Fixed–mobile bundles can erode value rather than generate it – operators need to act carefully

There are “only two ways to make money in business: one is to bundle; the other is unbundle,” according to Jim Barksdale (who served as president and CEO of Netscape).

This statement represents the choice that operators with access to fixed and mobile networks face: they must choose between offering discounts to customers that take both mobile and fixed services, promoting the two services separately or promoting the two services together by offering benefits other than monetary discounts.

Analysys Mason conducted an in-depth scenario analysis in early 2024 to understand when operators should pursue a fixed–mobile convergence (FMC) strategy. Our research indicates that fixed–mobile operators should offer FMC discounts if they have a large, fixed customer base to upsell mobile services to, or if rivals compete aggressively on prices. In all the other situations, operators risk lower profits if they offer FMC discounts.

Many operators offer FMC discounts without being sure that this will maximise their profits

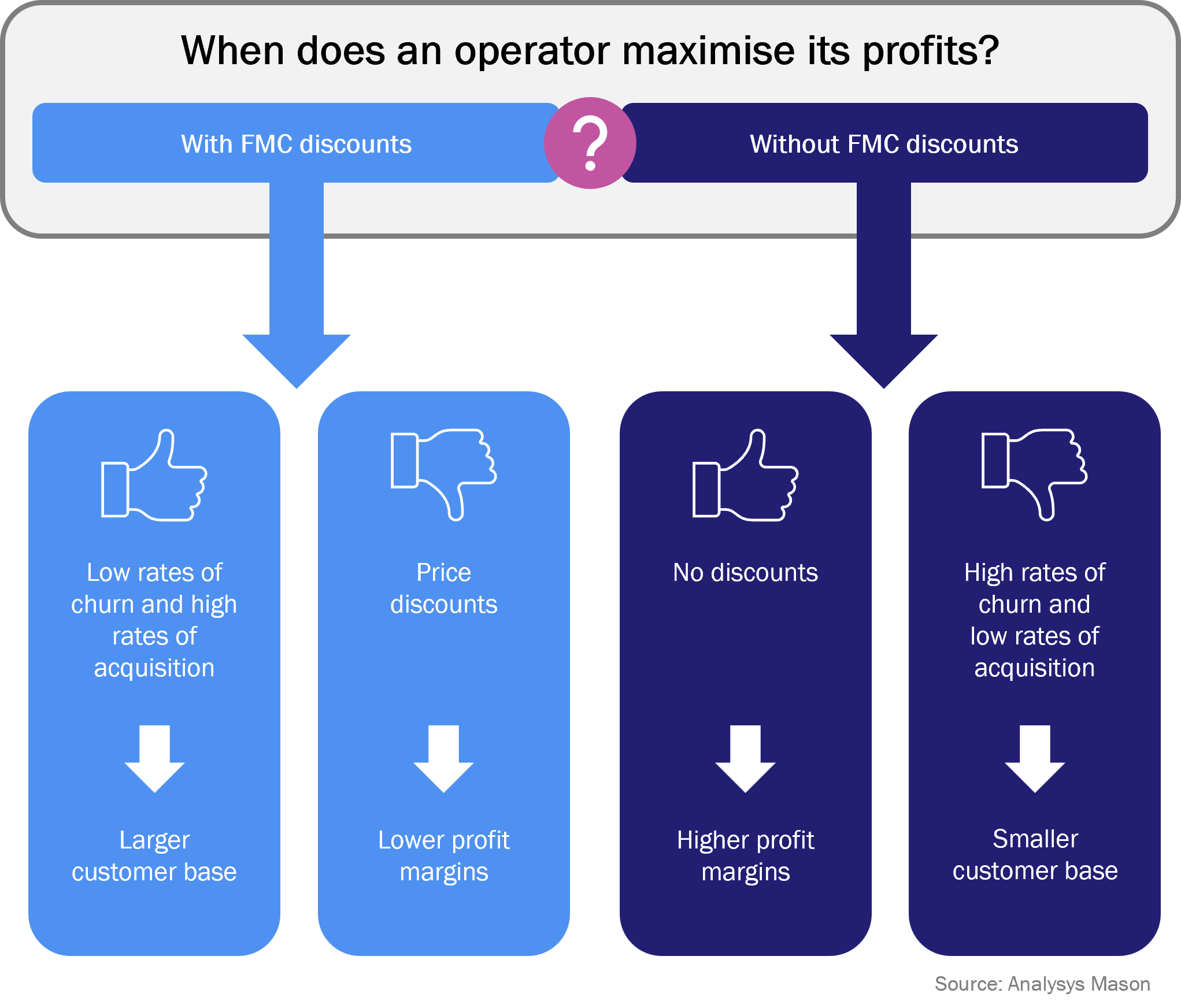

The advantages and disadvantages of FMC discounts are well-known:

- they help to retain operators’ existing customers and help them to gain new customers

- they can reduce operators’ profit margins.

