The edge: what it is and what it means

Edge computing has been a hot topic for operators for some time, but the extent, potential, and even definition of this market are still unclear. To accurately capture what is new, disruptive and innovative in the edge compute market, we built a bottom-up, supply-side forecast that imposes a rigorous taxonomy on this emerging market, using tight geographical and product definitions. The resulting forecast is a pared-down, effective tracker of what is new and disruptive in edge compute.

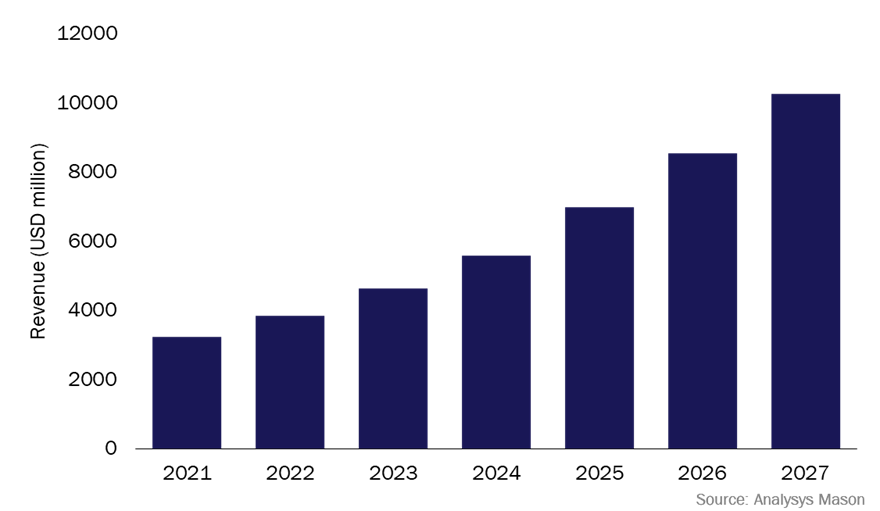

The report shows that the current size of the supplier opportunity in the public edge market as USD3.7 billion, which will grow at a CAGR of 21% to USD10.2 billion by 2027. This report covers the public edge; we will publish another report on the private edge later in the year.

Figure 1: Public edge revenue, worldwide, 2021–2027

A definition of edge

A definition of edge is difficult for two main reasons.

- Edge can mean something quite different depending on the viewpoint of the person using it. For a chip manufacturer, the edge is the device itself. To a carrier-neutral data-centre company, it means the place where traffic ‘breaks out’ or reaches the internet. To a public cloud provider it means a data centre in a city outside the central internet hubs in Frankfurt, Silicon Valley and elsewhere. None of these viewpoints are incorrect but they cover different markets, use cases and opportunities.

- A useful edge forecast needs to pick out what is new and significant about edge computing today and distinguish that from the wide variety of infrastructure already in place in remote locations. Factory floors and oil rigs have long been hosts to complex industrial systems that rely on considerable in-house compute resources. These activities are interesting, but are mature and do not capture what is innovative or disruptive about edge computing.

To solve the first of these problems, we have segmented the edge market into three sub-markets that accommodate the three viewpoints described above: industrial, interconnect and metro.

We addressed the second problem by imposing strict conditions on what we considered to be edge. We removed the following from our forecast:

- services delivered from financial centres, internet hubs and capital cities of countries with over 10 million inhabitants and internet hubs, even if they are marketed (as they often are) as part of an edge network

- mature edge activities such as caching and streaming media

- products like ‘serverless’, which currently lack the capability to support full run-time compute environments

- systems such as proprietary operational technology (OT) industrial systems that do not contain or support cloud or cloud-like features.1

These considerations gave us the following definition: edge computing is the delivery of private or public cloud-like full run time compute and storage environments from edge locations outside internet hubs, financial centres and capital cities.

