FPA manufacturers must balance product performance with production costs

Flat-panel antenna (FPA) manufacturers need to consider both cost and performance when developing new products in order to stand out in the market. Investing in cutting-edge FPA solutions, though initially expensive, ultimately leads to superior performance, reduces long-term costs and results in overall market success. Navigating this balance requires foresight, innovation and a commitment to quality. Manufacturers will need to tailor their products to meet the unique needs of multiple use cases including high-speed broadband connectivity, low-Earth orbit (LEO) constellations and enterprise, military and mobility applications.

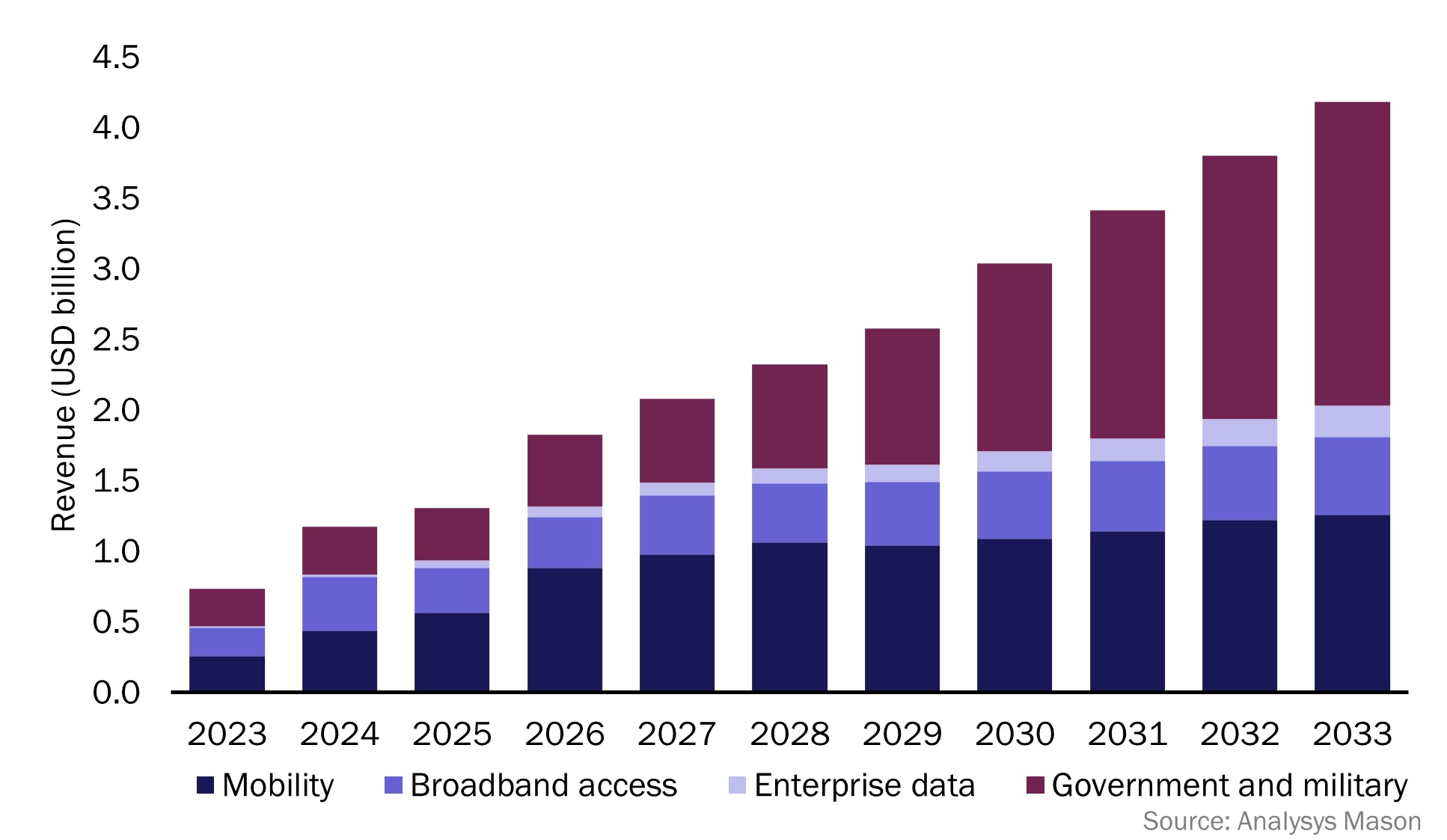

The flat-panel antenna (FPA) market has been characterised by rapid growth and technological advances for the past 10 years. Analysys Mason’s Flat-panel satellite antennas: trends and forecasts 2023–2033 predicts that this growth will continue and that the cumulative revenue opportunity in the FPA market will reach USD26.5 billion by 2033 (Figure 1).

