GenAI winners and losers: the technology could upset the established order in the telecoms industry

09 February 2024 | Research and Insights

Article | PDF (3 pages) | Fixed Services| Mobile Services| SME Services| Video, Gaming and Entertainment| Enterprise Services| Fixed–Mobile Convergence | AI

Analysys Mason has developed three scenarios to explore the impact of generative artificial intelligence (GenAI) on the telecoms industry, as discussed in a previous article and podcast. This article explores the winners and losers in each scenario.

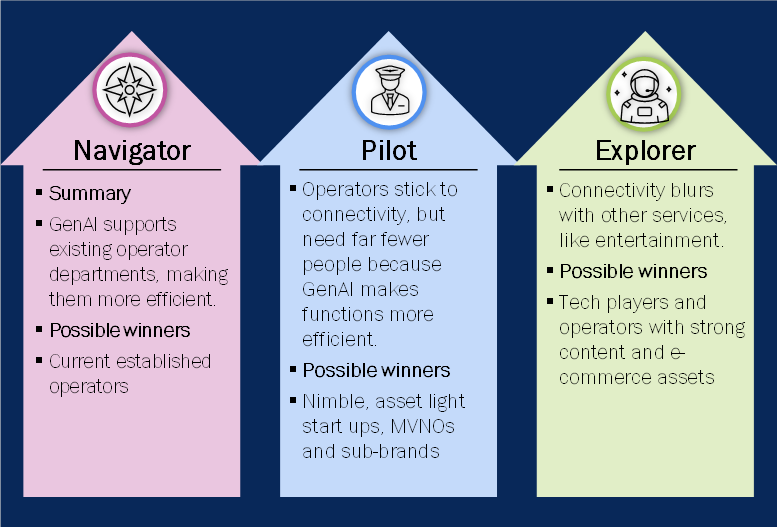

The first scenario, Navigator, is the most promising for established telecoms operators because it is the least disruptive. The second scenario, Pilot, is more disruptive and will favour lean service providers that do not have the baggage of legacy operations. Asset-light start-ups are likely to do well. The third, Explorer, will favour companies that have a wide range of services beyond telecoms connectivity. This will favour some of today’s service providers, but others will struggle.

Figure 1: Possible winners in the three scenarios for GenAI

Source: Analysys Mason

An individual company will not be able to dictate which scenario emerges; each will have to adapt to the market conditions they find. The most successful will be those that best adapt to these fluid conditions. Responses are likely to include a mix of asset acquisition (and sales), repositioning (either through the main brand or with sub-brands) and exploring new operating models.

The Navigator scenario is the most reassuring scenario for operators, but revenue may be hit

In the Navigator scenario, GenAI will become an extremely useful tool to support telecoms operators with their existing tasks. Increased productivity means that the same jobs can be done with fewer people. It is not, though, a radical scenario. The shape of an operator will be similar to that of today, and the structure of the industry will largely unchanged; the same brands will dominate and continue to operate networks and services divisions.

This may be reassuring for large established players, but the implications could be significant nonetheless. Increased efficiency will help to reduce costs, but with limited differentiation between players, low switching costs for consumers and a highly competitive market, lower costs are likely to ultimately result in lower prices. GenAI is likely to be deflationary and the total size of the telecoms market will shrink.

Pilot is a radical scenario; established players will be threatened by nimble start-ups

In the Pilot scenario, developments in GenAI technology are more revolutionary. The activities of many teams within an operator will be partially or completely carried out by GenAI-powered solutions. The obvious example would be in customer service and care, but marketing, sales, legal and other areas would be significantly affected.

In our Pilot scenario, regulators restrict the extent to which retail service providers can combine different services, limiting the capacity for operators to differentiate through new, innovative bundles of adjacent products like TV or IT services. Instead, operators are forced to compete on a narrow set of services. The scenario also helps to accelerate the delayering of the sector – network assets are owned by wholesale companies that sell to a range of retail service providers.

Established retail service providers are threatened in this scenario. The traditional assets used to defend their business (such as network and spectrum) are no longer relevant as all players access the same wholesale networks.

Instead, competition will be based on price more than ever, with operators that adopt GenAI technology the fastest benefiting from the lowest cost base. Today’s operators, with their legacy operations (and possibly a customer base that expects traditional service and support through shops and call centres) may find themselves at a disadvantage. Instead, nimble asset-light operators, including MVNOs and potentially operator sub-brands, as well as start-ups, may be well-positioned.

As with the Navigator scenario, the emphasis on lower costs and the lack of differentiation between offers will put pressure on prices, and, potentially result in reduced total industry revenue.

The Explorer scenario will provide opportunities for some operators, but will threaten most

In our final scenario, Explorer, GenAI technology is extremely advanced and many functional areas of a telecoms operator will be automated. We also see the accelerated delayering of telecoms into networks and services companies. However, there are no restrictions in this scenario on bundling different services, often powered by AI recommendations.

Some of today’s operators will benefit from this scenario and use it to support their ambitions of becoming a ‘super-app’, offering telecoms connectivity alongside other products (TV, music, games, payments and so on in the consumer space; cloud, security and other IT services in the business space).

However, in many countries, other technology companies will be better placed to add telecoms connectivity to their bundles than telecoms operators are to do the reverse. Amazon could add connectivity into its monthly Prime offering, for example.

One of the main barriers to these technology companies entering the telecoms market – the need to offer local customer sales and support – will disappear if GenAI can largely remove the need for heavily staffed contact centres. Today’s established operators risk losing out to global technology companies.

The impact on the total industry size could be more positive in this scenario, because there is less pressure on connectivity and service providers are able to do more to differentiate their offers and limit churn.

Operators need to consider how to respond to the wide-ranging impact of GenAI

Telecoms operators are already experimenting with GenAI, at least on a limited basis. These projects give them some exposure to the potential of GenAI for individual areas. They should also be considering their response to the more radical impact of GenAI, perhaps experimenting with different types of customer support through existing sub-brands, or by considering the potential impact of GenAI on any possible acquisitions.

We will continue to explore operator responses to GenAI in our future research.

Author

Tom Rebbeck

Partner, expert in TMT consumer and business servicesRelated items

Predictions

GPUaaS revenue will quadruple in the next 5 years, powering new data-centre investment opportunities

Predictions

Businesses will discover that AI can become kryptonite if they do not grasp how to wield this superpower

Predictions

AI adoption is surging, but <25% of portfolio companies’ AI tools will fully succeed in 2026