FTTR may appease the QoE concerns that consumers have about carriers’ gigabit services

This article was commissioned by Huawei. Analysys Mason does not endorse any of the vendor’s products or services.

More than half of the world’s premises are now passed by FTTP infrastructure. As fibre becomes ubiquitous, price competition will inevitably intensify. Carriers must ensure that they do not compete purely on the price of their services because this will eventually squeeze their margins. Accordingly, they must find new business opportunities that can take advantage of changing consumer behaviour and expectations.

Potentially, they can generate more value by satisfying the demands of early-majority users of latency- and bandwidth-sensitive applications such as augmented reality (AR) and virtual reality (VR) (collectively referred to as extended reality, XR) and gaming. Analysys Mason’s recent research reveals that users are concerned about QoE because their in-home connectivity is failing to keep pace with the high-performance broadband that carriers provide to their optical network terminals (ONTs). Fibre-to-the-room (FTTR) technology could be used to help to resolve this bottleneck and maintain differentiation for carriers.

Increased engagement with digital gaming and interest in AR/VR are driving demand for ultrafast broadband speeds

Connectivity reached an important turning point in 2022: for the first time, more than half of the world’s premises were passed by FTTP access infrastructure. Two thirds of premises worldwide will be covered by wired infrastructure that is capable of delivering at least 1Gbit/s downstream by 2028. Coverage is even further developed in Western Europe, boosted by cable services: Analysys Mason expects 80% of households to be passed by Gigabit-capable access infrastructure by the end of 2023. The EU is aiming to cover 100% of households with very high-capacity networks (VHCNs) (effectively gigabit-capable) by 2030. We expect 90% coverage to have been achieved by 2028. Nearly all of the premises passed by gigabit-capable/upgradable access networks will have access to full fibre FTTP by 2028.

As FTTP coverage increases, many consumers will have access to gigabit-capable broadband from multiple service providers (although overbuild might limit the number of infrastructure providers). As a result, operators will not be able to differentiate simply by offering FTTP services because access on its own will become increasingly commoditised. Indeed, this is already the case in countries such as Italy, where a healthy wholesale market for FTTP is making it harder for operators to differentiate their retail propositions. In such a situation, differentiation becomes more dependent on factors such as in-home connectivity performance: over time we expect another shift in broadband retail strategy away from tiering on last-mile connectivity and towards in-home service quality.

This aligns with changing consumer behaviour and the use of applications that require high bandwidths and low latencies. Analysys Mason’s survey of 18 000 consumers worldwide noted that engagement with cloud gaming and interest in XR technologies are increasing, both of which will put further demands on in-home connectivity.

Cloud gaming is a nascent technology used by a growing number of early adopters: 7% of respondents to our survey used cloud gaming services in 3Q 2023, up from 6% in 2022. However, beyond the 7% of consumers that currently use cloud gaming services, a further 7% state that they know what cloud gaming services are and that they plan to use them in the future. These consumers can be considered the ‘next cohort’ of cloud gaming users. Once this group has subscribed to services, then penetration among adults aged 44 or under will be well beyond the ‘early adoption phase’ and services will have entered the mainstream; it is likely that 20% of consumers could be using cloud gaming services at this point. Cloud gamers are willing to pay extra for their connectivity; results from our 2022 survey show that their fixed broadband spend was 14% (USD6) higher than the market average, and their mobile spend was 38% (USD13) higher on average. This makes them an important audience for carriers.

Similarly, the increased availability of XR devices, in particular following the announcement of the Apple Vision Pro headset in 2023, may act as a catalyst that propels the development of AR, VR and metaverse applications and expedites mass-market adoption. Over the next 2 years, Apple’s XR proposition will undergo significant evolution, with in-home connectivity playing a crucial role in shaping the user experience. According to our survey, 15% of consumers in 2023 were very interested in purchasing an XR headset in the next 2 years with a further 27% expressing some interest: Apple and others may convince them.

