The emerging role of hyperscalers and their use of satellite capabilities

Industries are transforming rapidly, and this is increasing the sustainability risk for the inertial players. COVID-19 has forced businesses across nearly all industries to invest in and deploy remote-working models, process automation, and system and network optimization. Undoubtedly, hyperscalers such as Amazon, Facebook, Google and Microsoft are at the core of these digital transformations, by offering cloud, networking and internet services via infrastructure-as-a-service (IaaS) models. Demand is ramping up quickly, and the hyperscalers are proportionately responding to this demand by offering scalable, flexible, and cost-effective cloud-based solutions and network function virtualizations.

Among the top transformational trends during the first wave of COVID-19, Microsoft witnessed a 775 percent increase in Teams calling and meeting users in just one month in Italy. Currently, the Teams platform has more than 44 million users with 900+ million meeting/calling daily. The company also registered >3x growth in the Windows Virtual Desktop usage. As a response to COVID-19, AWS now offers highly scalable and reliable infrastructure capacity, technical support, and AWS services to help its customers with their research, remote working and learning, and other solutions. Clearly, the hyperscalers are progressively innovating and looking into addressing the future needs of various industries. This article by Northern Sky Research (NSR) (an Analysys Mason company) discusses how the hyperscalers are utilizing satellite capabilities to boost growth.

Hyperscalers – satcom players are ramping up

Connectivity is a key element for the ongoing digital transformation, as it is as useful as the applications and services being derived from it. Satcom (satellite communication) stakeholders are expected to play a major role as hyperscalers scale their seamless and reliable service offerings. The trend is clearly validated as various partnerships, deals and certifications are executed across the ecosystem, such as the following.

Microsoft

Microsoft expanded its relationship with SES Networks: planning to use connectivity by SES’s GEO and O3b mPower satellites to boost network diversity and resiliency at its Azure Network locations.

SES teamed up with Amdocs to operationalize the first open network automation platform (ONAP) for scalable and automated delivery of satellite-enabled network services on Microsoft Azure.

Intelsat’s Cloud Connect now supports Microsoft Azure ExpressRoute connectivity via the FlexEnterprise managed service: providing network service operators and their enterprise customers, a new level of flexibility in adopting a growth-oriented cloud strategy.

Viasat teamed up with Microsoft Azure to provide enterprise customers with connectivity over ExpressRoute.

Amazon

SES Networks received certification under Amazon Web Services’ (AWS) Direct Connect program, achieving a prime position to serve up cloud access to customers in hard-to-reach locations.

Project Kuiper and AWS may be a separate vertical within Amazon (now), but there is a clear synergy in both. NSR expects the future integration of application and services at multiple levels.

Google Cloud and SpaceX recently announced their partnership to deliver data, cloud services, and applications to customers at the network edge, utilizing Starlink’s ubiquitous capability and Google Cloud’s infrastructure.

While most players are focusing on extending their cloud capabilities targeting enterprise customers, Facebook, with its Express Wi-Fi platform, is enabling downstream partners to deploy affordable Wi-Fi networks with the target to address regions with usage and capacity gaps. The solution is already deployed in Africa (10 countries), South America (5 countries), and Asia (5 countries).

What does this mean for satcom stakeholders, and how will it affect the satellite communications market?

Unquestionably, it is a clear opportunity for the satcom stakeholders in the terms of capacity and service demand. Satcom stakeholders must focus on building a scalable, flexible, affordable, and compatible solution in alignment with the emerging requirements from the hyperscalers.

