CSPs are investing in enterprise service-related AI and analytics to improve their value propositions

18 May 2023 | Research and Insights

Article | PDF (3 pages) | AI and Data Platforms | AI

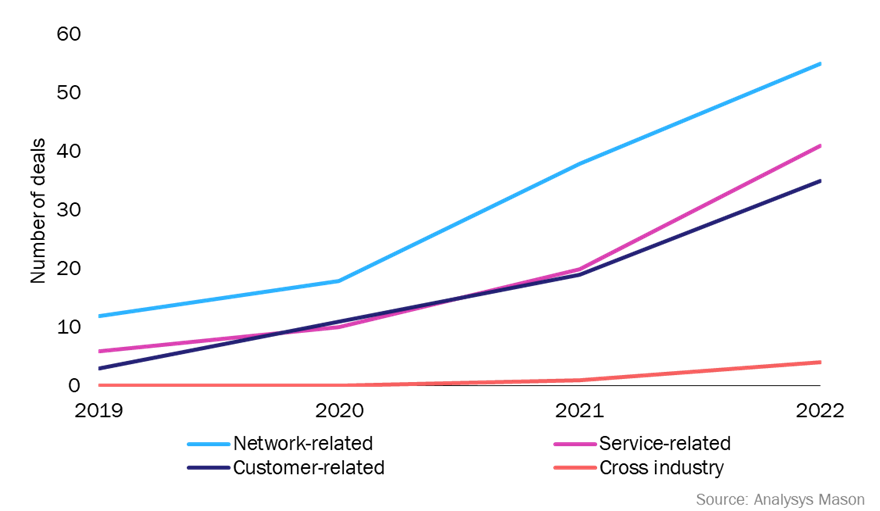

Communications service providers (CSPs) continue to spend on AI and analytics tools across use case domains (Figure 1), according to Analysys Mason’s Communications service provider data and AI/analytics activity tracker 2H 2022. This article examines the services-related AI and analytics use cases that CSPs invested in during 2022.1 Network-related use cases are explored in a separate article.

Figure 1: Cumulative number of CSP contracts and partnerships for AI and analytics by type of use case, worldwide, 2019–2022

CSPs’ interest in services related AI/analytics use cases increased, but the shift in regional trends highlights technology maturity

CSPs’ investments in services-related AI and analytics use cases surged in 2022. CSPs publicly announced 20 engagements within the services domain, a two-fold increase on the 10 deals recorded in 2021. Services-related AI and analytics use cases pursued by CSPs were almost all related to enterprise services – 19 out of the 20 were this category.

CSPs in the developed Asia–Pacific region (DVAP) were the most active players in this domain, accounting for 45% of announcements recorded in our database. KT, SK Telecom, LG Uplus, KDDI and Singtel all announced contracts in 2022. By comparison, CSPs in the region accounted for only 20% of announcements in 2021.

Creating new enterprise-focused services based on AI/analytics can take time, given the industry and technical expertise that is required to develop these services. The number of CSPs investing in this use case highlights that these CSPs are becoming accomplished in their use of AI and analytics. CSPs in the region are quick to take advantage of advanced AI technologies to improve their services; KT and SK Telecom have both deployed generative AI (GenAI) solutions. KT’s MI:DEUM is using AI to improve its call centre operations and SK Telecom’s upcoming A. (A dot) unified customer experience offer that will enable customers to use the CSP’s digital services. These are both customer-facing applications of the technology, but the CSPs may start offering the products to enterprise clients when they prove useful.

CSPs can improve the positioning of their networks, by offering enterprise AI and analytics use cases

The enterprise AI and analytics use cases that CSPs are targeting are mostly focused on smart industries; for example, services for smart manufacturing, smart cities and smart homes. CSPs also signed deals to tap into technologies such as ML, robotics, and computer vision, as well as applications of these technologies such as mobility analytics, predictive maintenance and video analytics. The partnerships that have been formed to target video analytics and computer vision capabilities highlight the value of these capabilities in industrial settings; the engagements of AT&T, BT and Verizon all reference manufacturing and transportation as prominent industries for the use cases. CSPs claim that these solutions may improve the operational efficiency and site safety of enterprise clients.

A striking commonality across the enterprise AI and analytics use cases engagements, is the context and messaging that CSPs chose when announcing these deals. CSPs focused on emphasising the capabilities of their 5G and edge networks; they are using the newly acquired capabilities to extend the value of their networks and win enterprise clients. AT&T, Airtel, BT, KDDI, KT, Singtel and Verizon all reference their next-generation network infrastructure to some degree, and their ability to deliver enterprise use cases. CSPs worldwide can use the example of these operators to raise the interest of enterprise clients in their connectivity services.

CSPs must choose vendor partners with the right delivery capabilities to monetise their AI and analytics investments

CSP vendor partners are important in helping CSPs to deliver enterprise AI/analytics use cases. Most CSPs chose to work with public cloud providers (PCPs) in delivering these AI and analytics-related enterprise use cases. Google Cloud dominated the network- and customer-related use case domains, but AWS and IBM were the most contracted PCPs in the services-related domain. The edge capabilities of the cloud providers present unique selling points because these capabilities are critical for delivering enterprise applications with low latency.

- IBM’s partnership with AT&T is focused on creating analytics solutions for smart manufacturing use cases, such as video analytics and inventory management. IBM also partnered with Airtel India to use the cloud provider’s edge network to deliver enterprise-related AI and analytics solutions. An example raised was improved quality inspection in industrial settings.

- AWS engaged with SK Telecom to develop computer vision-based services for smart manufacturing use cases, such as maintenance and safety. AWS also won a contract with KT for Alexa AI, expanding the functionality of the operator’s GiGA Genie smart home solution, part of its consumer services offer.

Other than PCPs, IT services vendor Atos was also successful. Atos struck deals for its computer vision/video analytics software with BT and Verizon. The remaining deals were split across independent software vendors (ISVs). The services-related use case domain is the most fragmented one; vendors offering AI and analytics capabilities for enterprise service use cases may find this domain more open to them than the network-related use cases, which are mostly dominated by the original equipment manufacturers (OEMs) and PCPs.

Going to market with the right vendor partner will be crucial. Developing and integrating enterprise AI and analytics use cases into clients’ businesses requires more than just having access to the technology. Atos, AWS and IBM are examples of vendors that CSPs can work with to explore, develop and deliver these enterprise use cases. The combination of their systems integration, application development and other professional services offerings and cross-industry expertise will be valuable assets when pursuing these opportunities.

1 Service-related use cases are those where CSPs invest in new AI and analytics solutions to offer to their consumer and enterprise customers.

Article (PDF)

DownloadAuthor

Adaora Okeleke

Principal Analyst, expert in AI and data managementRelated items

Predictions

GPUaaS revenue will quadruple in the next 5 years, powering new data-centre investment opportunities

Predictions

Businesses will discover that AI can become kryptonite if they do not grasp how to wield this superpower

Predictions

AI adoption is surging, but <25% of portfolio companies’ AI tools will fully succeed in 2026