Commercialisation in the LEO and lunar markets will drive the demand for in-space cloud computing

In-space data centres may be the next step for space cloud computing. Increased activity and the growing number of satellite constellations are driving the demand for data storage in space, as well as the associated data processing. Indeed, the Spaceborne Computer-2 on the International Space Station (ISS) is already using artificial intelligence (AI), machine learning (ML) and cloud processing to make predictions and draw conclusions.

The commercialisation of the low-Earth orbit (LEO) market and long-term lunar and space exploration missions will increase the use of data centres in space. In particular, R&D missions focused on space cloud computing, the adoption of AI/ML algorithms for space applications and the transition from the ISS to commercial space stations are the main factors that will boost the use of in-space data centres.

The adoption of cloud services by space industry players has increased significantly, particularly in North America

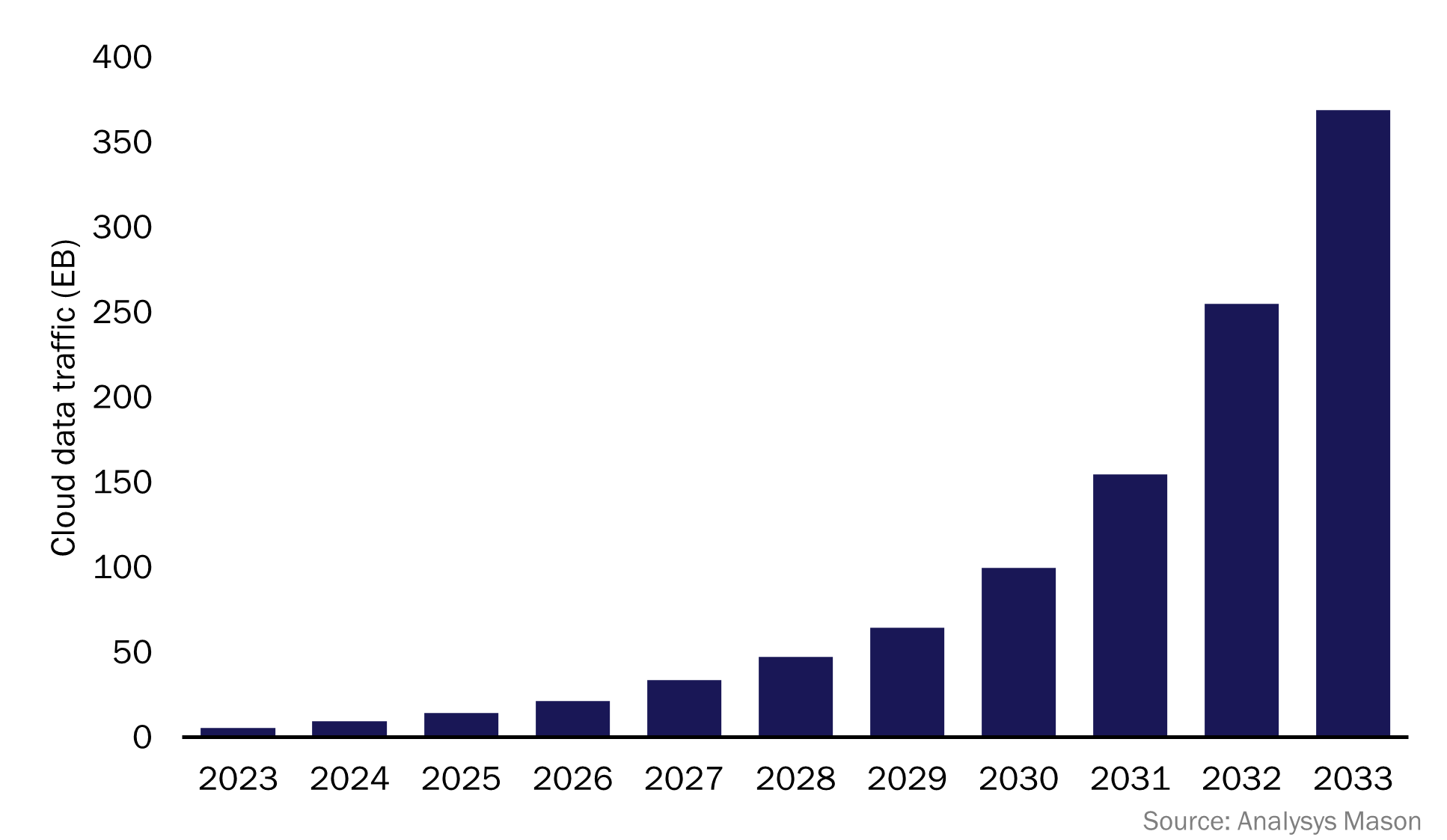

Analysys Mason’s Space cloud computing, 5th edition forecasts that the cumulative satellite cloud data traffic worldwide will be more than 1000EB between 2023 and 2033 (Figure 1). This will generate USD46.8 billion in cumulative revenue.

Figure 1: Satellite cloud data traffic, worldwide

A large portion of this traffic will come from North America (NA) due to the presence of hyperscalers, such as Microsoft and Amazon, in the region. These players have been making strategic moves to integrate space technology into their cloud services. For example, Amazon’s AWS platform provides cloud-powered solutions to support the use of space cloud computing activities and Microsoft’s Azure Orbital enables space-to-cloud satellite connectivity.

