Which ESG strategies are telecoms operators pursuing?

Listen to or download the associated podcast

Telecoms network operators are increasingly focusing on environmental, social and governance (ESG) strategies. They are using ESG measures and reporting to attract investment primarily, but also to increase their appeal to customers and employees. Thus far, network operators are putting most of their emphasis on environment-related matters.

What is ESG?

ESG criteria are standards that investors, customers and employees can use to evaluate the sustainability of a company.

- Environmental criteria are used to assess the company’s impact on the natural environment, and are particularly likely to relate to energy consumption.

- Social criteria are used to measure the impact of the company on a range of stakeholders – employees, customers, communities, policymakers and shareholders.

- Governance criteria are used to understand the company’s approach to leadership, demographics and internal controls.

ESG ostensibly addresses concerns beyond those of the direct interests of shareholders, but the investment community is having a significant impact on corporate ESG efforts.

Many organisations worldwide are working to standardise ESG reporting but the proliferation of methods is creating inconsistencies and comparisons are difficult. However, most telecoms operators report greenhouse gas (GHG) emissions.

Why is ESG important for operators?

Larry Fink, chairman of multinational investment management company BlackRock, has noted that mutual and exchange-traded funds invested USD288 billion in sustainable assets worldwide during 2020, an increase of 96% compared with 2019. Fink stated that future BlackRock investment would be linked to ESG goals, particularly environmental ones, because stakeholders – customers, policymakers, employees and shareholders – are likely to lose confidence in companies that are not responding to the need to control global warming.

The growth of ESG-linked funds is not expected to slow; Bloomberg Intelligence expects the value of ESG exchange-traded funds to increase from USD35 trillion in 2020 to USD50 trillion by 2025, representing a third of projected total global assets under management. In a survey of 200 asset owners conducted by Morgan Stanley Capital Investments (MSCI), 62% cited climate change or ESG measurement as a top 3 impactful trend in the next 3–5 years and 73% planned to increase ESG investment either significantly or moderately by the end of 2021.

Another MSCI study published in April 2021, revealed that USD1136 billion of investment in communications is in ESG mutual and exchange-traded funds. Half the funds were based in Europe where, MSCI notes, ESG adoption has been long established. Other industries such as information technology, healthcare and financials represented a larger proportion of shares, which reflects the diverse methods by which ESG investment is calculated and the opportunity for expansion. Specifically, within the telecoms industry, there has been an increase in the issuance of green bonds – in which commitment to sustainable targets is necessary to access proceeds – by companies such as NTT, Orange, Telefónica, Verizon and Vodafone.

Investors understand that by integrating ESG standards in their businesses, companies can:

- boost employee motivation

- attract larger talent pools

- align with consumer demands for sustainable products

- adhere to regulators’ wishes

- reduce operational costs

- engage in opportunities for diversification into new markets.

In general, ESG reporting promotes the sort of long-term, sustainable and resilient thinking that is attractive to investors. This resilient thinking is especially crucial today as industries face large and unpredictable challenges due to climate change. It also reduces risks that are associated with poor ESG management including reputational damage and social stigma, which can cause a decline in market capitalisation.

The GSMA, the mobile operators’ industry association, conducted research that demonstrated that ESG reduces the cost of capital, provides better operational performance and positively influences stock prices.

What are operators’ ESG strategies?

Operators must establish their ESG credentials if they are to continue to attract investors. Most approaches involve detailing commitments, transparency, performance and advocacy related to ESG issues. The most common actions that operators are taking in each ESG category are as follows.

Environmental

Environmental issues include carbon emissions, air pollution, water pollution, biodiversity, energy efficiency, hazardous materials, waste management and deforestation. The telecoms industry is focusing on GHG emissions and waste management. GHG emissions calculations are classified into the following areas.

- Scope 1: direct emissions from owned sources such as company facilities or vehicles.

- Scope 2: indirect emissions from purchased electricity, heating and cooling:

- market-based emissions are those that that are purchased

- location-based emissions are calculated using the average emissions of the specific grids.

- Scope 3: all other indirect emissions within the supply chain, including those generated by suppliers, transportation of goods, employee commuting, end use and financial investments; this is often the biggest source of emissions.

