CSPs’ service management and orchestration spending will reach USD1.4 billion by 2028

22 March 2024 | Research and Insights

Article | PDF (3 pages) | Service Design and Orchestration

Analysys Mason’s latest forecast on communications service providers’ (CSPs’) spending on service management and orchestration (SMO) software systems and related services predicts robust growth between 2023 and 2028. This growth is primarily attributed to the rapid deployment of 5G standalone (SA) networks and the digital transformation initiatives undertaken by CSPs.

The market is currently at a juncture where single-vendor Open RAN investments have been deployed and tested, and CSPs are starting to invest in multi-vendor Open RAN technology. This technology will be a driver for CSPs needing to deploy SMO solutions because they provide a unified framework with standardised interfaces ensuring seamless communication and control between diverse network elements without which operators will not be able to deploy dynamic network slices and fully optimise Open RAN operations.

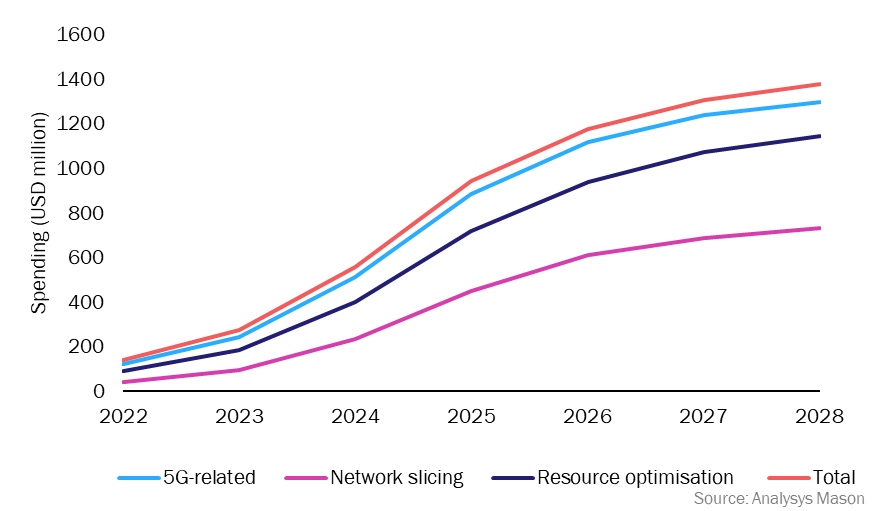

Figure 1: CSP spending in the service management and orchestration software and services market, by driver, worldwide, 2022–2028

5G-related spending in the SMO segment will reach USD1.3 billion by 2028 and will account for 94.3% of CSPs’ SMO spending

5G will be a leading driver of spending in the SMO segment; CSPs’ spending on 5G-related SMO solutions is projected to increase at a CAGR of 48.5% from 2022 to 2028, reaching USD1.3 billion. This growth will be driven by the increasing number of CSPs that are deploying 5G SA technology. We are also witnessing an increase in the deployment of open networks by operators, and the provision of government incentives to encourage the adoption of open networking technologies (for example, Taiwan has allocated USD658 million for a 5G action plan). In general, spending growth will be particularly strong in Asia during the forecast period and we also expect rapid growth in North America. However, we expect a slowdown in 5G-related spending from 2026 onwards because the technology will have matured and CSPs may start to explore new technologies

Spending on network slicing solutions in the SMO market will reach USD732 million worldwide in 2028

Network slicing is poised to become the fastest-growing driver in the SMO market. We expect CSPs’ spending on network slicing solutions to increase at a CAGR of 60.5% to reach USD732 million in 2028. While the monetisation models for network slicing remain somewhat undefined, its potential impact is evident. CSPs can use network slicing to guarantee service provision for emergency communications, but other use cases may face challenges in navigating net-neutrality regulations.

Despite these hurdles, network slicing is important in the telecoms industry. As we embrace 5G-enabled applications, the ability to recoup 5G investments hinges on realising the true value of network slices – the ability to dynamically configure network slices with target SLAs to enable differentiated services. This value can only be fully delivered in open and automated environments, where each slice remains isolated and resources are optimised to higher capacity levels. SMO solutions play a pivotal role in achieving this by facilitating the onboarding of network functions (both containerised and physical), orchestrating slices and mapping cloud topologies.

However, it is important to recognise that while SMO is essential for effective slice orchestration, Open RAN architecture necessitates integration with broader management and orchestration systems. This co-ordination spans the entire network, including core and transport components, ensuring seamless operation and efficiency.

Spending on resource optimisation solutions in the SMO market will reach USD1.1 billion worldwide in 2028

The gradual monetisation of 5G, coupled with narrowing profit margins, the recent energy crisis, and growing environmental concerns, has sparked a heightened interest in resource optimisation. Total cost of ownership (TCO) savings serve as a primary motivator for implementing AI and automation in the RAN, and CSPs are shifting their focus away from investing in new services; instead, they are focusing on optimising existing resources.

Recent spin-off activities have also fuelled this interest in resource optimisation. NetCos are actively updating their legacy software and embracing open infrastructure to facilitate more efficient resource sharing. However, despite these advancements, a significant proportion of CSPs continue to rely on manual operations. Even those employing self-organising network (SON) technology have not consistently achieved high levels of automation.

To achieve their ambitious automation targets, CSPs must not only adopt SMO solutions but also transcend the limitations of distributed SON. By doing so, they can unlock the full potential of resource optimisation and pave the way for a more streamlined and efficient network.

Analysys Mason is at the forefront of analysing service management and orchestration systems and services

Our recent report, Service management and orchestration: worldwide forecast 2023–2028, provides forecast data for CSPs’ spending in the service management and orchestration market, and includes: detailed evaluations of spending on products and professional services worldwide and by region; an assessment of the key drivers that will influence the market; and recommendations for vendors and operators. For a broader analysis of operational support systems (OSS), we also have the following reports.

Article (PDF)

DownloadAuthor

Michelle Lam

Senior AnalystRelated items

Report

Analysys Mason research and insights topics for 2026

Forecast report

Service design and orchestration: worldwide forecast 2025–2030

Article

Hyper-automation can re-energise revenue growth, but only if operators look beyond mere cost reduction