FPA’s Time to Cross the “Valley of Death”?

There is no secret that ‘times are hard’. Today is especially hard for early-stage pre-revenue technology ventures. The satellite communications sector has seen LEO constellations come into and out of viability as funding runs out. It should therefore be no surprise that one of their other ‘key enabling technologies’ Flat Panel Antenna (FPA) ventures are starting to hit a similar stage in their development cycle. Following an already hard past few years due to COVID-19 pushing supply-chains to the breaking point, FPA manufacturers could have some bright spots ahead as more LEO networks are launched and end-users start placing a premium on terminal flexibility in markets such as Aero or Gov/Mil. This however, all assumes they survive the next 18 months.

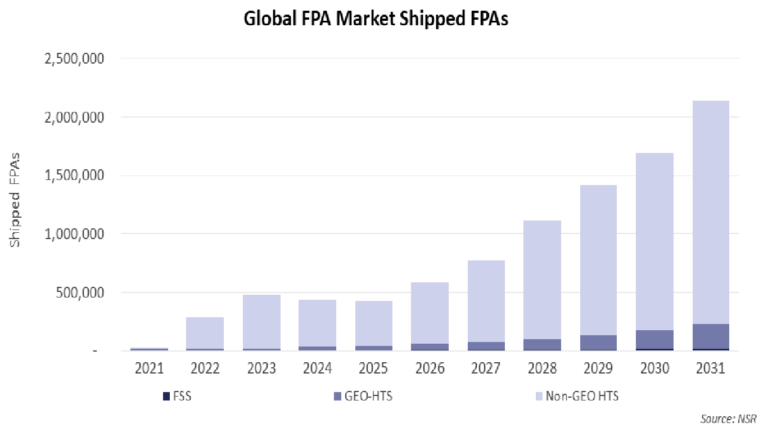

The FPA market will ship more than 2 million units a year by 2031 according to NSR’s Flat Panel Antenna, 7th Edition market study. Most of those will be for Starlink. With the ‘volume play’ tied closely into a closed ecosystem of satellite + modem + antenna, a diverse ecosystem of manufacturers will be looking at the rest of the market opportunities. Already, NSR is seeing a high/low strategy emerging within the market. Manufacturers are either building technology that has the potential to scale to extremely low-price points (given sufficient volume) or bringing exquisite technology priced at the upper echelons of the satellite communications market.

Looking under the curve, enterprise and consumer broadband terminal shipments in 2031 will account for 2 million by themselves. These terminals face a compounded pressure of the “Starlink threat” from a connectivity perspective as well as CPE pricing pressures. While there are very high-end echelons within the enterprise segment (think oil and gas, backhaul, mining, etc.), the rest of the market cannot provide the volumes truly required to bring a low-cost terminal into the market amongst a large number of (viable) manufacturers. In short, while there is likely enough ‘low end’ opportunity for a few manufacturers to build out a true volume business, it likely cannot support dozens of players in building out a volume-based business strategy.

Instead, that means manufacturers must launch technology focused on upper to high-end price points. Those market segments are largely aeronautical, government and military, and some maritime vessels. Of those, the size of the market shrinks significantly. While markets such as maritime do have the potential to reach ‘millions of vessels’ should every pontoon boat, dingy, or small fishing boat suddenly require satellite connectivity – those solutions are likely to be better served with some flavor of a closed-ecosystem solution whereby terminal prices and service prices can be offset with each other. Government and military customers are a wildcard, where hundreds of thousands of land-vehicles, aircraft (piloted vs. unpiloted, fixed-wing or rotorcraft), and maritime vessels could be connected for the ‘right price’. Yet, even there domestic content requirements and other procurement barriers typically associated with high technology products are likely to significantly limit the amount of market penetration of any one manufacturer – again, pushing manufacturers into a dilemma of high-end segments with high-end prices (that usually don’t scale down the price-point ladder well).

As such, NSR’s 7th Edition study highlighted a few key observations:

- End-users have not picked an approach or solution for terminal architectures. While Starlink’s Dishy-series is the ‘most commercially ubiquitous FPA’ in the industry, it does not provide multi-band or multi-orbit capabilities.

- Other vendors are approaching the market with an ‘open ecosystem’ approach – Ultimately there is likely enough room for ‘everyone’, should cost of production, R&D and other determinants of success be solved.

- While they are all solving some unique set of needs, the market will likely require some external force to either rationalize the number of players or a demand-stimulating event.

These observations are not new – throughout the satellite sector ‘mass market’ solutions pivot to high-end niches, and FPAs are largely no different. What is different is that macroeconomic headwinds are making funding difficult. Business headwinds are helping to pick winners and losers as an outside force acting upon the sector. Over the next 18 months, FPA manufacturers that have not moved into early stages of production will have an increasingly difficult time finding a place (and funding) in this fast-moving market.

The Bottom Line

Knowing your customer is key for FPA manufacturers. Understanding the size of your niche is even more important. Moving from R&D to productivity will be where the market picks winners and losers. Bottom line, the FPA market is being pushed into venturing through the valley of death as funding for ‘interesting ideas’ cools and pivots towards profitable/practical ventures.

Author

Luke Wyles

Analyst, expert in space and satelliteRelated items

Tracker

Satellite consumer D2D news and deals tracker 2024–2025

Tracker

Consumer and enterprise broadband via satellite news and deals tracker 2024–2025

Report

Analysys Mason research and insights topics for 2026