Operators’ business revenue is growing faster than revenue from other areas, despite weak growth in 2023

Operator business revenue grew by 3.5% year-on-year, on average, in 2023, and business revenue accounted for 26% of operators’ total revenue (based on the 60 operators included in Analysys Mason’s Business revenue tracker for 2023). Operators’ previous investments in delivering IT services helped to offset the slower revenue growth rates for connectivity services caused by a challenging economic environment. Our Business-services-related M&A tracker indicates that operators continued to invest in cloud and security in 2023 despite a sharp fall in the total number of acquisitions. These investments are expected to support sustained revenue growth from business services, over and above that from operators’ consumer divisions.1

A challenging economic environment caused business revenue growth rates to slow in 2023

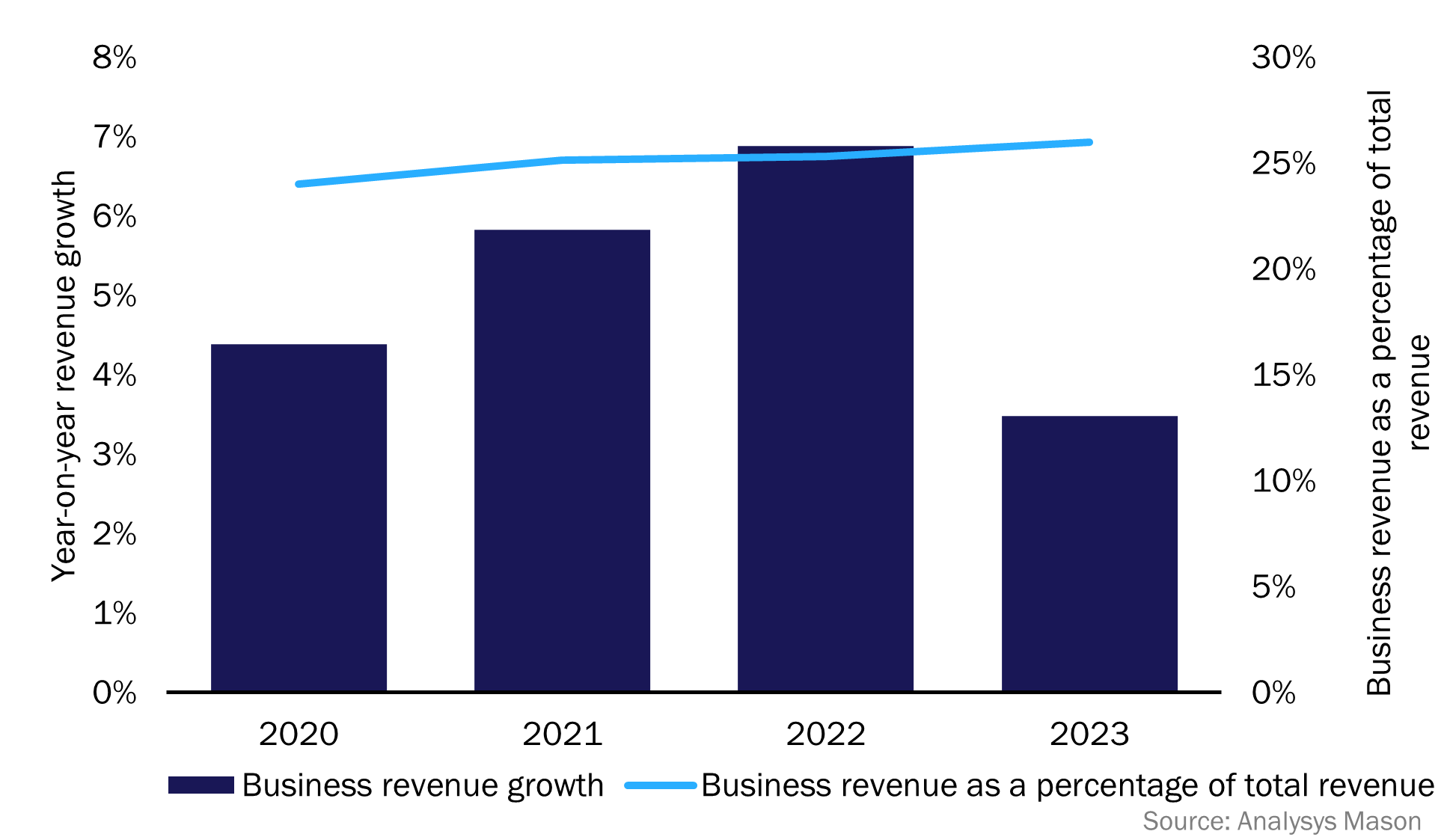

Our Business revenue tracker indicates that business revenue growth rates increased continuously between 2020 and 2022, from an average of 4.4% to 6.9% (Figure 1). Operators’ IT services were the primary drivers of this revenue growth. Indeed, data from operators that consistently report IT revenue suggests that IT services now account for over a third of all operator business revenue; this share has been growing consistently since we started tracking it in 2017. However, declines in operators’ fixed connectivity and voice revenue has partially offset the growth in IT service revenue. For example, Orange Business’s fixed connectivity revenue fell by an average of 4.6% each year between 2020 and 2022.

Figure 1: Year-on-year change in operator business revenue and business revenue as a share of the total, worldwide, 2020–20232

Business revenue continued to grow in 2023, albeit at a much slower rate than in 2022 (3.5% versus 7.0% in 2022). A challenging economic environment was the main factor in this slower growth. Businesses have come under pressure to reduce their spend and this will have led at least some businesses to postpone their plans to upgrade their telecoms or IT packages and adopt new services. Further to this, most operators were unable to implement effective prices rises for business customers despite high inflation. Indeed, business mobile ARPU and business fixed connectivity ARPU increased by only 1.2% and 1.4% year-on-year, respectively, in 2023; this is well below the level of inflation. Some operators noted that it has been easier to increase prices for small and medium-sized enterprises (SMEs) than for larger enterprise customers.

Revenue from operators’ consumer and wholesale divisions continued to grow more slowly than that from business divisions in 2023. As such, business revenue as a percentage of the total revenue increased from 24% in 2020 to 26% in 2023.

