Operators and vendors should prepare now for the shared industrial edge

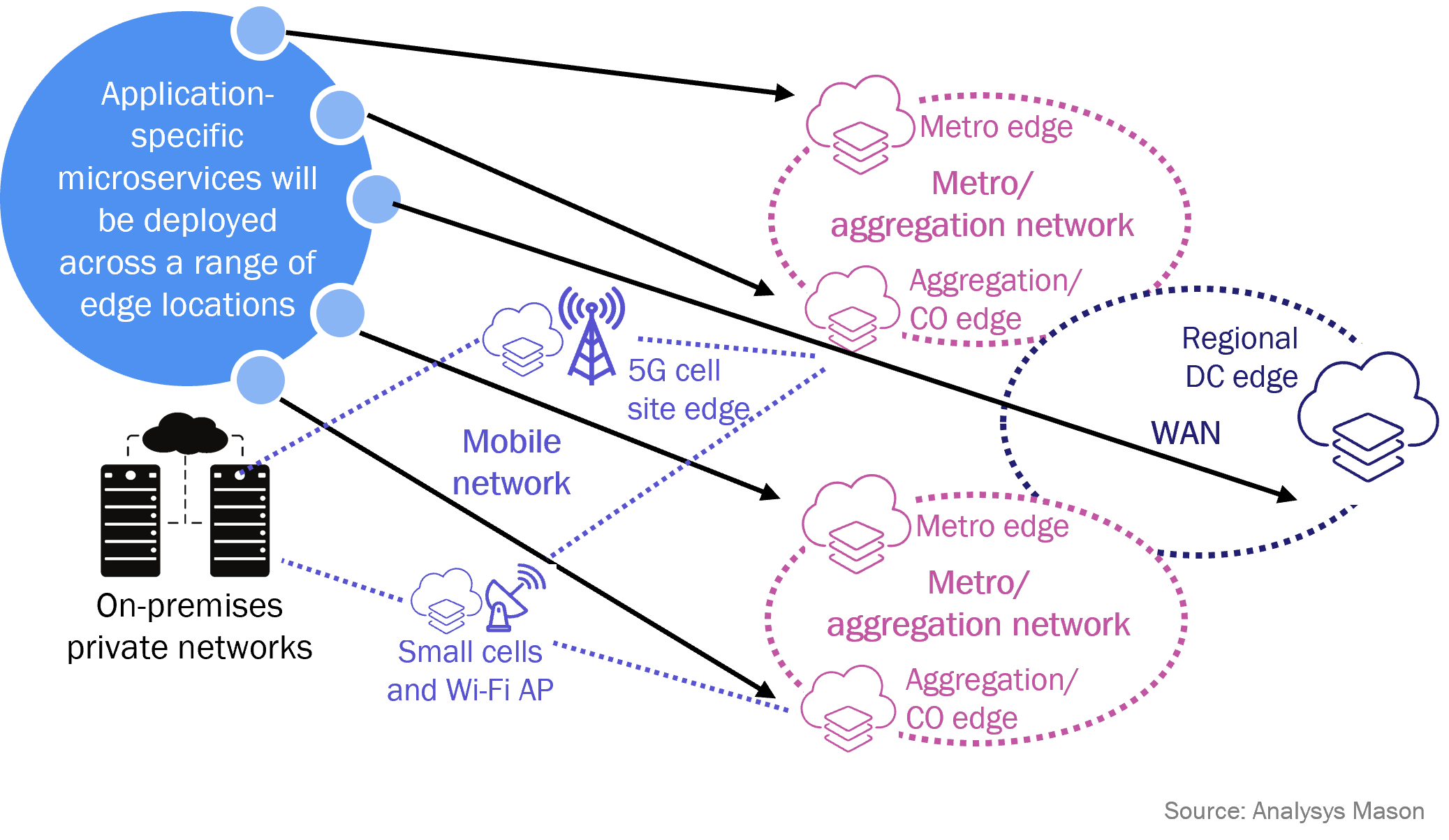

Our recently published report Edge and wireless private networks: use cases and strategies shows that the industrial edge is starting to produce real, live – and disruptive – use cases. This disruption is an iteration of the transformation that we have seen in enterprise IT over the last 10 years, that is, the opening up of proprietary, monolithic operational systems and their evolution into a distributed, cloud-native, microservices-based architecture that we call edge-native (see Figure 1). This application deployment methodology has become mainstream in the enterprise segment and is now – much more slowly – being used for operational technology (OT) use cases in industry sectors such as manufacturing, utilities and logistics hubs such as ports and warehouses, as well as locations such as hospitals, quick-service restaurants and smart cities.

