From cost allocation to CO2e allocation: how past experience could inform future practice

Technology, media and telecoms (TMT) companies are gaining experience with quantifying and reporting their greenhouse gas (GHG) emissions. However, there are also increasing expectations to report emissions in a sensible way to both upstream suppliers and downstream customers. This article considers how well-established approaches in the allocation of costs could provide inspiration for allocating emissions to products and services.

Recent EU-level directives require more businesses to comply with sustainability reporting requirements by 2028

Frameworks for the monitoring and reporting of GHG emissions have been in place for over two decades.1 More recently, sustainability reporting requirements have come into sharper focus on a widespread basis, particularly in the European Union (EU).

A key instrument in the EU has been the Corporate Sustainability Reporting Directive (CSRD). This came into force at the beginning of 2023 and sets out a timetable that, by 2028, most listed non-microenterprises operating within the EU must undertake regular sustainability reporting, with the GHG Protocol a recommended standard.2 Separate reporting of GHG emissions should follow the GHG Protocol’s three-scope classification:

- Scope 1: emissions arising directly from a company’s operations, for example vehicular fuel consumption

- Scope 2: emissions arising indirectly from a company’s operations, for example emissions resulting from generating the electricity consumed

- Scope 3: emissions encompassing all other emission types, including those from activities both upstream and downstream of a company’s operations.

An increasing number of companies worldwide, including those in the TMT sector, are dealing with the complexities of quantifying and reporting their Scope 1/Scope 2 emissions, expressed in carbon dioxide-equivalents (metric tons of “CO2e”). However, Scope 3 emissions remain challenging to capture given their wider scope.

TMT companies may need to track their overall emissions and also analyse how these emissions are distributed across their services

According to the EU’s Delegated Regulation of December 2023, companies must adhere to specific reporting requirements, with Disclosure Requirement E1-6 focusing on GHG emissions. Of particular note is AR46(g), which states companies must:

“disclose the extent to which the undertaking’s Scope 3 GHG emissions are measured using inputs from specific activities within the entity’s upstream and downstream value chain, and disclose the percentage of emissions calculated using primary data obtained from suppliers or other value chain partners.”

