New FTTP entrants should prioritise the launch of services that support home Wi-Fi and the connected home

05 November 2021 | Research and Insights

Article | PDF (3 pages) | Fixed Services| Fixed–Mobile Convergence

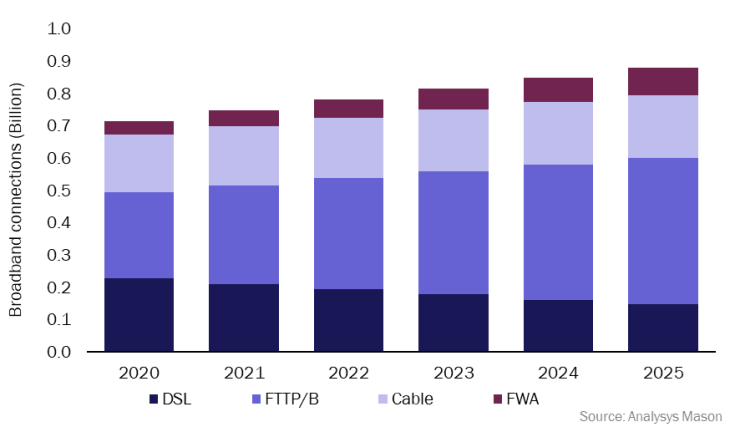

FTTP investment is at very high levels and new fibre entrants are proliferating in markets across the globe. As FTTP investment grows, fibre overbuild is increasing, as is the number of wholesale fibre access connections. These trends make it increasingly difficult for retail ISPs to differentiate on FTTP speeds alone as fibre access becomes standard (see Figure 1). This article assesses the extent to which new FTTP entrants can use services associated with home Wi-Fi and the connected home to differentiate and to accelerate retail subscriber take-up. This topic is covered in further detail by our report Opportunities for operators in the connected home.

Figure 1: Broadband connections by technology, worldwide (excluding China), 2020–2025

Unlike large integrated operators, smaller ISPs may lack the room for differentiation

There are many service elements that retail ISPs can use to distinguish their tariffs from those of their competitors. Fixed–mobile retail bundles are prevalent in many countries in Europe and integrated operators can use these to drive subscriber take-up and potentially to reduce fixed broadband churn. This helps to explain why we forecast that the fixed–mobile retail bundle share of fixed broadband subscriptions in most Western European markets will increase over the next few years. Smaller ISPs that are not mobile network operators (MNOs) may come under pressure in this environment and may even lack the scale and resources to develop MVNOs.

At the same time, larger ISPs can differentiate themselves by offering access to exclusive content. Smaller ISPs lack the resources on their own to acquire expensive content such as premium sports rights. This restricts the potential for smaller ISPs to acquire new subscribers. However, the impact of this limitation is not as severe as with fixed–mobile retail bundles because we forecast stagnant penetration of operator video services, and many OTT players are also now entering the market to acquire exclusive premium sports rights.

Faced with these challenges, smaller retail ISPs need to find other ways to appeal to customers to attract retail broadband subscribers over competitors.

Services associated with home Wi-Fi fit well with new fibre entrants’ connectivity propositions

New FTTP entrants will naturally focus on the quality of the broadband propositions that they can offer. Consumers now consider their home Wi-Fi connection to form an intrinsic part of their fixed broadband connection. In this way, our sense is that new FTTP entrants must offer cloud-managed home Wi-Fi; without it, a poor-quality home Wi-Fi connection risks undermining the expensive investments made by new fibre entrants. The business case for justifying such an investment is that it can also reduce support desk-related costs. Cloud-managed home Wi-Fi is so fundamental to new fibre operators’ retail propositions that it should be offered free of charge to all the operator’s customers.

Parental controls and device identification are services that new FTTP entrants could consider offering. This could include the ability to switch Wi-Fi connectivity on and off for different devices at different times of the day. Such functionality fits well with fixed broadband plans that are targeted at families. The downside is that such services are becoming increasingly commonplace among the operator community. New FTTP entrants could also benefit by offering connected home cyber-security solutions. There is a growing need for cyber security based on the home router rather than endpoint devices. This is because the number of connected devices continues to increase and the COVID-19 pandemic, and home working more specifically, has also raised concerns about cyber security. Operators could add Wi-Fi Sensing to their service propositions. This value-added service transforms Wi-Fi connected devices in the home into motion sensors. This could have applications for home security and elderly care. We believe that this is a promising service, and chipset support for it is improving.

Operators need to decide how to position these value-added-services within their retail bundles. If sold on a standalone basis, 10–20% of an individual operator’s customer base might take such services. We believe that operators should consider offering them to as wide a range of customers as possible given the intense competitive environment in many retail fixed broadband markets. It may not be possible to offer such services to all customers without any additional charge. but operators can offer a wide range of tariffs (not just the top-end proposition) to respond to these challenges.

New FTTP entrants should partner with third parties to deliver services associated with home Wi-Fi

New FTTP entrants may suffer from a lack of brand recognition, and they will have to overcome the concerns that potential customers may have about the durability of these new ISPs. By partnering with well-known players (such as Amazon Eero) that offer value-added-services associated with home Wi-Fi, new entrants can address some of these concerns. It is noteworthy that players that aggregate multiple value-added-services (such as Plume) are also focused, at least in part, on catering to Tier 2 and Tier-3 retail ISPs.

A final challenge for new entrants is that if the partnership between third-party software suppliers and operators is too successful, then any differentiation that new FTTP entrants can acquire from an operator partnership will disappear. However, many services associated with home Wi-Fi are still nascent so there are still ample opportunities to offer such services in the absence of competition. In addition, new FTTP entrants can, over time, look to form partnerships with more third parties to deliver more services. Even if different operators offer the same value-added services, they can differentiate themselves by the way such services are offered to customers in their mobile apps. It is essential to deliver a good user experience to be successful in the connected home space, and new FTTP entrants should therefore, as a priority, make their services accessible and easy to use. Even if the room for differentiation through services associated with home Wi-Fi declines over time, these services can still provide operators with the opportunity to increase ARPU and reduce churn.

See Analysys Mason’s report Opportunities for operators in the connected home for more detail on this topic.

Article (PDF)

DownloadRelated items

Forecast report

Worldwide: fixed–mobile convergence forecast 2025–2030

Tracker report

Fixed–mobile customer benefits: trends and analysis 3Q 2025

Article

US operators should focus on FMC as consolidation boosts competition and reshapes the fixed market