Telecoms operators’ consumer divisions should learn from the success of business divisions

Telecoms operators’ near-term plan to maintain, or even raise, ARPU by upgrading customers to unlimited (mobile) data plans or faster (fixed) speeds has limited potential. Some operators already have 80% of their mobile customers on unlimited plans and a third of their fixed customers on 1Gbit/s speeds. Operators will need to include more than just connectivity in their plans to raise revenue further.

This is not a new strategy. Operators have already tried to bundle a limited number of services, such as pay TV and mobile, alongside fixed plans. However, the new strategy involves not just one or two additional services, but could include ten or more.

A similar strategy has been followed by telecoms operators’ business divisions for a number of years with considerable success. Consumer divisions should look at what the business divisions have done and learn from their success.

For more on this topic, see Analysys Mason’s presentation, Where will service revenue growth come from?

Business divisions have done a better job at stabilising revenue than consumer divisions

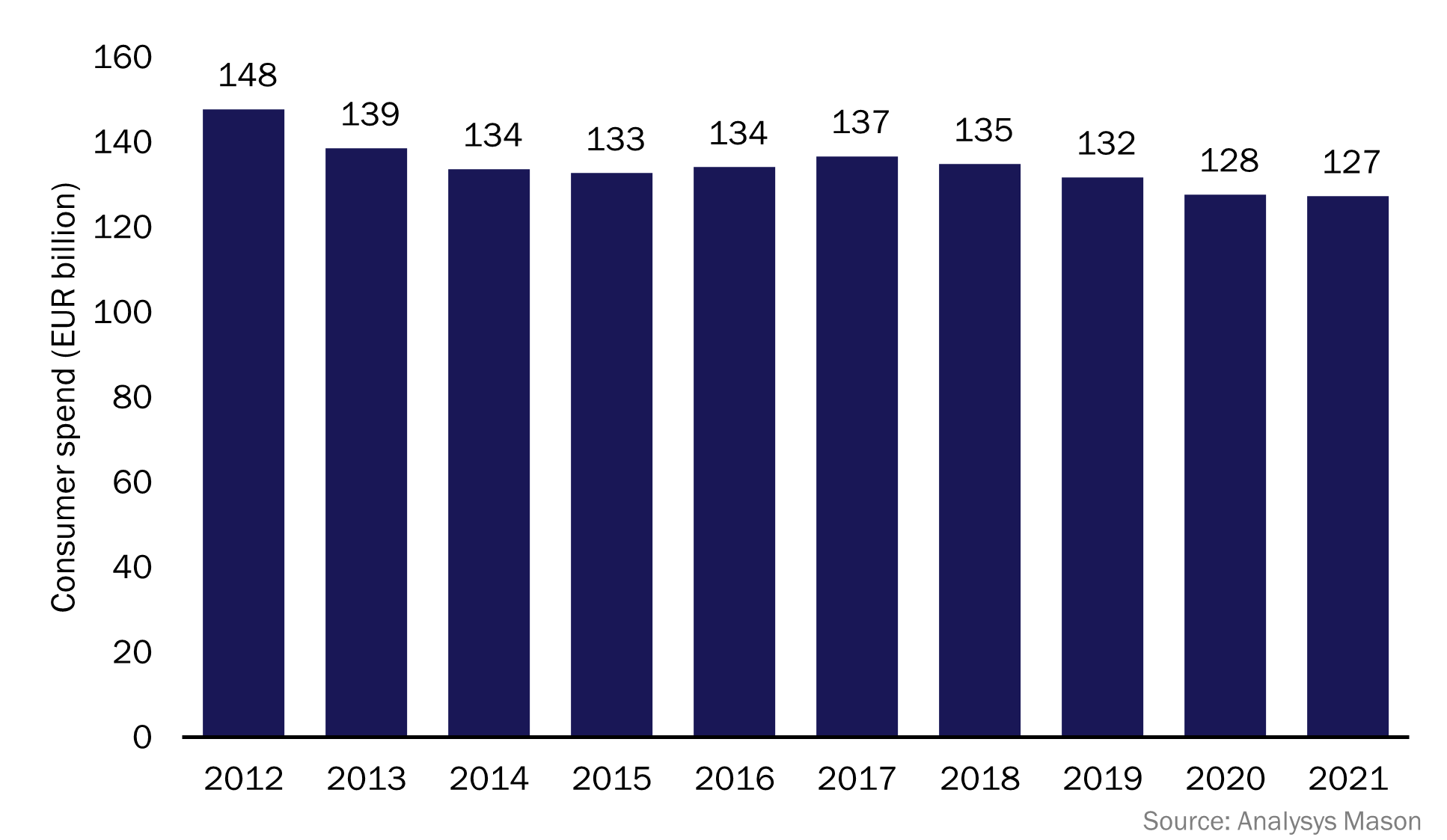

Consumer spend on telecoms services has been in decline, in real terms, for much of the past 10 years. Indeed, spending in Western Europe declined by EUR20 billion between 2012 and 2022. Part of the recent fall may be due to the pandemic, but the longer term trend is clear (Figure 1).

Figure 1: Consumer spend on telecoms services in real terms, Western Europe, 2012–2021

