Demand for downstream EO applications is growing in verticals beyond defence and intelligence

Growth in the Earth Observation (EO) market has been driven by several factors, including an increase in the number of advanced satellite capabilities, which in turn is causing industries and customers to expand their aspirations.

The demand for EO imagery remains the highest in the defence and intelligence (D&I) vertical due to growing geopolitical conflicts and commercial data accessibility. Nonetheless, there is a need for downstream EO applications in a large and increasing range of other verticals.

In this article, we will focus on the increasing demand for satellite imagery to improve asset monitoring in multiple verticals.

Information products and big data are driving the demand for downstream EO satellite imagery

The EO market has evolved significantly over the past 10 years with a marked shift towards enhancing existing downstream applications and creating new ones. These applications integrate EO data with analytics, AI/ML and cloud computing and are tailored to specific industries.

Indeed, the adoption of cloud computing AI has revolutionised the way in which EO data is processed and analysed. These technologies enable real-time data processing and reduce the time between data acquisition to actionable insights. Moreover, the development of sensor technologies including synthetic aperture radar (SAR), as well as higher-resolution payloads, have catalysed the adoption of EO imagery in previously untapped commercial markets.

There has also been a shift towards subscription-based models, priority tasking and cloud-access platforms, which makes EO data more accessible to a broader range of users. This democratisation of data has allowed smaller and more diverse organisations to use EO insights without needing to make significant upfront investments in infrastructure and technology.

