Analysys Mason’s data-centre hype index: why investors must scrutinise new capacity announcements

AI is significantly boosting the demand for data centres, driving a rapid rise in demand for co-location. The resulting surge in new developments (notably large campuses that claim to reach extraordinary levels of IT capacity) raises legitimate concerns of oversupply.

The truth is that in most cases, the risk of oversupply is overblown: demand remains strong, and (more importantly) the timing and scale of new IT capacity is likely to fall well short of recent announcements. Discerning hype from reality is vital for investors and operators that need clarity over the evolving supply and demand to inform their decision making.

This article gives investors and infraco operators insight into the evolution of data-centre capacity, with a spotlight on a hype index that summarises risks in some of the sector’s key markets.

The data-centre market is experiencing an unprecedented boom

The developments and pressures in the data-centre market are global in nature, but the Asia–Pacific region offers particularly useful insights from the forefront of the sector’s evolving dynamics. The rest of the world is likely to experience trends similar to those now spreading across the Asia–Pacific region:

- greater decentralisation away from traditional hubs (such as Singapore and Sydney) to new and emerging markets (such as Jakarta and Batam in Indonesia, and Johor in Malaysia)

- greater IT capacity per data centre (more facilities with potential capacity of 100MW or more).

Figure 1 highlights some examples of recent announcements about planned data centres.

Figure 1: Planned data centres in the Asia–Pacific region

| Country (region) | Data centre operator | Announced IT capacity (MW) |

| Australia (Perth) | GreenSquare DC | 96 |

| India (Mumbai) | Digital Edge | 300 |

| Indonesia (Batam) | Princeton Digital Group | 96 |

| Malaysia (Johor) | YTL | 500 |

| Malaysia (Johor) | Yondr | 300 |

| Philippines (Metro Manila) | STT GDC Philippines | 124 |

| Philippines (Laguna) | ePLDT | 100 |

| Thailand (Chonburi) | CtrlS | 150 |

Source: Analysys Mason

New data-centre hotbeds are emerging quickly. The 2019 moratorium on new data centres in Singapore created the conditions for 3 years of rapid growth in data-centre development in the neighbouring Malaysian state of Johor. The potential data-centre capacity in Johor is set to reach approximately 1.9GW1 which is almost double that of the current operational capacity of the traditional regional hub, Singapore.

Concerns on data-centre oversupply may be overblown

This dizzying growth in announced capacity raises the spectre of oversupply. This would lead to lower asset utilisation, a decline in co-location prices and ultimately lower yields. However, these concerns may be overblown due to both demand and supply factors.

- Capacity will be staggered. Most demand for data centres comes from hyperscalers with specialised infrastructure requirements. They prefer build-to-suit arrangements, which allows data-centre operators to make the fit-out of facilities contingent on securing a hyperscale customer, and then customise the facility to meet that customer’s needs. This allows a phased approach, where a first-phase investment covers limited capacity, and subsequent phases are activated when additional demand is realised.

- Power supply will be a constraint. From a supply perspective, power is critical. Given the power consumption of major data centres, securing the required power may require lengthy application and approval processes that can take several years. The surge in power demand from data centres has already resulted in electricity outages as infrastructure struggles to keep up in some markets. In addition, many data-centre customers (for example, Google and Microsoft) and investors (for example, Blackstone) are increasingly prescriptive about environmental, social and governance (ESG) issues. Users’ demand for data-centre services powered specifically by renewable energy may create additional constraints that delay or reduce the IT capacity becoming available.

- Water supply will be a constraint. Fresh water is the cornerstone of most cooling technologies. Existing water infrastructure has not been designed to accommodate the additional water consumption of data centres. For example, Johor has faced water constraints and disruptions, with some of the announced facilities understood to be facing challenges or delays in securing sufficient water. While the local Johor government has announced that it is considering new water infrastructure, this will take years to complete. There are options for cooling systems that use little or no water while also enabling lower power usage effectiveness (PUE), but this typically involves higher capex and thus needs to be evaluated carefully.

