Earth Observation’s strategic shift: cracking the code of commercial markets

The satellite-based commercial Earth Observation (EO) industry faces a crucial turning point, deeply entrenched in a historical reliance on government and military (Gov/Mil) contracts as its primary revenue source. This gravitational pull of Gov/Mil demand has prompted another commercial player to relocate its main offices to United States due to its inability to meet revenue projections. This shift indicates a pivot of industry stakeholders to address the demand from EO’s main anchor customers. Thus, a pressing questions looms: is this dependable alliance between Gov/Mil customers and commercial players sustainable? Or is it merely a transient phase in the industry's evolution?

The current trajectory, anchored in the stability promised by Gov/Mil engagements, calls for a deeper examination of the industry's future. Will Gov/Mil continue to wield disproportionate influence, dictating the revenue streams and shaping the industry's direction for the future? Moreover, with a surge in commercial demand for Earth Observation, how can industry stakeholders decode strategies to finally tap into this unwavering market segment?

Gov/Mil: a reliable partner first

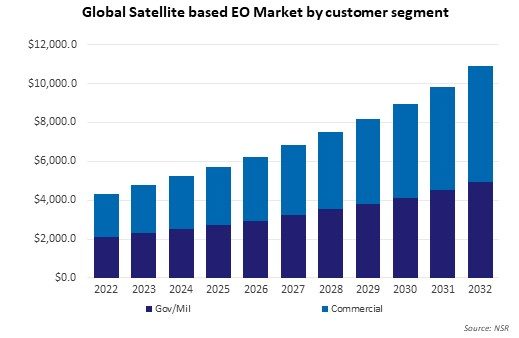

The commercial EO sector is experiencing a burgeoning demand, with emerging data sets like radio-frequency (RF) monitoring and greenhouse gases (GHG) emissions amplifying their interest. NSR’s Satellite-based Earth Observation, 15th edition report forecasts Defense & Intelligence (D&I) and Public Authorities (PA) to drive a significant cumulative revenue opportunity, accounting for 26% and 21% respectively over the next decade.

Geopolitical conflicts escalate the need for continuous monitoring, triggering increased data demand, especially for military land and maritime applications. The global drive towards sustainability also escalates the need for ESG-related applications, urging Gov/Mil players to adopt new data sets. In this context, the roads to success are forged with disruptive datasets, innovative pricing models, and downstream shifts. Maintaining a robust Gov/Mil strategy remains pivotal; catering to their needs early will ensure steady revenue streams afterwards.

Integrating with terrestrial businesses strengthens the market penetration potential through data fusion, free data sets, embedded products, software, and systems, bolstering insights and business cases. The reliance of Gov/Mil players on commercial imagery, evidenced by numerous contracts from NGA, NOAA, NRO, and NASA, amplifies this trend. Indeed, there was an uptick in the adoption of commercial imagery for D&I applications, exemplified by a recent USD476 million contract by NASA to companies such as Umbra, Capella Space, and GHGSat, Maxar, PlanetIQ, Spire, and Airbus Defence and Space. Rising geopolitical tensions have reinforced the satellite imagery demand from Gov/Mil players, supporting a sustained growth path in this sector.

