Operators such as Deutsche Telekom and Free demonstrate how to differentiate broadband services

Differentiating fixed broadband services is becoming increasingly challenging given the development of operators’ fibre-to-the-premises (FTTP) roll-outs. Around 67% of premises worldwide will be passed by FTTP by 2029. Operators will be less able to compete on the speed and reliability of their services, because most connections will be provided using identical or near-identical technology.

As FTTP roll-outs near completion, consumers may perceive few differences between operators. Our annual survey of 18 000 consumers worldwide shows that the spread in satisfaction metrics such as Net Promoter Scores (NPSs) decreased between 2021 and 2023.

Nonetheless, some operators still receive notably higher customer satisfaction scores than their competitors. Operators such as Deutsche Telekom and Spark show that high customer satisfaction can be achieved by upselling faster speeds and bundled ancillary services to high-value subscribers. Other operators can learn from these examples to develop their own strategies for improving satisfaction. However, the exact approach that operators should take depends on the conditions of local fixed broadband markets.

Operators such as Free and Verizon show that strong differentiation is possible

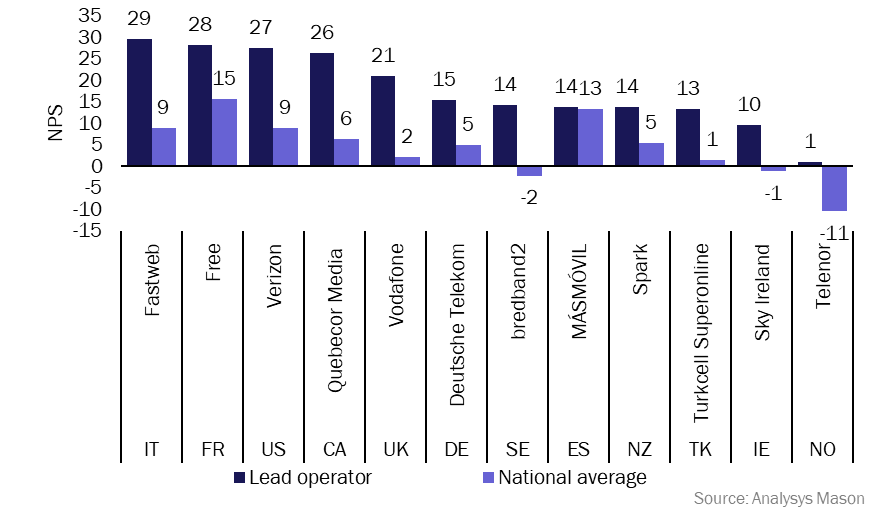

Analysis of survey data at the country-level shows that operators can differentiate their services so that their individual NPSs are significantly above the national average for their respective countries (Figure 1).

Figure 1: NPSs by country, national average and operator with the highest, selected countries, 2023

Question: “On a scale from 0–10 (where 0=not at all likely, and 10=definitely), how likely are you to recommend your home broadband service to friends or family members?”; n=11 174.

However, the challenge for operators is to improve customer satisfaction without reducing their margins. Many operators in Figure 1 are low-cost challenger providers that undercut incumbents to gain market share.

This strategy can attract customers who value price above other service elements. Free in France, for example, offers fixed broadband tariffs with multi-gigabit speeds at a much lower price than other operators; its 500Mbit/s tariff is priced at EUR39.99 per month and is cheaper than Orange’s 500Mbit/s tariff (EUR42.99).

