Operators will need to invest in educating and supporting enterprises in their SASE migration

Listen to or download the associated podcast

SD-WAN vendors continue to report steady growth in the number of enterprises and sites served. The number of partnerships between SD-WAN vendors and telecoms operators is also growing steadily, with many of these new partnerships embracing SASE. We expect the secure-access service edge (SASE) market to grow more rapidly than the SD-WAN market, with especially strong growth in the small and medium-sized enterprise (SME) segment, though from a small base. Operators might need to do more to help convince larger enterprises of the benefits of SASE and support their migration to these services.

The SD-WAN market is growing steadily, with new partnerships still being announced

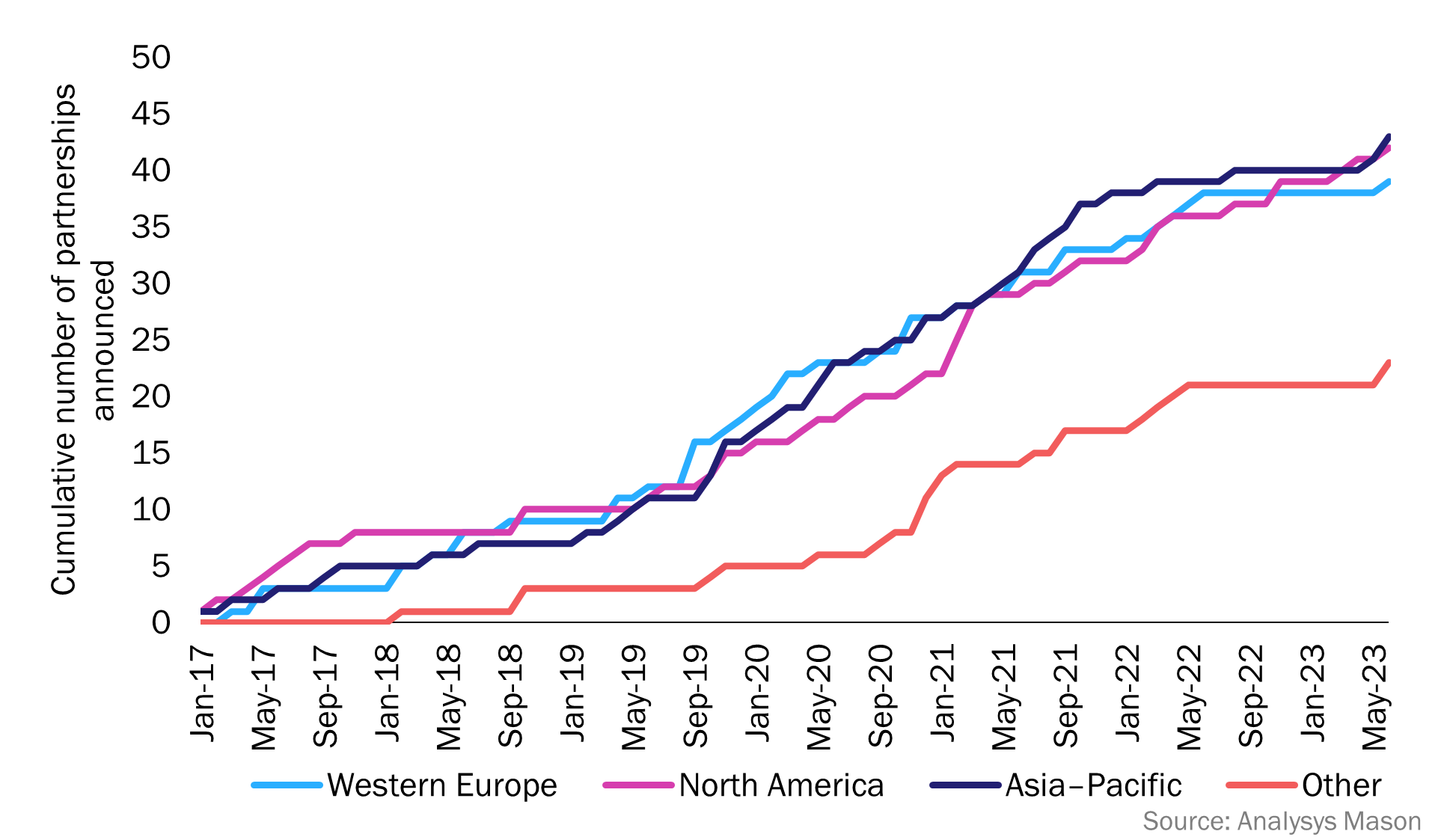

The SD-WAN market has grown steadily since it first became a mainstream networking option around 2018 and is offered by most telecoms operators worldwide. Indeed, we track almost 270 partnerships between telecoms operators and SD-WAN vendors from the start of 2017 to the first half of 2023 (Figure 1). While there was a slight slowdown in the number of new partnerships in 2022, the number continued to rise in 2023. Fortinet, VMware and Versa report the most new partnerships since the start of 2022. Partnerships are spread evenly across Western Europe, North America and Asia–Pacific where SD-WAN adoption is the highest, but there is a growing number of partnerships between SD-WAN vendors and telecoms operators in emerging regions such as the Middle East and Africa.

Figure 1: The cumulative number of partnerships between SD-WAN vendors and operators, select regions, January 2017–May 20231

According to our latest forecast, total SD-WAN retail revenue will reach USD57 billion worldwide by 2028, growing at a CAGR of 14% between 2023 and 2028. The underlying connectivity revenue associated with SD-WAN will account for 82% of this revenue, while the overlay service will account for the rest, or about USD10 billion in 2028. We expect that by 2028, almost a third of all business connectivity revenue will be accounted for by services associated with SD-WAN.

