Foreign players must form domestic partnerships to capture the burgeoning satcom opportunity in India

The Indian Space Research Organisation (ISRO) has previously dominated the market for satellite communications (satcom) capacity provision in India. However, the NewSpace policy is revolutionising the historically isolated Indian space sector by enabling private sector participation from both domestic and international parties. Indeed, foreign satellite capacity will be essential to address the USD13.5 billion opportunity in India’s satcom market. NewSpace will reduce market access barriers for private and international players, but the pace of change remains slow. Nonetheless, India is the world’s most populous country and presents a vast opportunity for satellite operators and service providers due to its growing economy and over 700 million people with no/limited internet access.

India promises huge revenue opportunities for satellite operators, but the ecosystem will need to grow beyond the incumbents

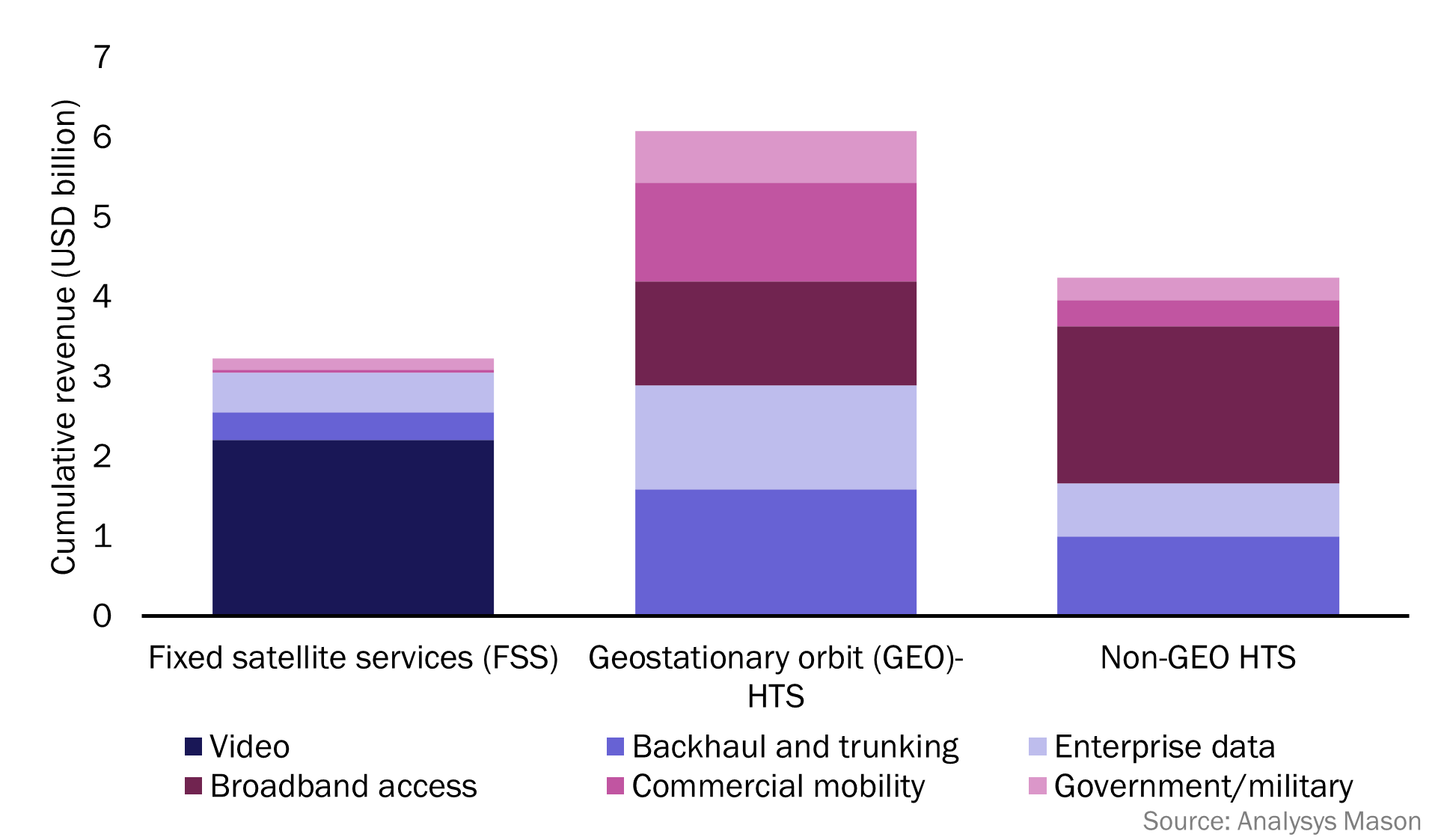

Analysys Mason forecasts that the cumulative revenue for satcom capacity in India will exceed USD13.5 billion between 2022 and 2032 (Figure 1). The business case for wideband services will become weaker in all verticals other than video, and revenue from high-throughput satellites (HTS) will grow significantly (CAGR of 35.6%). The largest opportunity is in the presently unaddressed broadband access segment, which is expected to account for a quarter of the total satcom capacity revenue between 2022 and 2032. India’s geography has hindered terrestrial infrastructure from reaching a largely untapped rural population, but satellite technology can increasingly be used to reach this group as the Indian government’s commitment to digitalisation makes satcom services more affordable.

