Western countries’ export restrictions on chips could derail China’s ambitious edge compute plans

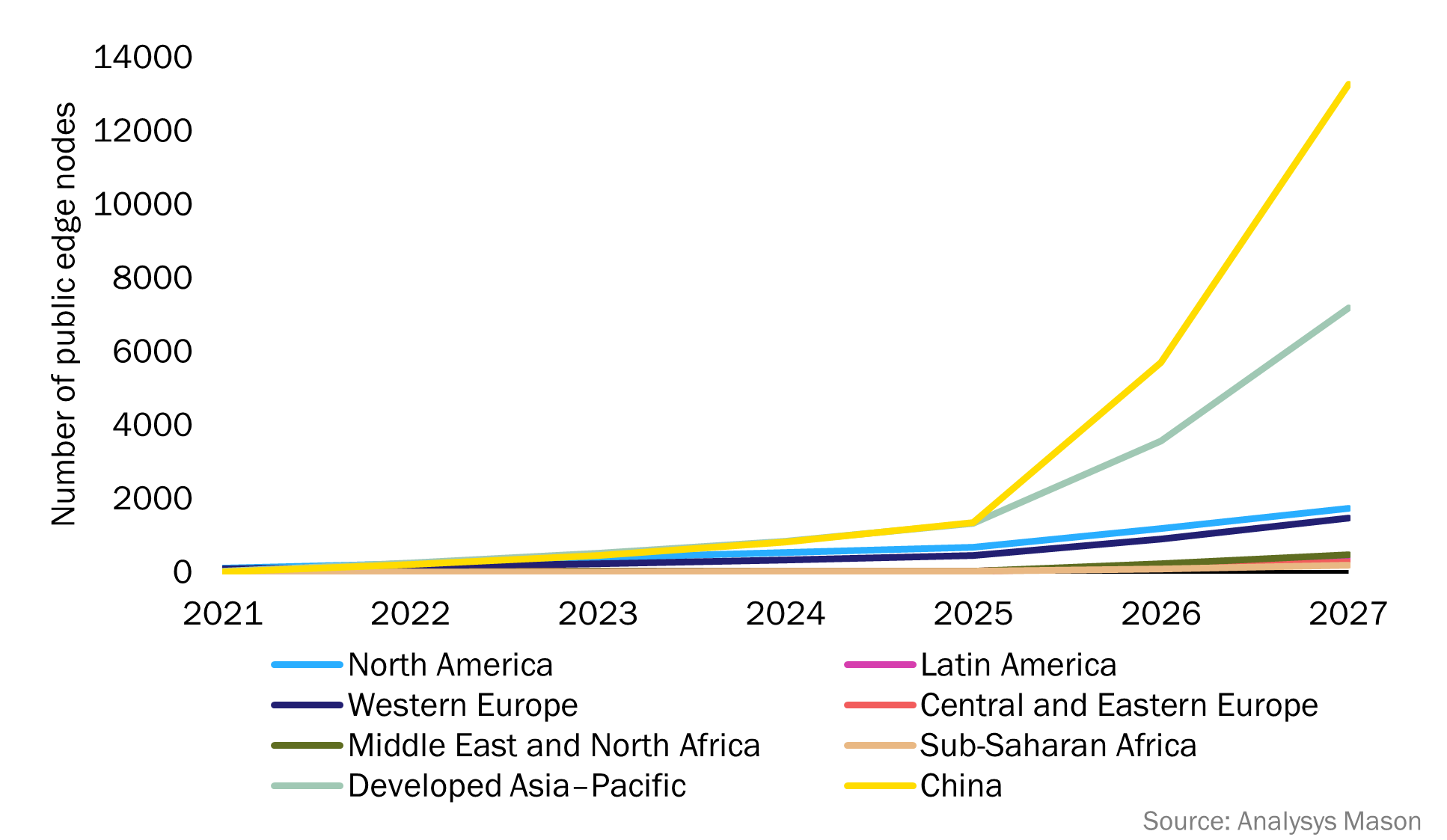

One of the most interesting trends that emerged from the research included in our Public edge: worldwide forecast 2022–2027 is the extent of the investments China is making in public edge (Figure 1).

The builds that are being talked about dwarf anything proposed either in Europe or the USA, but there is a possibility that they could be undermined by Western countries’ growing attempts to isolate China and its supply chain in the field of silicon chips. This article looks at the impact this geo-politically driven development could have on vendors and other suppliers that target the Chinese market, the operator community and the edge compute market as a whole.

