Our latest consumer survey shows that FMC bundles can attract mobile customers when FMC penetration is low

Many operators across Europe offer consumers fixed–mobile convergence (FMC) plans, and FMC penetration will continue to increase, driven by a number of mergers and acquisitions across the continent. Operators need to be able to compare their performance against that of their peers in terms of the churn and satisfaction metrics associated with FMC customers. Operators also need better insights into the likely demographic characteristics of FMC customers because this will help them to tailor their offers. This article presents a summary of the findings from Analysys Mason’s Fixed–mobile convergence in Europe: consumer survey.

Our annual consumer survey dataset allows us to investigate a range of different metrics

The results from our 2021 consumer survey have enabled us to analyse FMC penetration, the characteristics of customers with FMC plans and how adoption of FMC correlates with churn intention and customer satisfaction in each of the nine European countries included in our survey.1 We have categorised a survey respondent as an FMC customer if they selected ‘mobile’ as one of the answers to the question ‘Are any of the following services included as part of a bundle or package from your home broadband provider?’. This article uses analysis from our recent report to address some key questions that are relevant to operators that are offering (or considering offering) FMC in Europe.

- How prevalent are FMC bundles and how is this changing?

- Is FMC being used generally as a defensive measure, or can it be an effective customer acquisition tool?

- Is there an effect on NPS from FMC and is this related to bundling itself?

Our survey shows that self-reported FMC penetration is increasing in almost every European country that we surveyed

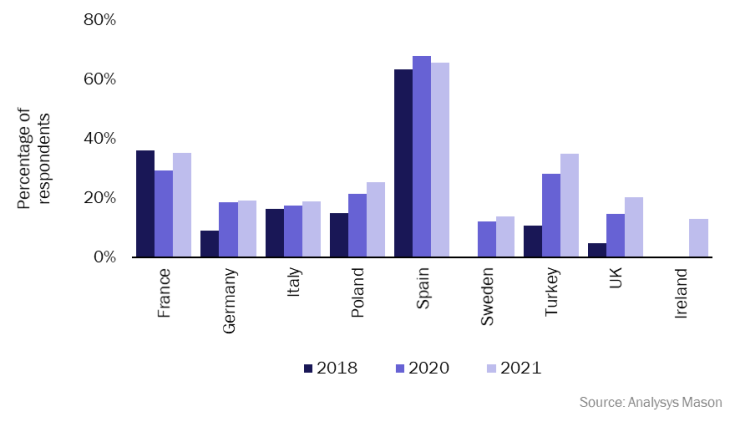

As shown in Figure 1, the level of self-reported FMC penetration has continued to increase in almost every European country surveyed between 2018 and 2021. However, the rate of increased penetration appears to be decelerating as of 2021 in many countries. For example, in Germany and Sweden, cross-selling bonuses remain the dominant form of FMC offer, and discounts have been either too low or not targeted strongly enough to stimulate strong growth in FMC penetration. France and Spain remain the most-penetrated markets, where FMC bundles appear to have reached saturation.

Poland and the UK have seen significant increases in FMC penetration since 2020 as operators adapt to an increasing level of infrastructure convergence that has been driven by M&A activity. Operators such as Play in Poland and BT in the UK have increased their focus on convergence due to fixed and mobile operator mergers in these markets. FMC penetration is also growing in Turkey, where FMC bonuses may be central in influencing consumer purchasing decisions for new fixed broadband subscribers.

This year, we have included Ireland in our FMC survey report for the first time. Ireland is still a nascent FMC market and Eir is the only operator that has a significant FMC bundled base. Despite Vodafone having a greater than 15% market share in Ireland for both fixed broadband and mobile services, it has yet to offer FMC bundles. Offers from Eir have not included high enough discounts to stimulate market-wide offers from competitors.

Figure 1: Self-reported FMC share of total broadband subscribers, by country, Europe, 2018, 2020, and 2021

Our research returned key insights into FMC consumer characteristics

FMC offers operators the opportunity to attract new mobile customers. In our survey report, we investigated the average self-reported mobile lifetime of FMC subscribers. which we arrived at conclusions about customer churn and customer acquisition.

In the established FMC markets of France and Spain, the average mobile customer lifetime (the average time that respondents report subscribing to their current mobile provider) is longer among FMC subscribers (by around 15% in both cases) than for non-FMC subscribers. This provides empirical evidence that FMC consumers will, in the long term, be easier to manage (from a churn perspective) than non-FMC subscribers.

In those countries where FMC penetration is growing, there is evidence that mobile consumers are being poached by fixed broadband operators using FMC discounts and bonuses to incentivise consumers to switch provider. In the UK, for example, the percentage of FMC subscribers that have subscribed to their mobile provider for under a year is almost double the average of the entire mobile panel. This is particularly interesting because the UK is one of the fastest growing markets (in terms of convergence), and our survey results indicate that this growth in the number of converged mobile customers may be the result of mobile net additions rather than simply offering convergence benefits to customers that were already taking both services This suggests that convergence can allow operators to build market share in the short term, rather than it purely being a long-term defensive strategy.

Net Promoter Scores (NPSs) for fixed broadband services at the operator level are generally higher among customers that take fixed and mobile from the same operator. However, within this sub-sample of respondents, there is a limited correlation between fixed–mobile bundlers and improved NPS. This suggests that, rather than FMC bundling itself improving broadband NPS, it is likely that more-satisfied broadband subscribers will take mobile services from the same operator (this is perhaps a strong case for cross-selling mobile services to satisfied broadband customers). Our analysis of the average mobile lifetime (as discussed earlier) further supports this idea, and operators should look to actively cross-sell mobile services to satisfied fixed broadband customers (FMC discounts and bonuses may provide an additional incentives).

Consumers that take both fixed and mobile services from the same operator have consistently returned a higher fixed broadband NPS than those that do not. For mobile NPS, this was not always the case, but consumers that bundled fixed and mobile services returned a higher mobile NPS than those consumers that took mobile and fixed broadband services from the same operator but did not bundle these services. Operators may wish to drive the migration of customers that take both fixed and mobile services from them to FMC bundles because our results suggest that bundling can improve mobile customer experience.

1 The countries included in the survey are France, Germany, Ireland, Italy, Poland, Spain, Sweden, Turkey and the UK.

Related items

Article

KDDI’s results demonstrate the challenges of entering new markets such as energy and finance

Tracker

Fixed–mobile convergence quarterly metrics 4Q 2024

Forecast report

Ireland: fixed–mobile convergence forecast 2024–2029