Community Fibre shows how threatening the pureplay fibre model can be to established operators

Community Fibre’s high-quality fibre broadband, excellent customer service and competitive pricing pose a significant threat to established operators. Community Fibre is continuing to grow rapidly, capturing market share from other operators while maintaining access to funding. Its main limitation is the relatively small coverage of its fibre network and the challenge of expanding into new areas.

This article explores Community Fibre’s strategy, its potential limitations and what other operators can learn from it. It is part of our research into the future of the service provider.

Community Fibre’s strategy

Community Fibre’s strategy can be summarised as follows:

- It aims to sell a simple, high-quality fibre broadband product for a competitive price. At the time of writing, Community Fibre is offering 1Gbit/s for GBP25/month on a 2-year contract. This compares with Vodafone (GBP38/month), Virgin Media (GBP41/month) and BT (GBP48/ month); Vodafone, Virgin Media and BT all have an annual GBP3/month price increase, compared to GBP2/month for Community Fibre.

- It has some, relatively limited, additional services, such as a voice plan (GBP10/month), TV plan (GBP10/month) or security (Norton security offered for GBP5/month). Guaranteed home Wi-Fi coverage can also be purchased for an extra GBP7 per month on the 1Gbit/s plan. These services are offered as they are needed by some customers. However, Community Fibre is deliberately not trying to compete with premium TV offers or with mobile bundles.