Discerning hype from reality is central to informed investment decisions

For investors, monitoring the inflexion point at which the early ‘gold rush’ gives way to saturation (and the risk of oversupply) is clearly a critical, but subtle art. In the data centre market, this is made particularly difficult by the way in which developments are announced, constructed and made operational.

Recent years have been characterised by ambitious announcements, but also cases of projects that have not broken ground almost 2 years after their announcement, as well as projects where the announced capacity (estimated via proxies based on land size rather than technical assessment) turns out to be overstated.

Investors need to establish a robust framework that brings greater structure and certainty to the tricky question of discerning hype from reality. This will need to address both demand and supply considerations:

- Demand assessment. Assessing the demand outlook granularly at a customer level is important because hyperscaler demand is becoming increasingly concentrated among just a few major companies. Understanding their approach to infrastructure in the market (for example, local vs. overseas needs, or use for AI training) is key to understanding their expected demand trajectory which will shape the fitting-out of hyperscale facilities to address their needs.

- Supply assessment. A detailed assessment of land, water and power constraints is critical to gain a realistic picture of the expected fitting-out of announced data-centre capacity. Understanding reserve margins of utility providers will inform their ability to support data-centre demand. In addition, granular facility-based analysis may also be used to understand the status of securing water and power and allow for a comparison against potential targets.

Analysys Mason’s data-centre hype index can help investors to identify the risks and rewards of investment in specific markets