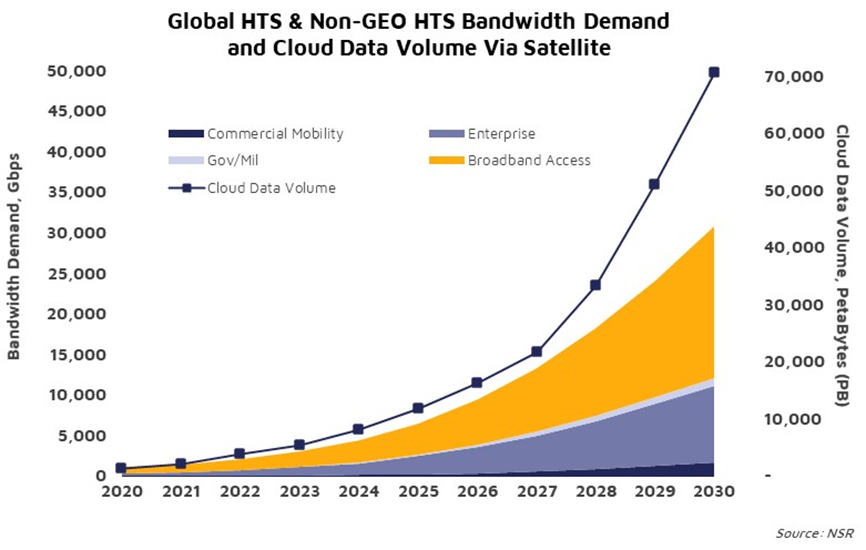

Comparing the assessment of HTS capacity demand across applications from NSR’s Global Satellite Capacity Supply and Demand, 18th Edition report and the increase in the volume of cloud data from NSR’s Cloud Computing via Satellite, 3rd Edition report, a clear resonance between the two trajectories can be observed. Accelerated cloud data volume and capacity demand is expected starting 2024–2025 as the satcom industry adds more supply in both GEO and LEO orbits. The major partnerships and deals listed above are expected to witness rapid solution deployments as the significant bandwidth availability and flexible solutions using HTS in GEO and LEO across regions are ascertained by the satcom stakeholders in the next 3–4 years. Cloud data volume via satellite is expected to ramp-up to >70PB by 2030, with 90% contribution from mobility and enterprise users. Syncing with this trend, the capacity demand for the commercial mobility and enterprise data segments is forecasted to grow at CAGR 38.2% and CAGR 41.2% respectively, aggregating >11Tbit/s capacity demand by 2030.

While segments such as enterprise data, commercial mobility and government/military capacity demand growth will resonate with the cloud data volume growth curve as hyperscalers-satcom stakeholders invest in new deployments, broadband access with massive market addressability is expected to generate long-term capacity demand. Continued capacity pricing drops will be key parameters that will ensure infusion for new solutions into new markets and geographies. NSR estimates that the average pricing from the enterprise VSAT segment will reach close to USD70 per megabit per second per month and USD50 per megabit per second per month for broadband access applications. Facebook’s Wi-Fi platform, is expected to play a key role in enabling downstream players in the emerging markets such as Africa, Asia and Latin America.

Bottom line

The role of the hyperscalers across user segments are ramping up rapidly, especially with the increased digital transformation requirements post COVID-19. As cost to space and cost per megabit per second in the satcom industry is eroded, both hyperscalers and satcom stakeholders are looking into these trends as opportunities to expand quickly into new geographies, customer groups and deploy innovative solutions across applications. Various partnerships have already been executed to capture the existing and future demand, such as Microsoft–SES, Microsoft–Intelsat, Microsoft–Viasat, AWS–Project Kuiper, Google–SpaceX, and Facebook–downstream regional service provider. While NSR is positive about this integration and the same is depicted in its demand assessment in the Global Satellite Capacity Supply and Demand, 18th Edition report, it also foresees a major hurdle in terms of the execution timeline sync-up. Historically, hyperscalers have been rapid innovators whereas the satellite industry has always had a longer innovation lead time. Satcom players must move quickly to achieve a suitable service level across regions and applications, delivering required speeds, latency, and pricing.

Overall, NSR expects an ecosystem of partners across the value chain that will be key for enabling and capturing long-term opportunities as hyperscalers progress in their roles in targeting digital transformation across applications and regions. Competition will be fierce across the value chain and cloud ecosystem, but in the long run will lead to a greater and more prominent role for the satcom industry in this emerging landscape.

Article (PDF)

Download