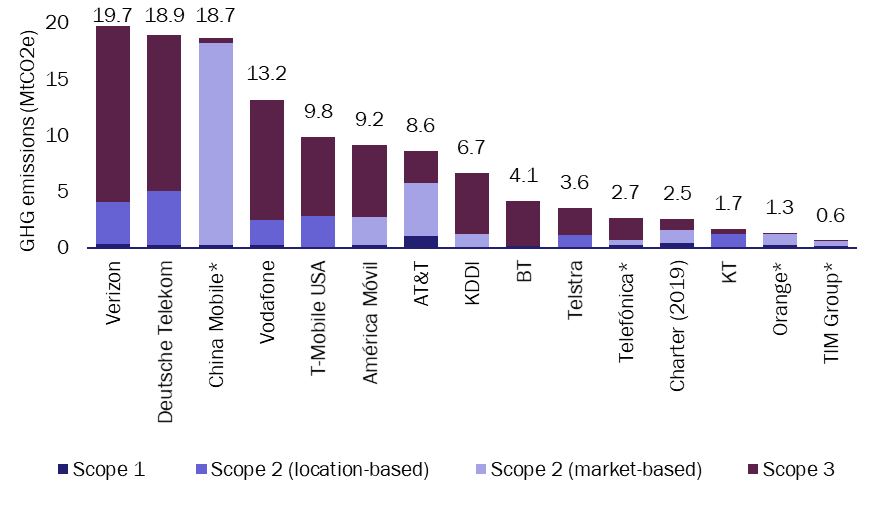

Nearly all 20 of the operators that we researched for this article (those that earn more than USD20 billion in annual revenue) report their Scope 1 and 2 emissions, although they do not consistently report location- and market-based emissions. Most operators calculate Scope 3 emissions. Figure 1 illustrates GHG emissions disclosed by operators, with location-based Scope 2 measurements where given.

Figure 1: GHG emissions disclosed in operators’ ESG reports, by type, 2020 (unless otherwise stated)

Source: Analysys Mason

* Note: these operators include only commuting and business travel emissions in Scope 3.

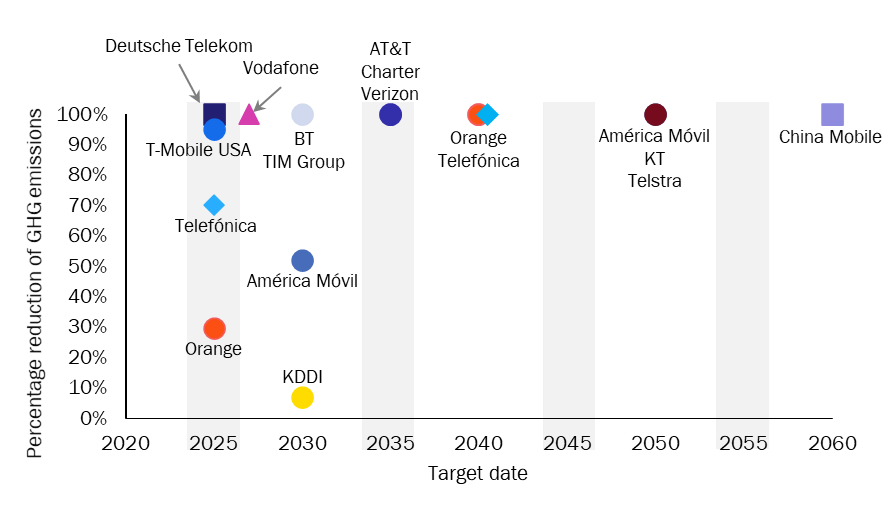

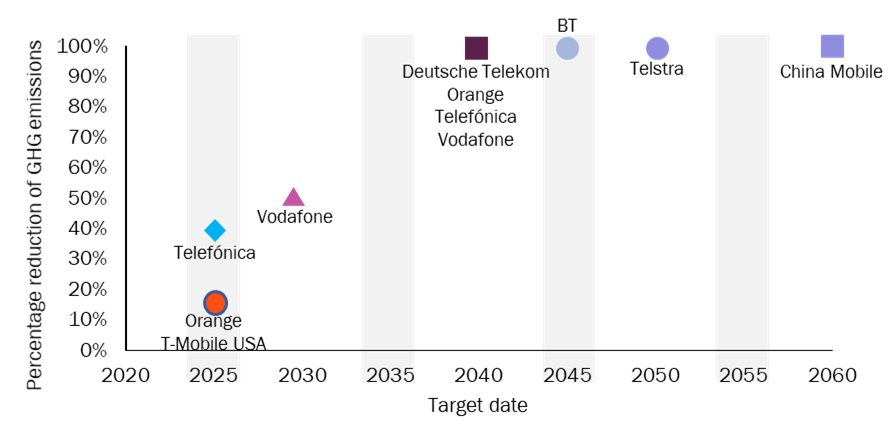

Many operators have set reduction targets for Scope 1 and Scope 2 emissions (Figure 2) and some for Scope 3 (Figure 3). Strategies for these targets involve renewable energies, energy-efficient technologies and carbon offsetting, although the amount of emissions that are to be offset by climate protection projects is not widely specified.

