Operators view cost saving and coverage as the two main drivers for network sharing

The benefits of network-sharing are becoming increasingly visible. Based on a recent operator survey conducted by Analysys Mason, 31 of the 79 operators that responded (39%) were already engaged in some form of network-sharing/co-investment agreement. Of these 31 operators, 81.5% were able to see the benefits of sharing within the first 3 years. A range of different fixed/mobile network-sharing arrangements are being explored by operators to help alleviate some of the pressures of a cost-intensive period, driven by the deployment of 5G and fibre, but also by energy price inflations.

In this article, we summarise some of the key findings from Analysys Mason’s survey, Network sharing: the benefits and challenges for operators. We will also discuss information from the Network sharing and co-investment tracker, which gives examples of signed network-sharing agreements worldwide between 2021 and the present.

Operators are achieving improved clarity on which network elements to share in order to target different types of cost savings

Based on our survey, the most sought-after benefit of network sharing for operators is the potential to achieve a reduction in capex and opex (this was selected by 40% of the total 31 respondents). Operators are increasingly keen to free-up budgets for network infrastructure and re-direct them into innovations that can help the development of new revenue streams and service differentiation. After cost saving, operators also highlighted improved coverage (17%) and accelerated build-out timescales (13%) as important benefits of network sharing.

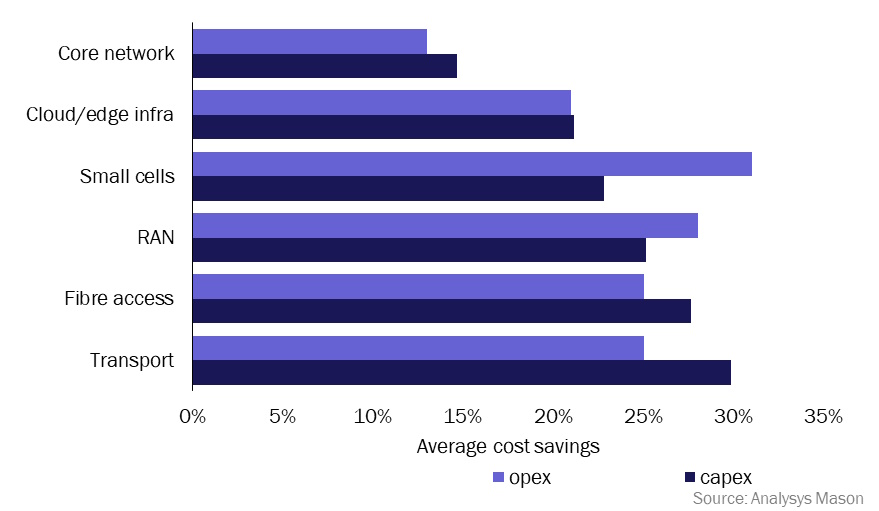

As network-sharing models are maturing, operators are more certain about the benefits of sharing specific elements of the networks in order to achieve either opex or capex savings, or both. As shown in Figure 1, operators are expecting to achieve the greatest amount of opex savings in sharing small cells (31% savings), while the highest capex savings are expected to come from sharing the transport network (30% savings).

Figure 1: Average operator cost savings from sharing various network elements

Question: ‘What capex and opex savings do you expect to achieve in each part of the network, compared to deploying alone (over a 5 year period)?’; n = 79.

The high costs of deploying 5G often drive the business case for network sharing, but only if operators can overcome the challenges

The business case for deploying 5G in many countries remains challenging due to high deployment costs and uncertain return on investment (ROI). This is pushing operators to explore network sharing as an alternative ownership model to help reduce the burden of investment associated with 5G roll-out. A 5G-only sharing scenario (including active RAN-sharing) could achieve savings for operators in the range of 18–35% (compared with a no-sharing scenario).

