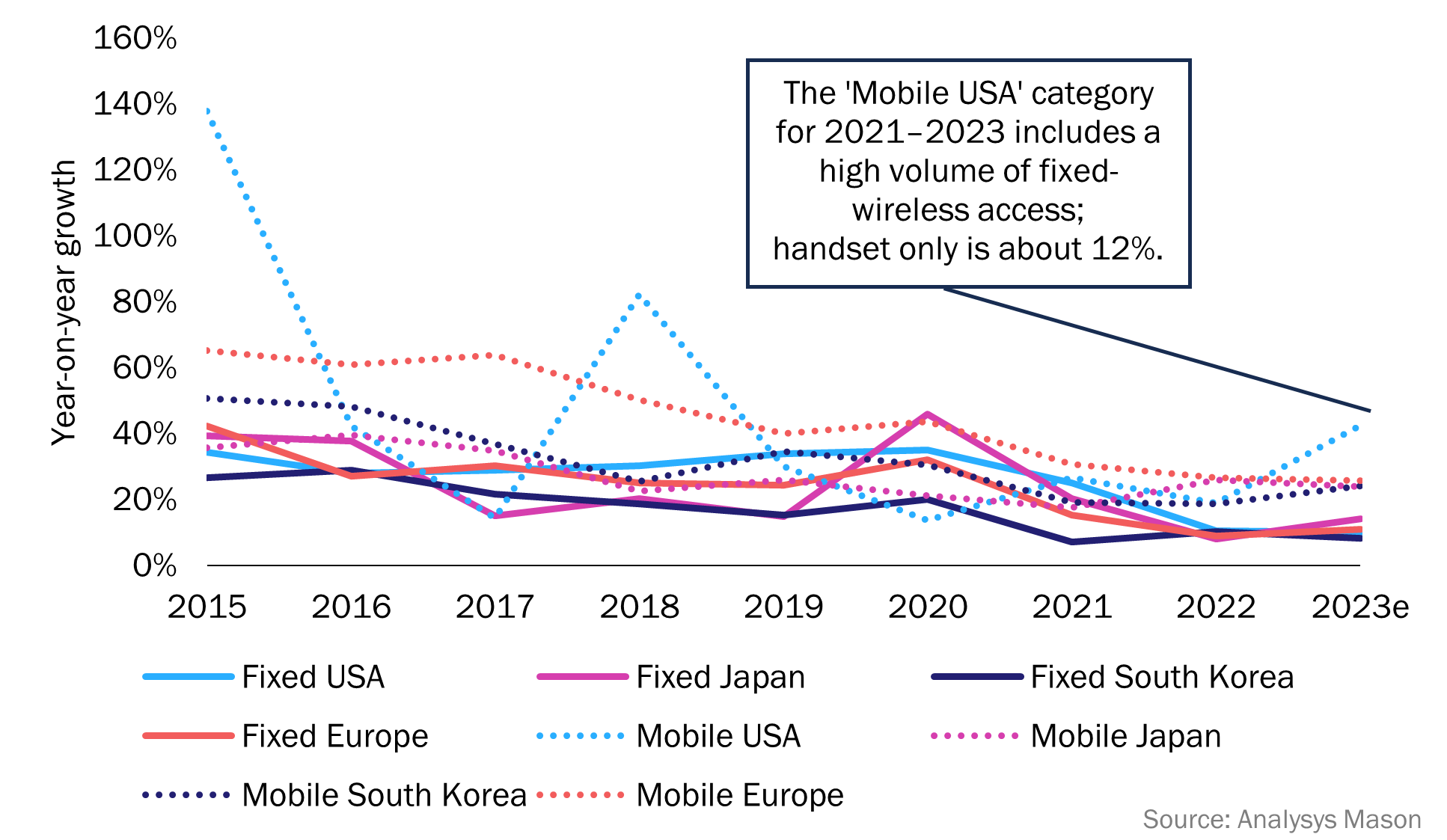

Figure 2: Fixed and mobile data traffic growth rates, USA, South Korea, Japan and Europe, 2015–2023e

Growth rates are not declining because of supply-side constraints such as spectrum or coverage; access networks have never been emptier. Rather, the two principal drivers of traffic growth, smartphone usage and broadcast-to-streaming migration on mobile and fixed networks, respectively, have both run up against human limits; limited hours for engagement and the limits of human vision.