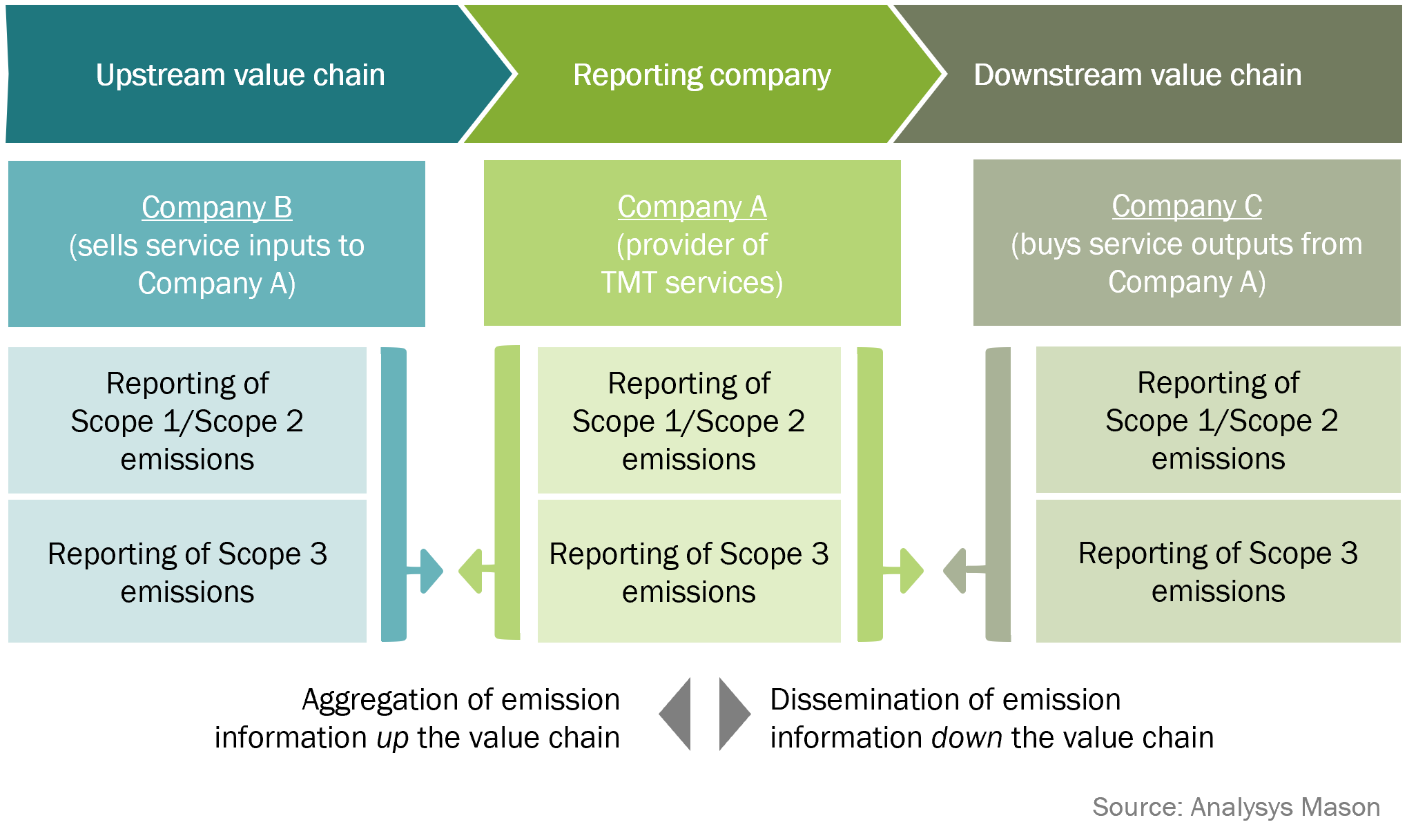

This points to a further complication in understanding emissions footprints. A company must not only have a comprehensive view of its footprint, but also be aware that other businesses in its value chain will likely be dependent on its reporting to measure their own Scope 3 emissions.

Consider a TMT company that supplies services (such as leased lines) downstream of its business, and the buyer of those services. The buyer will view the TMT company as upstream to its own business and therefore will rely on the emissions reporting information supplied by that TMT company in relation to the service purchased in order to inform its own Scope 3 emissions reporting. Similarly, vendors that sell products to the TMT company (such as suppliers of leased-line modems) may seek emissions information from the TMT company to calculate their own Scope 3 emissions.

Figure 1 below illustrates the typical flow of emissions reporting information between companies in a value chain.

Figure 1: Flow of emissions reporting information between companies in a value chain

Allocating emissions to services is undoubtedly challenging since the service portfolio of a TMT company can be highly diversified. However, the TMT sector’s experience with regulatory cost allocation suggests a possible way forward.

Modelling approaches to cost allocation can provide an insightful point of reference for allocating CO2e emissions to services

Allocating costs to services has long been an area of considerable commercial and regulatory challenge in the TMT sector. Numerous methodologies have been developed. Broadly speaking, all methodologies cover the following steps:

- definition of a list of services and a list of assets/activities to be considered within the cost allocation

- calculation of the capital cost and operating cost associated with each asset/activity

- derivation of annualised costs for each asset, that is adjustment of capital costs to reflect the lifetime of the asset, to derive those costs that should be recoverable in any given financial year (operating costs are already considered annualised)

- allocation of annualised costs by asset/activity to services, including any overhead costs (i.e. costs supporting multiple activities across the business).