Data released by Swisscom in 2018 confirms this pattern. The annual churn rate of its FMC customers was 5.4%, compared to 7.5% and 8.8% of mobile contract and fixed customers, respectively. From 2017 to 2018, the average spend of FMC customers declined by 5% to CHF75 (EUR76) per month, while the average spend of fixed-only customers remained almost flat and that of mobile-only customers grew only slightly.

It is not straightforward to determine if (or when) an operator can maximise its profits by offering FMC discounts. The answer varies by operator and depends on several factors.

Figure 1: Uncertainties related to the promotion of fixed–mobile discounts

Many operators should review their business strategies: most should use FMC discounts only as a last resort

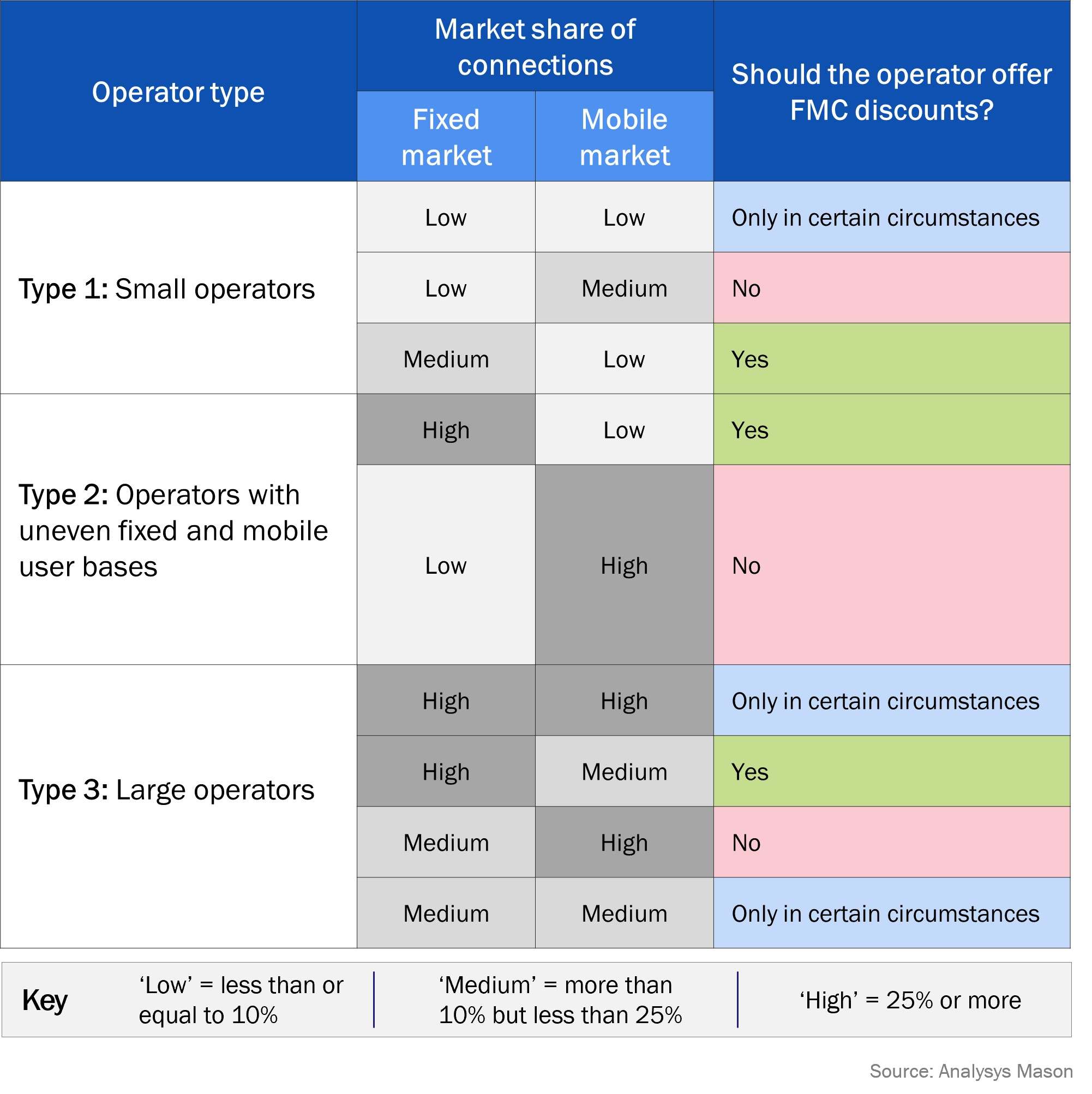

We have conducted a scenario analysis to identify when the promotion of FMC bundles is the best way for operators to maximise profits.1 As part of this exercise, we grouped operators into three categories (types), based on their positioning in the fixed and mobile markets (see Figure 2).

The promotion of FMC bundles leads to lower profits for most operator types and in several circumstances (see Figure 2).

Figure 2: Overview of which FMC discount strategy that various types of operators should use to maximise profits

- Small operators. These operators should offer FMC discounts only when they compete against operators that follow a price-aggressive mobile strategy.

Small fixed operators have a significant opportunity to gain new customers without offering FMC discounts. Typically, these operators already offer plans with low tariffs. Any additional discounts would likely have a marginal impact on customer acquisition. These operators should first look for differentiators other than discounts to win over customers from competitors.2

- Operators with uneven fixed and mobile user bases. Operators that have a larger share of fixed services customers than mobile services customer should offer FMC discounts, unlike operators that have a larger share of mobile services customers than fixed service customers.

FMC discounts can help fixed operators to drive the adoption of mobile services and defend profitability. It is easier to sell mobile services to fixed customers than vice versa.3 Customers typically consider a bundle as a fixed service combined with another service. Mobile plans are easier to upsell because they are usually cheaper than fixed plans.

FMC discounts can help large fixed operators to build a much bigger mobile user base. The large mobile user base can compensate for the discounts.