While mobile data traffic has usually grown faster than fixed, the difference in volume between the two remains huge, and substitution – either way – is rarely strong. High mobile usage is not primarily driven by applications, but by the absence or unaffordability of fixed, which is usually a temporary phenomenon. Fixed networks are the more likely beneficiaries of any xR-related surge in growth, if this ever occurs.

There is a pervasive narrative in the telecoms industry that persistently high or cyclical capex is driven by exponential growth in demand. This narrative has several causes.

- Mobile erroneously gets treated as the template for all telecoms services. Mobile capex has historically been cyclical, but it is not a useful template because it represents just a third of capex and a sixth of usage (and less in many of the most-advanced countries), and the other major parts of capex are not cyclical.

- CAGRs are often used misleadingly to give the impression of steady (or ‘exponential’) growth, which disguises more-complex trends.

- The rhythm of equipment replacement, driven by useful asset lives or inter-operator competition, is misinterpreted as a pattern of demand.

- Industry lobbyists encourage a perception that high capex intensity is a result of continuous pressure caused by the volume of traffic originating from content-providers. Developers want their devices and applications to reach a critical mass of users and are disincentivised from investing in the development of devices and applications that would push operators towards further heavy capex.

The symptoms of a crisis of bandwidth overproduction are already evident

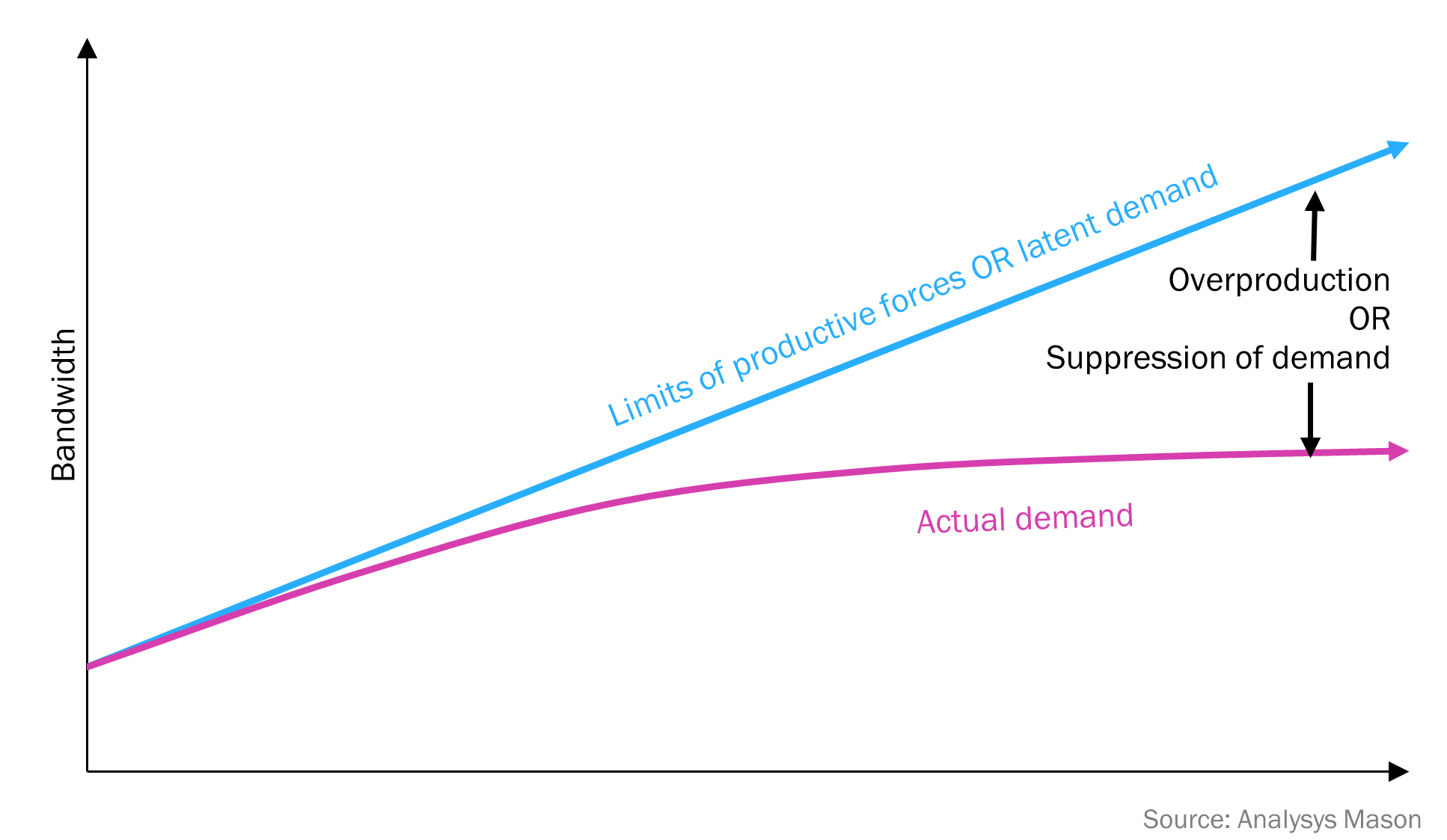

Crises of overproduction are caused by producing according to the limits of technology without any consideration for the actual limits of the market. These crises often get (erroneously) presented as suppression of demand that would match latent demand if there were certain interventions.

Figure 3: Two ways of interpreting flattening demand: overproduction and suppression of demand

The standard response of the telecoms industry to crises of overproduction, just like earlier industries that have experienced similar crises, takes two main forms.

- Pile it high, sell it cheap. Overproduction can clearly be seen in the growing disparity between entry-level services and actual demand: one discount operator in Europe offers an entry-level 10Gbit/s symmetrical consumer broadband service. Competitive fixed-wireless access (FWA), such as that of T-Mobile, depends on the fallow capacity between produced capacity and mobile demand, but yield per gigabyte is only about 5% that of mobile.

