Price rises in Western Europe are giving challengers an opportunity to boost their mobile and fixed market share

21 March 2023 | Research

Article | PDF (3 pages) | European Core Forecasts

Listen to or download the associated podcast

Many operators in Western Europe have already implemented price increases for their fixed and mobile services or plan to do so in the future, attempting to offset inflationary pressure.

Market challengers in countries with unbalanced market shares of subscribers will keep prices flat, delaying price rises or promising no mid-contract price rises in an attempt to increase their subscriber base. It may lead to increased churn for established operators and may even change the competitive balance.

Operators will try to reduce the impact on churn by revamping their offers and upgrading customers to higher-speed and higher-priced plans. They can also promote social plans and affordable sub-brands to reduce churn and to respond to political pressure.

This article is based on the Western Europe telecoms market: trends and forecasts 2022–2027 report. The forecast numbers are available in Analysys Mason’s DataHub.

Operators are revising prices to mitigate inflationary pressure

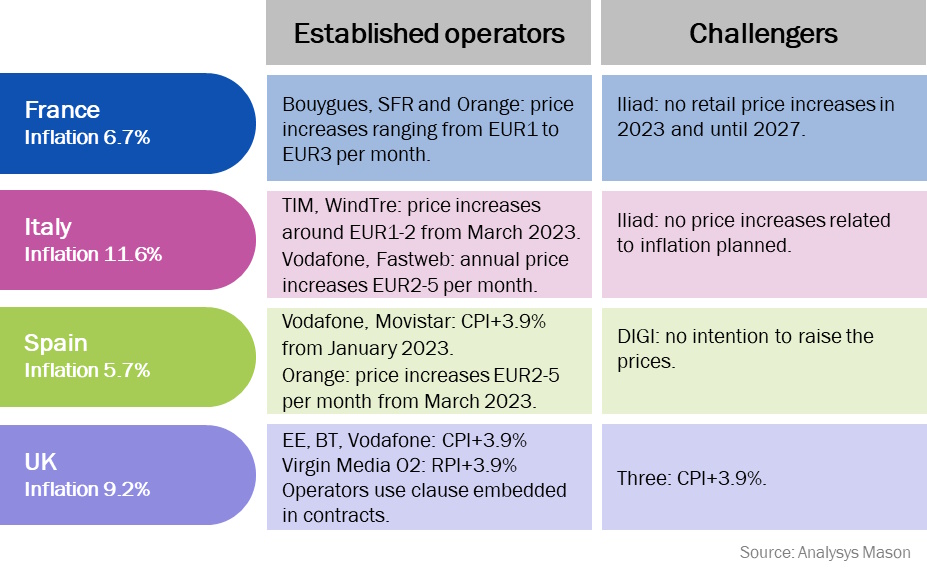

Economic instability and rising costs are major pressure points for telecoms operators. In many Western European countries, operators have already implemented price increases in retail (and wholesale) telecoms services to offset or limit the impact of inflation on their businesses. Some operators who have not yet revised their tariffs plan to do so in 2023 (see Figure 1: Implemented and planned price increases and inflation in selected Western European countries, December 2022 for operators’ tactics in selected countries).

Figure 1: Implemented and planned price increases and inflation in selected Western European countries, December 20221

We expect that in the coming years, operators will be able to raise retail prices systematically, but ARPU may not keep pace with inflation (meaning a revenue cut in real terms). However, telecoms services constitute a relatively small part of a household budget and the annual price increases will be far lower than those for other products and services, such as food and energy.

Market challengers will use locked prices as competitive leverage to increase their subscriber market share

Price increases have created an opportunity for market challengers to grow their subscriber base. Some will freeze their prices, while others will only delay price rises or limit the price increases to a specific plan.

The challengers’ actions will lead to increased churn for the established operators. It may change the competitive landscape in some instances. Especially in countries with unbalanced market shares of subscribers, it becomes a chance for these challengers to grow their market share.

Iliad in France and Digi in Spain illustrate this.

- Iliad - Free (France): the operator offers simple and low-cost tariffs. It launched a widespread campaign in January 2023 to tell mobile users that Free is the only operator in France with no intention to increase the price of its packages (EUR2 and EUR19.99) until 2027. This was reiterated in March 2023 when the competitors’ price increases were implemented. However, Free has increased the price of its new booster add-on, available with the EUR2 plan from EUR2.99 to EUR4.99 per month.2 Free is therefore increasing prices without breaking its fixed-price tariff promise and it still has an appealing offer to subscribers of other mobile network operators (MNOs). The booster plan price hike should increase revenue but is relatively low risk. If the strategy proves successful, Free may shortly overturn Bouygues’s market share of subscribers. At the end of 2022, Bouygues had around 20.8% of the total active subscribers, and Free had around 19.4%.

- Digi Mobil (Spain) is the largest MVNO and FTTP broadband provider with the fastest-growing subscriber base. Operators in the highly competitive Spanish market tend to follow the more-for-more strategy. Still, most large networks raised prices in 2023. However, Digi stated in December 2022 that it would not follow that trend, and went even further, introducing price reductions in various fixed and mobile plans. It is a challenging strategy, especially since Telefónica is its MVNO host and wholesale access provider. Digi is close to reaching a milestone of 5 million subscribers and its market share has grown at around 1 percentage point each year since 2020. It reached 6.3% of the market share in terms of subscribers in December 2022.

Not all challengers are following this strategy though. For example, Three UK had kept its prices fixed and promised no increases in contract prices. However, in November 2022 it changed its approach and adopted the same pricing formula (CPI+3.9%) as its competitors. Three’s active subscribers accounted for 11.6% of the total mobile connections in 2022, up from 11.3% in 2021. Its market share of subscribers has been relatively stable since 2018, as well as the market share of other, larger MNOs. Therefore, for Three, the market share benefit of keeping prices fixed was not worth the risk, and the operator chose to increase its revenue.

Operators protect their revenue and subscriber market share by revamping pricing plans

In the current economic climate, most large operators prefer to raise prices and risk higher churn than keep prices at the same level. They can also try to defend their market share and reduce churn by revamping fixed-mobile convergence (FMC) offers and upgrading customers to higher-speed and higher-priced broadband plans.

Where mobile plans with unlimited data are not widely adopted (for example in Germany and in the UK), MNOs may try to upgrade their subscribers to larger, or even unlimited, mobile data plans. Additionally, operators are more strongly promoting social plans and affordable sub-brands. The reason is partially in response to political pressure but can also help to reduce churn.

The larger operators risk losing some subscribers even if they successfully manage to raise prices for most of their subscribers. The operators need to monitor how successful challenger strategies are, and if needed, they will have to rethink their approach.

1 Inflation.eu (December 2022), Inflation – current and historic inflation by country.

2 Booster is a package with unlimited calls and 1GB of LTE data available as an add-on package to Free’s EUR2 plan. The EUR2 plan offers 50MB of data, 120 minutes and unlimited SMS.