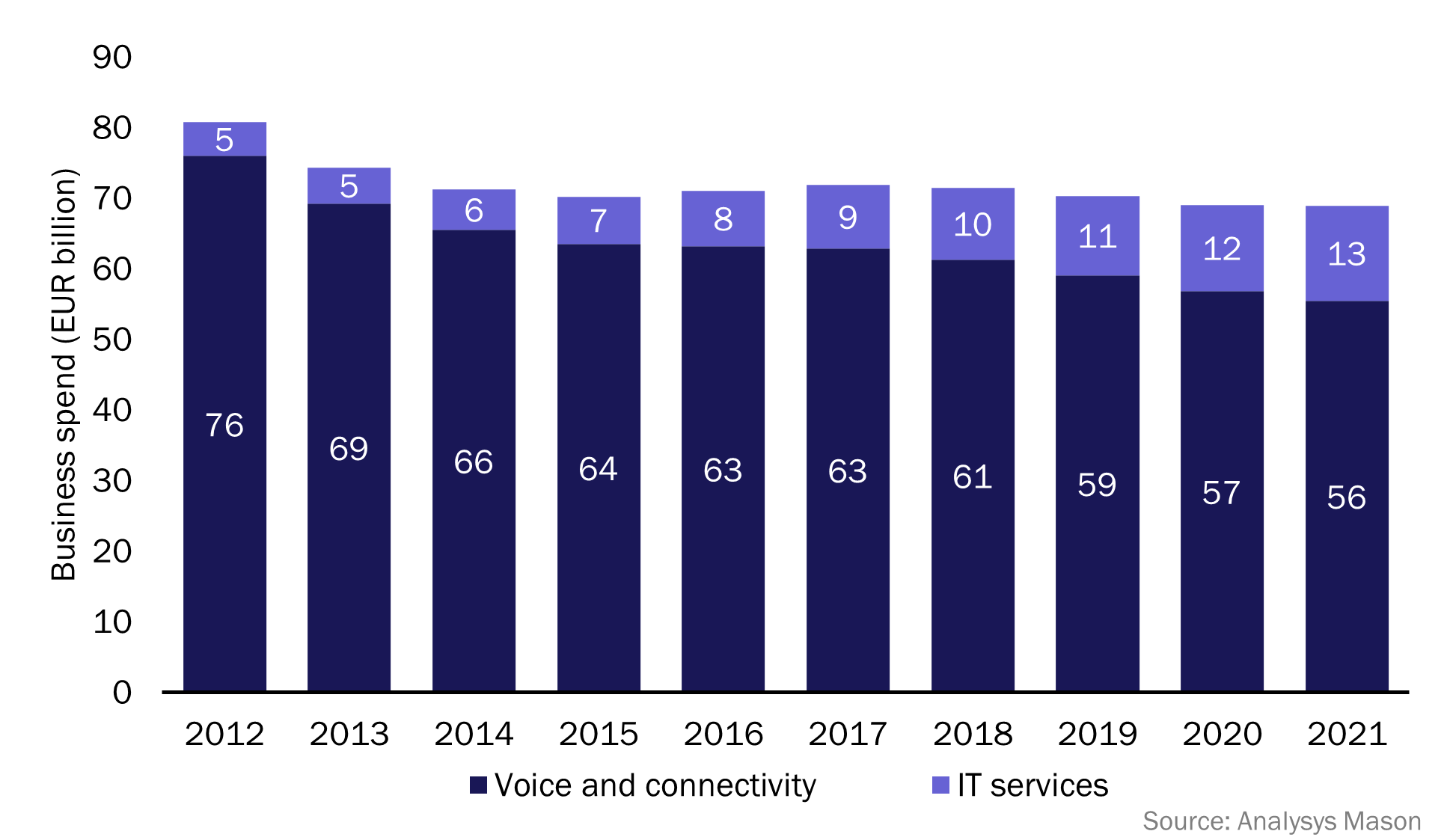

Business spend with telecoms operators has held up better (Figure 2). Spending in Western Europe declined between 2012 and 2015 almost entirely due to a fall in spending on voice services, but has remained at around EUR70 billion since. Again, these figures are in real terms; business spending has increased slightly in nominal terms.

Figure 2: Business spend on telecoms services in real terms, Western Europe, 2012–2021

Figure 2 also shows that the increase in spending on IT services has been a key driver of business divisions’ relative success. Business divisions have become aggregators of IT services from multiple providers. Consumer divisions will need to implement a similar strategy if they are to grow their own revenue.

Consumer teams should replicate aspects of business divisions’ strategies

Operators’ consumer divisions can play an equivalent role to business divisions and aggregate a range of services. Consumer divisions can learn a number of lessons from their business counterparts.

- Offer a broad portfolio of services. Operators should offer a wide range of hardware and services for consumers. Wi-Fi mesh hardware, endpoint security, cloud storage, pay TV and streaming services, games and other products should all be part of the portfolio.

- Take products developed by others. The products and services offered do not have to be developed or created by the operator. Operators want their products to be relevant in all the countries in which they are active, so it is unlikely that it would make sense for them to develop them themselves.

- Have low thresholds for success. Business divisions do not try to sell all of their products to all of their customers; they are happy if only 5%, or even 1%, of the customer base takes a product. These products are low-risk because the operator has not invested in their development. Indeed, some operators have ceased to offer certain products because they were only being taken by a small share of customers, even though they were profitable.

- Experiment. Operators that broaden their portfolio of services (many of which will only appeal to a small minority of customers) need to be willing to experiment and be flexible. They will need to add and remove products, test different pricing strategies and so on. They probably need to be bolder than they have been in the past.