The first generation of Apple Vision Pro is restricted to on-device rendering. This iteration is not a mass-market device, but its successors may be. We expect that rendering for this and allied devices will transition to edge/cloud locations in future and this will lead to rapid growth in network traffic. Despite local rendering, the Vision Pro will have an impact on network traffic nonetheless, which will increase the demand for 4K+-per-eye video content. The device’s ability to record ‘3D spatial videos’ will also prove popular and will inevitably generate large amounts of traffic. Furthermore, as more social and gaming applications are released for XR devices, the demand for lower-latency connectivity technologies will increase.

Improved fixed broadband performance is directly proportional to customer satisfaction and QoE

Changing consumer demands are already creating a bottleneck, particularly among gamers, who account for the majority of consumers. Gamers appear to be more sensitive to, and more well-informed about, quality-of-service metrics than other consumers (that is, their broadband speed, latency, reliability and frame rate). This awareness is potentially monetisable not only through upsell to higher-speed service tiers, but also by offering these customers improved home connectivity features such as providing dedicated gaming ports on routers, faster and more-reliable connectivity throughout their home and through improved latency policy management.

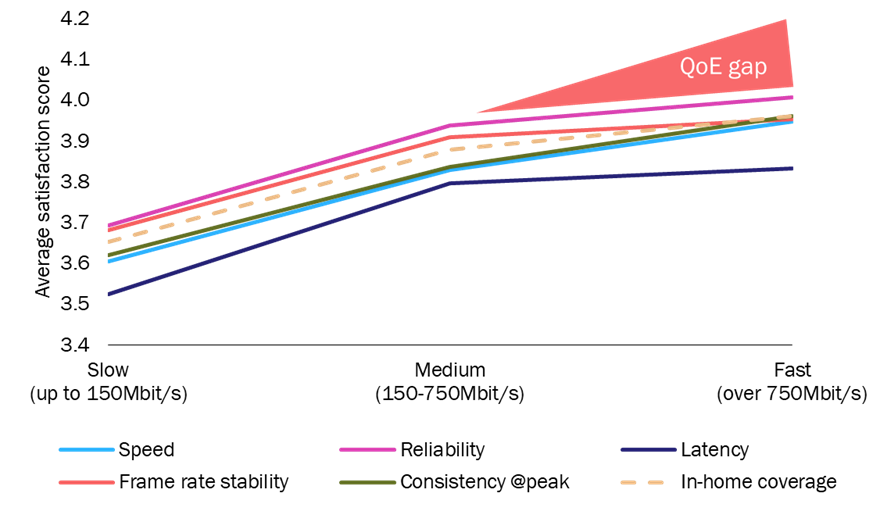

This opportunity is clear; according to our survey, consumer satisfaction with latency, reliability and frame rate stability is not keeping pace with speed and peak-hours performance satisfaction as consumers migrate to higher-speed services (Figure 1).

The average speed satisfaction score increases consistently from 3.6 among respondents with slow speeds to 3.8 among those with medium speeds and 4.0 among those with fast speeds. Conversely, satisfaction with reliability (3.7 (slow), 3.9 (medium) and 4.0 (fast)) and latency (3.5 (slow), 3.8 (medium), 3.8 (fast)) did not increase quite as linearly. This suggests that reliability and latency improvements are not keeping pace with the increased throughput that fibre has enabled. This may indicate that new customer premises equipment (CPE) is required to optimise latency and reliability and support future applications such as higher-fidelity cloud gaming and AR/VR/metaverse-type applications.

