What opportunities does FTTR bring to telecoms operators?

Fibre-to-the-room (FTTR) technology extends fibre-optic connections directly to individual rooms within a home or building, providing ultra-fast internet access with low latency. This technology enhances Wi-Fi performance and improves the support for high-bandwidth in-home applications. It provides customers with a seamless, high-quality online experience throughout the entire premises.

What is FTTR and how does it work?

Traditional FTTH services terminate the optical fibre at a single point in the home or building. To achieve full Wi-Fi coverage of a home, many customers need to purchase a Wi-Fi mesh system, which includes a main router and multiple nodes placed around the home. Each individual unit communicates with the main router, ensuring comprehensive Wi-Fi coverage throughout the premises.

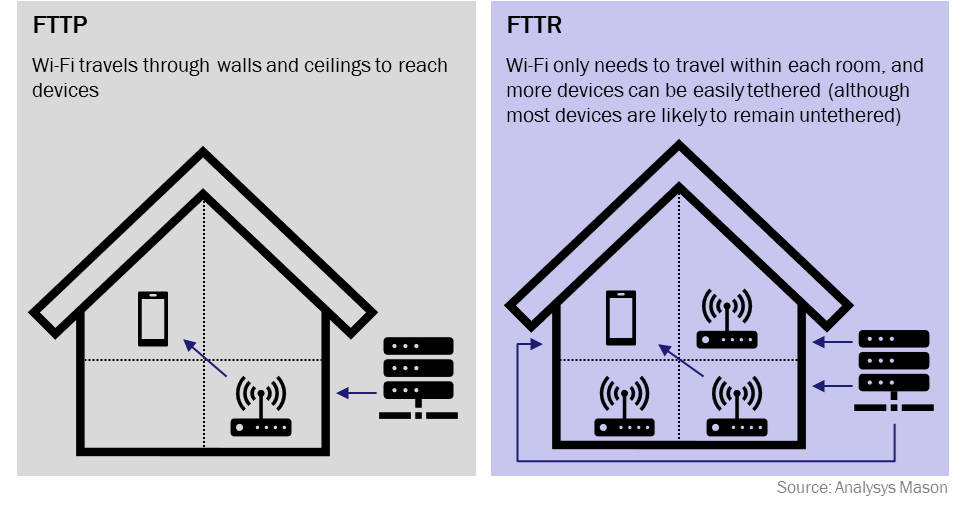

FTTR technology extends this concept by bringing optical fibre directly to each individual room. This approach removes the need for Wi-Fi mesh with remote nodes and offers a premium experience (Figure 1). Here are the three main reasons why FTTR is advantageous.

- Ultra-high-speed network. FTTR is capable of providing symmetrical speeds of up to 10Gbit/s and low latency less than 10ms. Traditional Wi-Fi mesh systems often struggle with handovers between access points, leading to slow network performance and dropped connections when a user moves between rooms. FTTR solutions are optimised to avoid this issue, making them well-suited to supporting high-bandwidth and latency-sensitive activities, such as AR/XR and cloud gaming.

- Higher transmission stability. Unlike traditional in-home connectivity solutions such as Wi-Fi mesh, FTTR is not affected by thick walls, frequency clashes or electromagnetic interference, which ensures more stable and consistent connections. This is important in large homes, apartment complexes with lots of competing Wi-Fi networks and older buildings with thick walls.

- Increased device connections. FTTR supports a significantly greater number of terminal device connections (up to 256), which is eight times the maximum number of connections typically supported by traditional networks. This is important for supporting smart home applications where sensors and other connected devices are becoming much more common.

Figure 1: Comparison of FTTR and FTTP with multiple Wi-Fi access points/Wi-Fi mesh

What revenue opportunities does FTTR bring to telecoms operators?

FTTP is becoming more widely available, with approximately 70% of premises worldwide passed by FTTP access infrastructure as of 2024. Operators will find it increasingly challenging to differentiate themselves because many consumers will have access to gigabit-capable broadband services from multiple services providers (although overbuild might limit the number of infrastructure providers). Indeed, this is already the case in countries such as Italy, where a healthy wholesale market for FTTP is making it harder for operators to differentiate their retail propositions.