Figure 1: China’s public edge nodes compared to other regions worldwide, 2021–2027

China is advancing in chip production but lacks a clear path to self-sufficiency in one key area

Self-sufficiency in chips is a long standing Chinese strategic goal and a core part of its Made In China 2025 initiative. Despite making considerable progress, China remains reliant on chip imports – currently only around 20% of the chips used in China are made domestically.

There is, however, one area of development where China is not only far behind the USA and other Western countries but also does not have a clear path to achieving self-sufficiency. Ever-increasing miniaturisation has always been the goal of chip manufacturers, and is a process that has helped PCs, IoT and smartphones come into being. Today manufacturing processes support chips in geometries of 3–5 nanometres. These are playing a critical role in the development of 5G because the low power consumption and small dimensions of sub-5 nanometre chips (nm) means they are the natural choice for baseband chips in 5G handsets. But for various historic reasons, the (fabrication plants (fabs)) for these chips are in South Korea, the USA and Taiwan, but not in China.

Since 2016, China has faced increasing US-imposed restrictions on the import of chips that include US technology, especially at the sub-5nm end of the market where China has no manufacturing capability. US chip vendors, such as Nvidia, are barred from exporting to many Chinese entities without a special licence. The supply chain has also found itself a target: ASML, a Dutch company that has a monopoly in the most-advanced lithography machines worldwide that make sub-5nm chips, has been banned from exporting its high-end machinery to China, by the Dutch government, since 2019.

Western countries’ supply chain restrictions will have a large but unpredictable impact on China’s edge compute plans

The importance of sub-5nm chips to smartphones means that handset makers like Huawei and Xiaomi will be most affected by these sanctions, but China’s desire to lead the global edge compute market will also be threatened. The combination of high performance and low power compute promised by sub-5nm is particularly well suited to the industrial edge. Power and space are limited, in comparison to the resources of the data centre where Intel’s power-hungry chips dominate. Sub-5nm processors also have use cases that could play an important role in the future development of the edge. A server with AMD’s sub-5nm EPYC 4 can support over 800 virtual machines while consuming 1.2kW of power, opening up the possibility of power-constrained sites like cell towers becoming edge compute nodes. Similarly, the question of whether China’s chip industry will be able to produce something that is competitive with Nvidia’s sub-5nm graphics processing units (GPUs) is particularly relevant to the edge. GPU-powered real time analytics is emerging as a leading-edge use case, whether on premise or processed in a nearby industrial or edge data centre. Sub-5nm GPU processors will open possibilities in remote industrial edge sites that, like cell towers, are space and power constrained.

Naturally, Chinese vendors want to and have taken moves to soften the impact of losing access to this critical part of processor market. Huawei, which has a strong presence in the edge compute market has continued to build out edge and cloud infrastructure, and so far, has been able to use stockpiled and home-grown chips to do so. In some ways the sanctions have given an impetus to China’s edge compute roll-out. Huawei says low-compute phones are being used more and more in China as edge computing infrastructure and 5G networks becomes mature enough for compute to be off loaded to the edge.

These counter-measures can only delay rather than halt the effect that sanctions will have on the evolution of edge in China. The local technology industry has the appetite for investing in the edge infrastructure that is needed to support early-metaverse VR/AR applications, but it will not have access to the chip sets for building the devices or the infrastructure and to build that capability could take as long as a decade. In contrast, Western countries will be able to produce the devices and the infrastructure. But as our public edge forecast shows, there is much less interest in investing in the infrastructure needed to support the metaverse. Operators particularly seem to want to see investments in 5G pay off before making further commitments.

There will also be second order effects within the telecoms industry. Isolating China means the pulling apart of intertwined global technology alliances and partnerships that have existed for decades. China’s pioneering work in telecoms, which has benefitted the whole industry, is less well known perhaps than it should be. China Mobile could be said to have invented the vRAN as well being one of the pioneers of Open RAN and massive MIMO, while Huawei and ZTE are among the biggest contributors to the 5G standards.

Predicting the precise impact of these restrictions, of course, is difficult. China has already built out a large 5G MEC infrastructure and will surely seek to obtain as much use as it can from it. Its progress in AR/VR and the metaverse will surely be limited if only for a while. It could also build sub-5nm capability far faster than anyone could have imagined. But it will be difficult to compete with the tens of billions invested every year by TSMC, Samsung and Intel, and by the time the plant is ready, processor technologies will have moved on, beyond 5nm in different – and unexpected – directions.

Article (PDF)

DownloadAuthor

Gorkem Yigit

Research DirectorRelated items

Article

Public edge forecast: the industrial edge represents a growing opportunity for operators in the next 5 years

Forecast report

Public edge: worldwide forecast 2023–2028

Article

The private industrial edge: what it is and what it means