The revenue growth trends for most cloud players continued into 2021

The overall market for cloud services continued to expand in 2020 and 2021 as a result of the COVID-19 pandemic, and cloud-related revenue grew at double-digit rates for many companies. Those in the unified communications (UC) space were particularly positively affected by the pandemic; their revenue grew much faster in 2020 than ever before (or since). Revenue growth rates in other parts of the cloud market in 2020 were similar to or lower than those in previous years. The pandemic may have helped to sustain already-high growth rates, but other factors such as global expansion and M&A activity also played a major role in driving growth.

This article uses data from Analysys Mason’s Cloud service providers’ revenue tracker to examine trends in the cloud services market.

The COVID-19 pandemic’s impact on cloud services revenue was not uniform

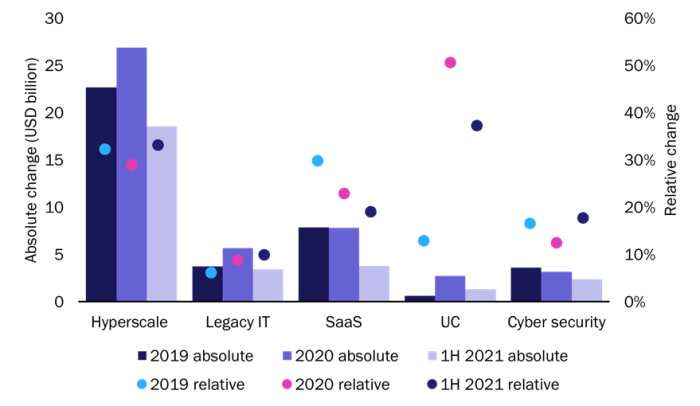

We classify cloud service providers according to their area of focus. Figure 1 shows that revenue grew for providers in all areas, but revenue growth rates (in both absolute and percentage terms) varied significantly.

Figure 1: Absolute and relative year-on-year change in cloud service provider revenue, by area of focus, worldwide, 2019–1H 2021

Source: Analysys Mason, 2021

UC specialists had the highest percentage revenue increase in 2020 (51%). This was largely due to the shift to remote working as a result of the COVID-19 pandemic. The success of UC providers in 2020 was driven by Zoom, whose revenue grew by 326% year-on-year, though other players also experienced strong revenue growth. For example, RingCentral’s revenue grew by 31% and 8x8’s revenue grew by 22%. The year-on-year revenue growth in this category dropped slightly in 1H 2021 to a (still very high) rate of 37%.

The pandemic did not cause a spike in revenue growth in other cloud categories, but it may have helped to sustain already-high growth rates. Software-as-a-service (SaaS) providers’ revenue grew faster in 2019 than in 2020 or 2021 in both percentage and absolute terms. Cyber security specialists’ revenue also grew more slowly in 2020 than in 2019 or 1H 2021. The revenue growth rates for hyperscalers (AWS, Alibaba Cloud, Google Cloud and Microsoft) were slightly higher in 2019 than in the following years, but they continue to be above the market average.

Several factors other than the pandemic contributed to cloud revenue growth. For example, hyperscalers invested in expanding the geographic coverage of their cloud services. AWS increased its number of availability zones from 76 at the end of 1Q 2020 to 81 at the end of 3Q 2021, and Microsoft added new data centre regions in 15 countries across 5 continents during its 2021 financial year (starting in July 2020). Furthermore, some cyber security providers were able to grow their revenue at double-digit rates due to acquisitions. For example, CrowdStrike acquired Preempt Security for USD91 million in September 2020 and Humio for USD400 million in March 2021 and its revenue increased by 70% year-on-year in 1H 2021. Zscaler acquired four companies between 2018 and 2020 for a total of USD54 million; its revenue grew by 40% year-on-year in 2020.

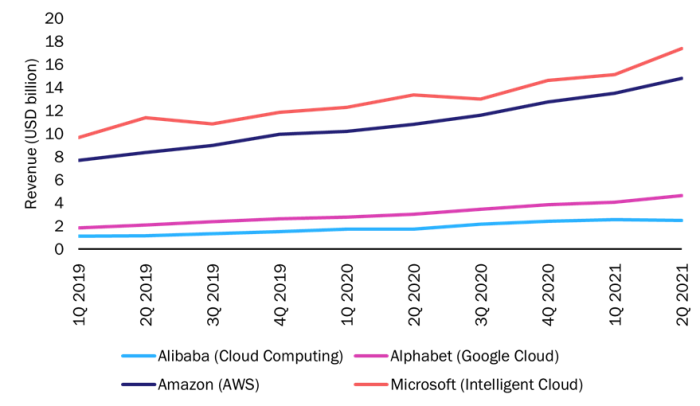

Amazon and Microsoft remain the dominant cloud service providers

Amazon and Microsoft remain the dominant providers of cloud services (Figure 2). Alphabet’s Google Cloud and Alibaba’s Cloud Computing arm generate markedly less revenue, though Alibaba’s cloud revenue grew the fastest in percentage terms in 2020 (57%). This can partly be attributed to the company’s strong presence in fast--growing markets in emerging Asia–Pacific such as China and India. Nonetheless, AWS’s revenue grew the most year-on-year in absolute terms in 2020, by more than USD10 billion. Microsoft’s Intelligent Cloud revenue grew by USD9.5 billion in this period.

Figure 2: Hyperscaler revenue per quarter, worldwide, 1Q 2019–2Q 20211

Source: Analysys Mason, 2021

The COVID-19 pandemic has not drastically altered the cloud services space

The varying revenue growth rates for different types of service providers between 2019 and 2021 show that the pandemic had an uneven impact on cloud-related revenue. UC providers experienced strong revenue growth in 2020, which continued, albeit at a slightly lower rate, in 2021. Conversely, the revenue for cyber security and SaaS providers grew faster prior to the pandemic. Hyperscaler firms continue to dominate the cloud services space, as they did before 2020, and Amazon and Microsoft lead this group in terms of total cloud revenue.

Revenue growth for all cloud service providers remained strong in 1H 2021, but the COVID-19 pandemic was just one of several factors that contributed to this success. As was the case prior to the pandemic, expanding geographic coverage and pursuing acquisitions were two other ways in which companies were able to actively grow their revenue.

More details regarding the cloud revenue of the companies mentioned in this article are available in Analysys Mason’s Cloud service providers’ revenue tracker.

1 Amazon’s AWS revenue includes earnings from the global sales of compute, storage, databases and other services. Microsoft’s Intelligent Cloud revenue includes earnings from server products and cloud services (including Microsoft Azure, Microsoft SQL Server, Windows Server, Visual Studio, System Center and related client access licences), GitHub and enterprise services (including Premier Support Services and Microsoft Consulting Services). The inclusion of non-Azure-related revenue means that Microsoft’s reported revenue for Intelligent Cloud is not directly comparable to Amazon’s AWS revenue.

Related items

Forecast report

USA: telecoms operator business and IT services forecast 2024–2029

Report

Operator business revenue: trends and analysis 4Q 2024

Article

MWC25: telecoms players pushed new B2B products, but any boosts to revenue are years away