CSPs continue to invest in AI and analytics tools to improve network efficiency

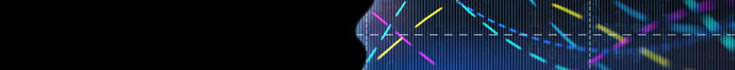

Communications service providers (CSPs) continue to spend on AI and analytics tools across use case domains (Figure 1), according to Analysys Mason’s Communications service provider data and AI/analytics activity tracker 2H 2022. This article examines the network-related AI and analytics use cases that CSPs invested in during 2022. Service- and customer-related use cases are explored in a separate article.

Figure 1: Cumulative number of CSP contracts and partnerships for AI and analytics by type of use case, worldwide, 2019–2022

The demand for AI and analytics tools for network-related use cases is growing

Engagements involving AI and analytics tools in the network domain accounted for around 50% of the total number of deals during 2019–2021. Interest in these use cases remained strong in 2022, but due to increased spending on service- and customer-related AI and analytics tools, the network segment only accounted for 30% of the new deals (Figure 2).

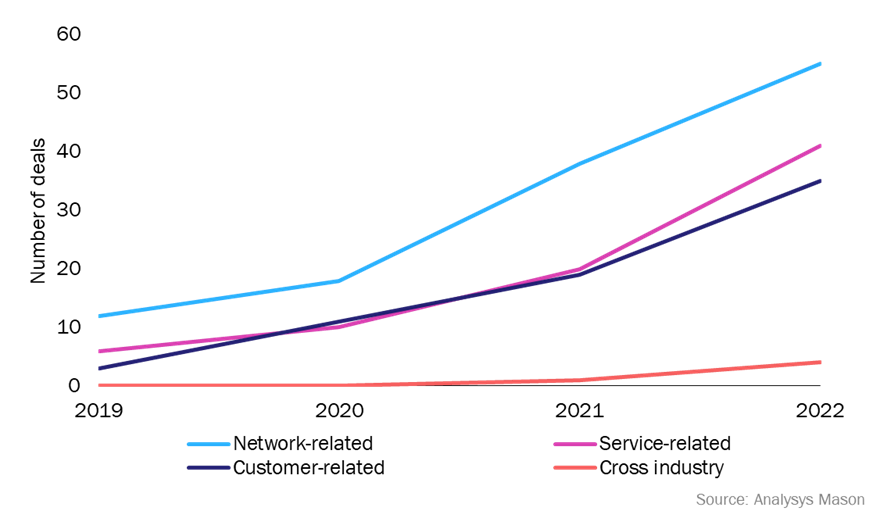

Figure 2: Top-three network-related AI and analytics capabilities sought by CSPs, worldwide, 2019–2022

Most network-related deals in the last 3 years have focused on AI and analytics tools relating to network operations, optimisation, and design and planning. This continued during 2022, but the balance between the different use cases changed; CSPs signed more contracts relating to network optimisation and network design and planning in 2022 than they had done in previous years.

- Network optimisation: STC used Ericsson’s solution to optimise radio parameters on its network, enabling the operator to reduce the energy consumption of its infrastructure.

- Network design and planning: NTT Docomo used Nokia’s AVA to determine suitable locations for equipment for its 5G network, and T-Mobile used a supply chain management solution to enhance its network planning procedures in partnership with Microsoft.

CSPs are using a range of vendors for their AI/analytics needs and are shifting spending to consolidate network operations

CSPs’ ecosystem of vendors remains diverse because different network AI and analytics use cases are addressed by different types of vendors – telecoms original equipment manufacturers (OEMs), independent software vendors (ISVs) and public cloud providers (PCPs) all signed deals with CSPs in 2022. Telecoms OEM use cases were centred around radio frequency optimisation and energy savings: Ericsson, Nokia and ZTE formed partnerships worldwide. This shows that telecoms OEMs are able to win deals that align with the network infrastructure they provide and are limited when it comes to multi-vendor use cases. The use cases that apply to the lower level radio functions are best addressed by the OEMs, hence the increased activity. Open RAN is likely to change this approach, but the industry has yet to see a third-party vendor control another vendor’s RAN DU in near-real time. Therefore, OEMs are most active around radio spectrum or frequency optimisation and utilisation.

ISVs also signed deals with CSPs, and they did more than fill gaps in operators’ network AI and analytics portfolios. CSPs, in partnership with ISVs, are addressing the complexity of their vendor ecosystems by investing in improved traffic visibility and data operations to enable consolidated network operations/management – Vodafone, Deutsche Telekom and Globe Telecom all signed contract with ISVs in 2022.

- Vodafone partnered with Cardinality.io (acquired by Elisa Polystar) and Google Cloud to consolidate network performance applications into a single data platform to support holistic traffic monitoring and analytics use cases for the CSP’s pan-European network.

- Deutsche Telekom mobilised BENOCS, one of its spin-outs, and business monitoring and anomaly detection solution vendor Anodot to help the CSP to process data from multiple sources to simplify its IP network operating environment through data analytics. The combined solution provides traffic monitoring and automated anomaly detection with noise reduction to enhance network operations.

- Globe entered into an engagement with Cellwize and Amdocs to simplify the configuration management for the RAN, by providing better oversight of their disaggregated and fragmented multi-vendor ecosystem.

Overall, Google Cloud was the most active in signing deals with CSPs in 2022; 5 out of 15 new deals involved the cloud provider. The popularity of Google Cloud can be attributed to its ability to function at a large scale, a capability mentioned in recent press releases with BT and Vodafone. Vodafone has deployed the solution in more than 10 countries. Google’s popularity with CSPs has increased in recent years; it signed just one contract in 2021, with Bell Canada for modernising the CSP’s network and drive better customer experience. In addition, Google Cloud Platform is learning from these AI/analytics engagements and is developing a data platform that addresses CSPs’ network analytics use cases – the GCP Telecom Data Fabric. These developments may appeal to CSPs that are looking for a simplified approach to managing data and using it to address several analytical use cases, but they must be careful to avoid vendor lock-in issues.

CSPs must be intentional about their AI and analytics investments if they wish to derive value from them

Investing in AI and analytics tools can provide CSPs with quantifiable benefits. A number of CSPs reported improvements on their networks since 2019: China Mobile achieved a 7% decrease in energy usage on its network, while Telefónica reported 8–26% savings (depending on traffic volumes) after deploying intelligent network optimisation solutions. AI and analytics tools can affect other areas of operations as well; Hutchison 3 Indonesia indicated a 17% increase in spectral efficiency after using a vendor’s spectral performance management tool. However, most of these benefits were recorded in trials or isolated settings and we have yet to hear about the network performance benefits of the use cases in production, or how these affect CSPs’ financial performance. This trend continued in 2022, with only 2 out of the 15 new engagements reporting any measured improvement: the earlier-mentioned Telefónica trial on energy savings, and BT subsidiary OpenReach contracting Vyntelligence for its video and audio analytics solution – OpenReach reduced customer premises equipment deployment time by 71%, achieved a 68% reduction in quality defects and 93% reduction in failed audits.

Not measuring and monitoring the quantifiable outcomes of these engagements may leave CSPs in the dark when it comes to determining the value derived from their AI and analytics investments. CSPs should be intentional about understanding the benefits; identifying the right metrics to track will be a good first step in meaningfully monitoring the value that AI and analytics tools generate for the business. Examples of key performance indicators (KPIs) for network use cases include spectral efficiency, changes in ticket dispatch times and level of CO2 emissions associated with the network.

Article (PDF)

DownloadAuthor