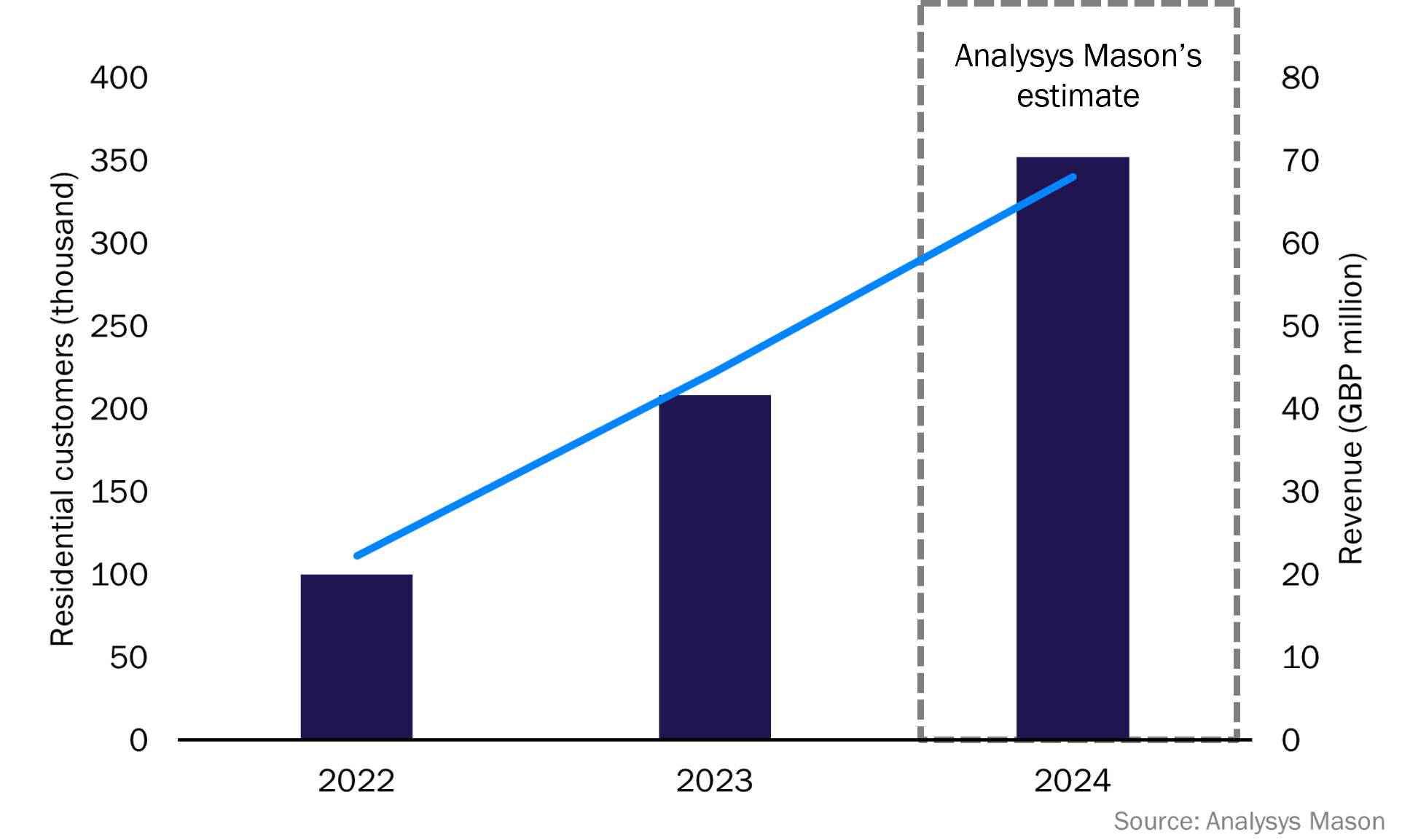

- Consumer sales are made through a mix of online sales, telesales and door-to-door campaigns. As can be seen in Figure 1, this approach has been successful in consistently growing the customer base.

Figure 1: Community Fibre revenue and customers1

- It owns and operates its network, which is primarily located in London (with some coverage in neighbouring Surrey and Sussex). This limited coverage means that it gets synergies for dense local coverage, for network build, maintenance, sales, marketing and so on, that it would not get if it launched in multiple areas. The network now passes around 1.3 million homes and 200 000 business sites. The take up rate of Community Fibre, at over 25%, is much higher than most other UK fibre altnets.

- It has a simple business proposition, sold directly and through partners which can bundle it with their own services (for example, cloud security). However, Community Fibre does not offer IT services, aligning with its strategy of keeping the service simple and its costs low. The business broadband connections include mobile backup and guaranteed 8-hour repair times.

- It also has a wholesale offer. TalkTalk is the only named customer in this sector, but others are also using the network. While wholesale customers potentially compete with the retail offer, offering wholesale services helps Community Fibre maximise network usage, which is a central element of its strategy.

- Quality is a big focus, both on the network and on customer service. Community Fibre places great importance on the quality of its network installation, for example, by tracking the performance of individual installers. There are signs that this strategy works. It has a TrustPilot score of 4.6 out of 5, which is similar to other pureplay fibre operators (Hyperoptic has a 4.5 score) but well above more established players like Virgin Media (1.4) or EE (1.6). As well as keeping customers happier, this approach helps to maintain its low costs by avoiding a high number of customer calls or visits and by reducing the need for fixes due to poor installation. The combination of low prices and a good service should also help with retention.

- It is following a low-cost model. Many of the team members at Community Fibre have worked for larger operators and seen how investment can be wasted by trying to chase incremental revenue that does not materialise. Community Fibre is deliberately avoiding this. It is focused on cost elimination; it has, for example, halved the cost of customer service on a per customer basis, in the last year. It also believes that its costs per customer are lower than the larger competitors, despite its size.

Challenges

Its strategy has been successful to date but Community Fibre faces a number of challenges:

- Its most obvious limitation is the size of its network. Community Fibre had previously talked of increasing its network reach to 2.2 million homes passed, but this project was put on pause due to the UK’s current high interest rates. Its focus has now shifted to getting more of the 1.3 million homes already passed to sign up for its services. Community Fibre has won roughly a quarter of the homes it passes as customers. However, there will be an upper limit (perhaps 50% or 60%) to the share of homes it connects where it has network. Even before it hits this point, growth in customers and revenue is likely to slow down. Community Fibre will have a choice to either remain as it is – a relatively small provider selling a profitable but limited set of products – or it will have to expand, either geographically or by selling a wider range of products and services.

- If it grows by offering additional products, that will likely negatively impact its profit margins. The likely products that Community Fibre could add to the mix (such as mobile, more advanced TV products, IT services for businesses) each comes with its own set of challenges. They are all are likely to have a lower profit margin and would compete with Community Fibre’s wholesale and business resale partners. Despite this, these new products may be justifiable if they can increase free cash flow, even at the expense of profit margins. For the time being though, Community Fibre is focused on keeping its offer simple.

- Expanding into new geographies outside of London would lack the scale benefits that it has in the capital. Community Fibre could revisit its plans to expand to more locations in London, where it already has installers, a sales force and some degree of brand recognition. London, obviously, also has the benefit of a being a large, relatively dense, target market. Expanding into neighbouring areas outside of London would not have that density, or expanding (either organically or through acquisition) in a different city would create new operational challenges. For example, it would need to recruit in new areas and it would have to build up its brand and so on.

- In its existing coverage area, the decision to keep the product simple will fail to attract some customers. Customers that want a bundle of premium sport packages with their fibre network will look elsewhere, as will those that want a bundle of fixed and mobile services. Community Fibre will be able to win some of these customers through wholesale deals, so it has some mitigation, but there will be a portion of the market it is not able to appeal to.