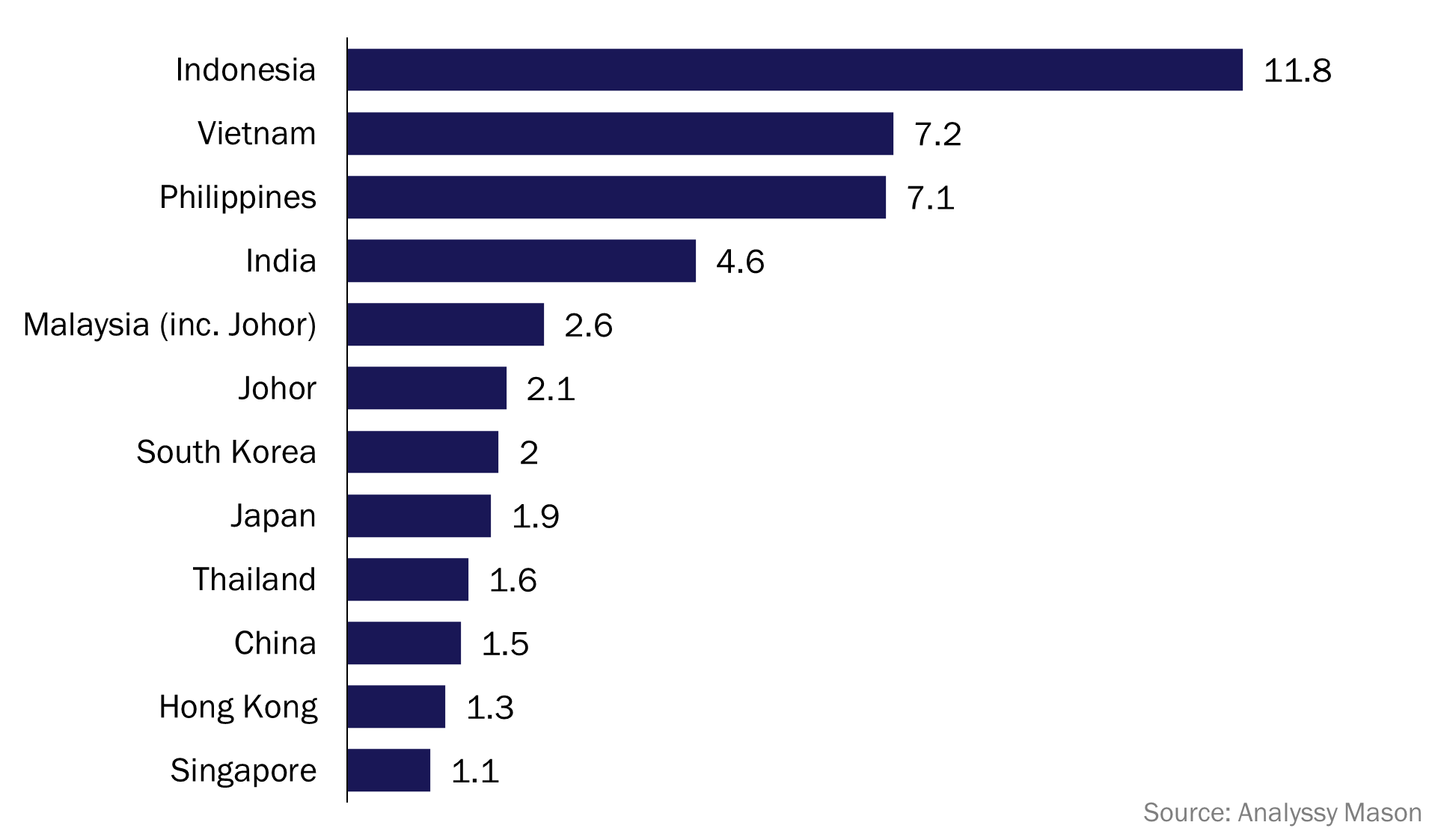

Following a series of market studies and due diligence exercises, Analysys Mason has developed a ‘hype index’ to quantify the relationship between announced capacity and the actual capacity expected to be delivered. An extract of this is shown in Figure 2.

Figure 2: Data-centre hype index for selected markets in the Asia–Pacific region2

A hype index value of around two is reasonable, given the phased approach that is common in large facilities that are being developed and the built-to-suit nature of hyperscale demand. Such markets will tend to create a mixture of winners and losers, with data-centre providers in the latter category not completing subsequent phases as initially planned. Indonesia, Vietnam, Philippines and India have ‘hype indices’ significantly greater than two, which implies a marked difference between the data-centre capacity that has been announced, and what we expect will actually be delivered. Much of the announced capacity in such markets is likely to remain unrealised.

A face-value assessment based on announced capacity certainly suggests a high risk of oversupply, but a more detailed and discerning assessment instead shows that this risk is likely to be overblown. A meticulous assessment of market fundamentals at both the demand and supply side is therefore critical to obtain a true understanding of the market and associated risks. In a co-location market that creates a mixture of winners and losers, investors need to be confident of the likelihood of specific players successfully launching initial and/or subsequent phases, with detailed due diligence assessments to support this.

Analysys Mason has conducted data-centre projects around the world, including market studies, due diligence exercises and projects supporting data-centre operators with strategy development and implementation. For further information, please contact the authors, Lim Chuan Wei (Managing Partner, Singapore) and Jay Lee (Principal, Singapore), or Richard Morgan (Partner, London).

1 Includes data centres that are currently in operation or under construction as well as planned data-centre capacity.

2 The hype index is calculated by dividing the announced data-centre supply pipeline by Analysys Mason’s expectations of incremental live supply over the next 5 years. A lower number indicates that a country has a more realistic supply pipeline relative to its potential capacity. A higher number is indicative of a market with a greater risk of falling short of announced capacity.

Article (PDF)

DownloadAuthors

Lim Chuan Wei

Partner

Jay Lee

Principal, expert in telecoms strategy and transaction supportRelated items

Article

High stakes for data-centre investors and operators: GPUaaS specialists offer growth with risk

Article

CFO interview: Netomnia’s Wil Wadsworth on raising finance in a challenging debt environment

Project experience

Providing end-to-end, essential support to a regional digital services company’s first Project Gigabit win