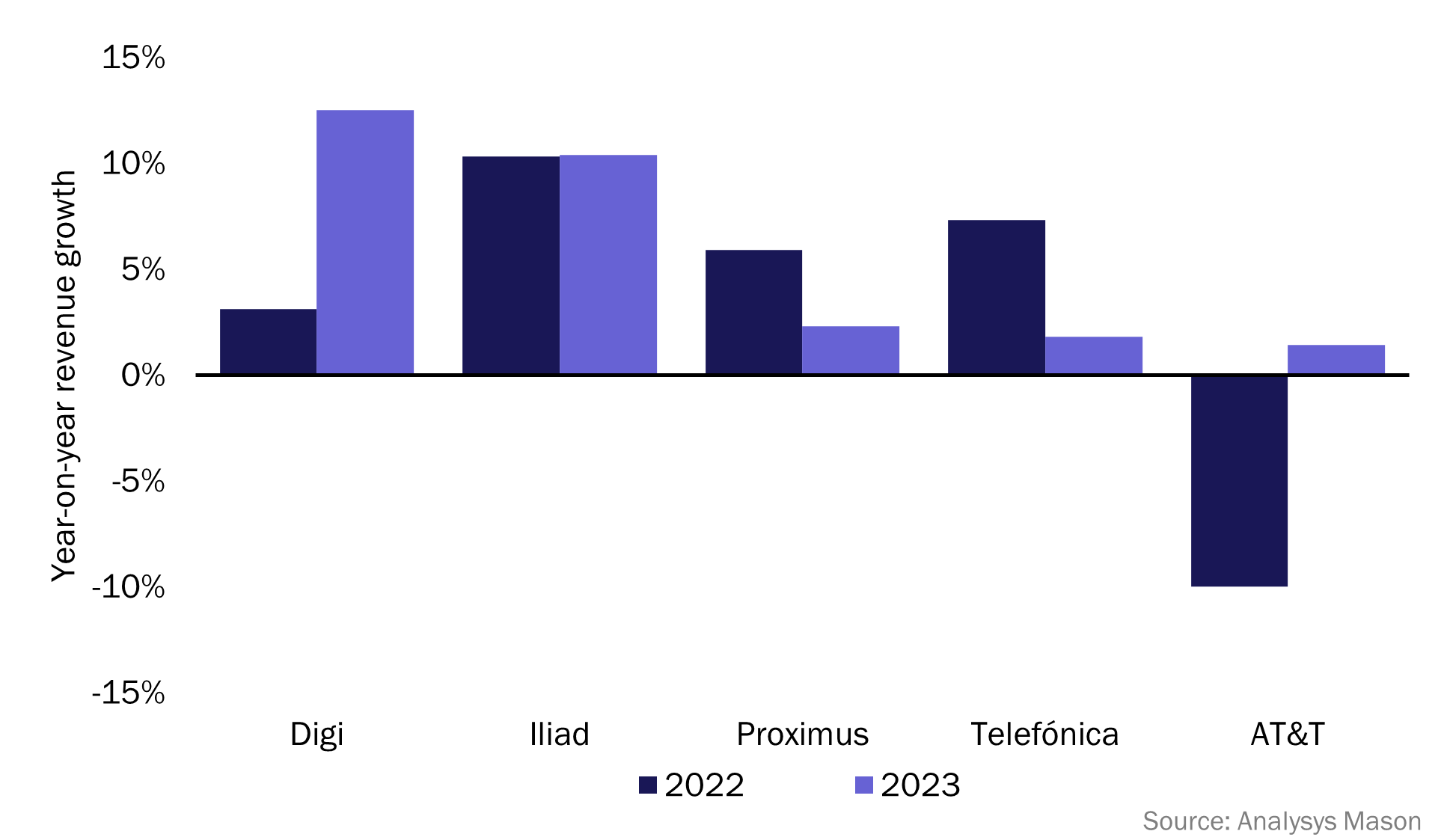

Digi and Iliad grew their revenue far more quickly than the established competition in 2023

Budget-friendly operators such as Digi and Iliad outperformed many established competitors in terms of revenue growth in 2023. Their simple, low-cost connectivity offerings appeal to many consumers, which has enabled them to expand their footprints and increase their market shares. Digi and Iliad are also smaller and more agile than many of their competitors, which enables them to move quickly and seize opportunities.

Both Digi and Iliad grew their revenue by more than 10% year-on-year in 2023

The economic conditions of high inflation and, in many countries, low GDP growth have resulted in price rises by many operators while consumers have sought to cut spending. Budget operators, such as Digi and Iliad, have benefitted from these conditions and experienced faster revenue growth than the more established players in 2023 (Figure 1).

Figure 1: Year-on-year revenue growth, selected operators in Western Europe and North America, 2022–2023

Indeed, the revenue growth rate for both Digi and Iliad was in the double digits in 2023 thanks to the use of a connectivity-focused strategy. These players had the fastest revenue growth of all the operators examined in Analysys Mason’s Telecoms operator growth strategies: case studies and analysis (volume VI).

