Access to first-party customer data and ad space puts operators in a strong place to explore digital advertising

Digital advertising offers strong revenue growth potential and is an attractive area for operators due to their access to customer data and ad space. However, recent operator exits from the digital advertising market (for example, Verizon) suggest that operators should be careful. This article accompanies our report, Operator digital advertising: case studies and analysis, and considers the case for operators to enter the digital advertising space, outlines the range of operator approaches covered in the report and offers a sense of how operators can improve their chances of success.

Digital advertising offers operators an opportunity to capitalise on growing digital ad spend and to monetise user data and ad space

The case for operators to seek involvement in the digital advertising space is generally thought of as follows.

- Digital advertising spend continues to grow worldwide. We forecast that the digital advertising spend worldwide will grow at a CAGR of 7% between 2021 and 2025.

- Operators have access to a large amount of user data that can be used to help brands find the right audiences. Furthermore, the value of first-party data (such as operator data) to advertisers is set to increase because the supply of available third-party data will decrease due to the phasing out of third-party cookies in Chrome in 2023 and Apple’s 2021 decision to make its Identifier for Advertisers (IDFA) opt-in.

- Operators have local advantages that global adtech companies may lack (such as an ability to identify local partners and work with regulators).

- Many operators also have first-party ad space (for example, on apps and video/gaming platforms) to monetise.

However, there are also significant challenges, some of which may explain the retreat of operator advertising players such as Verizon. These include the reputational risk associated with harnessing user data, the high levels of investment required to build tools and the stiff competition from duopoly players Facebook and Google and smaller adtech specialists such as The Trade Desk.

Operators’ approaches to digital advertising range from cautious to bold

How operators are approaching entering the digital advertising market varies considerably. This is linked to their bullishness about the opportunity and their view on the aforementioned challenges. Operators that are less willing to bear the reputational risk and make significant investments in developing tools and knowledge tend to take a more cautious approach, as do those that are less optimistic about their ability to compete against established players.

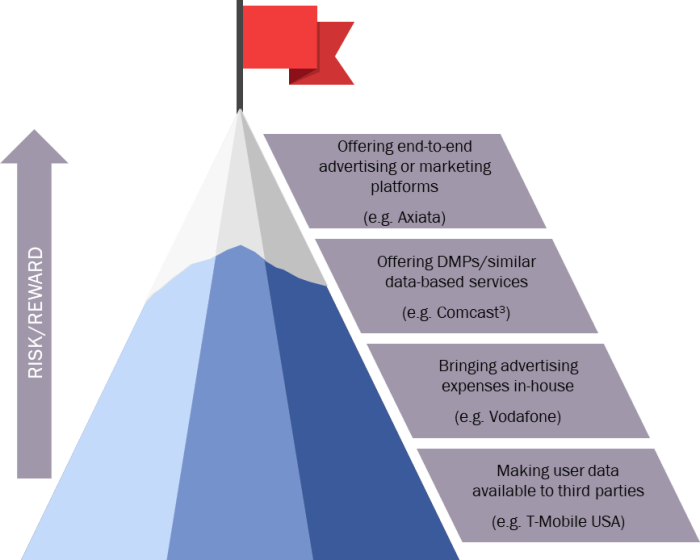

The approaches, in broadly ascending order of ambition, can be categorised as follows.

- Small-scale forays (such as selling customer data to third parties). Selling user data to third parties enables operators to generate revenue from customer data with limited exposure to the digital advertising market per se. T-Mobile USA does this.

- Bringing ad spending in-house. Building advertising capabilities to assist with in-house media buying can help operators to better monitor costs and attain digital skills. Vodafone has been bringing parts of its biddable media buying (approximately a quarter of its advertising budget) across 11 markets in-house since 2018. To do so, Vodafone has built both a data management platform (DMP)1 that uses first-party data and a demand-side platform (DSP)2 with ad-serving and ad-verification tools using third-party software.

- Operating ad platforms that compete on a local or global level. Operators, particularly those with valuable ad space, can build on their data and analytics capabilities by creating platforms that engage in (programmatic) media buying/selling for brands/publishers (that is, demand-side platforms/supply-side platforms) and offer ancillary tools to help brands and publishers to optimise their return on ad spending/ad space. Telkomsel in Indonesia runs two platform services (one is a pure DSP, the other is a DSP/supply-side platform (SSP)) that focus on competing on a local level. The pure DSP offers brands access to Telkomsel-owned inventory. Comcast (which has the greatest advertising revenue of the operators that we profiled) runs global platforms on the buy side and sell side through four divisions: Effectv, FreeWheel, NBCUniversal and Sky Media. It has also invested in building data onboarding tools and data clean rooms that enable brands to merge data pools efficiently.

- Pivoting to digital marketing and other related areas. Many digital marketing services use the same tools as digital advertising services, and operators may find it prudent to focus on digital marketing given the difficulties in competing with established global digital advertising players. For example, Axiata’s subsidiary ada changed moved from digital advertising to digital marketing a year after launching in 2018. It now offers two main platforms: ‘marketing technology’ (a suite of end-to-end digital marketing tools) and ‘eCommerce’ (a suite of marketing tools for e-commerce companies).

Figure 1: Operators’ approaches to digital advertising in terms of the associated risks and rewards

Source: Analysys Mason, 2021

Operators must play to their strengths and ensure that their overall strategies are consistent with their risk tolerance

Operators’ approaches to digital advertising vary considerably, but success depends on many of the same factors. It is key that operators are clear about the level of risk they are willing to take and the amount of investment they can commit. They must align this with their overall approaches because they must be consistent in what they do and realistic about what they can achieve given the level of exposure that they are seeking. For example, offering ad platform services but lacking the willingness to invest and harness customer data in a meaningful way because of the associated reputation risk means that the ad platform is unlikely to succeed.

In all cases, operators should play to their own strengths. It is probably wise for operators that do not have media businesses and do not have much involvement in the digital economy to leave operating a wide-spanning demand-side platform/supply-side platform to those that do. Operators with strong B2B service lines should see advertising as a strong opportunity to better target corporate customers via service bundles. Fundamentally, operators need to be clear that entering the digital advertising market only makes sense if there are synergies to target between their existing assets and the ad business.

1 A DMP is a platform for aggregating user data and making it available to advertisers.

2 A DSP is a platform that is designed to help brands find ad space and optimise their return on ad spend.

3 As discussed above, Comcast also offers end-to-end platform services.

Article (PDF)

Download