Cellular drones may not generate significant revenue for operators, but they can provide other benefits

Cellular drones represent a new revenue opportunity for operators. The total value chain revenue generated by cellular connected drones worldwide will be more than USD8 billion in 2030, according to Analysys Mason’s cellular drones forecast, and USD1.5 billion of this will come from connectivity.1 The cellular drones opportunity is not particularly large (cellular drones will account for less than 10% of the total IoT connectivity revenue in 2030) and there is no real threat to operators who do not enter the market, but those that do have the opportunity to develop new capabilities such as 5G and edge computing.

Countries with mature IoT markets, such as China and USA, will drive the adoption of cellular drones

Cellular drone activity varies significantly by region and country due to the following factors.

- IoT adoption. The demand for cellular drones is higher in countries with mature IoT markets because enterprises are already familiar with using cellular connectivity solutions and are aware of its benefits. Some operators and enterprises in these countries are already showing interest in cellular drone solutions and have started to conduct trials.

- Business case. Cellular connectivity is deployed more widely in developed markets in which deploying drones provides a significant cost saving (for example, compared to manual inspections and truck rolls).

- Regulation. Drone regulation differs from country to country. The speed at which regulations are developed also varies. Many countries have yet to define the regulatory framework for beyond-visual-line-of-sight (BVLoS) flights.

The USA and China will be the largest markets for cellular drones worldwide in 2030. Indeed, North America will account for 36% of the total cellular drone revenue worldwide in 2030, driven primarily by the logistics sector in the USA, where firms such as Amazon, DHL and UPS are already active in the drones space. The market in China will benefit from both the early entry of the Chinese MNOs (which cite drones as a key 5G use case) and the local presence of numerous drone manufacturers (including DJI, the market leader).

Operators can offer enhanced connectivity services to increase the connectivity ARPC

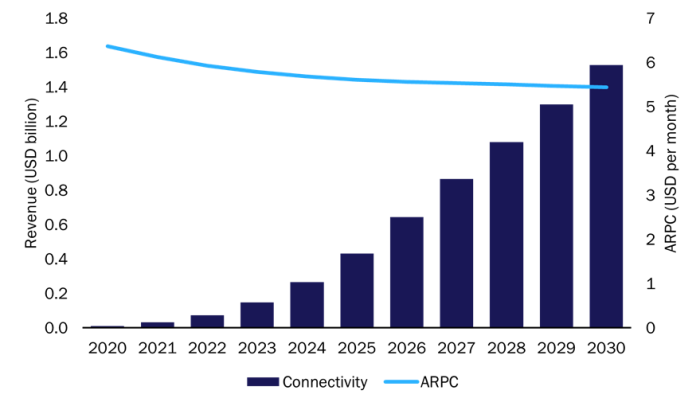

Figure 1 shows the connectivity revenue generated by cellular drones worldwide, which will increase from USD11.1 million in 2020 to USD1.5 billion in 2030. Cellular drones produce far more data traffic than typical IoT connections and therefore generate a considerably higher average revenue per connection (ARPC).

Figure 1: Connectivity revenue and monthly ARPC for cellular drones, worldwide, 2020–2030

Source: Analysys Mason, 2022

Operators will generate drone-related connectivity revenue from selling various services, such as:

- basic drone tracking

- the provision of a connectivity link to an unmanned aircraft systems traffic management (UTM)2 system to enable command-and-control (C2)

- routing services to ensure flight path adherence

- real-time transfer of the data generated by the drone payload. Payloads can include HD, 4K and/or thermal cameras and sensors (such as LiDAR systems, which use lasers to determine variable distances). Drones with these payloads are more likely to use 5G due to their need for large amounts of data and low latency.

The exact revenue generated will vary according to the use case and enterprises’ needs. For example, not all drones will transmit data in real time; some will instead upload data via Wi-Fi or a fixed connection once they have returned to the depot, and will therefore only require C2 connectivity.

Operators that wish to move up the drones value chain will need to use partnerships or acquisitions

Some operators will choose to focus solely on the connectivity aspect of drones. However, operators with a greater appetite for risk may pursue other revenue opportunities, including the following.

- Hardware. Telecoms operators do not typically operate or own a fleet of drones. They instead work with customers who have their own drones, or provide drones via a preferred hardware provider. Some operators may also partner with hardware providers to offer a joint go-to-market solution. For instance, Celcom Malaysia partnered with Aerodyne to integrate connectivity into Aerodyne’s drone portfolio.

- Support services. Vodafone and Telefónica are acting as supplemental data service providers (SDSPs) and are providing support services such as flight authorisation, permit handling and data off-loading. BT and Verizon are providing professional services such as security assessments and are designing drone solutions for enterprises.

- Platform services. These include fleet management platforms for predicative maintenance or data visualisation platforms for post-flight analysis.

A select few operators, including Deutsche Telekom and Verizon, are generating additional revenue by moving further up the drone value chain. These operators have acquired and partnered with aviation specialists, respectively (Skyward in the case of Verizon and DFS in the case of Deutsche Telekom); they will act as U-space service providers (USSPs) and will take responsibility for the management of a given drone airspace (known as U-space).

The experience gained by developing drone solutions will provide other benefits for operators

The most significant revenue opportunities related to cellular drones will only be available to operators that provide services to the aviation sector beyond simple connectivity. However, many lack experience in this sector. The most ambitious operators will use acquisitions or partnerships to develop the necessary competencies, but they will be in the minority.

However, drones still represent an interesting opportunity for other operators. They can use the drone market to develop and showcase their 5G and edge computing capabilities, or to develop new capabilities that they may have little experience with in the IoT realm (such as professional services). Drones are also highly marketable and operators may use them to improve their brand and achieve their ambition of becoming known as data service and platform providers rather than simply providers of connectivity.

1 Total value chain revenue consists of revenue from connectivity, hardware and applications. Hardware revenue includes the cost of the drone itself.

2 UTM systems are used to manage air traffic of unmanned aerial systems, including drones. They are analogous to air traffic management (ATM) systems, which manage all air traffic.

Article (PDF)

DownloadAuthor

Ibraheem Kasujee

Senior AnalystRelated items

Tracker

IoT/M2M revenue and connections tracker 2H 2024

Article

KDDI’s results demonstrate the challenges of entering new markets such as energy and finance

Article

Wireless Logic’s purchase of Arqia is a further sign of the threat that IoT disruptors pose to MNOs