Consolidation among FPA players will reduce costs, extend market reach and improve access to technology

Flat-panel antenna (FPA) manufacturers are exploring mergers and acquisitions to expand their capabilities and market reach and to achieve operational efficiencies. Manufacturers can merge with, or acquire, other firms to streamline operations, integrate advanced technologies and optimise supply chains, thereby ultimately leading to lower unit costs.

Analysys Mason’s Flat-panel satellite antennas: trends and forecasts 2023–2033 shows that the total number of FPAs shipped worldwide will increase eight-fold between 2023 and 2033. Much of this increase in the volume of shipped terminals will come from the broadband access segment, while the mobility and government/military verticals will continue to drive revenue.

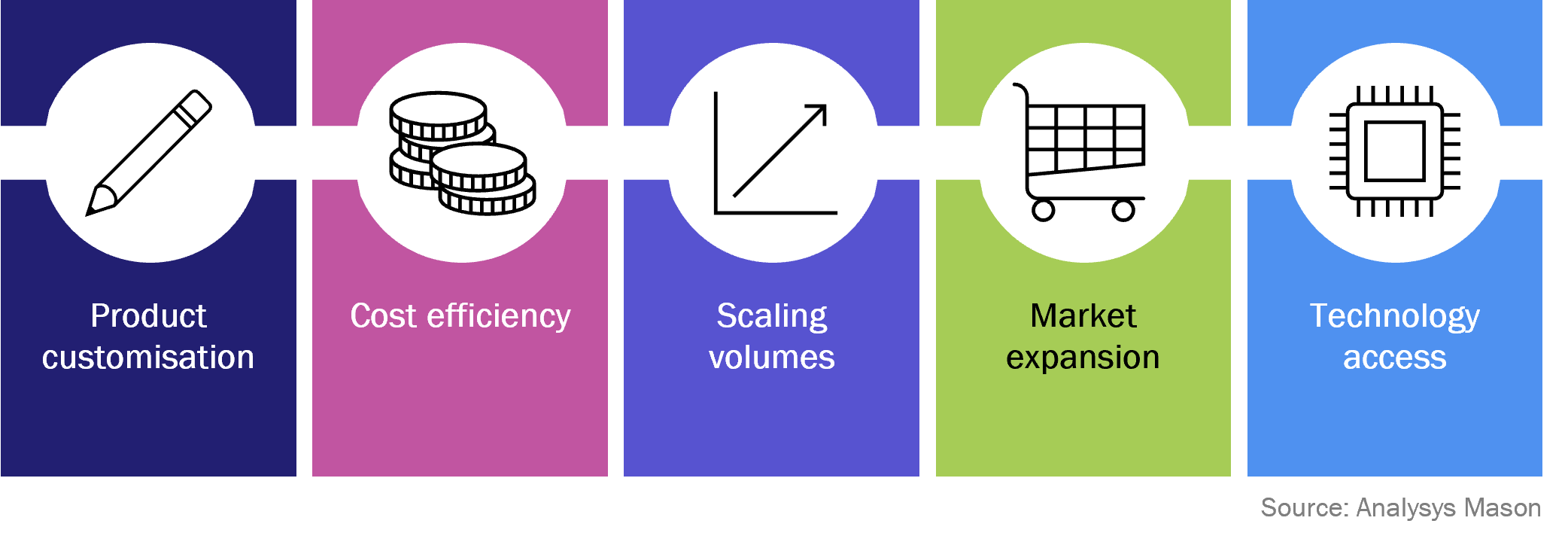

The demand for customised FPAs that are tailored to specific use cases and market segments is also increasing. This is pushing manufacturers to share resources and expertise in order to efficiently meet diverse customer needs. Collaboration via consolidation is proving to be more advantageous than traditional competition. Indeed, consolidation enables manufacturers to share strengths and optimise cost structures while unlocking new avenues for revenue growth, rather than competing solely on price and basic functionality (Figure 1).

Figure 1: Advantages of consolidation in the FPA ecosystem

Consolidation is paving the way for market differentiation and a lower cost of ownership for FPA manufacturers

Players in the FPA ecosystem are using consolidation to meet specific customer needs and thereby achieve specialisation and differentiation. For example, maritime customers need durable, reliable FPAs for harsh conditions. Aviation customers require lightweight, low-profile designs for easy integration. Defence customers need high-gain, secure FPAs for contested environments. Manufacturers that are able to address these customers’ unique needs have a strong differentiator to set them apart from competitors.

Some FPA manufacturers are also collaborating to address the growing demand for multi-band, multi-orbit FPAs for seamless connectivity across various satellite networks is also growing. Indeed, Kymeta acquired Lepton to expand into satellite communications services and ThinKom partnered with Panasonic Avionics to offer in-flight connectivity (IFC).

FPA manufacturers are continually striving to lower the total cost of ownership (TCO) by emphasising long-term cost efficiency and value. This is causing manufacturers to develop products that are more durable and reliable and that require less maintenance and replacement. FPA manufacturers can merge with, or acquire, other firms to streamline operations, integrate advanced technologies and optimise supply chains, thereby ultimately leading to lower unit costs.

FPA manufacturers are pursuing consolidation to expand into new market segments

FPA manufacturers can also use consolidation to expand into new market segments. Indeed, some FPA manufacturers are pooling resources and expertise in order to ramp up production and meet the growing demand for their products. This increased capacity will allow them to take on larger projects, enter new markets and serve a broader range of customers.

For example, Gilat is poised to acquire Stellar Blu as part of its IFC growth strategy. The combined strengths of Gilat and Stellar Blu are expected to drive innovation and accelerate the adoption of advanced FPA solutions in the IFC market, which will ultimately increase Gilat’s market share and competitive advantage.

Thales is also strengthening its offering and positioning within the IFC market by acquiring Cobham Aerospace Communications and Get SAT. The former’s expertise in security and navigation systems and the latter’s specialised multi-beam antennas for satellite communications (satcom) will allow Thales to offer a more comprehensive suite of solutions for aerospace and defence applications, including FPAs.

FPA manufacturers are using acquisitions to gain access to new technologies

FPA manufacturers are also using acquisitions to gain access to new technologies. For example, Qorvo has acquired Anokiwave in order to improve its frontend portfolio. Qorvo will gain access to Anokiwave’s advanced mmWave solutions, thereby strengthening its offerings for defence, aerospace and satcom applications.

The acquisition of Ball Aerospace will deepen BAE Systems’s relationship with NASA, a key Ball Aerospace customer, and will boost its command, control, communications, computers, intelligence, surveillance and reconnaissance (‘C4ISR’). The deal will also strengthen BAE Systems’s foothold in the US defence landscape and will position the company to capitalise on the expected increase in demand for missiles and munitions.

FPA manufacturers can also use mergers and acquisitions to offer end-to-end solutions that combine hardware and software capabilities. This enhances the overall value proposition of FPAs and will enable players to penetrate niche markets and unlock new use cases that were previously inaccessible due to technical or logistical constraints.

Article (PDF)

DownloadAuthor

Luke Wyles

Analyst, expert in space and satelliteRelated items

Forecast report

Military commercial satellite communication: trends and forecasts 2024–2034

Article

D2D services must balance capabilities, expectations and willingness to pay

Predictions

Predictions for the space industry in 2026