Figure 1: Future application topology at the industrial and metro edge

There is still a lack of clarity around the phrase ‘industrial edge’ in the market. At Analysys Mason, we see the industrial edge as edge-native, close to the consumers and producers of data and designed specifically for applications that can run autonomously from the public cloud. Industrial edge supports full run-time compute environments. This distinguishes it from IoT platforms that support factory sensors or content delivery network (CDN) platforms that deploy client-side JavaScript functions. It can be found in remote locations such as electricity pylons but also in smart cities. To date, the industrial edge is mostly private and using on-premises solutions, but we expect processing to move to a more cost-effective public edge (for example, local public multi-access edge computing (MEC) in microdata centres, embedded by a high-speed network mesh that can support edge-to-edge, low-latency traffic).

Industrial edge use cases indicate that manufacturers are warming to sharing infrastructure and value integration capabilities

Our use case report profiled ten use cases where the enterprises have deployed private wireless networks in tandem with edge compute, either privately or using public metro edges such as Telefónica’s AWS Wavelength node in Madrid. The market for combined private wireless and edge compute is still at an early stage and it only represents a fraction of the overall industrial edge market. Many of the use cases profiled in our report were at proof-of-concept (PoC) stage or are part of showcase projects funded by public sector bodies.

There are, however, three clear emerging trends.

- Enterprises at the industrial edge are open to sharing infrastructure. We anticipate that edge compute will move to local shared industrial and metro edges for cost and efficiency reasons. This process is, in fact, already underway, with three of our profiled use cases running on shared platforms. This was perhaps the most-surprising finding; industrial companies reputedly prefer to own rather than share infrastructure. One of our use cases ran a digital twin in an edge node located in the industrial and port zone of Barcelona, which specifically targets the businesses operating in the area. If the operator (in this case, Telefónica) builds a substantial industrial customer base, the edge node could become attractive to independent software vendors (ISVs) that serve these industries. The edge node could also evolve into a specialised industrial hub such as DRT/Interxion’s carrier-neutral data centre in the City of London, which now supports an entire (and highly valuable) ecosystem for the local financial services industry.

- Integration is critical at the edge. Our report gives valuable insights into the drivers for industrial edge. The most-critical derive from the close intertwining of edge compute with private networking, and the potential for integrating data gathered at the edge into line-of-business (LoB) applications in real time. The reliability and increased capacity of 5G and even 4.5G private networks mean that large quantities of data can be captured on site and processed at the edge in close-to real time with a carrier-grade level of reliability. In the past, proprietary devices and systems have generated data on the factory floor (or in the radiography room, for example), but this data has not been available to other applications to date. All ten of our report’s edge and private network use cases involved ingesting the data transmitted from connected devices via a private wireless network by a real-time data analytics engine. In each case, the analytics engine was integrated into LoB applications that used the parsed data to start a new process (such as ordering a new part or moving a robotic arm or setting off a security alarm). The killer app for edge is, perhaps, integration.

- Privacy, security and regulation are also emerging as key drivers. Enterprises and organisations increasingly see their data as their most-valuable asset, and security can also be improved through 5G and edge. For example, the US Department of Defense is using the improved capacity of 5G to gather video data from cameras in its warehouse, analysing it in real time for security purposes and anomaly detection.

Our use case report also shows that two requirements, latency and mobility, which were seen as key edge drivers a few years ago, appear to be less highly rated by end users. Latency was the most-important driver in only two of our use cases, and in both cases, its importance was self-evident (smart traffic light management and remote surgery). Only one of the use cases required support for a specific location. Original expectations for edge were that locations would be used for applications that needed to ‘follow’ their users for latency reasons (such as autonomous vehicles). In fact, these ‘edge-in’ applications have not yet materialised and instead the market is focusing on ‘cloud-out’ running of applications in specific locations that are geographically fixed. Looking further ahead, we can see that the edge-in market will materialise in time and edge node vendors and operators should still build it into their long-term strategic plans.

To conclude, we recommend that operators and vendors targeting the industrial edge should:

- prepare products and services for the increasing adoption of the shared public edge;

- work with operational technology (OT) application vendors to build ecosystems that can share and capitalise on real-time analytics data;

- link their edge positions closely with private wireless.

Edge and wireless private networks: use cases and strategies provides useful guidance to operators and vendors that want to enter this small but rapidly growing market. For those that already have entered this market, it will enable them to identify prospects and potential markets and help them to refine their sales efforts.

Article (PDF)

DownloadAuthor

Gorkem Yigit

Research DirectorRelated items

Article

Public edge forecast: the industrial edge represents a growing opportunity for operators in the next 5 years

Forecast report

Public edge: worldwide forecast 2023–2028

Article

The private industrial edge: what it is and what it means