Figure 2: Target years for reducing Scope 1 and Scope 2 emissions, operators’ 2020 ESG reports

Source: Analysys Mason

Figure 3: Target years for reducing Scope 3 emissions, operators’ 2020 ESG reports

Source: Analysys Mason

Most operators do not divulge how much reduction will be achieved through carbon offsetting – Deutsche Telekom and Vodafone are the exceptions, both of which note that they will offset a maximum of 5% of emissions.

Most operators also report on the number of devices that they collect to prevent e-waste, such as the 229 million devices collected by AT&T, which were refurbished or recycled. Very few operators contextualise this information, although Orange reported that it collected mobile phones equivalent to 15.1% of its sales volumes in Europe in 2020. Operators also calculate traditional measures of operational water and waste management, but there is little emphasis on targets to reduce these.

A popular claim within operators’ environmental strategies is that the deployment of new 5G or fibre networks will increase energy efficiency. Telefónica and Nokia commissioned a study that demonstrated that 5G is up to 90% more efficient than 4G in terms of energy consumption per traffic unit. However, these new roll-outs will only add to GHG emissions until legacy networks are decommissioned. In addition, the measure of GHG emissions per gigabyte does not reveal whether GHG emissions are increasing or not. Any energy efficiency strategy can only be verified as climate friendly when energy supply is 100% renewable, via a location-based emissions measurement.

The GSMA and the European Telecommunications Network Operators’ Association (ETNO) also suggest that the telecoms industry can enable emissions reductions in other industries through digitalisation, such as with smart grids, cities, buildings and transportation, which could save 7.7 billion tonnes of CO2 emissions per year. These ideas might affect future ESG strategy discussion in the telecoms industry.

Social

Network operators, as with most companies, provide less detail and apply less consistency when measuring social goals rather than environmental ones. Social topics include customer satisfaction, data privacy, employee diversity, employee engagement, community relations and labour standards.

Gender diversity

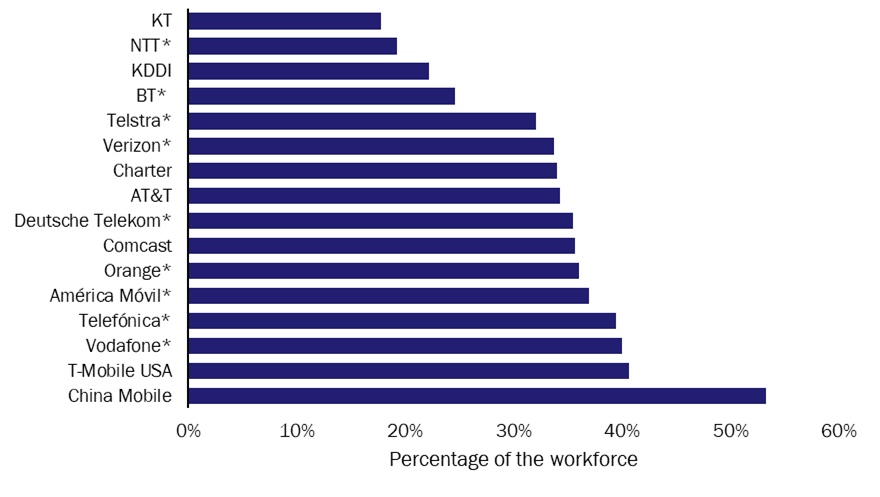

Most telcos measure employee gender diversity (Figure 4), and some report the number of minority ethnic employees or employees with disability. Such employee diversity has been correlated with profitability in 1000 large companies in 15 countries in a report by McKinsey, although few companies give details on gendered disparity in pay or sexual harassment or discrimination complaints.

Figure 4: Female representation in the workforce, operators’ 2020 ESG reports

Source: Analysys Mason

* These companies include pay gap reporting ranging from 69% difference in salaries to 100% pay equity.

Most operators’ ESG reports also highlight a wide range of employee benefits schemes, including training programmes and volunteering schemes.

Digital inclusion and child protection

Reducing digital exclusion for those in rural areas and the elderly can help to address many social, health and wellbeing issues such as isolation. Operators have launched a range of initiatives that aim to familiarise the elderly with digital devices including Telefónica Deutschland’s Digitial mobil im Alter (Digitally Mobile in Old Age) programme, Telstra’s Tech Savvy Seniors programme and China Mobile’s mobile phone mentors and exclusive service channels.