Figure 1: FPA equipment revenue, by segment, worldwide

FPA manufacturers are struggling to balance product performance with manufacturing costs

The ever-changing landscape of customer demand for FPAs adds a layer of complexity to manufacturers’ processes, thereby making it crucial that they stay agile and responsive. Procuring essential components can also prove to be a daunting task, given the specialised nature of the industry.

Product performance has a significant impact on the adoption of FPAs. FPAs offer advantages over existing infrastructure such as compact form factors and agility across orbits, but achieving robust signal isolation and seamless handovers requires sophisticated engineering.

Manufacturing costs and product performance are complex attributes to balance, which has prevented the widespread adoption of FPAs in the mass market. Pricing pressure caused by intense market competition, customers’ demands and high manufacturing costs also creates challenges for manufacturers.

There are many barriers to the adoption of FPAs

The significant investment in, and proven reliability of, existing infrastructure such as parabolic antennas has created a barrier to the adoption of FPAs. FPAs must demonstrate clear advantages in terms of performance, cost-effectiveness and reliability to gain market traction.

Manufacturers face difficulties in scaling up production due to the complexity of manufacturing processes, supply chain constraints, ongoing research and development, cost considerations and the dynamic nature of the market. The technical and integration-related challenges associated with FPAs have furthered slowed down their market penetration, despite their ability to address the demand for low-profile, lightweight and agile connectivity solutions for dynamic environments.

Stiff competition in the satellite communication (satcom) market also hinders the widespread adoption of FPAs because it creates a complex landscape for consumers and businesses to navigate. The abundance of choices with varying performance levels and price points can make it difficult for potential users to identify the most suitable solution for their needs, thereby leading to price pressure and thin profit margins.

FPA manufacturers must optimise their products for performance and affordability

FPA manufacturers should focus on achieving consistent and reliable high-speed connectivity while maintaining a low-profile and robust design. This requires agile beam steering, fast acquisition and tracking algorithms, multi-orbit support, robust design, efficient power management and scalability. These elements drive up production costs, thereby making it impractical to offer high-performance FPAs as cheaply as existing solutions. Manufacturers can strive for a balance between performance and affordability, but they must acknowledge that superior gain, wider bandwidths and advanced features such as beamforming necessitate greater investment.

FPA manufacturers should take a holistic approach to cost, and should focus on the total cost of ownership (TCO) rather than just the upfront price. A slightly higher initial cost for a more efficient antenna might seem less appealing, but it can lead to significant savings over time due to a reduction in capacity lease fees, especially for high-bandwidth applications. Optimising the antenna cost at the expense of efficiency might be a more strategic choice for low-bandwidth applications because the potential savings on capacity leases would be minimal.

Manufacturers must also futureproof their solutions. The dynamic nature of the FPA landscape demands that products are designed with the capacity to support future updates and standards (such as extra operating frequency bands) to ensure longevity and relevance in the market. FPA market growth will be significant during the next 10 years, so there is a great opportunity for manufacturers who can develop, manufacture and certify futureproofed terminals at a reasonable price.

FPA manufacturers must use the cost reduction methods that have been implemented in the manufacture of Wi-Fi, solar panels and other similar technology to reach consumer price points. Applying the principles of rapid innovation, miniaturisation and the use of standardised components can enable FPA manufacturers to reduce production costs while maintaining or improving performance.

Article (PDF)

DownloadAuthor

Luke Wyles

Analyst, expert in space and satelliteRelated items

Tracker

Starlink's maritime broadband plans and pricing tracker 4Q 2024

Article

New entrants can thrive in the optical communications terminal market, but there are challenges

Case studies report

Chinese satellite constellations: case studies and analysis