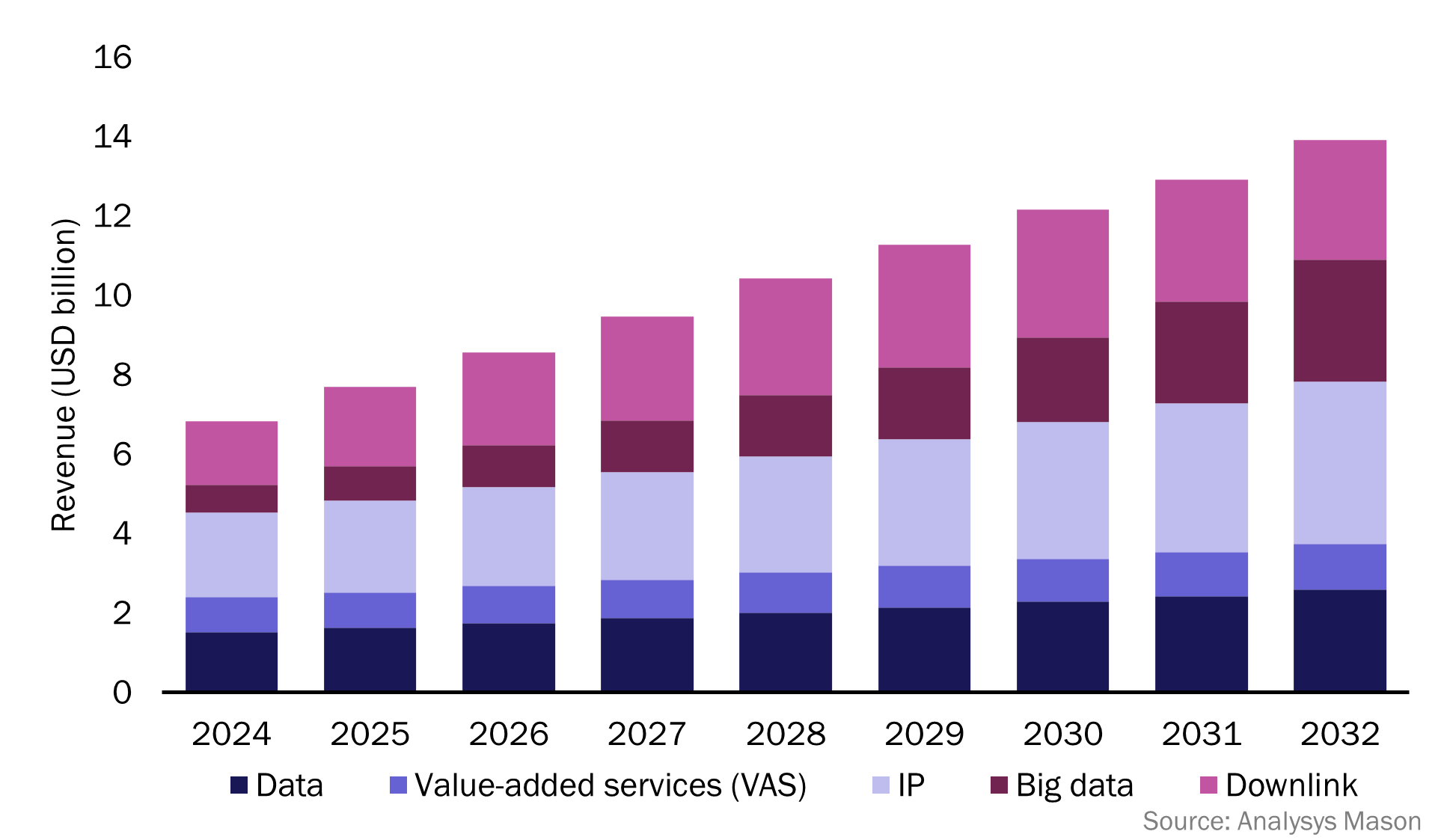

This trend is evident in the rapid growth of the information products (IP) and big data segment, which is forecast to account for most of the EO market revenue until 2023, according to Analysys Mason’s Satellite-based Earth observation, 15th edition (Figure 1).

Figure 1: Revenue from satellite-based EO, by segment, worldwide

The rise of critical asset monitoring is driving the demand for EO imagery in major verticals