SASE solutions can be used to combine SD-WAN and various cloud security products, most often including at least one of the following: firewall-as-a-service (FWaaS), security web gateway, (SWG), zero-trust networks access (ZTNA) and cloud access security broker (CASB). SASE has become an important part of many new partnerships between telecoms operators and SD-WAN vendors or security vendors. Indeed, it has been mentioned in more than 70% of all SD-WAN partnership announcements since the start of 2022. We expect more partnerships involving SASE to be announced as the market continues to grow rapidly and matures.

The SASE market is growing rapidly, with revenue from SMEs growing at the fastest rate, but from a small base

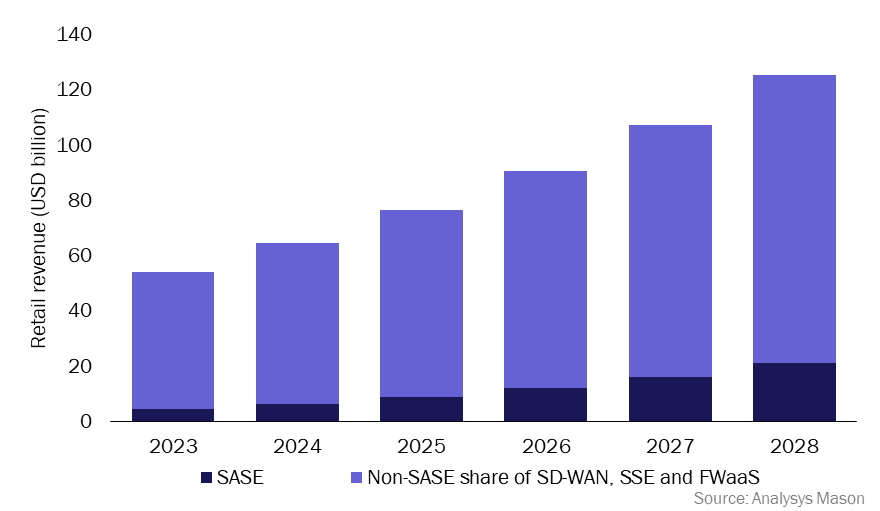

As the number of SASE partnerships rise, we also expect SASE retail revenue to grow rapidly. We estimate that SASE services will generate USD21.0 billion in revenue, worldwide, by 2028, growing at a CAGR of 36% between 2023 and 2028 (Figure 2). This is equivalent to 17% of the combined cloud security and SD-WAN market, which will reach USD125 billion in revenue in 2028.

Figure 2: SASE share of SD-WAN, SSE and FWaaS retail revenue, worldwide, 2023–2028

While overall SASE revenue will grow at a CAGR of 36%, growth rates and the amount of revenue generated will vary by business size. Initially, large (250–999 employees) and very large (1000+ employees) enterprises will generate the vast majority (80%) of SASE revenue, due to the fact that large and very large enterprises are more likely to be aware of SASE and be in a position to adopt it, compared to SMEs. However, revenue growth rates are expected to be higher for SMEs (49% CAGR in the period to 2028). SASE may be particularly appealing to SMEs as it allows them to address cloud connectivity and security needs in one solution, with many SMEs not having security solutions currently in place. The ‘as-a-service’ model is also likely to be more affordable compared to traditional security services with on-premises equipment where upfront costs may prohibit adoption.

Larger enterprises will often have long contract lifecycles for SD-WAN and security solutions, that will be managed by different internal teams, and may not be sufficiently co-ordinated to adopt SASE. SASE adoption for these enterprises will be complex, with migration being a gradual process. These enterprises will continue to work with their current vendors until it is clear that an integrated approach can work at the scales they require. Indeed, some customers in attendance of Orange Business’ Hello! World 2023 event seemed hesitant on SASE, indicating that operators will need to work to convince large enterprises on the benefits SASE solutions can bring them.

SASE adoption will be a gradual process for most enterprises; operators should develop approaches that support this

Most enterprises are unlikely to adopt all cloud security elements at one time, adoption is likely to be gradual and modular. Ultimately, single vendor SASE solutions are likely to be the simplest and most cost-effective option for most enterprises, but very few will adopt this approach in a single step. As such, operators will need to carefully consider which cloud security element(s) to focus on first when selling their SASE propositions and how best to support mixed solutions with multiple vendors.

Initial SASE propositions from operators often built on their existing capabilities in delivering SWG along with SD-WAN. Recently this approach looks to have, at least partly, shifted. ZTNA capabilities which help support common security policies for on-premise and remote workers and devices are emphasised by operators such as Deutsche Telekom through its partnership with Zscaler. Some service providers, are also including ZTNA within their standard SD-WAN proposition as they see ZTNA as a core networking solution.

Operators will need to think beyond which services they will offer and invest in educating enterprises on the benefits these services can offer, along with providing the support for these services. Recruiting and training experts for these tasks will be key if operators wish to take advantage of the rapidly growing SASE market.

1 Chart only includes partnerships that we have been able to date. The tracker includes a further 104 partnerships that we have not been able to date.

Article (PDF)

DownloadAuthor

Matt Small

AnalystRelated items

Article

KDDI’s results demonstrate the challenges of entering new markets such as energy and finance

Strategy report

Strategies for telecoms operators to evolve their network-as-a-service (NaaS) propositions

Tracker

Cloud service providers' revenue tracker 2024