Cloud migration will enable vendors to increase their revenue from operators, even while capex falls

The total addressable market (TAM) for telecoms equipment, software and services vendors will increase at a CAGR of almost 2% between 2017 and 2027, despite an overall decline in operator capex. Vendors will be able to address 73% of the total operator capex in 2027, up from 60% in 2017. This is primarily because operators are reducing their spending on in-house developments and resources and are relying more on external service providers, integrators and platforms. These conclusions come from our report, Telecoms capex: worldwide trends and forecasts 2017–2027.

The adoption of cloud-based networks will help operators to build more capacity without increasing total capex

The adoption of cloud-based and software-centric architecture will help operators to build out significantly more network capacity than in the 4G era for the same money. The migration towards cloud-based, software-defined and disaggregated networks will accelerate in the early 2020s, triggered by 5G and convergence and intensified by the impact of the COVID-19 pandemic and the bid to open up the supply chain for geopolitical reasons. The pandemic has put pressure on mobile revenue (which is usually the main source of revenue growth for converged operators) due to the increase in home working. Enterprise demand for telecoms services has also been diluted or delayed by economic uncertainty and lockdowns.

As a result, capex efficiency is crucial to achieving a satisfactory return on investment for 5G deployments. Operator surveys indicate that the pandemic has accelerated the migration to software-based networks, which will ultimately deliver total cost of ownership (TCO) efficiencies. Capex will decline by 22% between 2019 (when it peaked) and 2027; this drop will be driven by cloud migration.

Operators will only achieve the cost efficiencies that they are targeting if they reduce their number of in-house developments

TCO savings are a goal of cloud migrations, but most operators accept that cost efficiencies will only be visible after several years. They must look for other returns, such as greater service agility, in the initial period of investment. Operators’ own predictions suggest that network TCO savings directly attributable to new architecture will, on average, not overtake capex caused by migrations until 2029.

TCO savings will be delivered in two phases, and there will be revenue opportunities for vendors in each phase. In the first phase, traditional equipment will be replaced by software-centric systems with lower per-site capex, but additional capex will be required for cloud infrastructure and large migration projects. This will be mitigated by the growing trend for operators to work with external partners rather than relying on in-house software development and integration resources.

In-house development tends to result in customised solutions that are hard to keep up-to-date. Cloud-driven practices lead to enhanced agility and the use of DevOps practices, so operators, like most other businesses, find that using commercial software solutions allows them to adopt industry advances more rapidly. The shift to virtualised networks accelerates this move away from in-house customisation and specialised deployment.

This shift also enables the second phase of capex savings in which the upfront cost of deploying cloud-based networks will decline over time as such networks become less customised and more platform-based.

Vendors can achieve revenue growth by targeting pockets of cloud-related capex growth and by providing migration services

Vendors have the opportunity to increase their share of total operator capex in both of the phases mentioned above by providing the technologies and solutions for cloud migration. They can also offer services and platforms that facilitate operators’ reduction of in-house development.

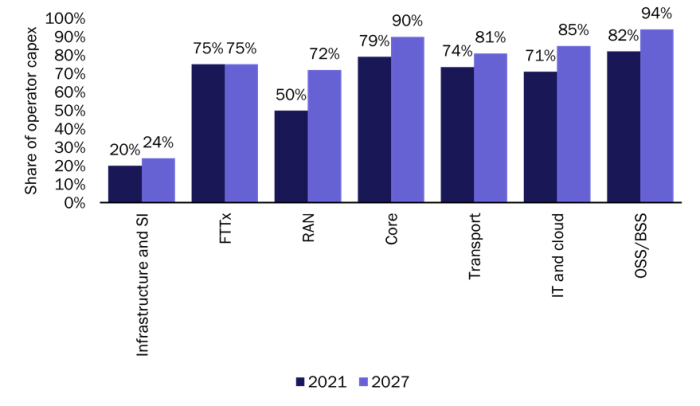

Figure 1 shows vendors’ share of total operator capex in seven areas of operator investment for 2021 and 2027. We can see that this share is expected to increase in most areas over time, particularly the RAN.

Figure 1: Vendors’ share of total operator capex, worldwide, 2021 and 2027

Source: Analysys Mason, 2021

Vendors that rapidly adapt their product and services portfolios rapidly to target key growth areas and also provide a significant services element will be able to capitalise most effectively on the outsourcing trend in the 5G era. Key revenue growth areas in 2021 include the virtualised RAN and disaggregated transport networks, plus the integration and development services that enable them.

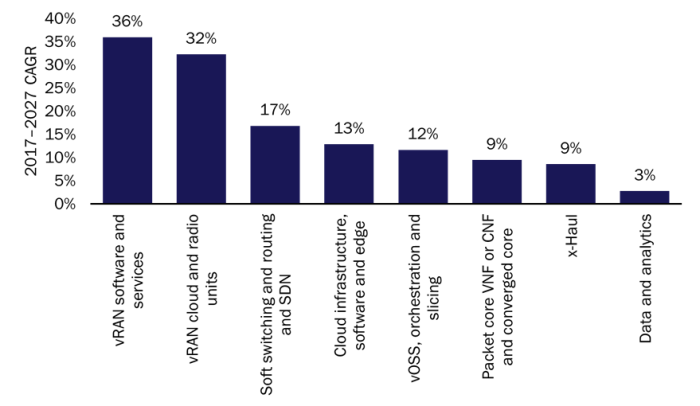

Figure 2 shows that operator capex in 8 out of the 16 categories included in our forecast will grow between 2017 and 2027. All of these areas are related, directly or indirectly, to the rearchitecting of networks and the adoption of network automation technologies. The highest growth, albeit from a very low starting point, will be in software, services and hardware to support the vRAN (which is usually associated with 5G migration or enterprise networks). Spending on cloud-native and converged core platforms, as well as that on x-haul to enable disaggregated RANs, will experience a CAGR of between 8% and 10%.

Figure 2: CAGRs for the categories of operator capex that will grow between 2017 and 2027

Source: Analysys Mason, 2021

The increase in spending on cloud infrastructure and software-based switching and routing reflects the slow but steady acceleration of network disaggregation, often with 5G as a catalyst. The 3% increase in spending on data and analytics, including AI, is largely due to 5G-era network automation.

Indeed, 5G drives considerable capex growth because many disaggregation projects are, directly or indirectly, related to a 5G migration. 5G will account for 75% of capex for mobile networks and enabling platforms in cloud, transport and software by 2027; it will account for 62% of the total operator capex. However, the spending pattern will be very different from that seen during the main period of 4G build-out in the early 2010s.

Spending will be spread over a longer period and (in all areas apart from China) there will not be the sharp peak followed by steep decline as has previously been seen for a new mobile generation. This is because operators will layer 5G onto existing assets, such as fibre for x-haul. They are also mitigating new capex with increased cost efficiencies driven by asset sharing and the migration to 5G will run in parallel with the migration to cloud-based architecture, which will convert some capex to opex.

Our full report provides capex forecasts for established and new telecoms operators and infrastructure providers between 2017 and 2027. It provides a detailed breakdown of capex by region, network technology and category. It also analyses the spending patterns and priorities of ten different operator types including converged, mobile-only, wholesale, B2B and hyperscale providers. A data annex provides chart details and supporting data.

Article (PDF)

DownloadRelated items

Article

Which operator is top of the sustainability leaderboard? Using benchmarking to see who is performing best

Article

Telstra highlights the failure of established operators to address the threat posed by low-cost challengers

Podcast

Delayering telecoms operators’ businesses: outcomes and future directions