DRaaS providers will need to differentiate themselves to be successful in the SMB market

A rapidly growing number of companies are competing in the disaster recovery-as-a-service (DRaaS) market, which is expected to be worth USD11.1 billion worldwide by 2026. However, these players are not doing enough to distinguish their services. As such, they risk competing on price, thereby damaging margins. Providers should instead differentiate their solutions using subscription management, automated processes and consultative services. Doing so will increase both their revenue and their market share.

Much of the growth in the DRaaS market will come from small and medium-sized businesses (SMBs). SMBs often have small IT departments (or none at all), so setting up recovery plans can be costly and difficult. DRaaS providers, such as Datto and Veeam, can therefore take advantage of this market opportunity by providing services that are tailored to SMBs; these are typically sold through managed service providers (MSPs) or other IT service providers

Traditional disaster recovery solutions tend to be costly or inefficient, especially for smaller businesses

Disaster recovery plans are designed to protect businesses by allowing them to continue to use their IT infrastructure in the case of a disaster (such as a hurricane, earthquake, cyber attack, power outage or human error). An effective plan will minimise businesses’ downtime and losses.

IT disaster recovery typically relies on back-up sites that are geographically separate from the rest of the IT infrastructure to reduce the risk of a disaster affecting both the primary and the back-up site. This can be costly to set up because it requires expensive hardware such as servers, as well as a safe, suitable location from which to operate. The initial cost can be prohibitive for small businesses and the ongoing cost is constant regardless of the level of use.

DRaaS providers offer a range of services and aim to save businesses time and money by providing an easy and secure alternative to setting up and running disaster recovery solutions in-house. DRaaS providers typically move businesses’ computer processing to the cloud so that they can recover data and IT infrastructure and enable continued operation in the case of a disaster.

DRaaS providers must differentiate to gain a competitive edge and capitalise on future market growth

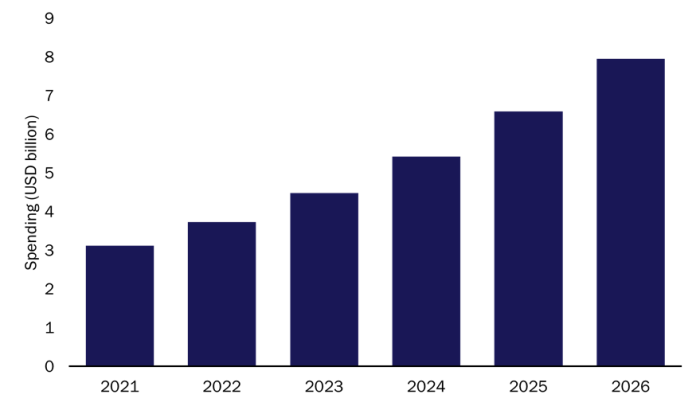

The DRaaS market is expected to grow substantially throughout the 2020s. Indeed, Analysys Mason estimates that DRaaS spending by SMBs worldwide will grow from USD3.1 billion in 2021 to USD8 billion in 2026 (Figure 1), at a CAGR of 20.6%. DRaaS providers should differentiate from their competitors early on to capitalise on this opportunity and cement themselves as key industry players.

Figure 1: SMB spending on DRaaS solutions, worldwide, 2021–2026

Source: Analysys Mason, 2022

DRaaS providers should offer subscription management, automated processes and consultative support

There are a number of available DRaaS offerings and many can be tailored to specific firms. We have identified some key areas that SMBs (and the MSPs that serve them) value particularly highly: subscription management, automated processes and consultative support. DRaaS providers that offer high-quality services in these areas will stand out from the competition and capture a greater market share.

DRaaS players have taken a range of different approaches to subscription management.

- Veeam has packages that are targeted at small businesses and are sold on a per year, per licence basis, with optional add-ons such as a network-attached storage capacity pack.

- Metallic charges per user per month, starting at USD3.60 for companies with up to 750 users. Businesses sign up through a partner that manages the billing.

- NinjaOne offers flexible per-device pricing that is easy for a client to understand.

SMBs and MSPs value simplicity and transparency in their subscription management solutions. DRaaS providers could deliver these benefits by investing in tools that clients could use to monitor and change their subscriptions easily, such as N-able’s MSP manager, which facilitates contract and subscription tracking and automated billing. Simplifying subscription management and increasing flexibility for SMBs and MSPs will improve sales for DRaaS providers.

It is critical that providers optimise their consultative support offerings as the DRaaS market grows in order to ensure that they are gaining and retaining as many clients as possible. Intervision is an example of a DRaaS provider that excels in this area. A long-term consultative support offering can be used in sales pitches to attract new clients. MSPs typically have expertise in implementing DRaaS solutions, but consultative support services can be extended to their SMB clients, who often have limited experience with on-boarding DRaaS. Such support services would therefore give SMBs the opportunity to learn DRaaS best practice.

DRaaS providers can use automated support processes to speed up their services and simplify processes for the end user. They can optimise their business methods by improving the efficiency of their chat tools and ticket submission processes, for example. As such, investing in AI and machine learning may help DRaaS providers to differentiate from their competitors. For example, ConnectWise offers AI-powered automated IT support tickets through Tribu.

The DRaaS market is expected to grow rapidly in the 2020s due to the increased frequency of disasters and the growing importance of cyber security. Subscription management, automated support processes and consultative support are three key areas in which DRaaS providers can differentiate to capture a greater market share and increase their revenue.

Article (PDF)

Download