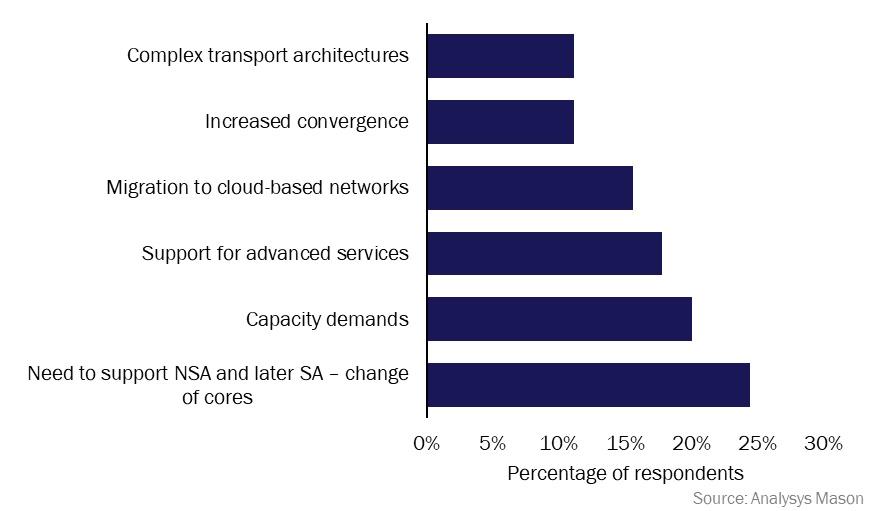

However, the sharing of 5G networks brings a variety of additional challenges (Figure 2). Based on our survey, 24% of the total respondents thought that the need to support 5G non-standalone (NSA) first, and later shift to the standalone (SA) architecture is the major barrier to 5G network-sharing. This is because at some point there will be a requirement to deploy a new core for SA.

Figure 2: 5G network-sharing challenges

Question: ‘What are the unique challenges of 5G network sharing, compared to 4G or fixed?’; n = 79.

However, those extra 5G-related challenges have not prevented operators from adopting this business model and we have seen several examples of 5G network-sharing agreements, particularly in the developed Asia-Pacific region and in Europe. For example:

- In 2021, Telia and Telenor Denmark’s JV TT-Netvaerket announced that their 2G, 3G and 4G network-sharing agreement had been upgraded to include 5G technologies covering the country’s four largest cities. This arrangement uses a Multi-operator core network (MOCN) approach.

- In January 2023, WindTre and Iliad established a 50:50 JV under the name Zefiro Net to deploy a shared 5G network in rural areas of Italy, after receiving approval from the regulator in August 2022.

- In January 2022, South Korea’s LG Uplus, KT and SK Telecom agreed to share their 5G networks in remote coastal/farm towns across the country. The project is expected to be commercialised in phases by 2024.

Sharing between operators and non-operators is less common than between operators only, but we expect this trend to change

Our survey found that the majority of operators are currently taking a traditional network-sharing approach that involves operators only, while just 19% were choosing an arrangement with non-operators, such as hyperscalers, towercos and utility companies. Sharing agreements with non-operators can be slow to establish, due to regulatory issues and since different parties may have incompatible business goals, since at times, non-operators lack network expertise. However, to unlock greater cost efficiencies, cross-vertical sharing or co-investment arrangements with partners outside the telecoms market could offer operators access to alternative and valuable capabilities, such as cloud expertise from hyperscalers. Operators are also looking to secure and improve their energy supply and cost-efficiencies through partnerships with tower and utility companies. For example:

- In October 2022, Airtel Africa signed an arrangement with ATC Africa for access to its communication sites in Kenya, Niger, Nigeria and Uganda. Other than increasing coverage, Airtel claims that the partnership will help to ‘reduce exposure to fuel-price volatility’ as ATC has invested heavily in introducing energy efficiency improvements to its sites and in decreasing its on-site reliance on fossil fuels.

- In July 2022, Rakuten Mobile and TEPCO established a new JV company, Rakuten Mobile Infra Solution, to build out 4G/5G mobile base stations cost-effectively using TEPCO’s existing power assets.

- In March 2022, Safaricom Ethiopia signed an agreement with power utility company, Ethiopian Electric Power (EEP), for access to EEP’s optical ground wire infrastructure for its private mobile network. This is a cheaper option for Safaricom compared to building all of its own infrastructure.

Operators are also starting to explore new types of network-sharing models such as NaaS and slicing. For example, NaaS agreements have been explored as a way to increase rural coverage (such as by MTN in parts of Africa). However, there is still a lack of clarity about which new models will prevail and which benefits operators will receive from them. We expect that the maturity of these models will be accelerated by the growing adoption of cloud/edge infrastructure and by partnerships that operators are establishing with non-telco companies.

Article (PDF)

DownloadAuthor

Grace Langham

Analyst, expert in sustainability and ESGRelated items

Article

KDDI’s results demonstrate the challenges of entering new markets such as energy and finance

Strategy report

Moving from cable to fibre networks: the economic implications on operating costs

Article

Operators are prioritising efficiencies within their organisations to reduce their operating costs