Figure 1: Cumulative satcom capacity revenue by application, India, 2022–2032

The ISRO currently addresses a large portion of India’s satcom capacity demand with the GSAT fleet in geosynchronous equatorial orbit (GEO). Hughes Communications India (HCI) is the leading very-small-aperture terminal (VSAT) provider in India by far, after having combined with Bhati Airtel’s satcom arm in 2022 to form a combined base of over 200 000 VSATs. The largest competitor is Tata Group’s Nelco, which has strong capabilities in the enterprise and mobility segments. Analysys Mason forecasts that the demand for HTS capacity in India will grow from 44Gbit/s in 2023 to over 3Tbit/s in 2032. This surge in demand will open the door for other satellite operators and service providers to enter the market and gain market share.

Satcom players must overcome complex regulatory and licensing hurdles, and the pace of NewSpace policy changes is slow

Satellite service providers must have numerous licences and authorisations from the Department of Telecoms (DoT) and the Indian National Space Promotion and Authorisation Centre (IN-SPACe) in order to operate in India. Indeed, there are several satcom-specific licences contained within the unified licence (granted by the DoT) that is required by all telecoms players. Further details of the current regulatory framework for the Indian space market can be found in Analysys Mason’s India satellite communications market: trends and forecasts 2022–2032.

India’s national security policy has screened foreign direct investment (FDI) from countries that have land borders with India since 2020. This approach applies for satellite manufacture and operations investments with more than 74% foreign shareholdings. However, a private company such as Starlink would be in breach of US and EU data privacy laws by disclosing its list of shareholders. The Indian government has reportedly accepted Starlink’s assertion that it has no shareholders in countries that border India, with undisclosed concessions, which should pave the way for the service to enter the market. Other foreign actors will also need to contend with the FDI screening and may find the formation of a partly Indian-owned subsidiary the easiest workaround.

The NewSpace policy hopes to make it easier for foreign investors to join the Indian space sector and level the playing field between private and public sector players. However, the implementation of NewSpace-related changes has been slow due to the scale of India’s bureaucratic processes. Nonetheless, the Telecom Regulatory Authority of India (TRAI) has recommended the removal of the ‘facilitation charges’ (levies) that are currently applied to capacity leasing from foreign operators. Additionally, the Space Activities Bill, drafted in 2017, will modernise authorisation processes and facilitate private sector technology transfer. These changes are beneficial for non-government satcom players, which would otherwise struggle to enter the Indian space market.

Satellite operators have partnered with Indian telecoms operators to navigate regulations and benefit from existing domestic brands

Indian conglomerate and telecoms giant Bharti Global is the largest shareholder in Eutelsat Group following its investment in the OneWeb constellation in 2021. This relationship has paved the way for the Hughes-Bharti joint venture, Hughes Communications India (HCI), to distribute low-Earth orbit (LEO) services from OneWeb in India. HCI became the first player in India to obtain all the necessary licences required to offer voice, messaging and broadband services from mobile land terminals in 2023. As such, OneWeb services are now able to launch, pending the completion of gateway infrastructure by mid-2024. This venture has set a trend for similar partnerships between Indian telecoms operators and foreign satellite operators.

Multi-orbit operator, SES, and India’s largest telecoms operator, Jio Platforms, announced, in 2022, a joint venture called Jio Space Technology (JST). JST unveiled its JioSpaceFiber product offering in September 2023, and demonstrated satellite broadband at speeds of up to 1Gbit/s. The service will target the government, enterprise, backhaul and consumer broadband verticals, and will use up to 100Gbit/s of capacity from the SES-12 GEO satellite and O3b mPower MEO constellation. SES has used JST to bring significant capacity to India while remaining under the 74% domestic investment threshold for FDI. SES will also benefit from Jio Platforms’s brand reputation to penetrate the consumer broadband segment.

Other operators may well emulate this method of market entry in the future. For example, Nelco has partnered with Canadian operator Telesat for LEO HTS capacity from the forthcoming Lightspeed constellation, though this has been delayed until 2027.

Article (PDF)

DownloadAuthor

Luke Wyles

Analyst, expert in space and satelliteRelated items

Case studies report

Chinese satellite constellations: case studies and analysis

Forecast report

Satellite capacity supply and demand, 4Q 2024 update

Article

Geopolitics and sovereignty are (once again) a driving force for the space industry