CSPs’ spending on DAD tools will grow, but may be limited by the need to modernise data infrastructure

Communications service providers’ (CSPs’) spending on data, AI/analytics and development (DAD) tools is growing as the amount of 5G- and digital transformation-related activity increases. Analysys Mason forecasts that spending on these tools will grow at a CAGR of 3.3% between 2021 and 2027 to USD12.4 billion worldwide. However, the growth of this market will be limited by the increase in both the complexity and cost of managing the growing volumes of data generated by CSPs’ networks and business operations.

This article is based on Analysys Mason’s Data, AI/Analytics and development platforms: worldwide forecast 2022–2027. It provides a summary of the drivers of, and barriers to, CSPs’ spending on DAD tools. It also include insights into how vendors can help CSPs to overcome their current challenges by investing in DAD tools over the next 5 years.

Analysys Mason has revised its segmentation of CSPs’ spending on DAD tools

We expect that CSPs’ spending on DAD tools worldwide will grow from USD10.3 billion in 2021 to USD12.4 billion in 2027, at a CAGR of 3.3%.

We have revised our segmentation of CSPs’ spending on DAD tools. We now consider spending in two key categories: standalone DAD platforms and AI/analytics applications.1 We believe that standalone DAD platforms will be critical to CSPs’ transformations in the next 5 years because they provide the common middleware services that support DAD lifecycle requirements across a CSP’s business. They do not provide specific business or application logic; this is delivered by AI/analytics segments.

The sub-segments within the standalone DAD platforms segment are as follows.

- Data platforms are the data middleware services that support data requirements across a CSP’s business. These standalone data platforms collect, store and manage access to data generated from systems across a CSP’s software environment.

- AI/analytics platforms enable CSPs to design, develop, deploy, operate and manage AI models at scale.

- Development platforms provide a set of common tools that support the development and runtime management of software applications. Examples include integrated development environments (IDEs), CI/CD tools and API management solutions.

