Future fixed traffic demands depend less on technological leaps and more on user engagement

According to Analysys Mason’s Fixed network data traffic: worldwide trends and forecasts 2023–2029, fixed networks accounted for 84% of total worldwide traffic in 2023, a share that will remain broadly consistent over the forecasted period. Several factors will contribute to fixed traffic growth, in varying orders. The most imminent factors include broadcast-to-streaming migration, the consumption of higher-definition video streaming, live-streaming sports and increased use of short-form video content on social media. One of the other big drivers of overall fixed traffic is subscriber growth in emerging middle and lower-middle income countries. The impact of AI on access traffic is uncertain. AI, including generative AI (GenAI), will not greatly change the access network bandwidth-intensity of applications, but could make interactive applications feel more ‘human’ to drive additional user engagement. Its main impact will be on traffic generated inside and between data centres (DCs).

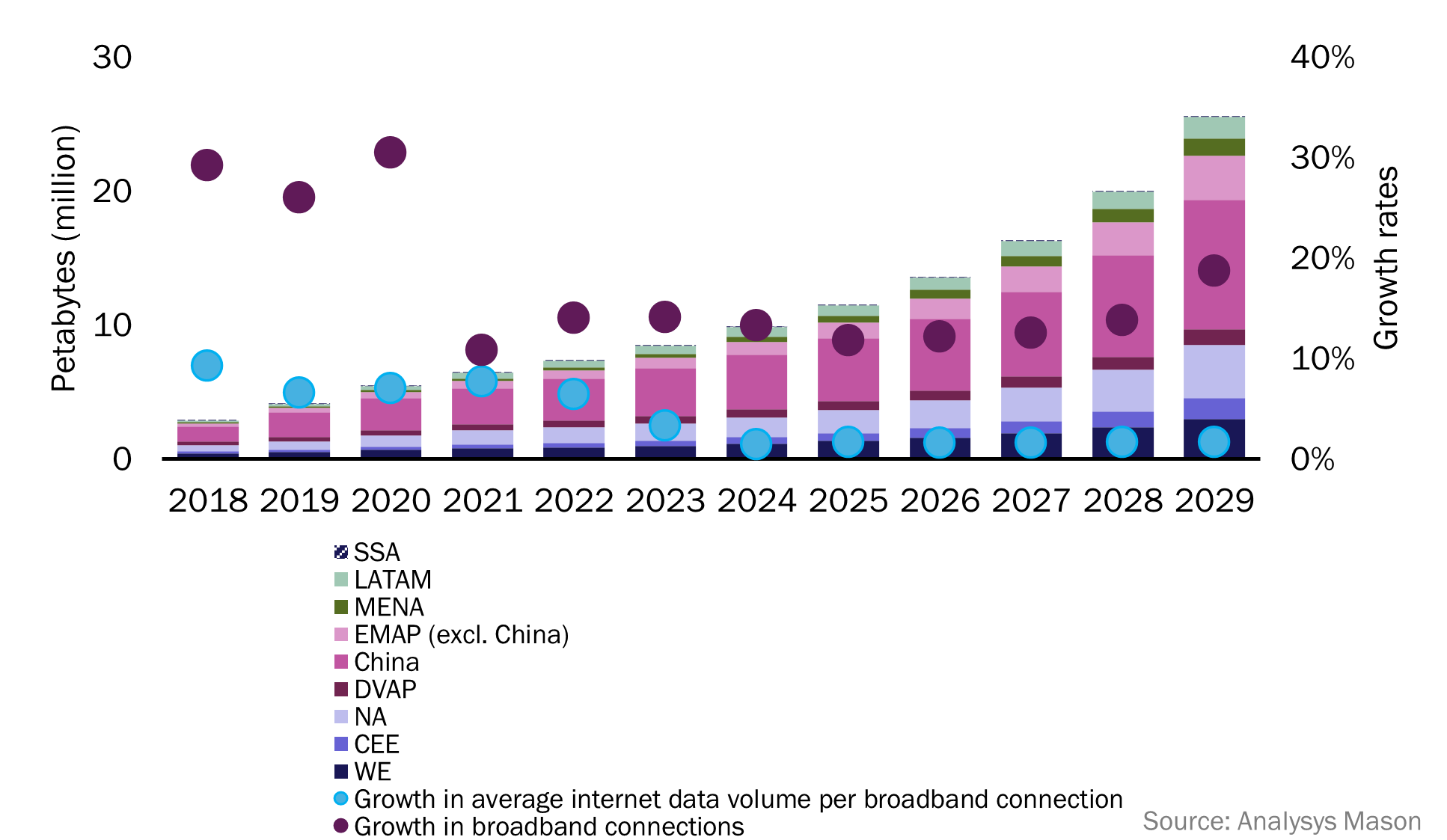

New device classes and innovative applications such as the metaverse and virtual reality (VR) (which will be more suited to fixed networks than mobile) could re-accelerate traffic growth and/or bandwidth, but this will also highly depend on user engagement. The metaverse and VR are still facing a number of headwinds, so our best estimate is a modest uptick in traffic growth rates due to these technologies around mid-decade (Figure 1).

