Business pay-TV revenue in Europe fell sharply in 2020 due to COVID-19 and the recovery is likely to be gradual

23 April 2021 | Research

Article | PDF (4 pages) | SME Services| Video, Gaming and Entertainment| Enterprise Services

The number of business pay-TV connections in Europe grew steadily between 2015 and 2019, accounting for 2.1% of total pay-TV connections and delivering 5.7% of total pay-TV revenue in 2019. The COVID-19 pandemic had a significant impact on the business pay-TV market in 2020 because many hospitality and accommodation venues were forced to close. Pay-TV providers will need to continue to support businesses as they resume activity in 2021, in order to drive a return to historical levels of revenue (which will depend on the health of the hospitality sector).

This comment draws on data from Analysys Mason’s DataHub.

COVID-19 affected the business pay-TV sector more than the residential sector because hospitality services were forced to close

We estimate that total pay-TV revenue in Europe fell by 3.9% in 2020 affected by the COVID-19 pandemic. The business segment accounted for 4.9% of total pay-TV revenue. The pandemic had a more profound effect on the business pay-TV sector rather than the residential sector. Businesses such as bars, restaurants and hotels were affected by the restrictions that governments imposed to contain the spread of the virus in 2020. Restaurants were ordered to provide services on a take-away basis for much of 2Q 2020 in most countries in Europe and many borders were closed to tourists. The situation improved slightly in 3Q 2020 as restrictions were eased, but worsened in 4Q 2020 as new lockdowns and curfews were introduced in response to the second wave of infections. Pay-TV providers tried to support businesses in order to retain connections at the expense of average spend per user (ASPU), which declined. Operators took various approaches as follows.

- Some, such as Telnet in Belgium, allowed their business customers to suspend their accounts temporarily if they were forced to close.

- Other operators suspended charges. For example, operators in Portugal did not charge a monthly fee in March 2020, and SKY did not charge businesses during lockdown in the UK (it also extended this option for businesses that decided not to re-open after lockdown was lifted).

- Some operators introduced flexible payments. BT in the UK introduced several mechanisms to support flexible payments for small and larger customers. BT also reassured small businesses that it would not automatically disconnect them if they struggled to pay BT’s bill. Sunrise in Switzerland extended payment due dates for small businesses and self-employed individuals; these customers were offered a 3-month period during which they did not have to pay their bills. In Russia, MTS and Beeline decided not to cancel unpaid services until the end of April, and allowed businesses to pay later.

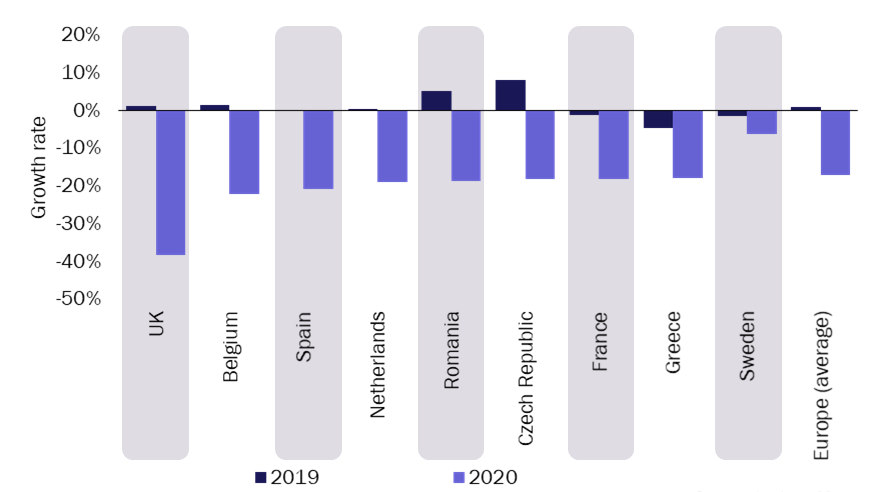

Operators’ actions resulted in a limited decline in the number of business pay-TV connections in 2020 (4.2%), but a significant decline in business pay-TV revenue of 17.3%. The rate of decline varied by country. Figure 1 illustrates the decline in 2020 and corresponding change in 2019 in selected countries (that have been affected the most and the least) as well as the European average. We estimate that the impact of COVID-19 was particularly noticeable in countries where:

- the lockdown periods were longer (such as France and the Netherlands)

- the economy depends on tourism (such as Spain and Greece)

- operators introduced greater discounts on business pay-TV services (such as SKY in the UK and Telnet in Belgium).