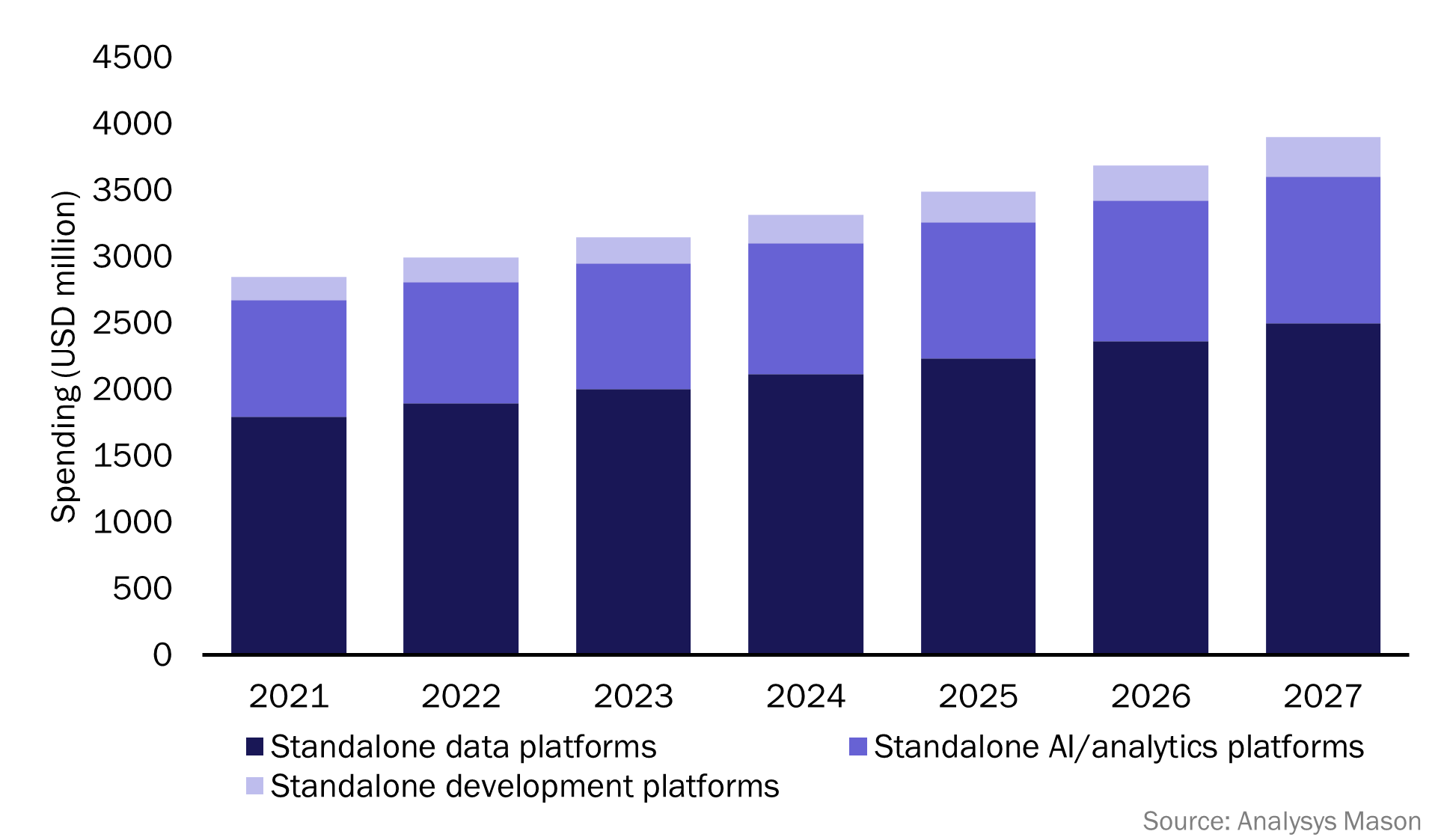

We forecast that CSPs’ spending on standalone DAD platforms worldwide will grow from USD2.8 billion in 2021 to USD3.9 billion by 2027, at a CAGR of 5.4% (Figure 1). We also forecast that CSPs’ spending on cloud-based standalone DAD platforms will grow from USD1.7 billion in 2021 to USD2.8 billion by 2027, at a CAGR of 8.5%. The cloud is becoming CSPs’ preferred environment to run DAD tools because it provides an agile, integrated and scalable environment for CSPs to run and manage workloads, and operations associated with these tools on the cloud are faster than on-premises alternatives.

Figure 1: CSPs’ spending on standalone DAD platforms, worldwide, 2021–2027

The remainder of this article provides a summary of Analysys Mason’s forecast for CSPs’ spending on data platforms and AI/analytics platforms.

Growth in data volumes will drive spending on data platforms, but management-related complexities could limit investments

CSPs are increasingly investing in and transforming their data infrastructure as their data assets and volumes grow. These investments are focused on building common data platforms and environments to enable CSPs to accelerate the development and operation of AI/analytics applications. CSPs are also increasingly taking advantage of data platforms that run on the cloud (private (on-premises), public or hybrid).

Consequently, we expect that CSPs’ spending on standalone data platforms worldwide will grow at a CAGR of 5.7% between 2021 and 2027 to reach USD2.5 billion. Spending on these platforms will account for the largest share of spending on standalone DAD platforms because CSPs realise that these data platforms play a critical role in ensuring that data is easy to access and analyse. This in turn enables CSPs to derive insights using AI and analytics tools in order to support decision making and other operational functions.

Several factors will limit CSPs’ spending on standalone data platforms. These include:

- the pace at which CSPs can transform their existing complex and siloed data environments

- current investments in big data Hadoop platforms and the related reluctance to invest further until these systems yield the expected returns

- compliance with data sovereignty regulations, which will affect the deployment of cloud-based platforms for data storage, management and access.

These factors will delay CSPs’ decisions to invest in data platforms and will therefore limit spending on AI/analytics tools. Vendors need to help CSPs to understand and implement data platform solutions that use state-of-the-art data architecture to remove silos and effectively govern existing data assets.

5G and the rapid implementation of AI use cases will be key drivers of spending on AI/analytics platforms

AI/analytics platforms are playing an increasingly important role in CSPs’ operations, especially as 5G networks are rolled out. The following are the key factors that are driving CSPs’ investment in these platforms.

- Management and monetisation of 5G networks and services. The distributed and disaggregated architecture of 5G networks will rely on data and intelligence-driven applications that are developed using AI/analytics platforms.

- Management and operations of legacy networks using automation. Legacy networks will co-exist with 5G networks so CSPs must use automation to deliver a high quality of experience to customers.

- Need for the rapid development and deployment of AI/analytics models. AI/analytics platforms provide integrated capabilities to support model lifecycle management for multiple use cases.

We forecast that CSPs’ spending on AI/analytics platforms worldwide will grow from USD880 million in 2021 to USD1.1 billion in 2027, at a CAGR of 3.9%. However, CSPs’ limited access to AI experts will limit this growth, as will data infrastructure that is unable to provide high-quality data sets. CSPs continue to compete for AI talent but find it challenging to attract and retain staff with the required skillsets. Vendors that offer AI/analytics solutions need to help CSPs to adopt cloud-based AI/analytics platforms that provide a simplified approach to implementing AI/analytics use cases. These platforms need to be directly integrated with data platforms to ease the implementation and on-going management of AI use cases.

1 AI/analytics applications include point applications targeted at single use cases and broader single-vendor AI/analytics applications that address multiple use cases.

Article (PDF)

DownloadAuthor