IT services are now the clear focus of operators’ M&A strategies

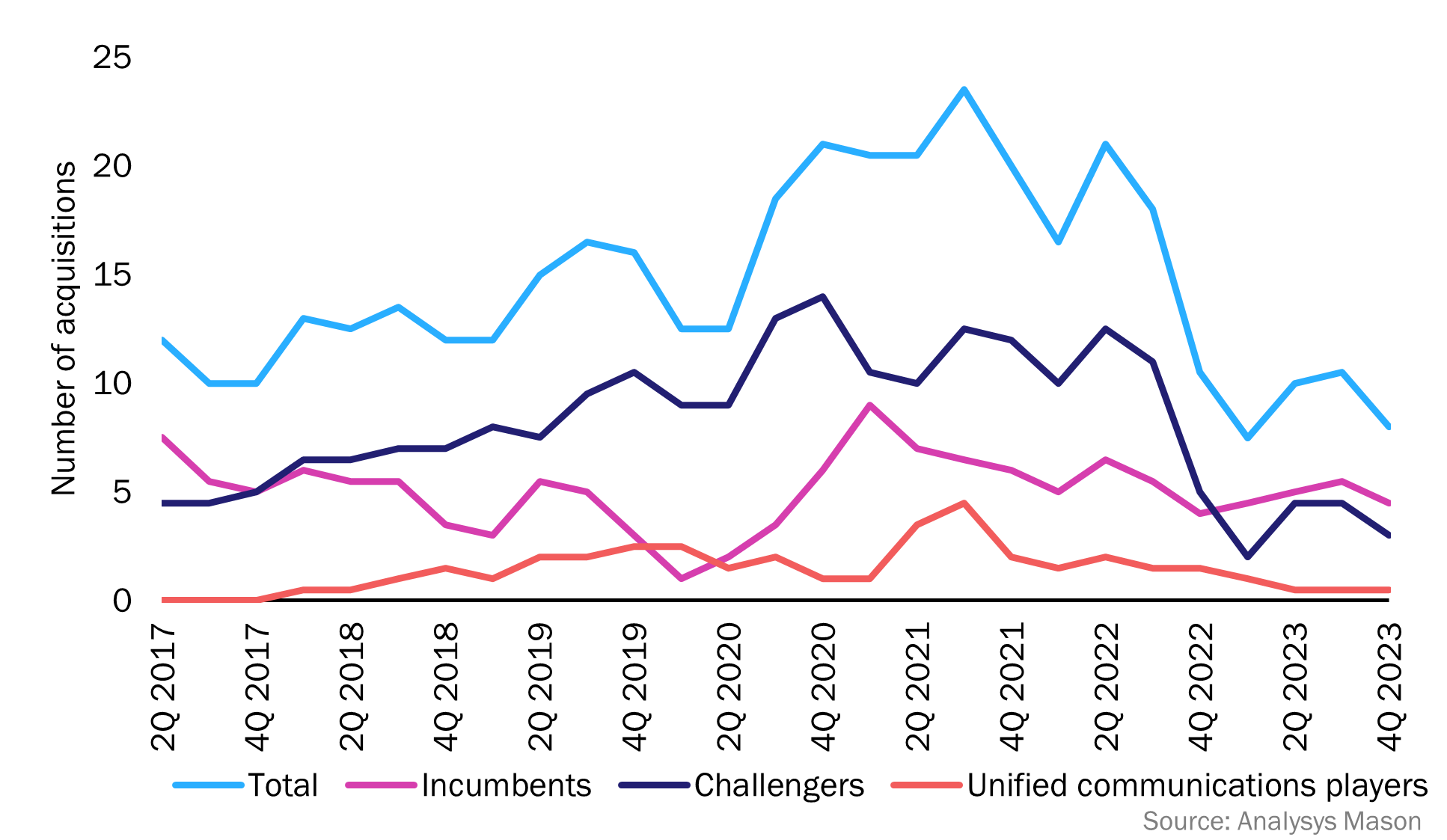

The rate of business-services-related M&A has fallen since the end of 2022 (Figure 2). Connectivity was the most common acquisition rationale for operators prior to this drop off; it accounted for more than a quarter of all acquisitions between 2017 and 2022. These acquisitions were often made by challenger operators that were attempting to gain market share or expand their geographical coverage. Cloud- and security-related acquisitions were the second- and third-most common type of deal, respectively, during this period. These deals were used by operators to boost their IT services revenue.

Figure 2: Number of business-services-related M&A announcements, half year rolling average, by operator type, worldwide, 2Q 2017–4Q 2023

The decrease in the number of M&A deals in 2023 did not affect all acquisition types equally. The number of deals involving connectivity-focused companies fell significantly; only 10% of acquisitions were connectivity-related in 2023. Conversely, operators made roughly the same amount of cloud-related acquisitions in 2023 as they did in 2022, and the volume of security-related acquisitions increased. Together, cloud- and security-related deals accounted for half of all business-services-related acquisitions in 2023.

The rationale behind IT-related acquisitions has also changed. The focus of these acquisitions prior to 2020 was to gain access to proprietary technology that operators could use to offer new business services. However, operators are increasingly looking to acquire companies that will enable them to deliver more managed and professional services. There is also more focus on smaller ‘bolt on’ acquisitions. Indeed, Orange Cyberdefense acquired two companies in 2019 that nearly doubled its revenue, while its two acquisitions in 2022 only grew its revenue slightly. These changes have tended to reduce the impact that acquisitions have on short-term revenue growth but are helping operators to offer a broader portfolio of IT services in the future.

Operators’ investments in IT services capabilities is expected to support sustained revenue growth

It is unlikely that connectivity alone will provide significant revenue growth for operators’ B2B divisions in the next 5 years. We expect modest growth at best for most established operators, driven by a small increase in the number of connections. However, operators’ investments in IT services capabilities should provide them with sustained revenue growth moving forwards.

IT service revenue is accounting for increasingly higher shares of operators’ business revenue, so the lower margins associated with delivering them compared to connectivity services will become increasingly important for operators to consider. Investing to be able to deliver managed and professional services alongside IT services will enable operators to move beyond the simple reselling of IT products from vendors and will increase their margins. This is an approach that many operators are pursuing.

1 Further analysis of the trends discussed in this article can be found in Analysys Mason’s Operator business revenue: trends and analysis and Business-services-related M&A tracker: trends and analysis.

2 These averages only include data from operators with comparable businesses revenue growth rates for 2020, 2021, 2022 and 2023.

Article (PDF)

DownloadAuthor

Matt Small

AnalystRelated items

Article

KDDI’s results demonstrate the challenges of entering new markets such as energy and finance

Strategy report

Strategies for telecoms operators to evolve their network-as-a-service (NaaS) propositions

Tracker

Cloud service providers' revenue tracker 2024