Operators with premium plans have also achieved a high NPS

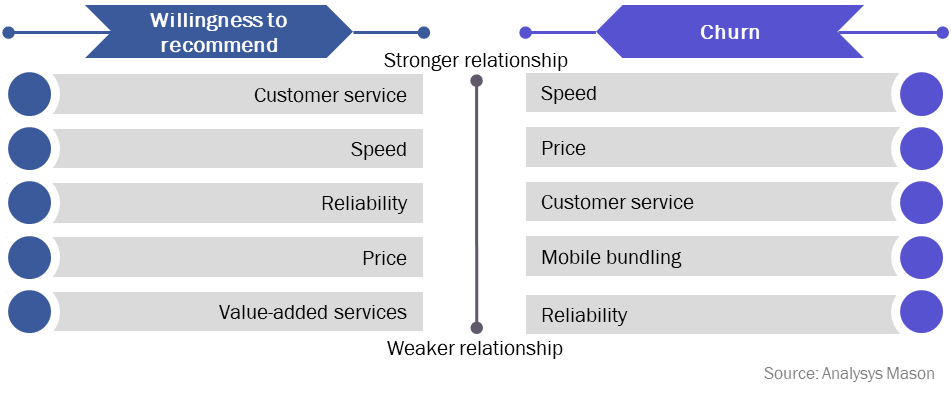

Operators can, and usually should, differentiate their tariffs through service elements other than price. A regression analysis of respondents’ willingness to recommend their provider (the score on a scale of 0 to 10 in the standard NPS question) and their intention to churn from their provider, shows that, on average across all surveyed countries, satisfaction with price is not the service element most closely correlated with NPS or churn (Figure 2). Service reliability and speed are often as, or more, important than price.

Figure 2: Ranking of the five service elements for which a change in satisfaction (on a scale of 1 to 5) has the strongest relationship with willingness to recommend (NPS) and churn

For example, another successful strategy for achieving a high NPS is to target less price-sensitive customers with higher download speeds and bundled services, such as streaming video.

- Deutsche Telekom’s fixed broadband ASPU (USD34.13 per month) is significantly above that of the market average for Germany (USD28.46). Its services are targeted primarily at high-value customers and it upsells faster speeds. Deutsche Telekom’s customers reported being more satisfied with the speed of their fixed broadband services and bundling more TV and streaming video services than all other German operators in our 2023 survey.

- Spark has a fixed broadband ASPU of USD55.5 per month compared to an average of USD39.5 in New Zealand. It is also the only operator in New Zealand whose NPS did not decline between 2022 and 2023. Spark promotes fixed broadband tariffs with no minimum contract period and bundles more streaming video services than other operators.

Operators need to adjust their strategies according to the conditions of local broadband markets and competitor offerings

Not all operators should replicate the approach of Deutsche Telekom and Spark. Operators that have historically targeted price-sensitive customers will struggle to upsell their customers. Similarly, in countries where many customers are already subscribing to faster speeds or additional services, the marginal effect of further upselling customers will be small.

Instead, operators should adapt their approach to their specific geographical areas. When a country-level regression analysis is conducted with our survey data, the service elements that have the strongest relationship with NPS and churn differ between countries. Operators need to consider the following factors when developing a strategy to improve customer satisfaction.

- FTTP coverage. Speed is less closely correlated with NPS and churn in countries where FTTP coverage is high, because the fast speeds provided by FTTP are common. In countries where FTTP coverage is limited, fast speeds are scarce and consumers place a premium on them.

- Wholesale markets and overbuild. When consumers can choose between multiple providers at a given location, operators are less able to compete on the quality of their fixed broadband networks. For example, most Italian fixed broadband connections are provided over two wholesale networks. Customers receive a similar quality connection regardless of their retail provider, which means that factors associated with network quality such as speed and reliability are less strongly correlated with retail NPS and churn than price satisfaction.

- The prevalence of service bundling. The effect of bundling ancillary services alongside fixed broadband decreases as service bundling becomes more common. For example, there is no statistically significant relationship between bundling mobile services and customer satisfaction in Spain, where over 60% of respondents already bundle mobile services with broadband.

This is part of a wider trend that we have observed in our research into upsell and growth strategies for fixed broadband operators. Best practice is determined by geography, competitor offerings and the preferences of their existing customer base. Operators should be aware of where their competitors have acted to boost customer satisfaction and reduce churn, but should not expect to replicate these approaches exactly.

Article (PDF)

DownloadAuthor

Martin Scott

Research DirectorRelated items

Survey report

Finland: consumer survey

Article

Operators in emerging markets must prioritise Wi-Fi as a key part of their broadband tiering strategies

Report

Analysys Mason research and insights topics for 2026