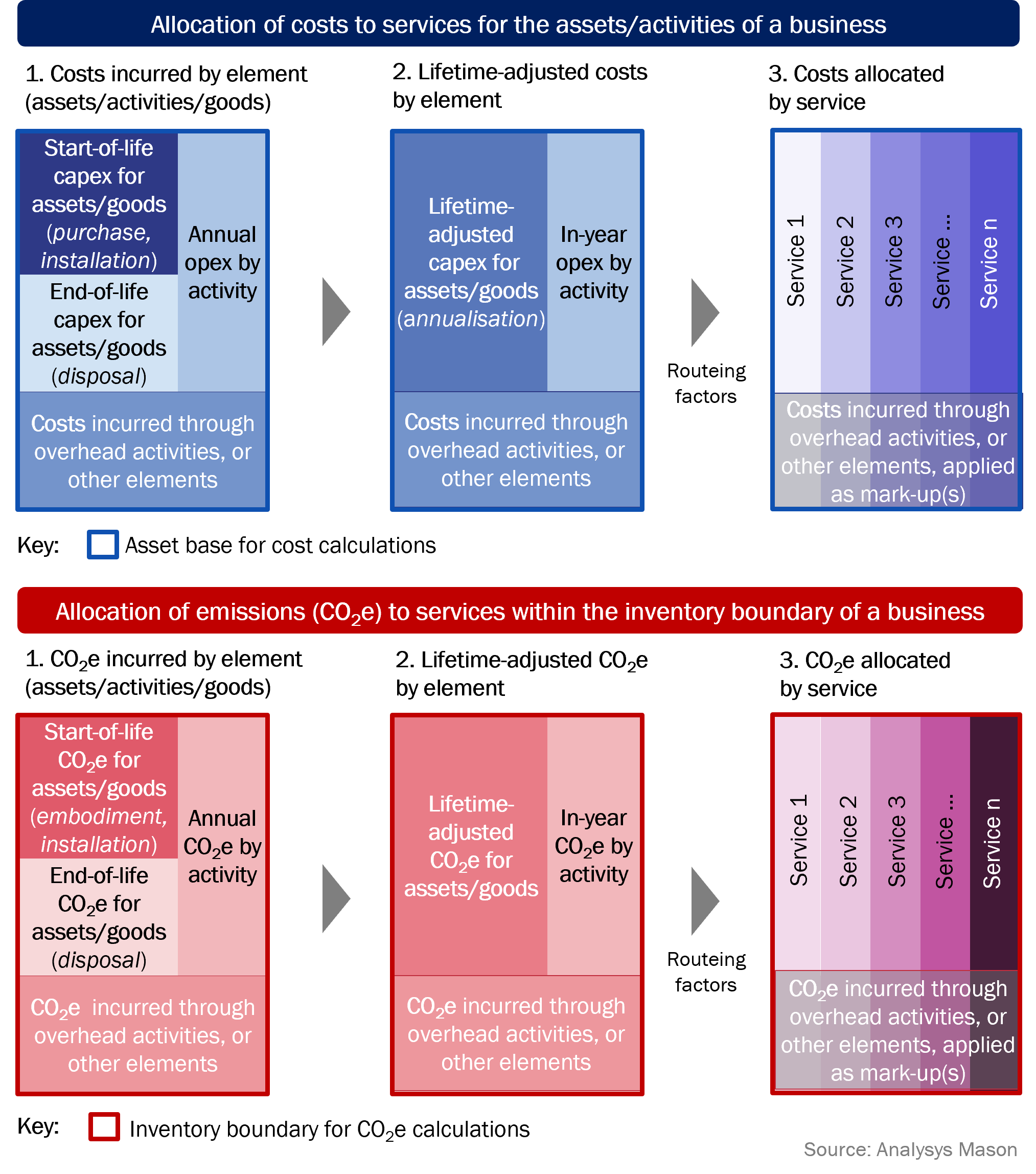

The top half of Figure 2 below illustrates how a cost modelling approach is used to complete these steps. The bottom half of Figure 2 shows that a similar approach can be applied to CO2e emissions, with the costs measured in environmental terms (such as metric tons of CO2e), rather than monetary terms.

Figure 2: Parallels between cost allocation and CO2e allocation for an assumed inventory boundary of a business

In principle, many of the techniques within cost-modelling frameworks could be used for CO2e allocation. These techniques can include:

- calculation of emissions on an element-by-element basis using bottom-up assumptions (where an element could be assets, activities or goods)

- allocation of element emissions to services based on which services use the elements (‘emission causation’)

- conversion into a single equivalent unit (metric tons of CO2e in this case)

- use of methods such as equi-proportionate mark-ups to allocate emissions for certain elements (such as overhead activities) to services.

There will inevitably be differences in certain aspects, which will need to be considered carefully. For example, the GHG Protocol recommends emissions attributed to a capital asset are not spread across its expected future lifetime, but rather reported in full in the reporting year when the asset is acquired. This is significantly different from the depreciation methods that are used to spread capital costs over an asset’s lifetime and could cause complexity in how emissions reporting can be compared from year to year.

Understandably, developing an allocation approach for a business is a complex endeavour, with many details to consider. While some companies are already developing methods to allocate GHG emissions (such as Google Cloud Carbon Footprint), TMT companies should start to consider their own approaches in order to support their customers. This will help them comply more effectively with the latest GHG reporting requirements, and make informed decisions regarding their overall GHG emissions footprint. Analysys Mason has unparalleled experience in refining modelling tools to provide tailored solutions that address the specific needs of its clients. If this topic is of interest to you, please contact Matthew Starling for an initial discussion.

1 In particular, the first edition of the Corporate Standard of the GHG Protocol was released in 2001. The revised edition was released in 2004, with two dozen companies listed as being “road testers” for the first edition.

2 Microenterprises are companies that do not exceed at least two of the following three criteria: (i) balance sheet total of EUR0.35 million, (ii) net turnover of EUR0.70 million and (iii) average number of ten employees. Non-EU enterprises that either have a net turnover of less than EUR150 million in the EU or do not have a subsidiary/branch within the EU will also not be required to prepare sustainability reporting in accordance with the CSRD. This is described in Directive 2013/34/EU of the European Parliament and of the Council of 26.06.2013, on the annual financial statements, consolidated financial statements and related reports of certain types of undertakings, Article 3(1).

Article (PDF)

DownloadAuthor

Matthew Starling

PrincipalRelated items

Article

Recovering copper leads to potentially huge volumes of avoided emissions

Report

Leveraging digital infrastructure to drive sustainability and revenue

Podcast

Benchmark your sustainability progress with the Sustainable Networks programme