Comcast’s success shows the power of a connected-home-centric strategy

Comcast launched its xFi proposition, which provides services that are closely linked to home Wi-Fi such as parental controls and device identification, in May 2017. xFi has been extremely successful for Comcast. In this article, we assess the scale of Comcast’s success, look at the drivers behind it and consider the lessons for other operators.

The xFi proposition encompasses a number of different components. It includes parental control and device identification functionality, which enables users to switch Wi-Fi connectivity on or off for specific devices at various times during the day, for example. Comcast has also added a connected home cyber-security service that can protect all of the devices connected to the home Wi-Fi network. The company’s modems incorporate smart home protocols and the xFi proposition allows smart home devices (such as connected thermostats) to be controlled. The xFi proposition also knits together different elements of Comcast’s other offerings. For example, xFi can be controlled through various touchpoints, namely a website, mobile app and voice-controlled remote. The voice-controlled remote in turn can be used to control smart home devices; for example, it can turn off the lights or show who is knocking at the door on the TV set, and can also perform home Wi-Fi-related tasks such as asking for the Wi-Fi password. However, the main focus of the voice-controlled remote is to enhance Comcast’s video offerings, by offering improved search functionality, for example.

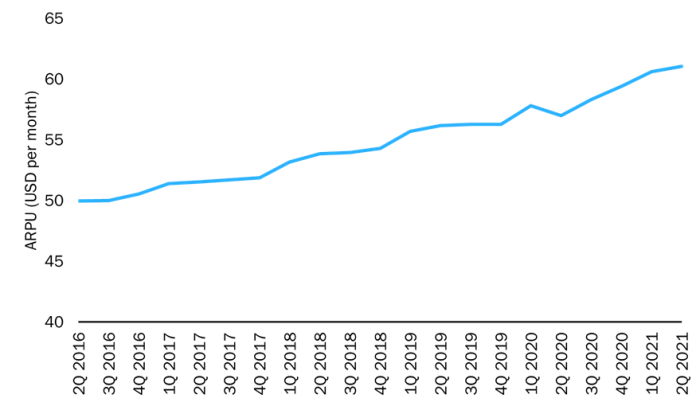

The xFi proposition has boosted Comcast’s ARPU and has resulted in improved growth in the number of subscribers

Comcast charges a separate monthly fee for modem rental (as do other US operators), and the xFi proposition has allowed it to increase these fees more frequently than before. Indeed, the monthly modem rental fee stayed the same from the beginning of 2015 to the beginning of 2018, but was increased at the start of 2018, 2019 and 2020. It is likely that around 70% of Comcast’s broadband customers also take its modem. This means that around 30% of the increase in Comcast’s broadband ARPU since the end of 2017 has been due to the increases in the monthly modem rental fee (Figure 1). The launch of the Wi-Fi-centric xFi proposition has put Comcast in a strong position to sell additional Wi-Fi hardware, and much of the rest of the ARPU uplift has probably come from the sale of such hardware including mesh Wi-Fi units.

Figure 1: Broadband ARPU, Comcast, USA, 2Q 2016–2Q 2021

Source: Analysys Mason, 2021

The xFi proposition has also reduced Comcast’s fixed broadband churn rate, which has improved for the 14 consecutive quarters to 2Q 2021. This helps to explain why we estimate that Comcast took around 43% of all US fixed broadband net additions in the 4 years to the end of 1Q 2017 compared to 51% in the 4-year period to the end of 1Q 2021.

Comcast has benefitted from continually enhancing the xFi proposition

The parental control and device identification features have periodically been enhanced since the launch of xFi. For example, Comcast launched a new feature in July 2019 that allowed users to automatically suspend network connectivity to all of a child’s devices once the child’s daily time limit has been reached. Comcast markets these types of features heavily, and we believe that they are more important differentiators than its smart home automation-focused offerings or its voice-controlled entertainment offerings.

Comcast further enhanced its xFi proposition by adding a connected home cyber-security solution. The xFi Advanced Security offer (which Comcast takes from supplier CUJO AI) was made available for an additional USD5.99 per month for its initial launch in January 2019. This probably helped to establish a value for the service in consumers’ minds. The service was then made available for free to all customers that use Comcast modems in January 2020. The launch of the xFi Advanced Security offer has allowed Comcast to stop offering Norton security solutions (which it previously offered to subscribers for free).

Including the connected home cyber-security service as a part of the modem rental fee and enhancing the parental control and device identification features helped Comcast to justify increasing its fees from USD13 to USD14 at the start of 2020.

Effective marketing and the pandemic have reinforced the value of the xFi proposition

Comcast has effectively marketed the benefits of the xFi proposition so that it is relatable to consumers. For example, it had an advert that showed a teenager trying to secretly enter his girlfriend’s bedroom. The girl’s father receives an alert because the cyber-security service provides a notification when a device connects to the home Wi-Fi network (in this case the boyfriend’s smartphone).

The pandemic has reinforced the value of xFi’s functionality. Comcast noted that there had been a 43% rise in the activation of settings that filter web content while browsing and searching in April 2020 as a result of the pandemic. Moreover, Comcast’s CEO noted, in September 2021, that the connectivity pausing feature had been used 60 million times during 2020.

Comcast’s backing of the RDK-B initiative has been an important enabler of its xFi success

Comcast has been the most important backer of the RDK-B open-source initiative for home router firmware, and some of its own teams even develop RDK-B code. This is important because the underlying firmware will also need to be changed when applications such as connected home cyber-security are added to the CPE. Taking a leading role in the development of RDK-B code has enabled Comcast to speed up the rate at which it can upgrade its CPE with new applications. It is not feasible for smaller operators to take on a leading developer role in open-source initiatives, but they can piggyback on the work done by Comcast (for instance, by reusing the work that has been done to get a particular application onto RDK-B CPE). It should be viable for smaller operators to use RDK-B because its open-source nature means that CPE costs should not be prohibitive. Smaller operators can also focus on other ways to more easily add applications to their portfolios. This might involve partnering with service aggregators; for example, Plume has deals with different CPE vendors to preintegrate its software.

Article (PDF)

DownloadRelated items

Tracker

Fixed–mobile convergence quarterly metrics 4Q 2024

Case studies report

Fixed broadband retention strategies: case studies and analysis

Article

Wi-Fi 7 helps telecoms operators to gain a competitive edge as demand for multi-gigabit connectivity grows