The government sector in NA is also promoting space cloud computing solutions. Analysys Mason expects that the US government’s plans for space exploration and human spaceflight will generate USD850 million in cumulative cloud service revenue between 2023 and 2033.

Applications related to Earth observation (EO), communications, science and human spaceflight will drive the use of edge computing and data centres in space

The need to downlink large amounts of data from EO and communications constellations is leading cloud service providers to integrate end-to-end solutions for tasking, downlinking and data ingress with the cloud. The need for additional stacked solutions for processing and storage will further increase the adoption of cloud services in the EO sector. For example, Lumen Orbit identified an opportunity to reduce the amount of data that needs to be downlinked to Earth and raised USD2.4 million to develop a data centre constellation that will collect data from other constellations and process it in space.

Government players drive most of the demand for in-space data centres in the science sector because they conduct most of the major scientific missions. For example, ESA is looking into ways to implement AI and cloud computing in space to increase the autonomy and agility of its satellites. Hosting data centres on the ISS will be the key use case in this area in the near future. LEOcloud is exploring this and plans to send its data centre to the ISS in 2025. Lonestar Data Holdings was the first commercial player to send its disaster recovery data centre to the Moon and it has plans to create an architecture of data centres on and around the Moon. In the long term, the increase in the number of lunar missions and the associated large volumes of data generated will drive the demand for in-space cloud computing. However, budget cuts on missions such as NASA’s Mars Sample Return (MSR) can lead to delays and additional costs, thereby putting the likelihoods of these missions at risk.