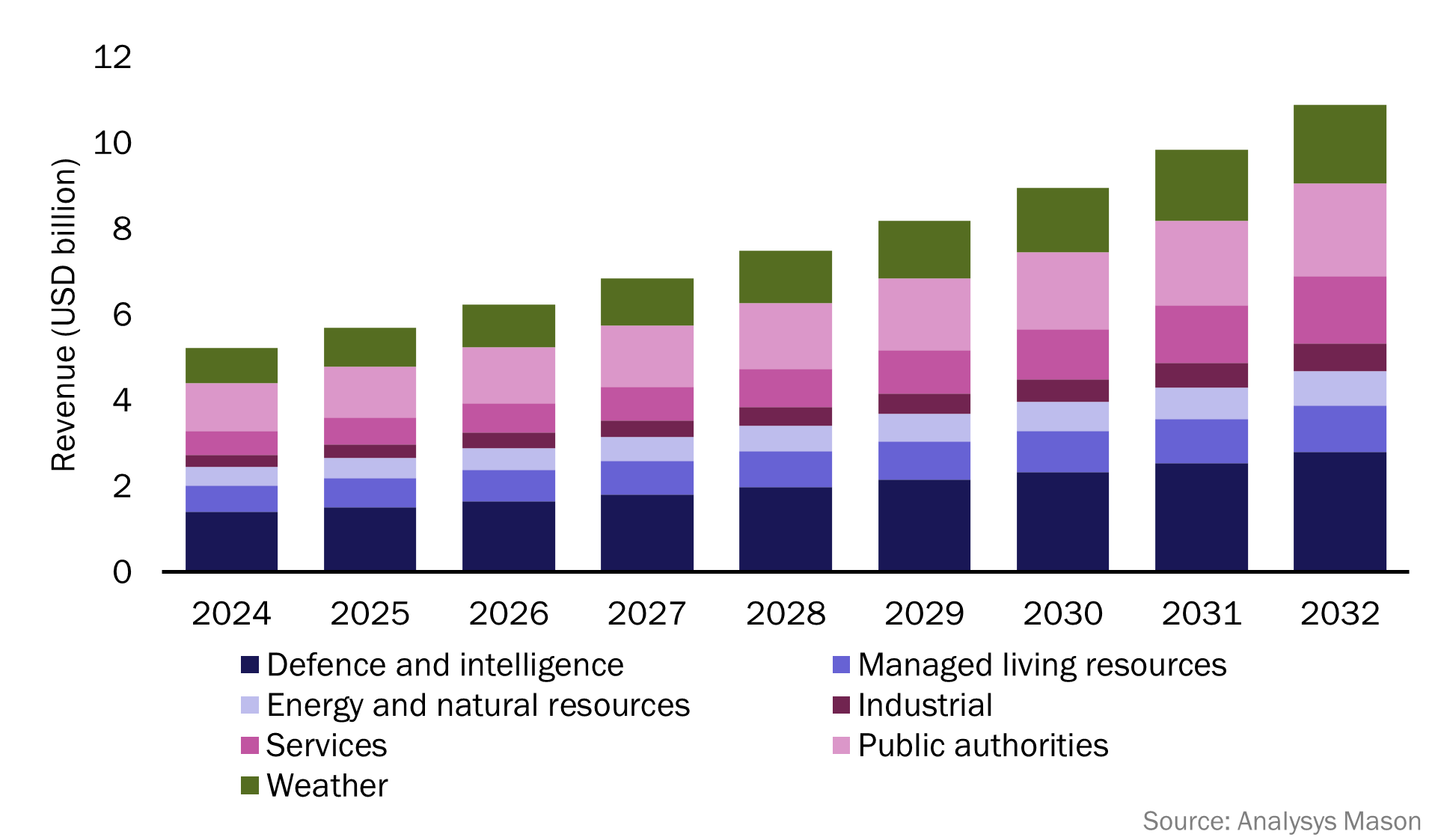

The services vertical is one of the fastest-growing markets for EO applications (Figure 2). Key use cases include risk assessment, valuation and the valuation of assets for insurance claims. For example, satellite imagery can provide critical insights when assessing infrastructure damage. This is a major benefit for banking and financial companies that offer insurance and investment products, and having the ability to monitor assets closely and consistently has driven the demand for EO imagery.

Figure 2: Revenue from satellite-based EO (excluding data downlink), by vertical, worldwide

Players in the industrial vertical also use EO applications for asset monitoring, supply chain management and infrastructure development. EO data helps these players to track the progress of construction projects, manage logistics and ensure compliance with environmental regulations. The integration of EO data with other data sources enables comprehensive analytics, enhances operational efficiency and reduces costs. Furthermore, enhanced satellite capabilities including SAR and thermal imaging enable users to monitor both their own and other companies’ assets. This has previously been exclusive to D&I use cases, but is now more commercially available.

EO applications are also used in the managed living resources vertical to enable precision farming, crop monitoring and yield prediction. Farmers can analyse satellite data to optimise irrigation, manage pests and monitor crop health, thereby leading to increased productivity and sustainable farming practices. The use of EO data for mapping, surveys and asset monitoring is particularly crucial for large agricultural firms, which require comprehensive and timely data for efficient operations.

Additionally, the energy and natural resources vertical uses EO data for exploration, environmental monitoring and compliance with regulatory frameworks. Satellite imagery aids in monitoring greenhouse gas emissions, assessing the impact of mining activities and managing natural resources. The demand for high-quality EO data is expected to rise significantly as the world moves towards net-zero initiatives.

Finally, public authorities use EO data for urban planning, disaster management and environmental monitoring. Using commercial data sources rather than government-owned data allows for faster and more detailed insights, which is crucial for effective policy-making and resource management. For example, EO data is instrumental in disaster response; it helps authorities to assess damage and co-ordinate relief efforts efficiently.

The D&I vertical remains a major driver of EO demand, but commercial utilisation across other verticals cannot be underestimated

The downstream EO market outside the D&I vertical is poised for robust growth, driven by the increasing demand for tailored solutions in various industries. The integration of advanced technologies and the shift towards more accessible data platforms are key factors propelling this demand. The market for downstream EO applications is expected to expand further as industries continue to recognise the value of EO data in enhancing operational efficiency and decision-making, thereby creating new opportunities and driving innovation across sectors.

Article (PDF)

DownloadAuthor

Claude Rousseau

Research Director, expert in space and satelliteRelated items

Article

Geopolitics and sovereignty are (once again) a driving force for the space industry

Strategy report

The pulse of the satellite industry: questions and answers for senior executives 2025

Article

Players in the satellite-based Earth observation market must target government analytics procurement