GEO satellite communications market players must pivot or perish

21 January 2025 | Research and Insights

Article | PDF (4 pages) | Space Infrastructure

Is the geostationary Earth orbit (GEO) communications satellite market dying? The question may sound provocative but market activity could lead observers to conclude that the answer is “yes”. Non-GEO constellations such as Starlink, Europe’s Iris2, and Amazon Kuiper continue to make positive headlines, while recent news from the GEO market has been quite negative: Intelsat’s IS-33e satellite shattered to pieces, which will probably have a negative impact on Indonesia’s upcoming satellite launch and the Australian Department of Defence has backed out of a USD5 billion GEO satellite programme with Lockheed Martin.

GEO communications satellite orders have dropped significantly in recent years, posing a threat to the manufacturing market

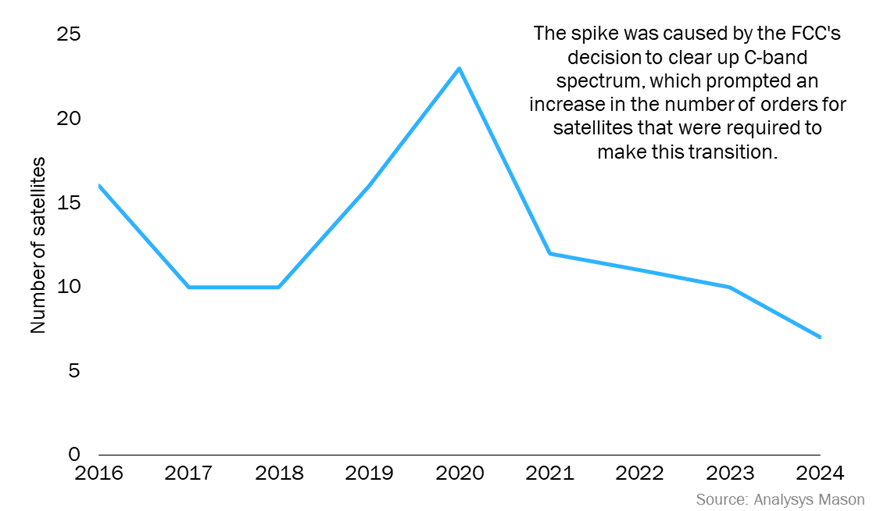

As constellations have become more competitive, GEO satellite orders have decreased (Figure 1). To compensate, satellite manufacturers such as Airbus, Boeing, Lockheed Martin and Thales Alenia Space, began developing software-defined satellites in 2019. These platforms aim to provide greater flexibility and ensure that GEO remains a competitive solution. However, some of these platforms have been delayed, while others have been underutilised, sold as fully flexible but only implemented as partially flexible, as operators have expressed doubts over the full application of the technology.

Furthermore, other manufacturers, such as Astranis and Swissto12, have developed 'small GEO' platforms, in an attempt to offer cost-competitive solutions and bolster the market. These solutions account for most of the GEO orders in the last 2 years, but it has still not been enough to counter the drop in GEO demand.

Figure 1: GEO communications satellite orders, worldwide

The future of the GEO communications market seems to be challenging; only seven GEO satellite orders were placed in 2024, the lowest number since 1994. However, the geostationary orbit provides unique advantages for satellite networks, and established players have a strong partnerships and supply chain processes that support ongoing activity. Moreover, continued demand for satellite–telecoms integration and multi-orbit solutions point to a future in which GEO satellites work in tandem with other architecture to provide more capable and reliable networks.

Satellite operators and manufacturers must work closely to develop strategies that leverage software-defined capabilities and AI, and pivot GEO towards its ultimate future, as the linchpin of satellite communications.