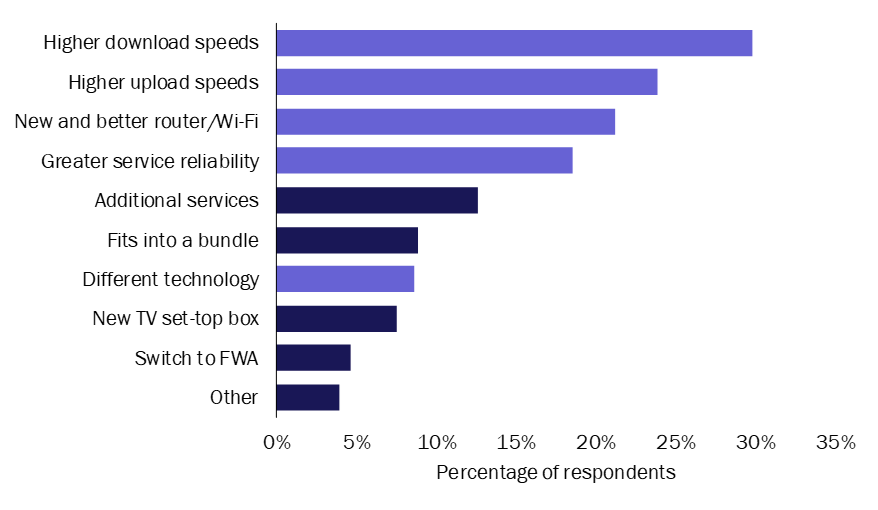

Indeed, customers are explicitly demanding improved home connectivity. Data from our 2023 consumer survey shows that, after price, the four most-important issues that customers consider when changing broadband plans all relate to in-home connectivity (Figure 2). This is a marked shift from 2020. Consumers are now placing greater value on service components such as reliability and new and better Wi-Fi routers than in previous years.

These changes will create opportunities for fixed broadband operators that can provide in-home network connectivity that caters to customers’ heightened expectations. Over the next 5 years, these expectations are only likely to increase as AI-enabled smart home services become more commonplace. Furthermore, local computing and storage demands are likely to increase – one possible way to satisfy this need may be for consumers to use more home cloud storage and on-premises edge compute, especially if XR applications particularly flourish in that timeframe and the vendors of headsets choose to move processing off the device in order to reduce headset weight, heat and cost restrictions.

FTTR, where fibre is extended into individual rooms within a property and then subscribers connect to multiple Wi-Fi access points, is one way in which operators can improve in-home connectivity. FTTR promises to offer superior quality compared to many existing wired in-home networks, such as those using Ethernet or coaxial cabling (although the Multimedia over Coax Alliance (MoCA) may also have a role to play in countries where hybrid fibre-coax (HFC) is already installed in several rooms).

FTTR can build on and enhance existing multi-Wi-Fi access point solutions

Some operators in Europe have now sold their multi-Wi-Fi access point solutions to as much as 80% of their retail subscriber bases; this shows the strong demand for improved in-home connectivity and, indeed, a regression analysis of which factors most affected Net Promotor Scores (NPSs) in Analysys Mason’s 2022 consumer survey of fixed broadband users identified the presence Wi-Fi mesh hardware as one of the most significant factors to improve customer satisfaction. FTTR is one logical progression towards improving customer satisfaction and offsetting the underperformance of QoE identified in Figure 1. FTTR deployments hold the promise of providing a premium experience that can enhance operators’ existing offers that are focused on in-home connectivity. There are three main reasons for this are as follows.

- The signal in an FTTR deployment does not need to pass through walls, significantly improving the propagation of higher frequencies and overall throughput.

- FTTR is not affected to the same extent by issues of contention when multiple people compete to use the same frequencies within a multi-dwelling unit (MDU). The same is true about contention within the home: FTTR can support a greater number of connected devices within the home, which is important for supporting smart home applications where sensors and other connected devices become much more common (as is happening in South Korea, for example).

- Traditional Wi-Fi mesh deployments are poor at handing over the connection between access points, which leads to lag and sometimes to dropped connections. FTTR solutions are optimised to avoid this point of failure, which will become increasingly important in XR applications, especially.

Earlier, we referenced how the Apple Vision Pro and further movements into XR and cloud gaming were likely to catalyse demand for low-latency and high-throughput in-home connectivity. The initial release of the Apple Vision Pro in 2024 will not revolutionise the XR market on its own. However, we expect this launch to accelerate more-immersive XR experiences with greater involvement of 3D and MR elements within the next 2 years. Similarly, mass-market pushes into cloud gaming from the likes of Netflix will also put further demands on in-home connectivity. It is not the broadband connection into people’s premises that will limit how these applications are used, but instead, it will be the way that broadband is distributed in-home. Consumers will demand improved in-home connectivity to support these services, and carriers must ensure that they offer full-home, reliable, fast, low-latency connectivity to support them.