In such situations, differentiation becomes more dependent on factors such as in-home connectivity performance: over time, we expect another shift in broadband retail strategy away from tiering on last-mile connectivity and towards in-home service quality. FTTR brings opportunities that can be monetised in the following ways.

- Premium pricing for FTTR. Operators can charge a premium for FTTR, targeting high-spending customers. The service can be bundled with advanced generations of Wi-Fi hardware to justify higher prices.

- In-home network speed guarantees. A growing number of fixed broadband operators offer home Wi-Fi speed or satisfaction guarantees tied to the sale of multiple Wi-Fi access point solutions. Currently, these guarantees are only for low speeds, but FTTR offers the promise of guarantees for much higher speeds, allowing operators to potentially charge more.

- Bundling value-added services with FTTR. Operators that focus on high-quality in-home connectivity can use FTTR upgrades as an opportunity to add more value by offering services such as connected home cyber security and home Wi-Fi motion detection.

- Premium FTTR installation. Operators can offer additional services as part of a fibre installation. Such services could include a technician to connect end-user devices to the Wi-Fi network or to advise on the optimal locations to install Wi-Fi hardware.

- Partner with real estate developers. In areas where many new flats or houses are being built, operators can partner with real estate developers during the planning and construction phases. This approach would allow early integration of FTTR infrastructure, ensuring optimal placement and reduced installation costs.

Which operators are deploying FTTR?

Huawei and ZTE have been leading the development FTTR technology, collaborating with major Chinese operators (China Mobile, China Telecom and China Unicom) to deploy FTTR across the country. Chinese operators see FTTR as a good opportunity to upsell to their customers, as they have faced challenges in improving revenue growth due to the wide availability of high-speeds fixed broadband. Indeed, in 1H 2024, the household penetration of fixed broadband in China reached 126%, with around 30% of connections on gigabit speeds (1Gbit/s or higher). ARPU increased by less than 1% year-on-year in 1H 2024.1

The adoption of FTTR outside China is mostly at trial phase, limited to countries where the majority of fixed broadband connections are delivered over fibre such as France, Malaysia, Saudi Arabia, Spain and the UAE. One of the primary challenges with large-scale FTTR adoption is the complexity of installation, which typically requires a professional technician visit. In China, operators have been upskilling their workforces through training provided by vendors to stay competitive. On the other hand, in countries with higher labour costs, vendors have tried to promote ‘do-it-yourself (DIY)’ packages, which allow customers to install the services by themselves. This approach can potentially encourage adoption as it avoids the high costs associated with training and installation. However, it is likely to have a negative impact on the user experience if the installation is not done well.

Despite the challenges associated with installation complexity, around 20–30 operators are experimenting with FTTR worldwide. Figure 2 provides some examples of operators’ FTTR deployment, based on publicly available information. This may differ from the actual service the customer receives as FTTR services typically require customisations.

Figure 2: Examples of operators’ FTTR services

| Operator | Country | Monthly price | Service details | Installation fee |

| China Unicom | China | RMB199–399 (USD27–55) |

|

Free installation service by a technician |

| E& | UAE | AED129 (USD35) |

|

Information not available |

| stc | Saudi Arabia | SAR134 (USD36) |

|

Information not available |

| TIME | Malaysia | MRY55–90 (USD12–20) |

|

Information not available |

| Telefónica | Spain | EUR9.9 (USD11) |

|

Information not available |

| ZOEP | France | EUR36.9 (USD39) |

|

EUR120 |

Dongye Liu is a Research Analyst in the Consumer Services team at Analysys Mason. She has worked on a variety of topics, including fixed services, mobile services and fixed–mobile convergence (FMC) services.

Article (PDF)

DownloadAuthor

Dongye Liu

AnalystRelated items

Tracker report

Fixed broadband speed tracker 2Q 2025: trends and analysis

Survey report

Norway: consumer survey

Forecast report

Fixed network data traffic: worldwide trends and forecasts 2024–2030