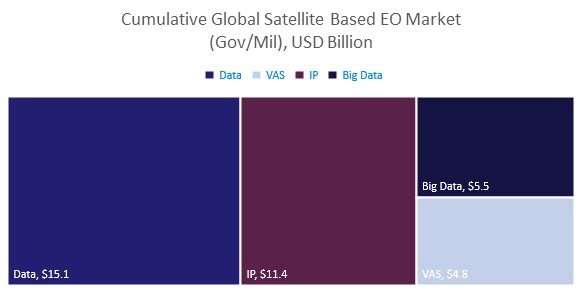

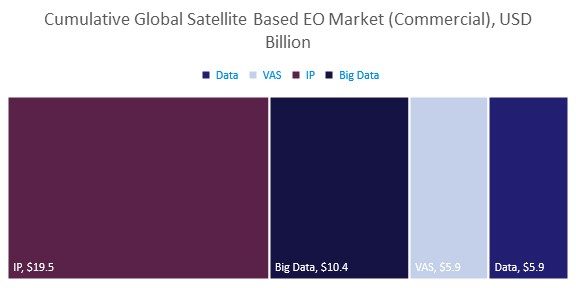

The appeal of Gov/Mil contracts lies in their reliability, scale, and consistency in generating revenue. EO players worldwide are vying for these contracts by showcasing reliability, security, and tailored solutions that align with stringent specifications set by these entities. However, as the landscape evolves, there is a pressing need to evaluate the viability of the demand from the commercial sector against this Gov/Mil dominance. NSR projects the commercial end-user market opportunity for EO data and services to surpass the Gov/Mil opportunity by USD5 billion in the next decade, reaching USD41.7 billion by 2032. This indicates a significant potential for diversification and expansion of the EO market beyond the traditional Gov/Mil segment. Moreover, relying too heavily on Gov/Mil contracts can expose the industry to various risks, such as policy changes, budget cuts, regulatory hurdles, and geopolitical tensions. The demand for Gov/Mil segment is mainly driven by data whereas for the commercial segment, it is driven by downstream analytics such as information products (IP) and big data solutions. Thus, the playing field is different for diverse stakeholders across the value chain.

Decoding commercial success and key verticals

The commercial market viability is swiftly overtaking government reliance, particularly due to downstream services like IP and big data, as mentioned. This surge spotlights an expanding avenue for downstream analytics providers. Yet, cost remains a crucial factor to do this. Competitive pricing trumps all, making open source data the bedrock for about 99% of downstream solutions. This limits the adoption of data for commercial applications unless use-cases demands it.

Looking at specific verticals, the demand surge is propelled by the weather, services, and managed living resources verticals, driving USD12.8 billion, USD9.5 billion and USD8.6 billion in cumulative revenues respectively. Sectors like agriculture, logistics, urban planning, and environmental monitoring are increasing the downstream adoption of EO. Industries such as insurance, energy, forestry, and infrastructure are also improving EO adoption for risk assessment, resource management, and infrastructure planning.

Learning from the gov/mil segment and adapting factors such as reliability, security, and custom solutions to cater to commercial clients. In addition, user-friendly interfaces, scalable services, subscription models trump one-off sales in ensuring steady revenue flow. Getting granular with vertical expertise is key. Understanding sector-specific needs and tailoring solutions accordingly is a non-negotiable requirement to establish a stronger hold in the market. Flexible pricing is the name of the game. Subscription models, pay-per-use structures, or tiered pricing options cater to diverse customer wallets. Partnerships and collaborations across data providers, analytics firms, big data providers will further the market addressability. Platform players and data aggregators could play pivotal roles in commercial play by acting as single point of contact for a end customer to procure imagery from multiple sources and offering integrated analytics solutions to cater to their needs, eliminating the need to establish contacts with multiple satellite operators and downstream providers for end customers, which leads to longer procurement cycles and establishing streamlined solutions. Thus, engaging single supplier could be advantageous for end customers and expected to increase in demand in medium and long term. Thus, agility, customization, aggregation and strategic collaborations will play critical role in tapping into commercial markets.

The Bottom Line

The satellite-based commercial Earth Observation (EO) industry stands at a crossroad, teeming with possibilities that extend far beyond conventional government contracts. The dichotomy between continuing to pursue the stability of government and military (Gov/Mil) contracts versus exploring the uncharted terrains of the commercial sector is not just a choice; it's a calculated maneuver that requires a recalibration of strategies.

While Gov/Mil contracts promise stability, there is a large commercial demand that is coming mainly for downstream products. For EO companies aiming to harness the burgeoning opportunities outside the government sphere, there is an imperative need to strike equilibrium between past learnings and the dynamism required to meet the evolving demands of the commercial landscape. In conclusion, embracing change, catering to diverse demands, and staying agile amidst an evolving landscape delineate the path to sustained growth and unmatched impact.

Author

Prachi Kawade

Senior Analyst, expert in space and satelliteRelated items

Tracker

Satellite consumer D2D news and deals tracker 2024–2025

Tracker

Consumer and enterprise broadband via satellite news and deals tracker 2024–2025

Report

Analysys Mason research and insights topics for 2026