Scenarios for GenAI and telecoms in 2033

07 November 2023 | Research

Article | PDF (4 pages) | Fixed Services| Mobile Services| SME Services| AI and Data Platforms| Video, Gaming and Entertainment| Enterprise Services

Generative artificial intelligence (GenAI) could be used by almost all (if not all) departments within an operator’s business, and the effects could be far-reaching. Rather than try to predict what will happen (an impossible task at this point), Analysys Mason has developed three scenarios to help telecoms operators and vendors understand how GenAI may impact the telecoms sector by 2033, and to help them to plan for these changes now (see our recent report GenAI and the telecoms sector: three scenarios for 2033 for more-detailed information).

Much of the focus on GenAI and telecoms has been on how service agents within customer services teams could be replaced by GenAI-powered chatbots. Even using GenAI to support customer service teams now can have a massive affect – one recent study indicates that productivity could increase by 14%.1 The potential ramifications go far beyond this context, with GenAI potentially affecting areas such as regulation, service offerings, industry structure and associated value chain, employment and skills.

Many large telecoms operators are already experimenting with GenAI, but mostly for relatively narrow internal use cases

Operators’ engagement with GenAI (see Figure 1) has, to date, been mostly limited to internally focused applications (for example, meetings summaries). Few operators are yet to embrace its broader applications, including for customer-facing activities.

The most ambitious of these operators is SK Telecom, which has launched internal GenAI projects, has invested in Anthropic and is developing a telecoms-specific version of Claude, Anthropic’s AI model. SK Telecom’s experiments point to the longer-term use of the technology in both generic areas of a business (such as finance and legal) but also telecoms-specific areas (such as customer service and networks).

Figure 1: Examples of operators using GenAI

| Operator | Use of GenAI | |

|---|---|---|

|

AT&T |

|

AT&T is working with Microsoft to develop ‘Ask AT&T’ to work on internal use cases, such as coding/software development and to translate documentation from English. AT&T is also exploring network optimisation, upgrading legacy code and customer service.2 |

|

BT |

|

BT is mostly focused on internal use cases around customer experience, new/enhanced products and services and increased productivity in operations. AI was mentioned in relation to BT’s planned 55 000 jobs reduction, potentially replacing 10 000 people.3 |

|

Charter Communications |

|

Charter’s ad sales business, Spectrum Reach, has a GenAI-supported offering to allow local businesses to produce TV adverts cheaply.4 |

|

Comcast |

|

GenAI is the theme for Comcast’s 2023 intake of companies into its start-up mentoring programme, LIFT Labs. All participating companies secured a partnership or commercial deal with Comcast or its subsidiaries.5 |

|

SK Telecom |

|

The company uses ChatGPT and its own large language model (LLM), which can be used by clients as part of its ‘A dot’ customer services app. It invested USD100 million in Anthropic, which will build an LLM that is customised for telecoms operators. SK Telekom is a founding member of the Global Telco AI Alliance operator group (alongside Deutsche Telekom, e& and Singtel).6, 7 |

Source: Analysys Mason

GenAI’s impact will be felt beyond individual departments

Operators’ experiments with GenAI should not be developed in isolation: new products developed with the support of GenAI will affect sales, marketing and support teams. A change in role and reduction in the number of call centre staff will also impact human resources teams, and so on.

GenAI could also change the broader industry structure. The affect, in terms of jobs, is most likely to be felt in the services divisions of operators, with reductions in employment of staff for customer services, sales and marketing activities. The changes felt by the networks team will not be as profound; physical infrastructure will still need to be built and maintained by relatively large teams. This could result in a larger number of lean, highly competitive service providers and a relatively small number of wholesale network operators. The logic of vertically integrated operators, already under pressure, may give way to a new structure.

Regulation will also have a bearing on the extent to which GenAI can be used by the telecoms sector. The White House’s ‘Blueprint for an AI Bill of Rights’ puts forward the principle that customers should be able to ‘opt out [of interacting with AI], where appropriate.’ Rules along these lines could limit how GenAI is implemented. The telecoms sector could evolve along different regional paths if rules are only introduced in some places.

We created three scenarios to explore how GenAI may be used in the telecoms sector by 2033

