eUICCs and iSIMs will disrupt the IoT connectivity chain, but operators should see opportunities, not obstacles

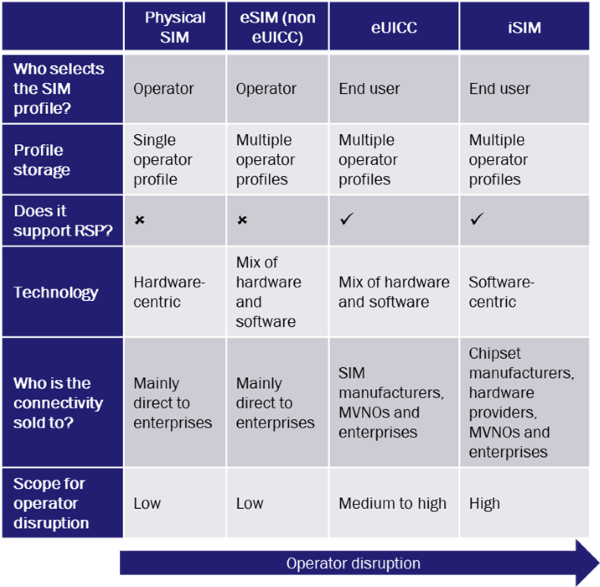

eUICCs1 are increasingly being adopted in the IoT market, and the introduction of iSIMs is expected to follow in 2020 and 2021. eUICC users’ ability to switch providers remotely may increase IoT churn (which has historically been very low) and put pressure on prices. iSIMs will cause further disruption by shifting power to the silicon players at the start of the connectivity value chain. The scope for operator disruption is highlighted in Figure 1.

Figure 1: Operator disruption from eUICCs and iSIMs2

Source: Analysys Mason, 2020

Operators will not be able to prevent the adoption of eUICCs and iSIMs for IoT; they must face the challenges head on and take advantage of the new opportunities. This article summarises the findings of our recent report, eUICC and iSIM for IoT: opportunities for operators.

The move to eUICCs and iSIMs for IoT is inevitable; operators must embrace it and invest in the technologies early on

Operators’ early forays into embedded SIM (eSIM) solutions were largely self-serving and in response to demand from specific verticals, especially automotive. These eSIMs were built into the device hardware, thereby simplifying logistics for OEMs, but did not meet the GSMA specification to enable operator switching. The demand for eSIMs with full eUICC capabilities has grown since the release of the GSMA M2M eSIM specifications. Operators must therefore embrace the adoption of eUICCs. Some public sector connectivity contracts are even specifying remote SIM provisioning as a requirement in the tender process. Operators will need to evaluate how the changing connectivity value chain will affect their ability to provide other IoT solutions (such as device management and application services).

iSIM adoption will be slower than that for eUICCs because the GSMA standard for iSIMs is still being developed. There are also complications in ensuring the security of the system-on-a-chip (SoC). We expect that a few iSIM solutions will be launched commercially in 2020 and 2021, and that iSIM adoption will speed up in the following years.

iSIMs will further disrupt the IoT connectivity value chain. Device IP providers (such as Arm) and SoC manufacturers (such as Qualcomm) will play a more-important role than they have done previously and operators will sell connectivity to these players. SIM manufacturers (such as Gemalto) will shift from running a hardware business (producing physical SIMs) to providing software (SIM IP and remote SIM provisioning services). Operators will need to understand the new iSIM value chain and identify where opportunities lie. Some examples of these opportunities are as follows.

- New channels to market. The iSIM partnership between Arm and Vodafone is an example of this. OEMs may approach Vodafone for an iSIM solution and Vodafone can direct them to Arm. Alternatively, OEMs may approach Arm directly, who can direct the OEM to Vodafone to provide connectivity, thereby creating a new channel to market for Vodafone.

- Fall in device costs. In time, iSIMs will reduce the total bill of materials, which in turn will reduce device costs, allowing a greater number of devices to be supported by end users. This will help to drive the business case for LPWA, which has very low connectivity margins. MNOs may start to win larger contracts for connectivity on their NB-IoT and LoRa networks.

- Automation of connectivity sales. The fall in device costs should encourage operators to evaluate how they sell connectivity. For low-value use cases such as simple asset tracking, they should automate their sales processes by selling connectivity online or via APIs. This will reduce the cost base for connectivity and will make the sales process quicker and simpler. It will also free up resources that can be diverted to higher-value, end-to-end solutions such as industrial IoT and smart city solutions.

- Fewer hardware issues. Customers often turn to operators for assistance with device and equipment issues, even though the operator does not provide the hardware in most cases. Operators dedicate significant time and resources to solve these issues. If the end user requests an iSIM, their hardware will have to be compatible, so hardware issues should be resolved by the equipment manufacturer before the device is put into production.

Operators should form new partnerships to help them gain an early understanding of the new technology

Operators will need to form new partnerships, especially with device IP providers and SoC manufacturers. Operators may not have partnered with these players for IoT solutions before, but there are benefits to operators in seeking these partnerships early.

- Early-mover advantage. Many operators are waiting for the GSMA iSIM standard to be developed before launching iSIM solutions. Operators that have made an early start (such as Vodafone and Deutsche Telekom) may find it easier to retain early iSIM adopters after the standard is released.

- Get on the learning curve. iSIM is a new technology (as is eUICC, though to a lesser extent) and operators are unlikely to have expertise on system-on-a-chips. Partnering with silicon players such as Qualcomm will help operators to get on the learning curve and gain an early understanding of potential iSIM and interoperability issues.

- Influence the standard. Arm is involved in the ongoing GSMA iSIM standardisation and Vodafone’s iSIM partnership with Arm will help the operator to influence the standard. Deutsche Telekom is taking a different approach for its open platform ‘nuSIM’ solution. It is collaborating with multiple vendors from different parts of the value chain including silicon players, SIM security providers and hardware providers. This collaborative approach could help to push nuSIM as a de facto iSIM standard.

Operators must be proactive in developing their eUICC and iSIM propositions or risk falling behind

MNOs are facing increased competition in the IoT connectivity market, and failing to embrace eUICC and iSIM will make it even more difficult to compete. Operators cannot fight against the adoption of eUICC and iSIM and must be proactive in facing the resulting challenges. Operators must understand the risks, evaluate how selling to different players will change their business and build new partnerships.

1 We use the term ‘eUICC’ as defined in the GSMA SGP.01 V4.0 M2M eSIM Architecture Specification: “A UICC which is not easily accessible or replaceable, is not intended to be removed or replaced in the device, and enables the secure changing of subscriptions.” This definition is often used interchangeably with ‘eSIM’ when referring to GSMA-compliant solutions; here ‘we use the term ‘eSIM’ to refer to solutions that predated the GSMA M2M SGP.02 specifications (first released in May 2016).

2 This diagram refers to standard physical SIMs. It excludes multi-IMSI SIMs, which are alternative physical SIMs that can support multiple operator profiles.

Downloads

Article (PDF)Author