Operators are also taking steps to educate parents and children of the risks associated with increased time spent online such as online abuse and cyber bullying. KDDI’s mobile phone safety classes, BT’s Skills for Tomorrow Portal and Verizon’s Parenting in a Digital World portal all attempt to increase child protection online.

Data privacy

Data privacy issues are typically included in the ‘social’ category of ESG reporting, and include policy, data enquiries, data deletion and data breaches. Many operators mention policy and data complaints or fines, but few quantify data requests from customers.

In addition to the above-mentioned measures, operators are gauging the opportunity for new ESG ventures that have revenue opportunities of up to USD3.5 trillion this decade associated with them in healthcare, education, environmental management, financial services and economic inclusion. New ventures include digital payment platforms, IoT for buildings to improve water and waste management, digital identity authentication, health tracking, and disaster response mobile platforms.

Governance

Governance issues are less sector-specific; areas of focus for the telecoms industry match those of other industries including board diversity, bribery and data breaches. Some operators report on other governance topics, such as tax strategy, whistle-blower schemes and executive pay.

What lessons can be drawn from operators’ current ESG attention?

At present, most operators focus on the reduction of carbon emissions and e-waste, workforce diversity, employee engagement and digital inclusion ventures. Although some comparisons can be made between metrics of emissions, e-waste and diversity in the workforce, measurement of other criteria, such as data privacy and digital inclusion, is less consistent. High-quality data and consistent measurement over time are necessary to give investors confidence and avoid the accusation of greenwashing. Standardisation is likely to improve as more companies collect and report on ESG data using frameworks such as those defined by the Global Reporting Initiative or the Sustainability Accounting Standards Board, and through ESG rankings by companies such as MSCI or Sustainalytics.

What are some ESG standards?

ESG-related reporting can affect an operator’s ability to access capital, attract investors, staff and customers, and satisfy regulators. Sustainability reporting is critical and is currently being done according to several different frameworks (Figure 5).

Figure 5: Overview of commonly applied ESG frameworks

| Organisation | Information |

| Carbon Disclosure Project (CDP) | Founded in 2000 to improve environmental disclosure to investors. It now assesses companies, cities and governments with TCFD-aligned information on emissions, water and biodiversity. It has an Open Data portal of climate actions disclosed by different parties. |

| Global Reporting Initiative (GRI) | Founded in 1997 and includes information for 40 sectors to drive corporate transparency. The most recent GRI frameworks are the GRI Standards of 2016. Examples of specific modules include materiality topics, occupational safety, customer privacy, child labour, corruption and tax. |

| Sustainability Accountability Standards Board (SASB) | Founded in 2011 with industry-specific standards for 77 industries. Implements a framework set by the TCFD. Telecoms standards include environmental footprint, data privacy and competitive behaviour. |

| Task Force on Climate-Related Financial Disclosures (TCFD) | Formed by the Financial Stability Board in 2015, it protects financial markets from climate-related risk. Its recommendations were first published in a 2017 report. Supporters are based in 78 countries and the G7 made a public commitment to mandate TCFD disclosure in 2021. Companies must disclose issues such as short-, medium- and long-term climate risks and well as Scope 1 and 2 emissions. |

Source: Analysys Mason

Many companies and organisations are working to understand and explain how ESG reporting affects network operators and other businesses (Figure 6). All the operators mentioned in this article have ESG reports on the investor pages of their websites.

Figure 6: Overview of reference sites and documents about ESG cited in this article

Source: Analysys Mason

Lucy Brooker (Research Analyst) is based in Analysys Mason’s London office. She holds an MSc Psychology of Education degree from the University of Bristol with a previous BA in Classics. Her MSc research assessed the impact of value reflection on climate action self-efficacy with quantitative and qualitative data analysis. She has previously processed data feeds and researched industry updates at the UK’s leading digital platform for electric vehicle drivers.

Larry Goldman (Chief Analyst) co-ordinates Analysys Mason’s work on leading-edge topics in telecoms, media and technology (TMT). He also leads network and software research. For the past 20 years, he has delivered analysis and forecasts of the rapidly changing role of software in telecoms, and more recently, cloud.

Article (PDF)

DownloadAuthors

Grace Langham

Analyst, expert in sustainability and ESGRelated items

Framework report

Digital twins in telecoms: a framework for understanding the opportunity and ecosystem

Article

Using dark fibre to track geothermal energy offers network providers an opportunity to monetise their assets

Survey report

Fixed operator energy benchmarks 2024