- Consider margins in terms of customer lifetime, not on a product-by-product basis. Business operators are looking to grow the total value of each of their accounts and view profitability on a per-account basis, not a per-product basis. Many of the products that consumer divisions (or business divisions) will provide will simply be resold from another party. Inevitably, margins (as a percentage of the total product price) will be low and may be unattractive if viewed purely in terms of margin per product. We believe that operators should be more concerned about the total value of the account. However, the implications of a different strategy are also worth considering: competition is likely to focus on price if an operator only provides basic connectivity with no additional features. Offering a wider range of services provides more scope for differentiation.

Consumer divisions can also make use of the investments made by the business division. Operators already do this to some extent (for example, they use the same modems for consumers as for small businesses), but more can be done. For example, the same basic products for mobile endpoint security can be sold to a multinational as to an individual on a prepaid contract. Few operators do this.

There will of course be differences from the approach taken by the business division. Most business products are sold for an extra fee while bundling additional services into premium plans may be a better approach for the consumer market. Operators also do not have obvious acquisition targets in the consumer market, unlike in the business market, where many are buying IT services firms.

Operators need to consider a more complex product portfolio

Telecoms operators’ traditional approach was to differentiate their consumer connectivity product with a relatively small number of additional features. Today, operators need to do more and offer a wider range of hardware and services to distinguish their services. This is no different from the business market. Business divisions no longer want to sell a single Ethernet connection to a customer; the focus is on selling a set of services. Consumer divisions should consider adopting a similar strategy.

Article (PDF)

DownloadAuthor