The impact of COVID-19 was less profound in countries that introduced lockdowns only during first wave of infections or did not introduce them at all – for example, business pay-TV revenue declined by only 6.3% in Sweden in 2020.

Figure 1: Business pay-TV revenue growth, 2019 and 2020, selected countries and average, Europe

Source: Analysys Mason

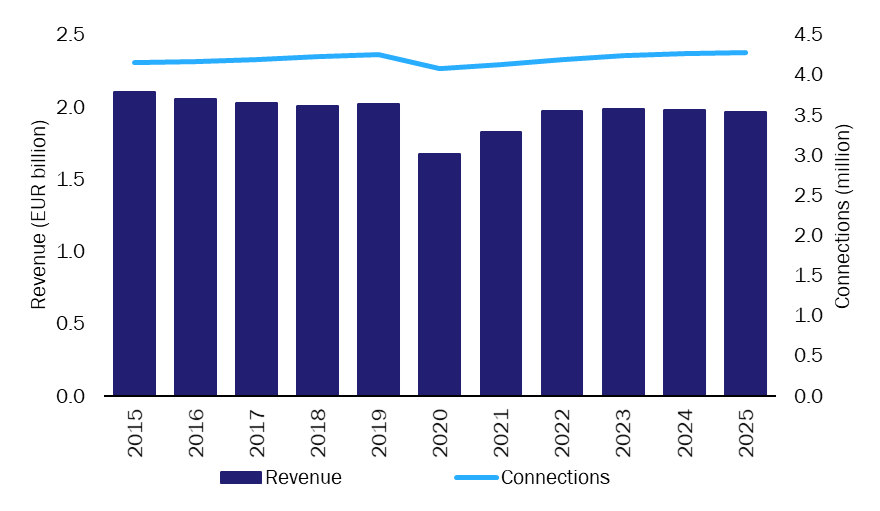

Operators revenue from business pay-TV services will return to pre COVID-19 levels by 2022

The health of business pay-TV sector largely depends on the health of the hospitality sector; business pay-TV revenue will only recover at the same rate as the hospitality industry. We expect business pay-TV revenue to begin to recover when businesses re-open in 2021 and 2022. Business pay-TV ASPU will reach pre-COVID-19 levels by 2022 as demand for pay-TV services in bars, restaurants and hotels will increase. The number of business pay-TV connections will increase in 2021 and will continue to grow (albeit more slowly) between 2021 and 2025, reaching pre-COVID-19 levels in 2024.

Figure 2: Business pay-TV revenue and connections, Europe, 2015–2025

Source: Analysys Mason

Operators can boost customer satisfaction and secure a return to pre-COVID-19 revenue levels by helping businesses in 2021

Businesses will re-open gradually in 2021 as restrictions ease, and tourism will begin to return to pre-COVID-19 levels. Accordingly, we expect the after-effects of COVID-19 on the business pay-TV segment to be negligible by 2022 but this depends on the assumption that consumer confidence in the hospitality sector returns to pre-pandemic levels. Businesses will continue to be affected in 2021 because COVID-19 is still present in most European countries and some further limitations on opening are likely. This will be especially problematic in countries that depend on tourists to support the hospitality sector.

Business pay-TV services are not usually a pay-TV provider’s main business and therefore providers will be able to fall back on more robust consumer service revenue, which will allow them to continue to support their business clients during this difficult time. It may have negative impact on their revenue in the short term, resulting in lower ASPU, but it will help them to maintain the number of business customers and increase their loyalty in the longer term. Operators can continue to support businesses using various mechanisms, such as discounted charges for limited time periods, deferral of payments, and free or discounted access to premium sports events.

Article (PDF)

Download

Insights into how COVID-19 will impact the TMT industry and how to navigate the challenges

Author