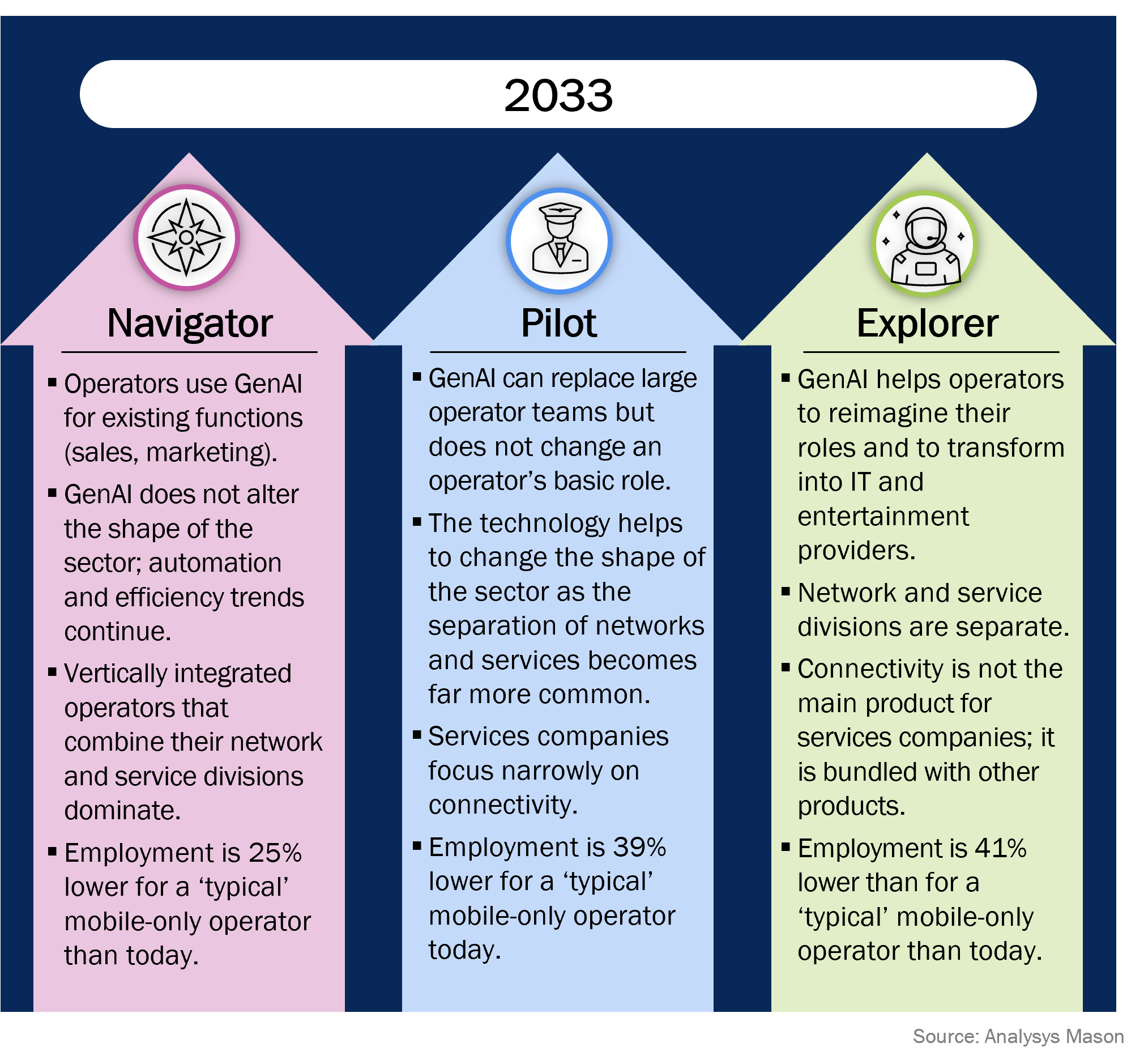

These and other issues are explored in our three GenAI scenarios: Navigator, Pilot and Explorer (see Figure 2, as well our report GenAI and the telecoms sector: three scenarios for 2033).

Figure 2: Summary of the three potential GenAI scenarios in 2033 developed by Analysys Mason

- ‘Navigator’ scenario. In this scenario, the technology supports existing processes and teams but does not replace them. Automation and efficiency trends continue but there is no radical transformation to the shape of the sector. For telecoms operators, this is perhaps the most reassuring scenario because it is similar to the current organisation. However, even in this relatively mild scenario, the industry will support thousands of fewer jobs.

- ‘Pilot’ scenario. GenAI becomes more powerful and plays a more active role, performing tasks currently performed by people. Operators mostly concentrate on connectivity, partly due to regulation that restricts how they can use customer data. Operators need fewer people because GenAI makes functions more efficient. The industry structure changes: in most countries, there is a split between network operators and service providers. This scenario is a logical, if extreme, continuation of current trends. The focus is on the increased use of automation and the reduction of costs to provide a highly efficient connectivity provider; not all that different from the implicit (if not the stated) strategy for many operators today.

- ‘Explorer’ scenario. GenAI helps operators to reimagine their roles and to transform into IT and entertainment providers. Regulation does not restrict how data is used, allowing service providers to package connectivity alongside other products. This scenario involves the radical transformation of the telecoms sector and its value chain, especially at the service layer, and it would have far-reaching implications for operators.

Our scenarios are an initial attempt to consider the potential impact of GenAI beyond limited use cases. Operators should also be considering the broader implications of GenAI for aspects such as the industry’s value chain and operators’ roles within it.

Please also see our associated podcast The impact of GenAI on the telecoms sector for further insight.

1 National Bureau of Economic Research (April 2023), Generative AI at Work.

2 AT&T (20 June 2023), Ask AT&T – AT&T’s new Generative AI Tool Will Help Employees Be More Effective, Creative, and Innovative.

3 Inform (19 July 2023), BT Group’s Digital unit accelerates AI use cases and navigates GenAI.

4 Charter Communications (23 February 2023), Spectrum Reach and Waymark Introduce Artificial Intelligence (AI) Generated Platform That Can Produce High-Quality TV Commercials With Voice-Over Capabilities in Minutes.

5 Comcast NBCUniversal (2023), LIFT Labs Accelerator: Enterprise AI.

6 SK Telekom (30 June 2023), SKT Evolves A. into a Smarter Conversational AI.

7 Informa Light Reading (4 August 2023), Google and Microsoft loom large in Vodafone’s gen AI plans.

Article (PDF)

DownloadAuthor

Tom Rebbeck

Partner, expert in TMT consumer and business servicesRelated items

Article

A move away from inflation-linked broadband pricing in the UK may actually accelerate ARPU growth

Case studies report

Optimising the operator TV opportunity: case studies and analysis (volume II)

Strategy report

Understanding AI agents in the telecoms industry