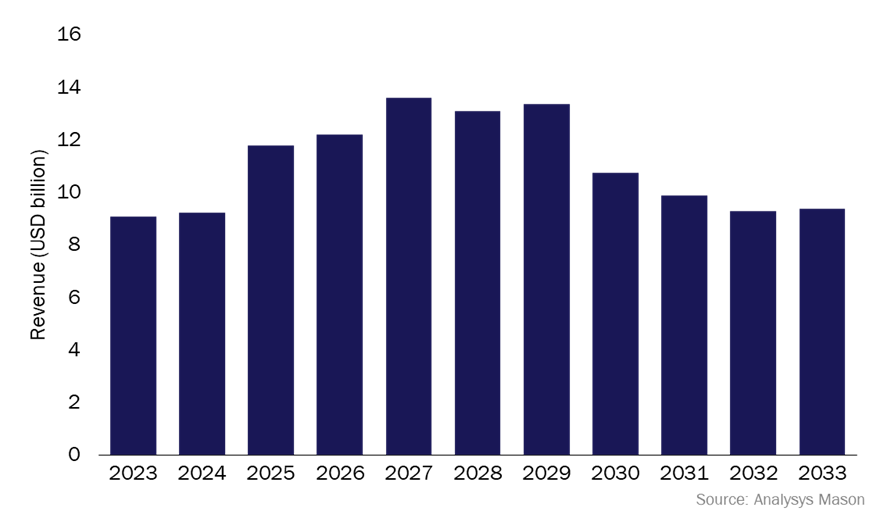

Analysys Mason’s Software-defined satellites: trends and forecasts 2023–2033 report forecasts that over 85% of all satellite communications manufacturing and launch revenue (a cumulative total of USD121.6 billion (Figure 2)) will come from software-defined satellite activity. Software-defined satellites will account for 75% of GEO communications satellite orders during this period.

Figure 2: Software-defined satellite manufacturing and launch revenue, worldwide

The market is currently in an ‘experimentation phase’, hesitating between new platforms and solutions. At the same time, satellite operators are not planning for the long term and are experiencing cancellations, atypical orders and a lack of customer loyalty. However, Analysys Mason expects the number of GEO satellite orders to increase, particularly after this experimentation phase and after 2028. To ensure that GEO maintains its competitive edge, players must align their strategies with the following considerations.

The GEO market cannot be considered separately anymore; GEO satellites are part of the competitive multi-orbit solutions of the future

The future of satellite communications does not rely on a single technology. Constellations have proven to be disruptive and innovative in terms of manufacturing, launch, operations and customer demand, but they have challenges ahead. The economics of constellations, including scaling manufacturing and delivering cost-effective prices, have restrained some player activity here. Many programmes have been delayed, are over-budget or were cancelled due to these challenges, including the need for stronger, more-diverse supply chain management.

GEO manufacturers and operators have had decades of experience to develop their processes, and the multi-casting, fixed positioning, longer-lifetime capabilities of GEO satellites should not be underappreciated.

The satellite communications market will continue to demand more. More capability, faster speed, more cost-efficiency, and so on. Constellations rose from the need to disrupt pricing and offer global coverage, and multi-orbit networks will allow for greater efficiencies, reliability, and bandwidth management. For the next stage, technologies such as machine learning and artificial intelligence will need to be implemented to improve capacity management, respond to changing customer demand and efficiently integrate in-orbit services and software-defined solutions.

GEO players need to change; manufacturing and operations must consider the reasons for rising non-GEO competition

Satellite–telecoms integration is the result of disruption in the satellite market narrowing the gaps between space and the ground. GEO, while powerful, has long been expensive and slow to change. Constellations have allowed operators to proceed in a more consumer-driven fashion, iterating solutions and offerings rapidly. The impact on GEO has been significant, with the solution feeling slow, expensive and low-scale. Some manufacturers have tried to use non-GEO ideas in the GEO market, such as with small GEOs, but changes have not been quick or common enough.

Single, robust GEO satellites will continue to be in demand for some opportunities, but the greater addressable market will be in meeting diverse customer needs. The eventual future of GEO will be a blend of offerings and capabilities that either focus on linchpin satellites that support wider networks, or GEO-placed platforms that are not hindered by traditional GEO manufacturing and launch constraints.

Article (PDF)

DownloadAuthor

Dallas Kasaboski

Principal Analyst, expert in space infrastructureRelated items

Article

D2D services must balance capabilities, expectations and willingness to pay

Predictions

Predictions for the space industry in 2026

Podcast

Military satcom and commercial capacity integration: why secure orchestration matters