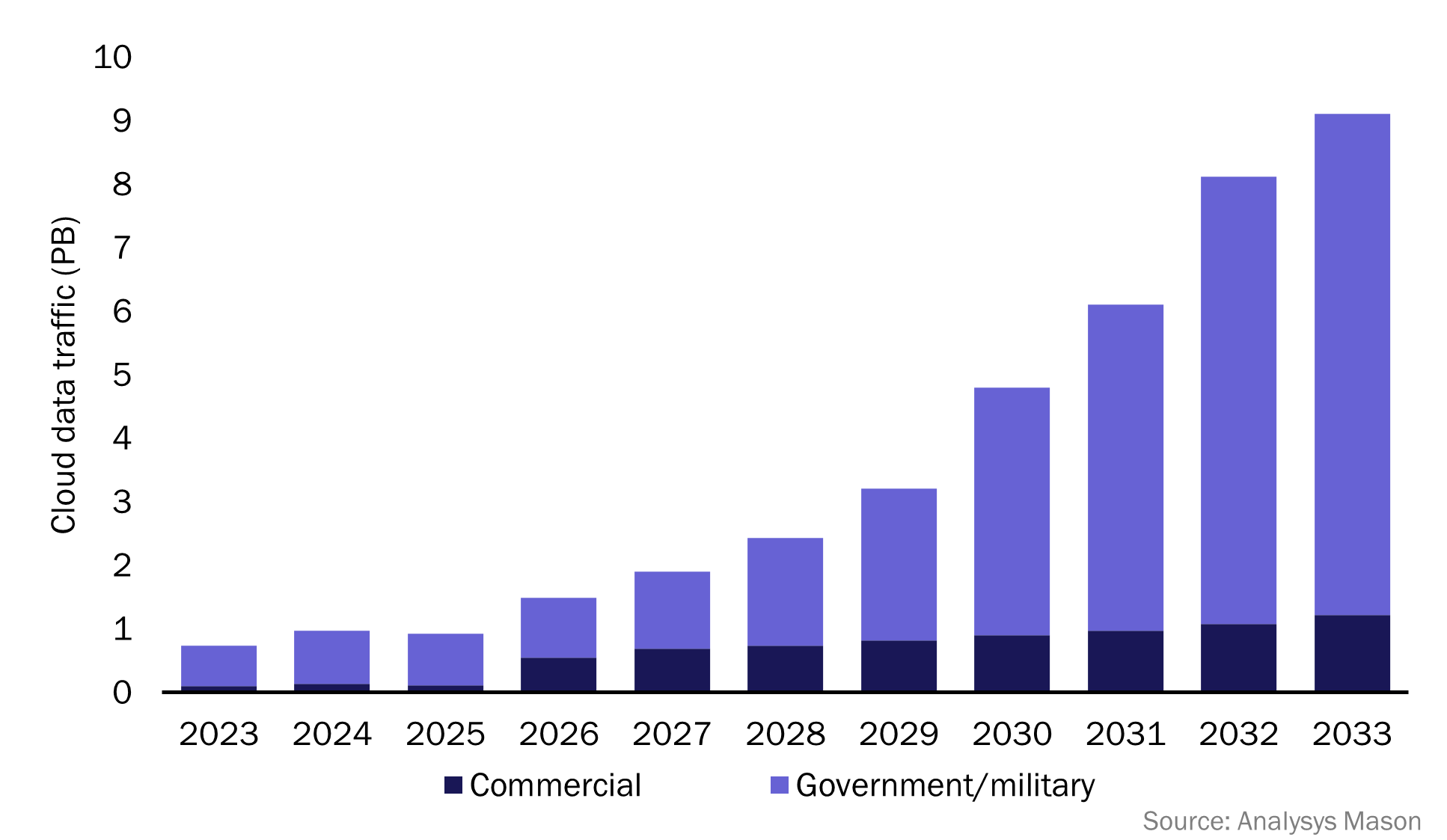

The transition from the ISS to commercial space stations will generate new opportunities for partnerships between space industry players and cloud service providers. Indeed, in-space edge computing services will enable players to handle the large volumes of data that will need to be processed for scientific and human spaceflight missions from 2026 onwards, when the first commercial space station will launch. Initially, most of the demand for science-related data downlink will come from the government/military sector due to the push for interplanetary and space exploration missions. However, the commercialisation of LEO satellites will create more opportunities for cloud service providers after 2028/2029 (Figure 2).

Figure 2: Satellite cloud traffic for science-related data downlink, by customer type, worldwide

There will be barriers to the adoption of in-space data centres

R&D is required to overcome the major challenges regarding the implementation of in-space data centres. Space industry players’ lack of expertise/awareness regarding cloud computing/big data requirements along with the disconnect between the cloud computing and space industries limit the adoption of this technology. Moreover, there are data security challenges and huge power requirements, along with costs associated with data egress and other cloud services, which may be significant setbacks for the growth of cloud computing market.

Governments and cloud service providers should work with space industry players to increase the use of in-space cloud computing

Governments and cloud service providers should work together to overcome the issues listed above. They should create strategic partnerships with satellite operators and space manufacturers to use cloud capabilities for operations and derive insights in LEO and lunar missions. Indeed, Analysys Mason expects that LEO and lunar science missions will generate large amounts of cloud data traffic after 2028/2029 driven by increased commercial activity in the LEO market and strong government initiatives in the lunar market.

Article (PDF)

DownloadAuthor

Dafni Christodoulopoulou

AnalystRelated items

Article

Geopolitics and sovereignty are (once again) a driving force for the space industry

Strategy report

The pulse of the satellite industry: questions and answers for senior executives 2025

Article

Players in the satellite-based Earth observation market must target government analytics procurement