Digi and Iliad are intending to expand their low-cost connectivity offers to new countries, while also growing their customer base

Digi and Iliad both employ strategies that focus on low-cost connectivity. They are actively expanding their operations in their current footprints, while also extending their reach to new countries. Iliad has been more focused on the former in 2024 so far, while Digi has been more focused on the latter (Figure 2).

Figure 2: Expansion initiatives by Digi and Iliad, 2023–2024

| Operator | Country/region | Description |

|---|---|---|

| Digi | Belgium | Digi has acquired 5G spectrum in Belgium and has a lease agreement with Proximus for fibre connectivity. It intends to launch services in 2024. |

| Digi | Portugal | Digi has acquired 5G spectrum in Portugal and is looking into options for leasing fibre connectivity; it may use Vodafone Wholesale. It intends to launch services in 2024. |

| Digi | Romania | Digi announced, in May 2024, a preliminary agreement to purchase Telekom Romania.1 |

| Digi | Spain | Digi announced the sale of its fibre networks in April 2024 to finance its MNO ambitions, despite significant investment in 2023. |

| Iliad | Italy | Iliad proposed, in December 2023, merging Iliad Italia with Vodafone Italia. However, this was rejected in January 2024. |

| Iliad | Latin America2 | Xavier Neil (the founder and owner of Iliad) announced, in May 2024, his intention to purchase Millicom International Cellular via his Atlas investment vehicle. |

| Iliad | Ukraine | Xavier Neil announced, in April 2024, his intention to purchase Ukraine’s Datagroup-Volia. |

Source: Analysys Mason

Digi has historically applied a step-by-step approach to gain traction and reach. It enters new markets when it sees an opportunity and takes advantage of any gaps in what is available. It uses a range of strategies, such as wholesale connectivity, leaseback agreements, infrastructure investments and spectrum acquisition via operator divestiture.

Iliad has been focused on increasing its share of connections in existing markets. Its mobile and fixed broadband market share of connections in France increased by 0.7 and 0.6 percentage points, respectively, between 4Q 2022 and 4Q 2023 (under the ‘Free’ brand). Its mobile connections market share in Italy increased by 1.5 percentage points during the same time frame. Furthermore, Iliad was the only operator in Poland to increase its mobile market share of connections year-on-year in 4Q 2023 (+0.9 percentage points).

Iliad has not increased its headline tariffs; it has instead opted to make quiet price increases by raising the prices of its booster add-ons, for example. This has allowed Iliad to increase its ASPU from its existing customers while marketing itself as a trustworthy operator who will not increase tariffs mid-contract.

Simplicity is another key aspect of Iliad’s offer. It has only a few simple mobile plans in Italy, while its competitors offer multiple plans with bundles and promotions. Iliad’s straightforward approach helps it to appeal to customers that are confused by other operators’ more complex offers.

Established operators can learn from agile and opportunistic operators such as Digi and Iliad

Digi was originally a cable operator in Romania, which then established itself as an MNO. It then spotted a gap in the market to deploy fibre in Spain, and doing so led to a rapid increase in its number of customers in 2023. It sold its fibre infrastructure to finance its ambitions to become an MNO in Spain in 2024, and has plans to launch as an MNO in Belgium and Portugal. These expansion plans are only possible due to Digi’s agility.

Iliad’s marketing has enabled it to build a reputation as an operator that consumers can trust. Indeed, Iliad leads the market in terms of Net Promoter Score (NPS) in Italy and France (NPSs of 53 and 28, respectively).3 It has marketed itself as an operator that will not raise prices by avoiding headline price increases. It has also positioned itself as an operator with simple and transparent tariffs, particularly in Italy.

Both Iliad and Digi are rapidly expanding their operations in Europe, but the established operators are retrenching. Digi is proposing to buy Telekom Romania Mobile from Deutsche Telekom. Deutsche Telekom also sold its operations in the Netherlands in 2022. Vodafone is in the process of withdrawing from Italy and Spain.

Digi and Iliad have grown their operations thanks to a mixture of simple, low-cost plans and agile strategies. For example, Digi uses different network strategies in each country in which it operates (with a mixture of its own networks and leased networks) and will form a joint venture (as in Belgium) where necessary. Competing established operators need to either copy the approach of Digi and Iliad or come up with a compelling alternative to avoid further retrenchment.

1 Digi Communications, Digi Communications N.V. announces the agreements concluded by Digi Romania (formerly named RCS & RDS S.A.), the Romanian subsidiary of the Company.

2 Millicom International Cellular operates in Bolivia, Colombia, Costa Rica, El Salvador, Guatemala, Honduras, Nicaragua, Panama and Paraguay.

3 According to Analysys Mason’s consumer survey in 2023. For more information, see Analysys Mason’s France: consumer survey and Italy: consumer survey.

Article (PDF)

DownloadAuthor

Stefano Porto Bonacci

Principal AnalystRelated items

Article

KDDI’s results demonstrate the challenges of entering new markets such as energy and finance

Article

MWC25: AI, network APIs and satellite solutions are the future of consumer mobile services

Survey report

Mobile price increases: consumer survey