- Community Fibre’s pricing is not hard to copy, even if the low-cost model and customer service levels may be hard to replicate. Any of the other fixed providers could copy Community Fibre’s pricing. They may not want to, but if Community Fibre’s share continues to rise where it has a network footprint, the bigger players might decide to respond more aggressively. The response may be in ways that Community Fibre cannot easily address (for example, competitors could push an aggressively priced bundle of fibre and mobile, or fibre and premium TV). Community Fibre will need to rely on its reputation for its good customer service, quality offering and competitive pricing to defend its position.

- Acquisition is an obvious route for expansion, but comes with many challenges. The UK is a crowded market for fibre players and many are struggling from higher debt costs (indeed, Community Fibre’s own interest payments have increased substantially, in part, due to interest rate rises. Its finance costs increased to GBP48 million in 2023, from GBP10 million in 2022, according to Companies House filings). Integration would be a complex and lengthy process, and Community Fibre may not have the same low cost base in other locations, as discussed above. Acquisitions would also be a distraction from execution of the current strategy of a relatively small team.

- Brand awareness may be an issue. Awareness of Community Fibre is likely to be lower than for larger operators and this may stop some customers from switching. Its brand is gradually gaining local traction, but there will be some customers that do not want to move to a relatively new, smaller player.

- Lower investment in technology may be a risk. Community Fibre has a low-cost model, and it is doing what it can to keep these costs down (for example, it has a work-from-home policy, in part to control costs), but inevitably it will not be investing as heavily as larger players in other areas, such as in AI for customer service. If large firms achieve significant cost savings through AI technologies (for example, from Generative AI (GenAI) powered chatbots for customer service), Community Fibre could find itself at a disadvantage. However, if Community Fibre does invest in GenAI-powered chatbots, it could gain an advantage with lower investment costs. These chatbots may be well suited for simpler businesses like Community Fibre but may struggle with more complex products, bundles and pricing plans of the established players.

Learnings

The basic elements of the Community Fibre proposition – a competitively priced, quality product and a good service – are hard to compete with and its success shows that it can work. The essential elements have many similarities to the strategies of Digi and Iliad.

The main lessons other operators can take from Community Fibre’s strategy are:

- Take the threat of small fibre operators seriously. Community Fibre has a take-up rate of over 25% in its coverage area. This could rise to above 50%, and yet there is little sign of the larger players responding to the threat. Community Fibre was able to raise a further GBP125 million in a debt facility in October 2024 and has been EBITDA positive since April 2024. Larger players cannot simply assume that start-ups like Community Fibre will run out of funding. The impact of smaller players is already showcased by Openreach, which lost broadband lines in 2023 and so far in 2024.

- Community Fibre’s strategy is as much what it does not do as what it does. Michael Porter said that “The essence of strategy is choosing what not to do”, and this defines Community Fibre. It has one product, based on one technology and in one city. Many other operators talk about ‘radical simplification’ but year after year fail to reduce their number of product offerings. Community Fibre is evidence that the very simple offer can be successful.

- Be willing to not serve parts of the market. Community Fibre’s strategy will not meet the needs of part of the market, but this was a deliberate decision.

- Manage price rises carefully. Community Fibre has built-in price rises, like many other operators, and the price increases at the end of the contract, but these are relatively small rises. At the end of a standard 2-year contract with Community Fibre, customers automatically switch to a month-by-month contract, with tariffs automatically increasing by GBP4 per month . If customers choose to recontract, they return to the original price. Compare this with Virgin Media – after the 18-month contract period for its 1Gbit/s price, the GBP41/month price doubles to GBP82. From our survey work, customers appear to be tolerant of small price rises, but not of large ones, and this aligns with Community Fibre’s strategy.

- The Community Fibre model may not work everywhere. Digi has been clear that it needs to offer TV and mobile in some of its markets (for example, in Portugal). In the UK though, fixed mobile bundling is still relatively unusual and TV, aside from premium sports packages (which is to say Sky), is mostly bought separately from a broadband package. Fibre operators in other countries may not be able to simply copy the Community Fibre model.

1 Please note that the 2024 results are our estimates as data was not available for 2024. These numbers are based on partial year data.

Author

Tom Rebbeck

Partner, expert in TMT consumer and business servicesRelated items

Article

Iliad’s central telecoms strategy is similar to that of most operators, but the details have lessons for others

Article

Norlys shows how smaller players can combine telecoms and energy products to remain efficient

Article

Digi’s approach with clear objectives but flexible execution is one that other operators could learn from