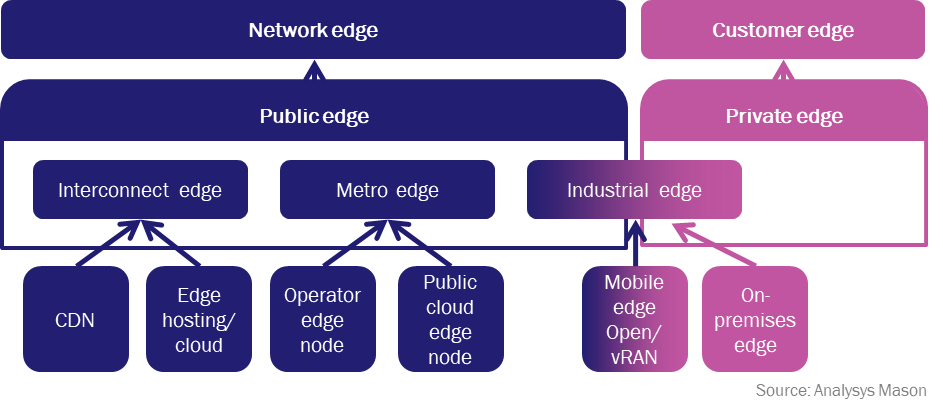

We view the edge as an extension of cloud, hence our use of the terms ‘public edge’ and ‘private edge’. However, many operators, use ‘customer edge’ and ‘network edge’. Our nomenclature maps on to these operator terms as shown in the Figure 2. Public edge maps to network edge as it comprises shared edge cloud and data centre infrastructure, and private edge is on-premises in the same way that private cloud is dedicated infrastructure on-premises, so it maps to the customer edge.

Figure 2: Mapping of edge categories and delivery models

Is edge real yet?

Despite scepticism brought about by overly optimistic predications over the last 5 years, there is an edge market and it is a considerable size and growing fast. By applying our definition and taxonomy to the broader edge market, we can see three clear trends in operation.

- At the metro edge, there is a cyclical reversal of the centralisation of internet infrastructure around internet exchanges, with data-centre owners and public cloud providers tactically building out more local infrastructure.

- At the industrial edge, we see the best practices of the cloud and the internet in terms of application development, deployment and management coming to industrial and manufacturing settings and in particular OT. This large market is dominated by proprietary hardware and specialist systems vendors and presents a large opportunity to cloud-centric vendors. As Matt Trifiro, CMO of Vapor IO, says: “We talk the internet of things but there are things and there is the internet, and the two are miles apart”.

- At the interconnect edge, there is the long-term strategic direction of application architecture towards ever greater fragmentation. To take a retail as an example, in first wave of web and cloud, monolithic proprietary applications that were popular 20 years ago, such as IBM Websphere, fragmented into SaaS (Salesforce), LAMP stack websites and mobile apps. Those websites and mobile apps are now themselves fragmenting into a microservices architecture delivered via containers and a CI/CD pipeline. Next-generation technologies like natural language processing, flow architecture and blockchain will need an even more distributed architecture, and a distribute edge compute infrastructure to support it. These applications will require access to customers and multiple clouds on multiple networks, driving demand for an interconnected edge in support.

How are these trends playing out in practice? Currently, most investment in the edge is being made at the metro edge and interconnect edge with public clouds and carrier-neutral data-centre providers extending their reach out from internet hubs to more regional locations. But over the next few years, we will start to see increasing investments from content delivery networks looking to build full edge compute nodes. Then operators will enter the market from 2025 as vRAN and 5G adoption reach a tipping point, enabling operators to sell enterprise services from edge locations.

1 We define ‘cloud’ as scalable, on-demand, usage-charged, virtualised compute and storage. We define ‘cloud-like’ as cloud but not containing all the features listed in the previous definition, for example bare-metal cloud (that is, non-virtualised).

Article (PDF)

DownloadAuthor

Caroline Gabriel

Partner, expert in network and cloud strategies and architectureRelated items

Article

Public edge forecast: the industrial edge represents a growing opportunity for operators in the next 5 years

Forecast report

Public edge: worldwide forecast 2023–2028

Article

The private industrial edge: what it is and what it means