- Shiny new business models. Overproduction is also evident from the scramble to invent/develop new business models, often with more-indirect or more-complex value chains, such as ‘frictionless’ wholesale entry/exit points, B2B2X models and network-as-a service (NaaS) models (including those where providers of content and applications pay for network features). Vendors in the supply chain employ marketeers and industry analysts to persuade their customers (and investors) that enabling innovative business models, often through ever more-sophisticated software, can capture latent demand or create new pockets of demand. These enhanced connectivity-based models remain largely unproven.

If demand does not revive, then the lower unit costs brought about by overproduction will, in any reasonably competitive market, result in further deflation of the value of the industry.

Telecoms capex will continue to fall sharply

Network capex can be broken down into passive, active and software components. These have different useful lives, and consequently different replacement cycles. The current split is about 60:30:10.

Infrastructure capex lies largely in fixed networks. It will fall because there are limits to how much overbuild is ever going to be commercially viable. The shift from build to buy has already started. Any strategic densification of mobile looks more remote than ever, and the scale of tactical wireless infrastructure plays (for example, indoor neutral-host and distributed antenna systems (DAS)) remains tiny.

Active equipment capex will shrink, and operators will look for ways of optimising replacement cycles.

- Many mobile operators have rethought the importance of SA to future business prospects. Open RAN should, in theory, drive capex down, as should mobile network cloudification, but the impact of these two developments will be limited.

- It is already clear there will be little appetite for more ‘big bang’ capital projects. 6G will turn out to be far less capex-intensive than 5G or previous generations, fulfilling some of what was already intended for 5G rather than the kind of capex-intensive, site-refresh that characterised previous generations.

- Upgrades of active equipment on FTTP networks will become less frequent. There is little appetite for upgrades beyond 10Gbit/s: 50G will be delayed. One sector with rising capex will be cablecos, which will have to make the expensive upgrade to fibre sooner than they would have wished.