FMC discounts are less likely to help mobile operators to drive the adoption of fixed services and therefore would likely erode margins. Operators that have sold fixed services to mobile customers (such as EE and Vodafone in the UK) have found it difficult to build a large FMC customer base.

- Large operators. This group of operators should only offer FMC discounts if necessary to compete with other players.

These operators should offer FMC discounts primarily to reduce the churn among their existing customer bases. FMC discounts can have a strong positive impact on customer retention when operators face significant threats from competitors. In any other situation, the lower margins caused by offering FMC discounts would likely outweigh reduced churn.

Operators should identify benefits other than monetary discounts to encourage customers to buy both fixed and mobile services

Our research shows that FMC discounts are a powerful tool for customer retention but are (potentially) damaging to profitability. Some operators are already looking at new FMC bundles that do not offer (explicit) monetary discounts. For example, in the UK, VMO2 offers benefits such as a speed boost to customers that take fixed and mobile services.4

Operators’ long-term (and ambitious) goal should be to develop an FMC proposition that maintains its traditional advantages (lower churn and higher rates of customer acquisition) and eliminates its main disadvantage (lower margins).

Our analysis is based on generic operator types and several assumptions. We can adapt the inputs of our model to reflect the specific market conditions that an individual operator faces. Please contact Analysys Mason for assistance.

1 A full overview of our methodology is available in this report.

2 For more information, please see Analysys Mason’s Mobile operators should offer more than discounts and higher speeds to attract fixed customers from rivals.

3 The operators that have a high rate of adoption of FMC bundles are typically the same operators that have upsold mobile services to their fixed customers, such as operators in France, Portugal and Spain.

4 The operator launched a new FMC proposition in 2021, called Volt bundles. 1.9 million of VMO2’s customers bought one of the Volt bundles in 2023.

Article (PDF)

DownloadAuthor

Stefano Porto Bonacci

Principal AnalystRelated items

Article

KDDI’s results demonstrate the challenges of entering new markets such as energy and finance

Tracker

Fixed–mobile convergence quarterly metrics 4Q 2024

Forecast report

Ireland: fixed–mobile convergence forecast 2024–2029