The benefits of FTTR solutions are likely to confer a positive brand effect on carriers at a time when consumers are frustrated that price rises are not associated with perceived improvements in services. Indeed, consumers demand faster and more-reliable speeds and services. FTTR could be used to monetise this opportunity in the following ways.

- Offer in-home network speed guarantees. A growing number of fixed broadband operators already offer home Wi-Fi speed or satisfaction guarantees that are tied to the sale of multiple Wi-Fi access point solutions. Satisfaction guarantees mean that customers get their money back if they are not happy with the solution, but they lack tangible additional monetisable benefits. Home Wi-Fi speed guarantees, conversely, do offer consumers an extra benefit that can encourage them to pay more, but so far, these guarantees are only for low speeds. For example, BT’s Complete Wi-Fi proposition in the UK promises speeds of 10Mbit/s in every room of the house. FTTR offers the promise of guarantees for much higher speeds, for which operators could correspondingly charge more. This has significant potential to boost ARPU. For example, BT charges GBP10 (EUR11.7) per month for its Complete Wi-Fi service, which includes mesh Wi-Fi hardware and its speed guarantee, compared to GBP30.99 (EUR36.2) for its entry-level FTTP plan. FTTR offers with guarantees of higher speeds could build on this and could have benefits in ARPU terms.

- Introduce new premium service tiers. Some operators are already tiering their fixed broadband retail tariffs based on features related to in-home network quality in addition to, or instead of, using traditional speed tiering – an approach that we anticipate will become increasingly prevalent in Europe and beyond. For example, Deutsche Telekom tiers its routers according to the features that are included in each device; customers with more advanced hardware pay more. By taking this approach it has also transformed a one-off cost (CPE purchase) into recurrent revenue. Indeed, this strategy of tiering home CPE by the number of features included could be an effective way of raising ARPU without harming customer satisfaction, because consumers are often more willing to accept price increases for improvements in Wi-Fi CPE than direct price rises on fixed broadband connectivity. In this way, it is possible to envisage how FTTR would enable the creation of a new premium tier, which could command a higher price.

- Serve as a basis for new connected home services. Fixed broadband operators that focus on providing a high-quality in-home connectivity experience will be best-placed to capitalise on value-added services that rely on home Wi-Fi networks. Some operators already offer such value-added services when customers buy mesh Wi-Fi hardware. These services include connected home cyber security, where the protection is delivered through the customer’s router, and home Wi-Fi motion detection, where end-user Wi-Fi-enabled devices can be turned into motion sensors. The latter may have applications for home security and assisted living for the elderly.

- Offer premium FTTP installation. One barrier to FTTP take-up is the inconvenience of having fibre installed, which may, for example, require the customer to take time off work. Operators can resolve this challenge by offering additional services as part of a fibre installation. Such services could include the technician connecting end-user devices to the Wi-Fi network or giving advice on the optimal locations to install Wi-Fi hardware. Adding FTTR could further drive FTTP subscriber take-up and is a service for which operators could charge extra. For example, Orange in France already offers a Wi-Fi optimisation service in which technicians visit a property to improve Wi-Fi coverage. Orange’s service costs EUR89, which gives an indication of the potential revenue benefits that could be achieved from FTTP installations that include FTTR installation.

Overall, FTTR appears to be an opportunity worth considering for fixed broadband operators. We expect there to be considerable interest among the operator community.

Article (PDF)

DownloadAuthor

Martin Scott

Research DirectorRelated items

Podcast

What is 'best practice' for broadband customer retention?

Article

KDDI’s results demonstrate the challenges of entering new markets such as energy and finance

Forecast report

Fibre conversion: worldwide trends and forecasts 2024–2030