- Transport networks are more sensitive than access networks to traffic growth, and will, unlike access networks, be strongly affected by AI. However, transport has never accounted for much more than 10% of overall capex. A higher proportion of transport network capex will be spent by hyperscalers.

Software capex will continue its migration to the cloud, where it reappears as opex. Figure 4 summarises Analysys Mason’s forecast of global telecoms capex.

Figure 4: Telecoms capex, worldwide, 2018–2030

For the vertically integrated fixed+mobile operator, network capex intensity will decline to about 12% by 2030. Historically, capex intensity has been lowest among mobile-focused operators, but it has rarely dipped below 10%.

The telecoms industry has to adapt to a permanent reduction in capex on infrastructure and networks

For operators, lower capex should result in improved cashflows, despite the danger that the margin gets competed away (‘investment’ in lower prices). While they may not have an embarrassment of riches, they will have enough additional cashflow to make less-proscribed choices about their futures. In particular, they have a new opportunity to invest in scale, much of it through acquisition more than capex. Their options include:

- consolidating physical network ownership and buy back stakes in key fibre assets

- finding synergies with adjacent existing or emerging networked infrastructure businesses

- delayering network and end-user-facing businesses, and consolidating at the service and enterprise layer, potentially at the regional as well as national levels

- investing to compete in new areas by acquiring selected B2B businesses: for example, not counting on advanced connectivity-related services to deliver growth.

An often-overlooked truth is that a large chunk of telecoms capex does not flow to equipment vendors, but rather to contractors. These civil engineering companies will need to look elsewhere for revenue growth.

Vendors need to refocus on new revenue growth areas outside mobile access technology. The severe slowdown in demand combined with the increasing improbability of mobile networks supplanting FTTP/Wi-Fi makes this particularly urgent.

Selling equipment that leads to an overproduction of bandwidth will get harder. So too will selling overproduced equipment, especially if vendors are forced to lend their capital to other countries in order to create a market for their goods.

However, there are three main opportunities to create ‘better’ networks:

- smarter networks

- greener networks

- more-durable networks.

If networks no longer need rapid expansions in capacity, then strategically it might make more sense to refocus on end-user devices. Motorway build has stalled, but cars continue to evolve. Smartphones evolve, perhaps at a slower pace than before, but there may be better or bigger opportunities in other customer premises equipment (CPE) (for example, home CPE and components for smart EVs). A further move might be a shift to industrial, enterprise and consumer applications unencumbered by any reliance on advanced connectivity.

Operators should harness new, quality productive forces

The green and digital industrial strategy for 2035 set out by the Chinese government in March 2024 indicates a strategic shift away from the productive forces that have hitherto propelled the Chinese economy in favour of harnessing new productive forces.

“New quality productive forces refer to advanced productivity freed from traditional economic growth modes and productivity development paths. It features high technology, high efficiency and high quality, and is in line with the new development philosophy.”

In the context of the telecoms sector, a move away from ‘traditional productivity development paths’ could be read as an acknowledgement that the old productive forces that delivered ‘strategic infrastructure’ (3G > 4G > 5G, or 10G FTTP), and ever-greater productivity gains (cost per byte), are no longer fit for purpose.

It is possible to have enough infrastructure, it is possible to have enough bandwidth. Oversupply leads to deflation. The search for ways of unlocking new sources of value from abundant infrastructure through advanced connectivity will not yield as much value as had been hoped. Running, maintaining and tactically improving those networks will remain an important high-margin, falling-capex but low-growth business. Business growth will have to come from other sources that deliver value to end users irrespective of whether they are tethered to networks.

This article is an abridged version of The end of big capex: new strategic options for the telecoms industry.

Article (PDF)

DownloadAuthor

Rupert Wood

Research Director, expert in infrastructure, fixed networks and wholesaleRelated items

Strategy report

Moving from cable to fibre networks: the economic implications on operating costs

Article

Operators are prioritising efficiencies within their organisations to reduce their operating costs

Case studies report

Telecoms operator opex reduction strategies: case studies and analysis (single-market European operators)