Figure 1: Fixed data traffic by region and global growth in fixed broadband subscribers and average FBB traffic, worldwide, 2018–20291

Going forward, fixed traffic growth hinges less on technological developments and instead depends on whether applications such as AI/GenAI can empower the creation of more engaging experiences for customers within those existing technologies and devices.

Fixed traffic growth and bandwidth requirements will be accommodated within the ample capacity already created

Even if new devices and applications, such as AR/VR, prompt a reacceleration of traffic, that does not necessarily mean that they will push at the limits of the capabilities of networks to carry that traffic or provide that bandwidth. It is in developers’ interest to reach a critical mass of consumers, and they will tailor development to the kind of connectivity they are certain will be available and adopted. If there is any uncertainty it will be in the quality of in-home networks or, although far less likely, in the availability of suitably distributed cloud infrastructure for quality, not in last-mile access.

In most cases, active network equipment upgrades on fixed/FTTP have a replacement cycle of around 8–10 years. This is usually connected to the useful life of active equipment. At this point, operators have a choice: stick with a like-for-like equipment replacement or upgrade to higher-capacity equipment that has fallen to the price of the previous generation’s model from 8–10 years ago. They almost always opt for the latter, even if it has no bearing on demand or likely future demand – it does, however, provide essentially a marketing advantage. The replacement cycle can thereby bring about huge changes in capacity even if it has little to do with demand.

AI will significantly increase inter-DC traffic, but its impact on traffic to the end user will depend on engagement

The increasing popularity of both AI/GenAI applications, typically hosted in centralised DCs, may induce demand which will drive some access traffic, but this will be relatively modest compared to traffic generated inside and between DCs.

It is where GenAI meets gaming and the metaverse that traffic could get generated through additional engagement. GenAI can dramatically improve how users interact with VR or augmented reality (AR) applications, by generating personalisation and improving the feel of interactive games or VR experiences. This will ultimately increase the hours users spend using these applications (within the constraints of leisure time). It is important to recognise GenAI as more than just another technology or service, like 4K or xR. It represents a distinct category that empowers the creation of more engaging experiences within those existing domains.

AI will change the historical trend that core transport network traffic grows at a slower rate than in the access network (which is largely brought about by content cacheing). Therefore, investment in new inter-DC capacity and links may actually increase. Even if this turns out to be the case, transport networks have never accounted for much more than 10% of an operator’s overall capex (and an ever-higher share of transport links are paid for directly or indirectly by the hyperscale cloud players). Furthermore, the growing interest in deploying AI workloads on edge nodes will mitigate some of this impact on transport networks.

The cloud migration can drive one-off spikes in B2B usage

B2B’s share of broadband data traffic is normally less than 7%. On average about 10% of all broadband lines are used by businesses (though this can vary). A variable proportion (as little as 4% in some countries to about 15% in others) are B2B-class lines where customers pay a premium for higher committed information rates (CIRs), service-level agreements (SLAs) and further features other than simply best-efforts bandwidth (or the default consumer CIR).

The average data traffic per B2B broadband line itself is estimated to be 50%–60% of the average B2C line, such is the influence of video on consumer usage. When businesses move their data and operations to the cloud, there is a significant, one-time increase in their data traffic, estimated to be around 50%. However, even with this move to the cloud, B2B’s share of total broadband traffic (excluding traffic generated by dedicated connections) is unlikely to increase much more above 8%. As for traffic on dedicated connections themselves, there is marked shift from point-to-point WAN to dedicated internet access as enterprise WANs are cloudified.

As the rate of traffic growth slows, it becomes more difficult to argue from current trends that frequent, capex-intensive upgrades are required to meet demand. GenAI will drive an acceleration of traffic in transport links between DCs, but its impact on the access network is less clear. New devices and applications may boost traffic demand, depending on users’ engagement, but the fiberisation of the last mile, with its low incremental capacity capex, pushes supply so far ahead of demand that it is unlikely they will overwhelm fixed network capacity for the foreseeable future.

1 CEE = Central and Eastern Europe; DVAP = Developed Asia–Pacific; EMAP = Emerging Asia–Pacific; LATAM = Latin America; MENA = Middle East and North Africa; SSA= Sub-Saharan Africa; WE = Western Europe.

Article (PDF)

DownloadAuthor